The Future of Wealth Management: Embracing Personalization for Client-Centric Success

The wealth management industry stands at a pivotal juncture. As we’ve explored in our series, the challenges are manifold, but so are the opportunities. The key lies in harnessing the power of personalization, not as a mere buzzword but as a strategic imperative. As we conclude our series, let’s reflect on the journey and the road ahead.

Recap: The Personalization Imperative

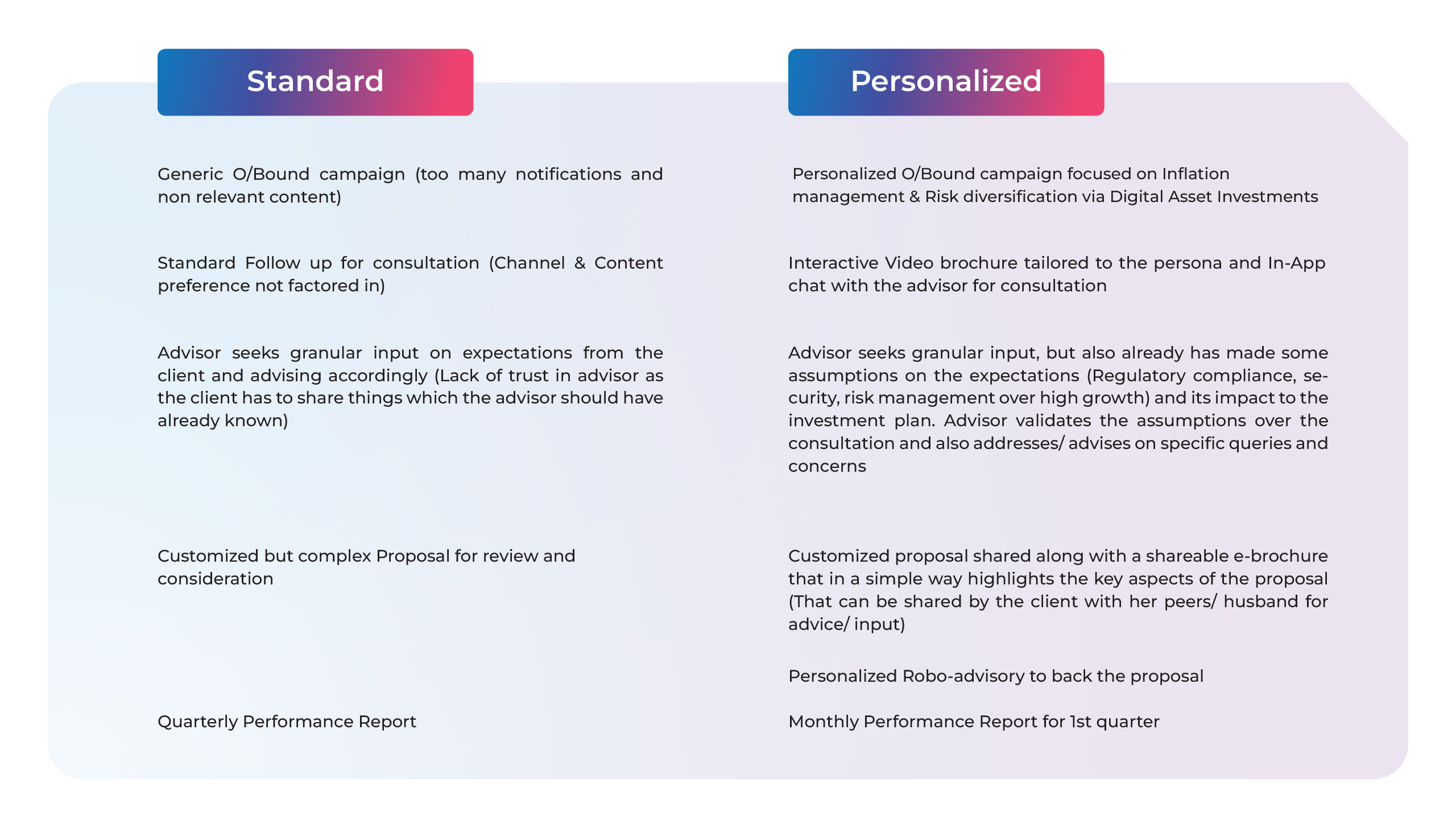

The wealth management landscape is undergoing seismic shifts. From evolving client expectations to the competitive pressures of a digital-first world, firms are grappling with the need to differentiate. Amidst this backdrop, as elaborated in our earlier blog (Blog 1), personalization emerges as the beacon, promising enhanced client experiences and tangible business outcomes.

