Digital Transformation in Retail Banking: Defining Creativity, Management, and Partnerships

What prevents banks from embracing the digital trend for retail banking? Indeed, cybersecurity and data privacy threats are among the top worries, followed by the prohibitive costs and complexity that technology poses. However, as with any shift, the digital revolution in banking necessitates a solid, all-encompassing strategy.

If Digital transformation is the primary objective to redefine creativity, management, and partnerships, then there are three crucial approach pathways:

- Redesigning the client experience

- Building a solid partner ecosystem

- Investments in emerging technologies

Let’s start with the requirement of redefining client management and partnerships. Incumbent banks will do well in this regard from what the neo-banks mainly do: Freed from legacy systems, neo-banks rely on lean business models to offer innovative features for friction-less services that power access to specialized market bases.

Creativity in Operating Models and Business Strategy for Retail Banks

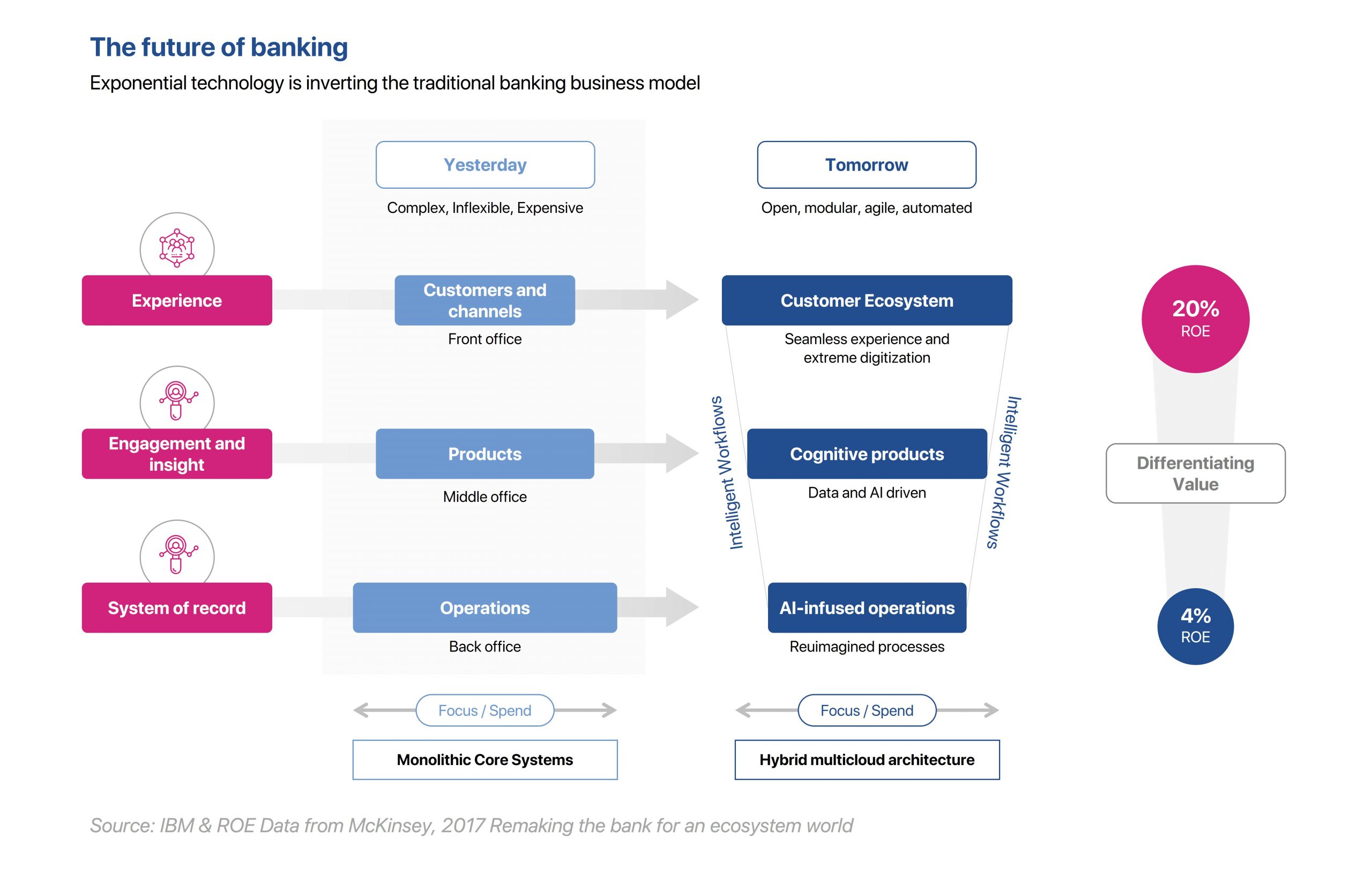

As strategic partnerships with leading banking technology providers such as Maveric systems bears out, digital transformation is about both the operational and cultural movements toward integrating digital technologies across all banking functions of the bank.

