Introducing a Groundbreaking Framework for Hyper-Personalization in Wealth Management

The Quest for Personalization Excellence

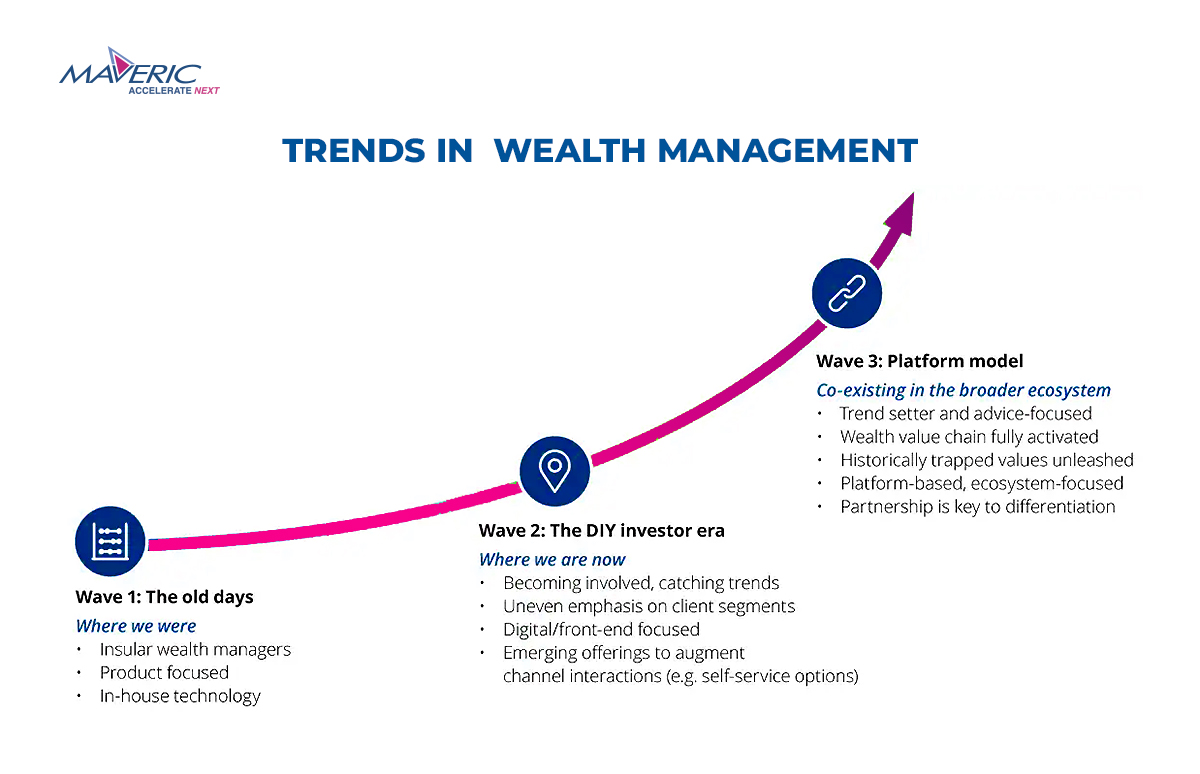

In the realm of wealth management, the demand for personalized client experiences has never been higher. As we’ve explored in our previous blogs (Blog1 and Blog2), the industry’s landscape is rapidly evolving, and the challenges of real-time hyper-personalization are manifold. From the intricacies of tracking countless “Product – customer segment – persona – journey stage – touchpoint” combinations to the vast technological infrastructure required, the road to effective personalization is complex. So, how can wealth management firms navigate this intricate maze and deliver unparalleled client experiences?