Our Framework: A Structured Approach

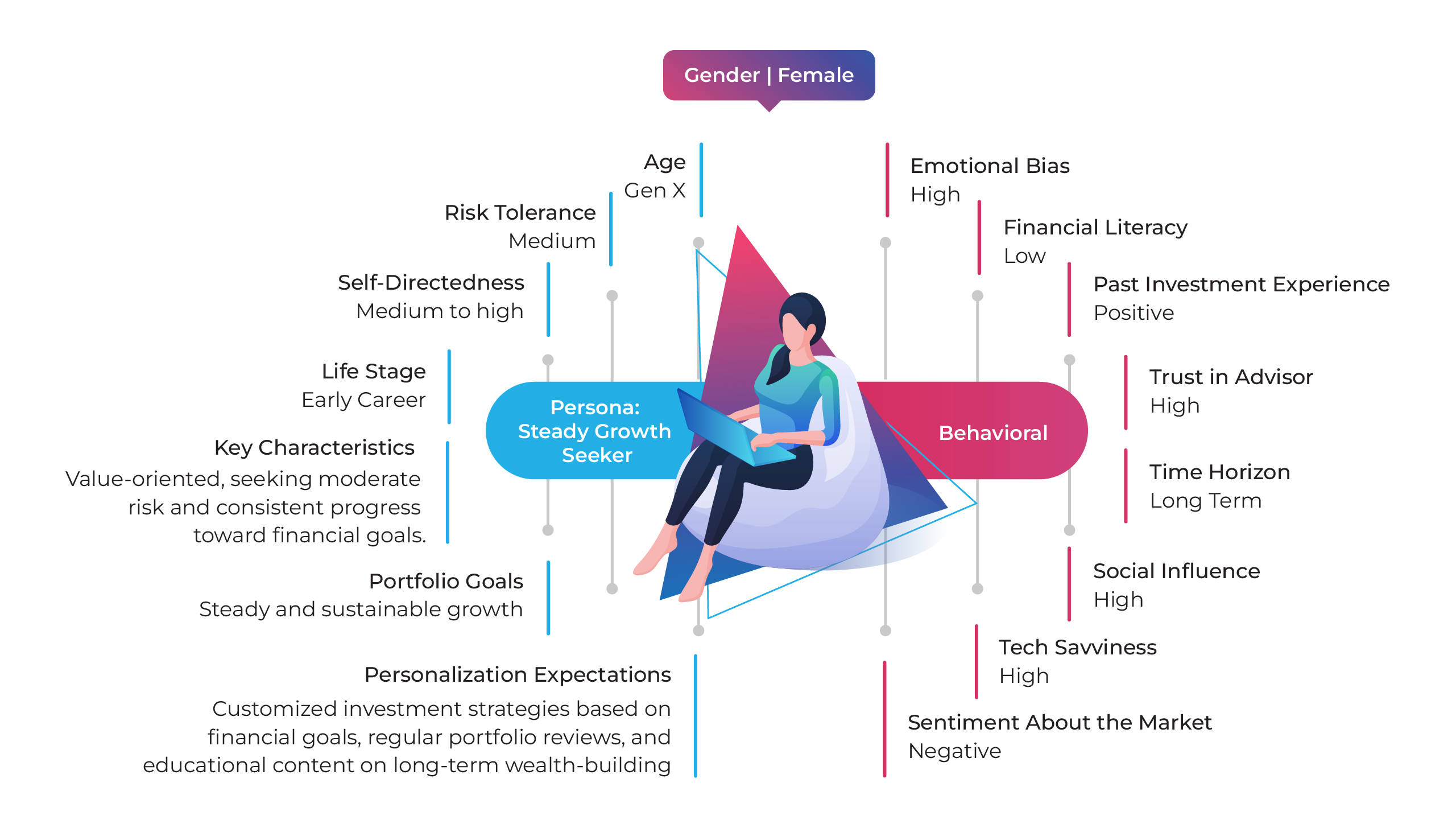

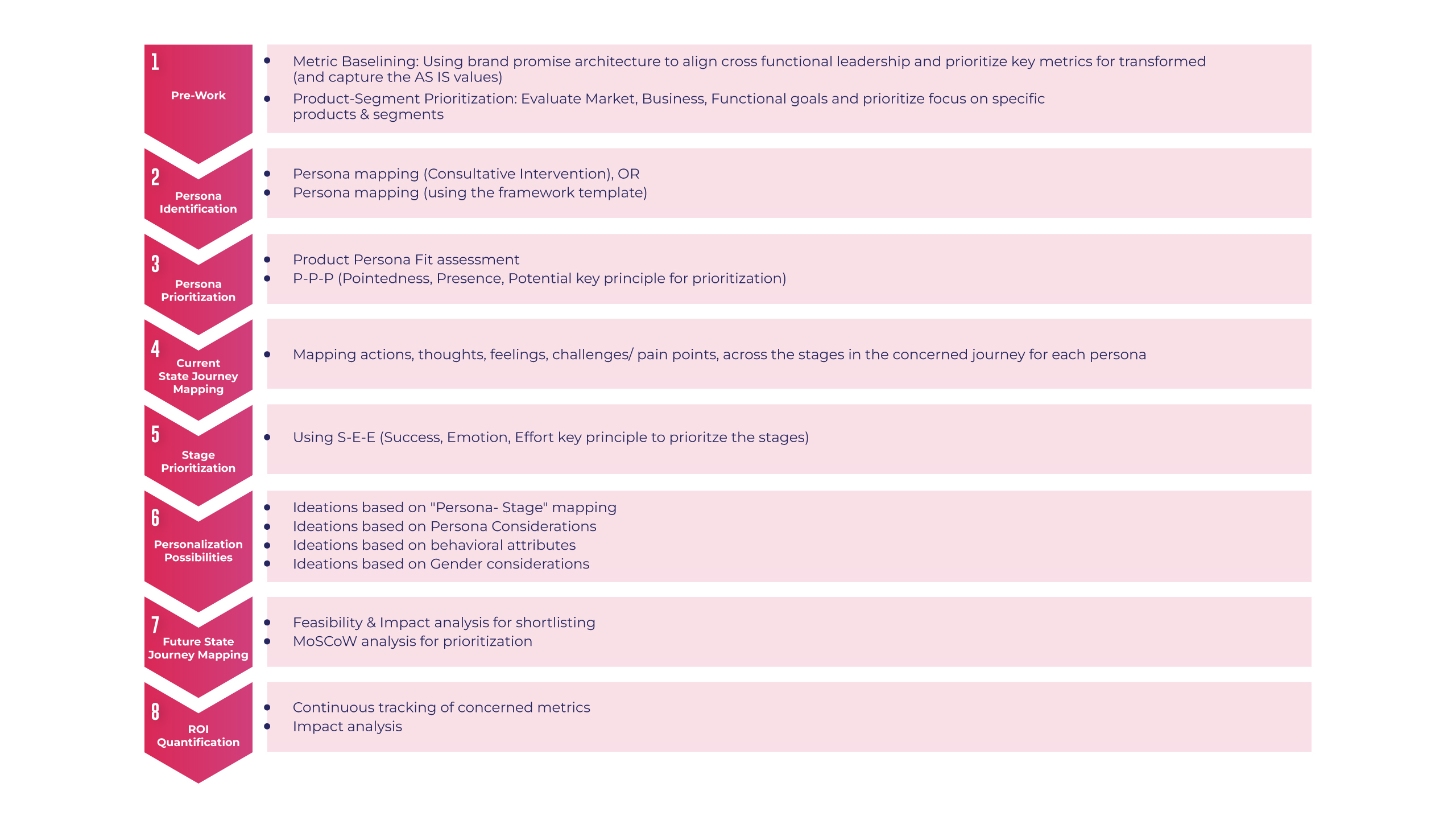