Creativity becomes indispensable when FIs are mandated to maximize customer value and bring an edge to compete in a saturated market. While technology is the foundation of digital transformation, banks must implement their digital strategies creatively to do more with less. After all, many digital transformations fall short because technology is the only factor considered. Crucial on the implementation checklist are addressing the cultural barriers and the change management needed.

![Digital Transformation in Retail Banking[6696]](https://maveric-systems.com/wp-content/uploads/2023/01/Digital-Transformation-in-Retail-Banking6696-scaled.jpg)

Driving creativity, partnerships, and management in Retail Banks – What are the success markers?

The advice for retail banks can be summed in a single phrase – operate like a technology company. Breaking it down for actionable insights,

- Employ data to enhance personalization and consumer engagement.

- Choose technology stacks that lower expenses and accelerate innovation ability.

- Adopting a flexible operational approach that adapts to rapidly evolving markets

Conclusion

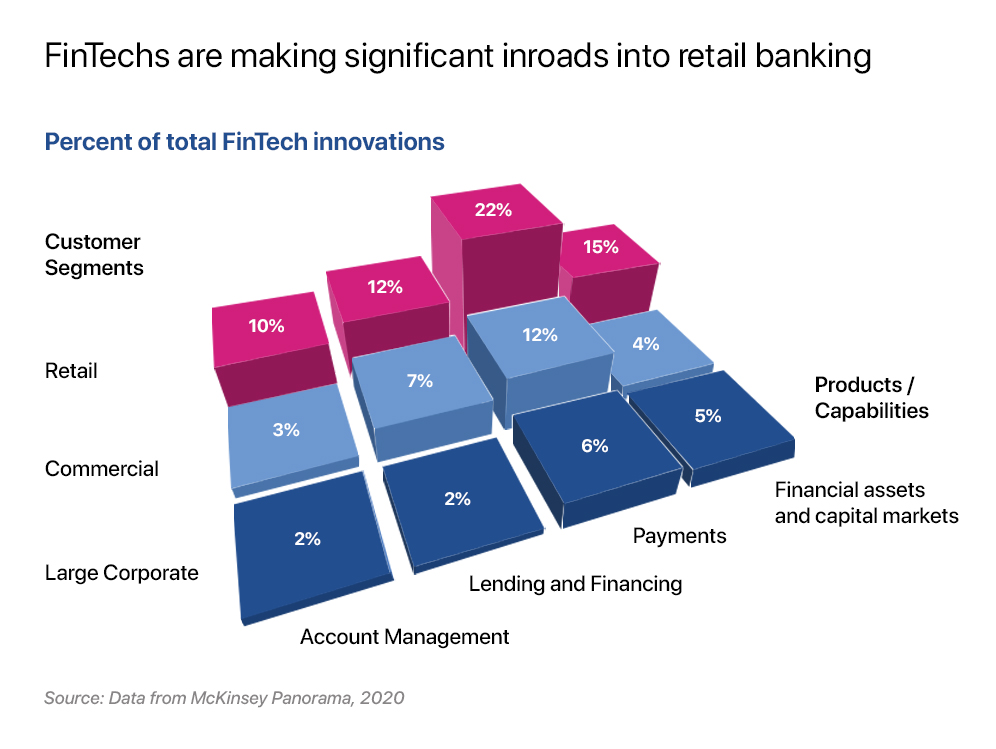

Although the banking industry has historically resisted change, the pandemic’s potential effects and the severe competition from Fin-techs drove banks to speed up their digital transformation. Banks have many opportunities to profit from digital adoption, including increased consumer convenience, process optimization, and efficiency gains. To access these values, several of the most prominent banking institutions in the world have already embraced enterprise software development.

About Maveric Systems

Starting in 2000, Maveric Systems is a niche, domain-led Banking Tech specialist partnering with global banks to solve business challenges through emerging technology. 3000+ tech experts use proven frameworks to empower our customers to navigate a rapidly changing environment, enabling sharper definitions of their goals and measures to achieve them.

Across retail, corporate & wealth management, Maveric Systems accelerates digital transformation through native banking domain expertise, a customer-intimacy-led delivery model, and a vibrant leadership supported by a culture of ownership.

With centers of excellence for Data, Digital, Core Banking, and Quality Engineering, Maveric Systems teams work in 15 countries with regional delivery capabilities in Bangalore, Chennai, Dubai, London, Poland, Riyadh, and Singapore.

View