Customer Centricity

![]()

This is the age of open retail and digital banking and open data sharing. It is a question of how banks make use of this landscape to have a better understanding of their prospect as well as customers and personalize their service portfolio. While this appears to be a mammoth task in itself, there is another critical dimension that adds substantial complexity – the demographic pattern of the customer universe. Each demographic segment starting from millennials need specific attention. Without the aid of new age tools and platforms, it becomes a daunting task.

Open Systems

![]()

Banks are recognizing that to turbo-charge with a front wheel drive at supersonic speeds mandates opening their systems, both for partnering with Fintechs as well as lifestyle partners, who cohort with their customer universe. In many cases, this ‘ecosystem build’ is emerging as one of the key business units alongside their product management.

Human Touch

![]()

Customer centricity is the key aspect of banking. For long, banks while recognizing the importance of human interactions in a certain part of their portfolio (namely wealth management), took their eyes off it in other lines of business. To gain back relevance, banking leaders have to humanize across channels – be it the call centre, branch walk-ins, or the digital platforms. Thankfully, there are technologies available which makes this possible, across demographic profiles and linguistic segments.

Regulatory Compliance

![]()

The period of forbearance is over, and the reign of penalty is in. Further accentuated by the pandemic, the digital platforms today need to be real-time. So, while other options are available, the banks need to commit considerable investment and strategic oversight to accomplish their compliance towards regulations.

Rip and Replace Alternatives

![]()

Given the demands on agility and quality, banks have to consider alternatives emerging from Fintechs or from new technologies and adopt them. Sunsetting, while an option, is neither carte blanche nor is it for all.

Our Focus

Progressive retail banking financial services (leader and challenger alike) around the world, turn to Maveric when they want a no-fuss solution, that’s designed to address challenges, and run as intended. Be it transformation of core banking operations or creating better customer experiences through superior digital enablement or integrating to the larger financial ecosystem for business empowerment, our retail business banking technology specialists help to make this vision a reality, faster. Our team has proven expertise across retail banking products spanning multiple functional areas, including the following.

Branch Banking

Account opening and maintenance, transaction banking, general operations and centralized back office functions

Reporting

Management control, regulatory reporting and customer profitability

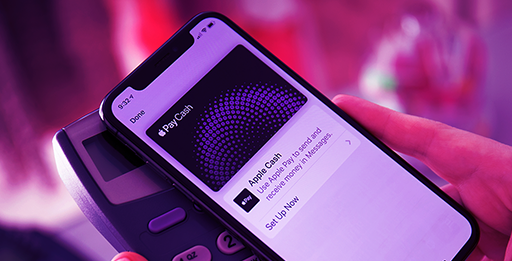

Online and Mobile Banking

Account management, electronic bill payment and presentment and mobile banking

Mortgages and Consumer Lending

Loan origination, account servicing, secondary marketing and delinquency handling

Personal wealth management

Investment advisory services

Branch Banking

Account opening and maintenance, transaction banking, general operations and centralized back office functions

Reporting

Management control, regulatory reporting and customer profitability

Online and Mobile Banking

Account management, electronic bill payment and presentment and mobile banking

Mortgages and Consumer Lending

Loan origination, account servicing, secondary marketing and delinquency handling

Personal wealth management

Investment advisory services

Large scale integration and validation of customer data for CCPA compliance

Implementing Consumer Privacy Act Compliance implies stepping into the deep…

Read More

Conscious contextualisation of solutions reduced efforts by 75%?

A regional banking leader was intending to integrate fragmented processes being followed by differen…

Read More

38% Pre UAT Defect Prevention through Digital Quality Engineering

A massive initiative for launching a new cutting-edge mobile application platform was initiated by one…

Read More

Trends in Retail Banking (Infographic)

Exploring the Evolution: Unveiling the Latest Trends Reshaping the Landscape of Retail Banking...

Tech-Driven Retail Bank Revolution

Operating like a tech company where data is leveraged for superior CX, and technology...

Elevating customer experience in retail banking

Acquire, onboard and retain customers with best-of-breed customer experience. Discover some of the best tips...