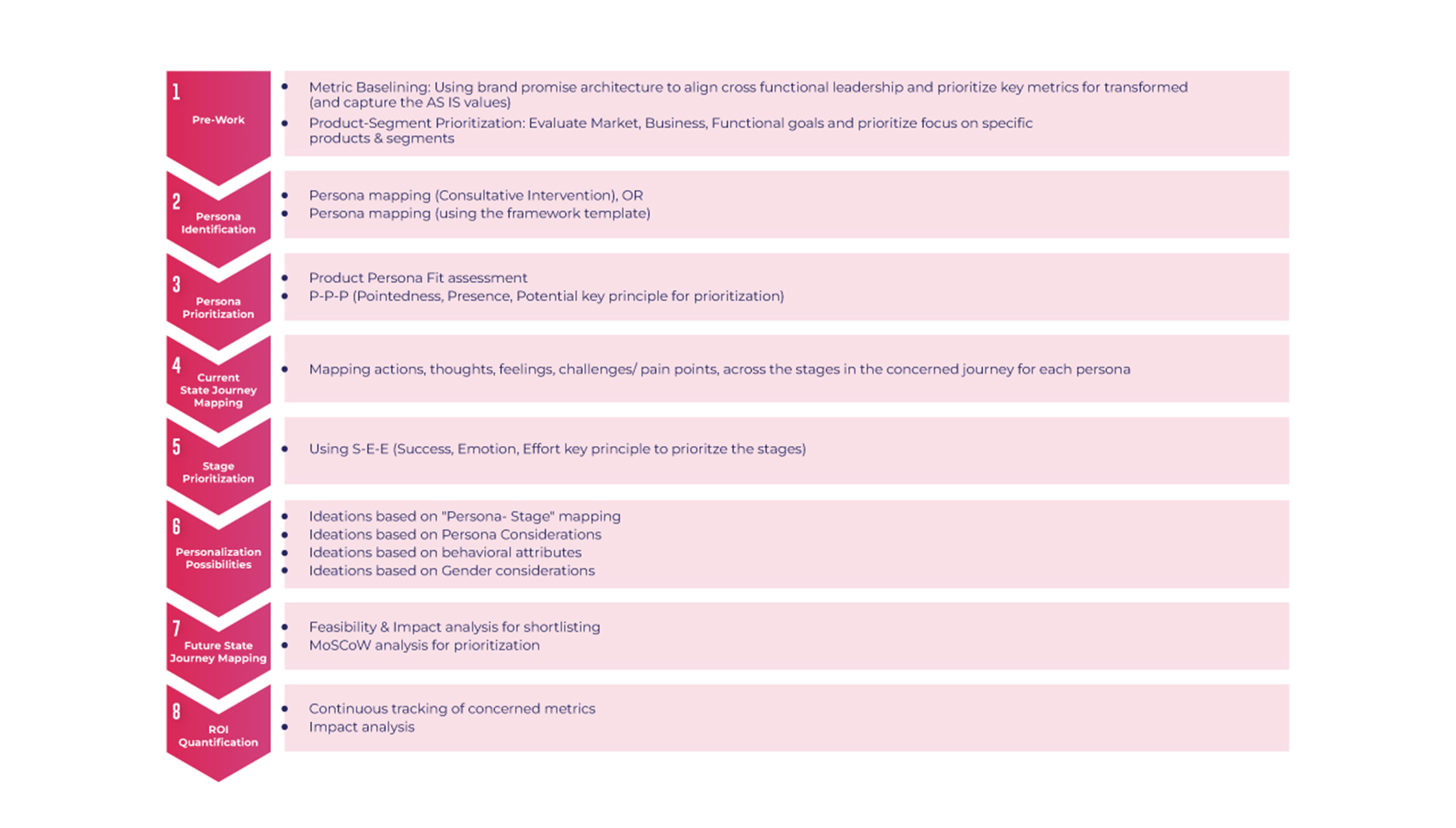

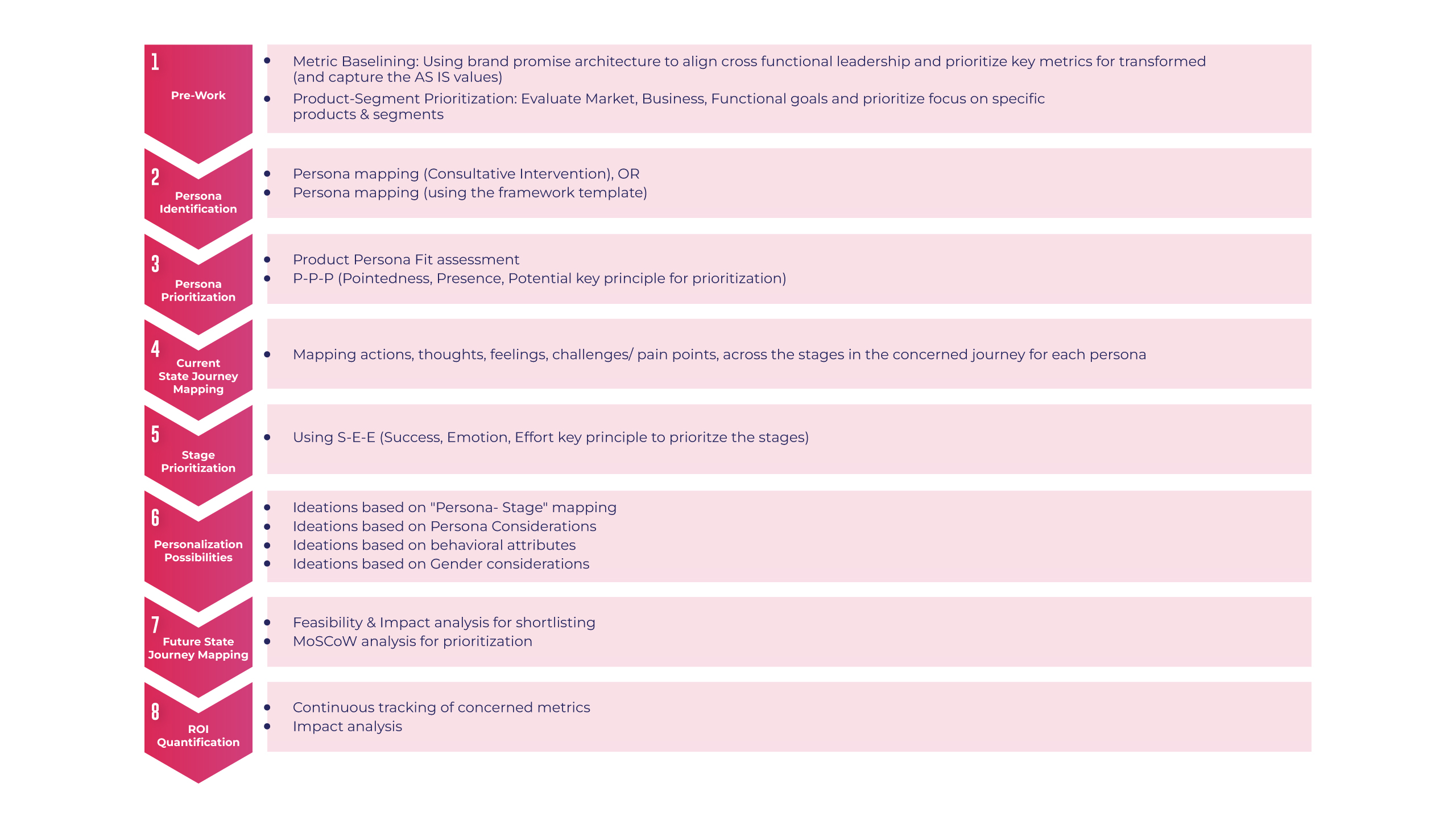

Our personalization framework, as detailed in our series (Blog 2 , Blog 3, Blog 4), offers a structured approach to navigate the complexities of the wealth management domain. From understanding the current landscape to identifying and prioritizing personas, from mapping client journeys to quantifying ROI, our framework is both comprehensive and actionable.