Enter the Structured Framework

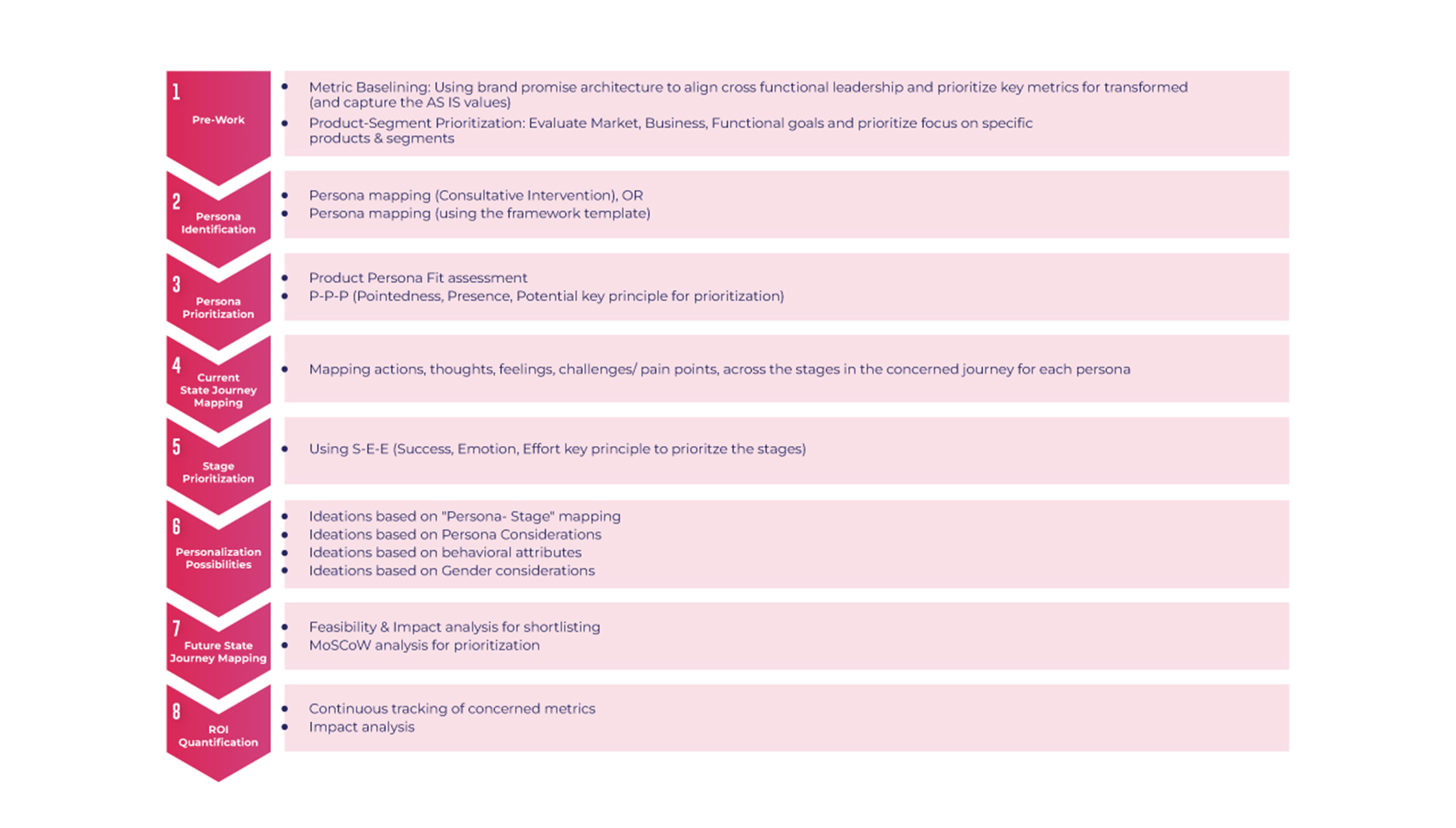

To address the pressing challenges and harness the potential of hyper-personalization, we introduce a groundbreaking framework tailored specifically for the wealth management industry. This framework isn’t just another tool; it’s a comprehensive guide designed to steer firms towards personalization excellence.

Key Considerations

Before delving into the framework’s specifics, it’s crucial to understand the foundational considerations:

- Client-Centricity: At the heart of the framework is the client. Every element, every strategy is designed with the client’s needs, preferences, and journey in mind.

- Data-Driven Insights: The framework emphasizes the importance of harnessing data-driven insights to inform personalization strategies, ensuring relevance and timeliness.

- Scalability: As the wealth management industry grows, so do the personalization demands. The framework is designed to scale, accommodating evolving client needs and industry trends.