Case in Point: Tangible Outcomes

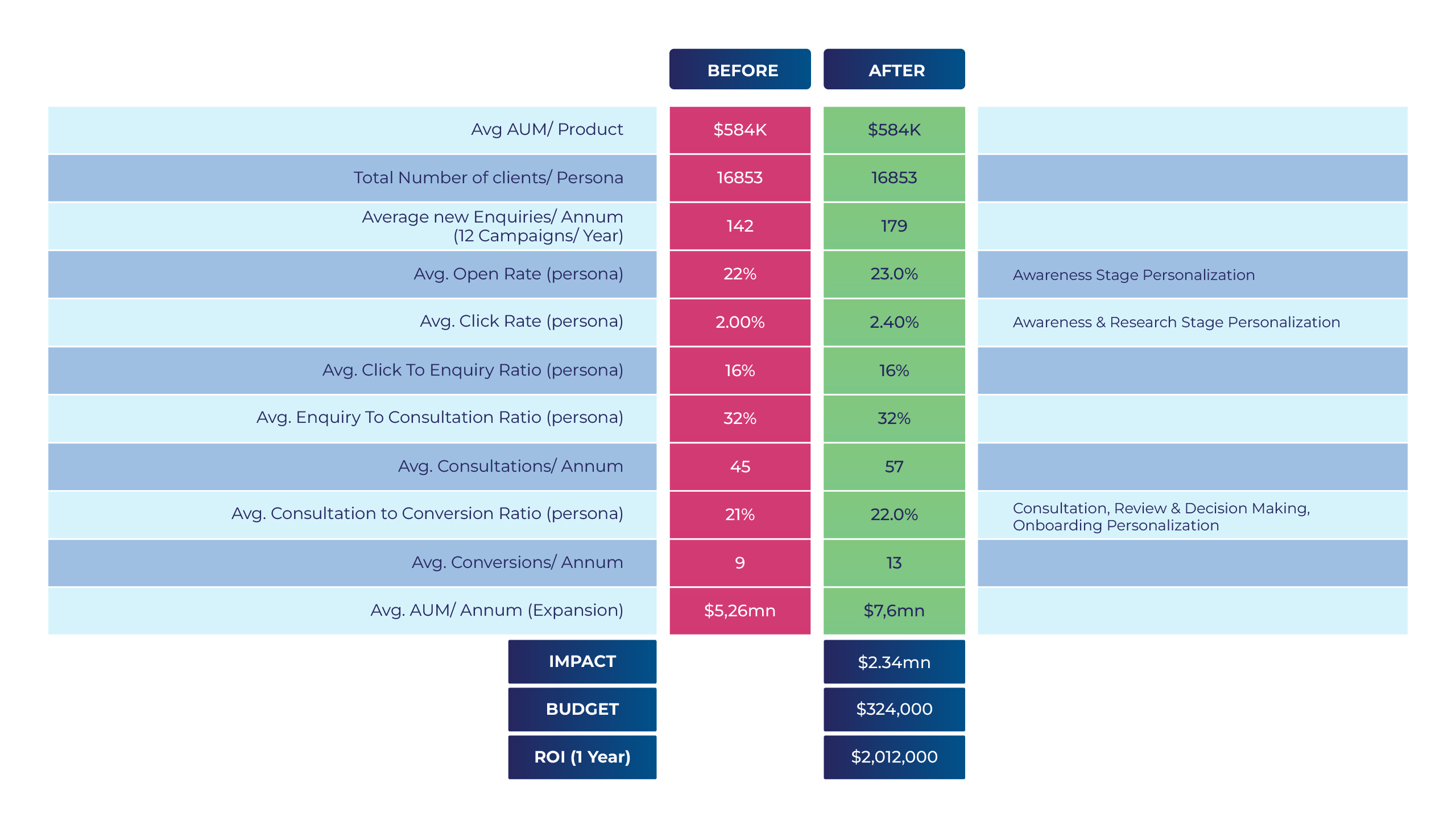

Our illustrative case study (Blog 5) underscored the tangible benefits of our framework. By focusing on a specific persona within the HNI segment, a wealth management firm could drive significant AUM growth, underscoring the ROI potential of personalization.

The Road Ahead: Embracing Continuous Evolution

The journey doesn’t end here. Personalization is an ongoing process. As client needs evolve, so must our strategies. The future of wealth management will be characterized by AI-driven insights, real-time personalization, and a relentless focus on client-centricity.

Conclusion

In the ever-evolving realm of wealth management, staying static is not an option. Firms must embrace personalization as a strategic lever, driving both client satisfaction and business growth. As we wrap up our series, we urge wealth management leaders to take the plunge, harnessing the power of our framework to elevate client experiences and chart a path to success.

Co-authored by Ashutosh Karandikar, and Venkatesh Padmanabhachari

Maveric’s thought leadership series – E.D.G.E (Experiences Delivered by Global Experts) – handpicks the game-changing technology ideas and pressing functional questions Banks and financial institutions must solve today.

These features – reports, whitepapers, podcasts, flyers, blogs, and infographics – are for Banking leaders and Technology evangelists to apply profound trends, the latest opinions, and transformational analyses to boost the performance of their organizations.

View