Framework Overview: Principles and Approach

The framework is built on four key principles:

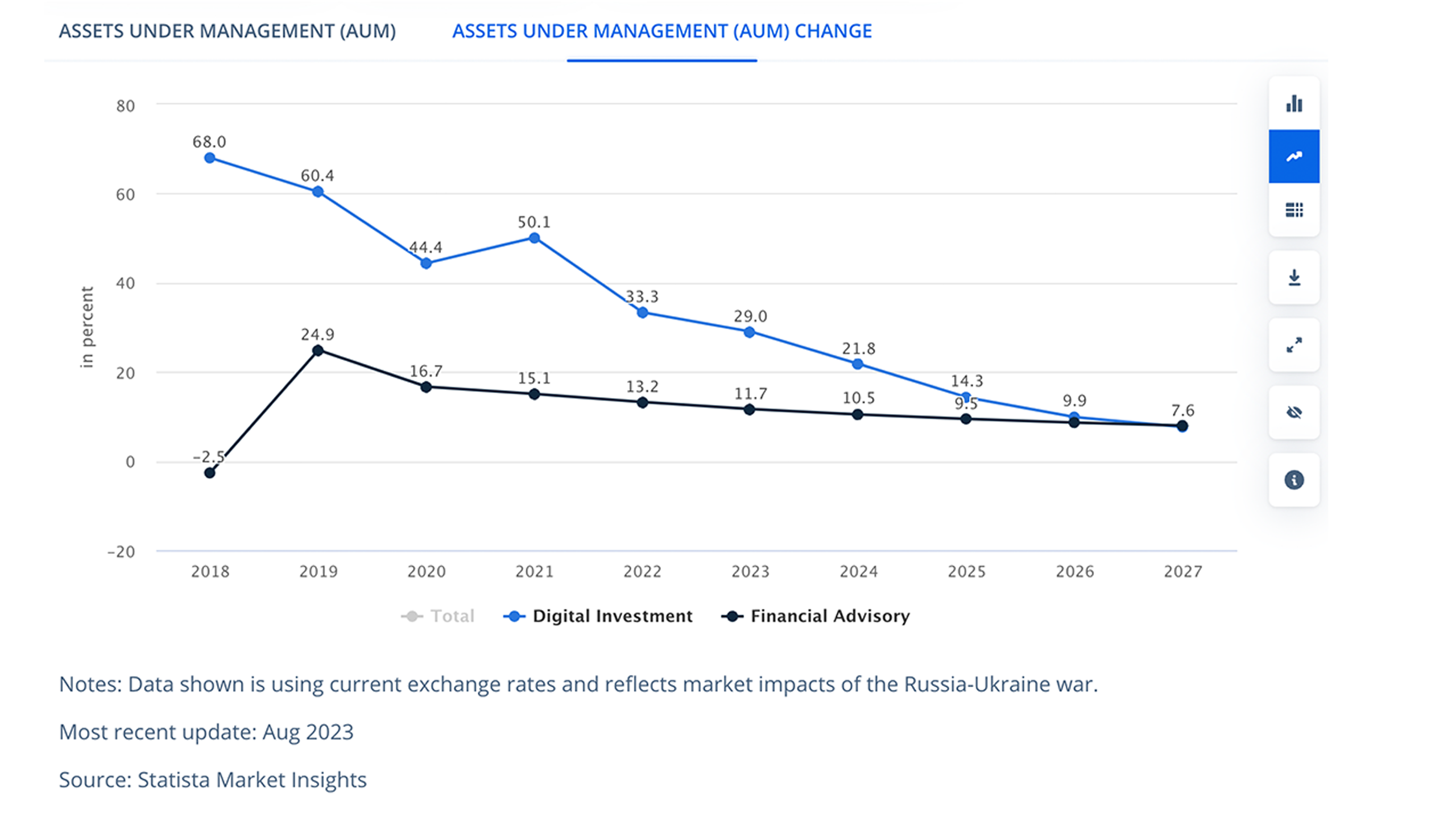

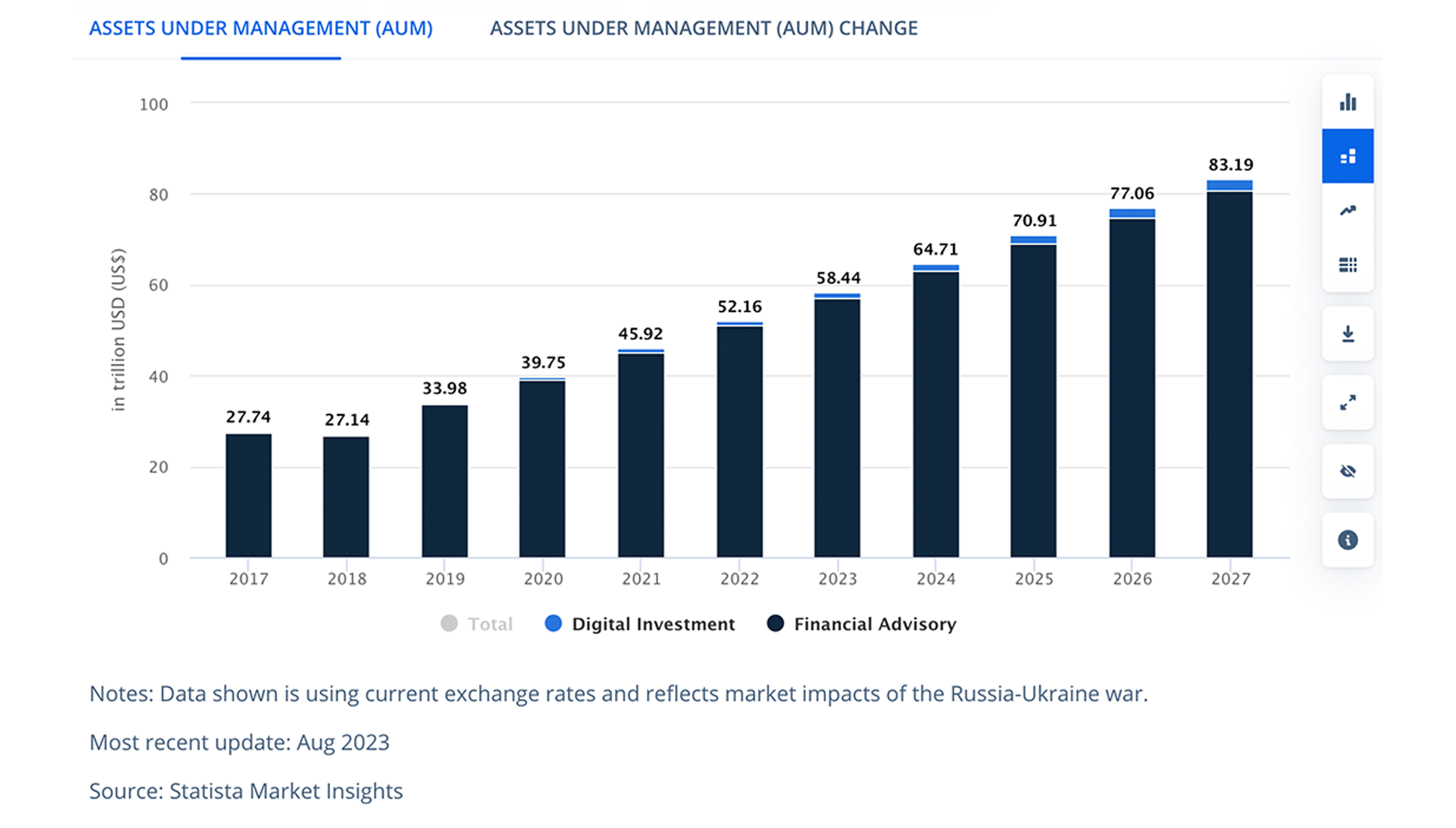

- Potential (ROI Quantification): Ensuring that every personalization effort is aligned with quantifiable outcomes, particularly in terms of Assets Under Management (AUM).

- Persona Specificity: Recognizing the uniqueness of each client persona and tailoring experiences accordingly.

- Product/Client-Segment Context: Understanding the interplay between products and client segments to deliver tailored recommendations and advice.

- Prioritization: Given the vastness of data and personalization possibilities, the framework emphasizes the need for prioritization, ensuring that efforts are directed where they matter most.

The approach is systematic, guiding firms from persona identification to personalization implementation, ensuring both efficiency and effectiveness.

A Glimpse Ahead

In our upcoming blogs we’ll delve deeper into the methodology of this framework, offering insights into its intricacies and benefits. Stay with us as we unravel the potential of this revolutionary approach to hyper-personalization in wealth management.

Co-authored by Ashutosh Karandikar, and Venkatesh Padmanabhachari

Maveric’s thought leadership series – E.D.G.E (Experiences Delivered by Global Experts) – handpicks the game-changing technology ideas and pressing functional questions Banks and financial institutions must solve today.

These features – reports, whitepapers, podcasts, flyers, blogs, and infographics – are for Banking leaders and Technology evangelists to apply profound trends, the latest opinions, and transformational analyses to boost the performance of their organizations.

View