A Structured Approach to Personalization

The wealth management industry stands on the cusp of a personalization revolution. As we’ve highlighted in our previous blogs (Blog 1 Blog 2 , Blog 3), the demand for tailored client experiences is soaring, and the challenges are intricate. Our groundbreaking framework, tailored for the wealth management industry, promises a coherent method to navigate these challenges. But what lies at the core of this framework? Let’s delve deeper into its methodology.

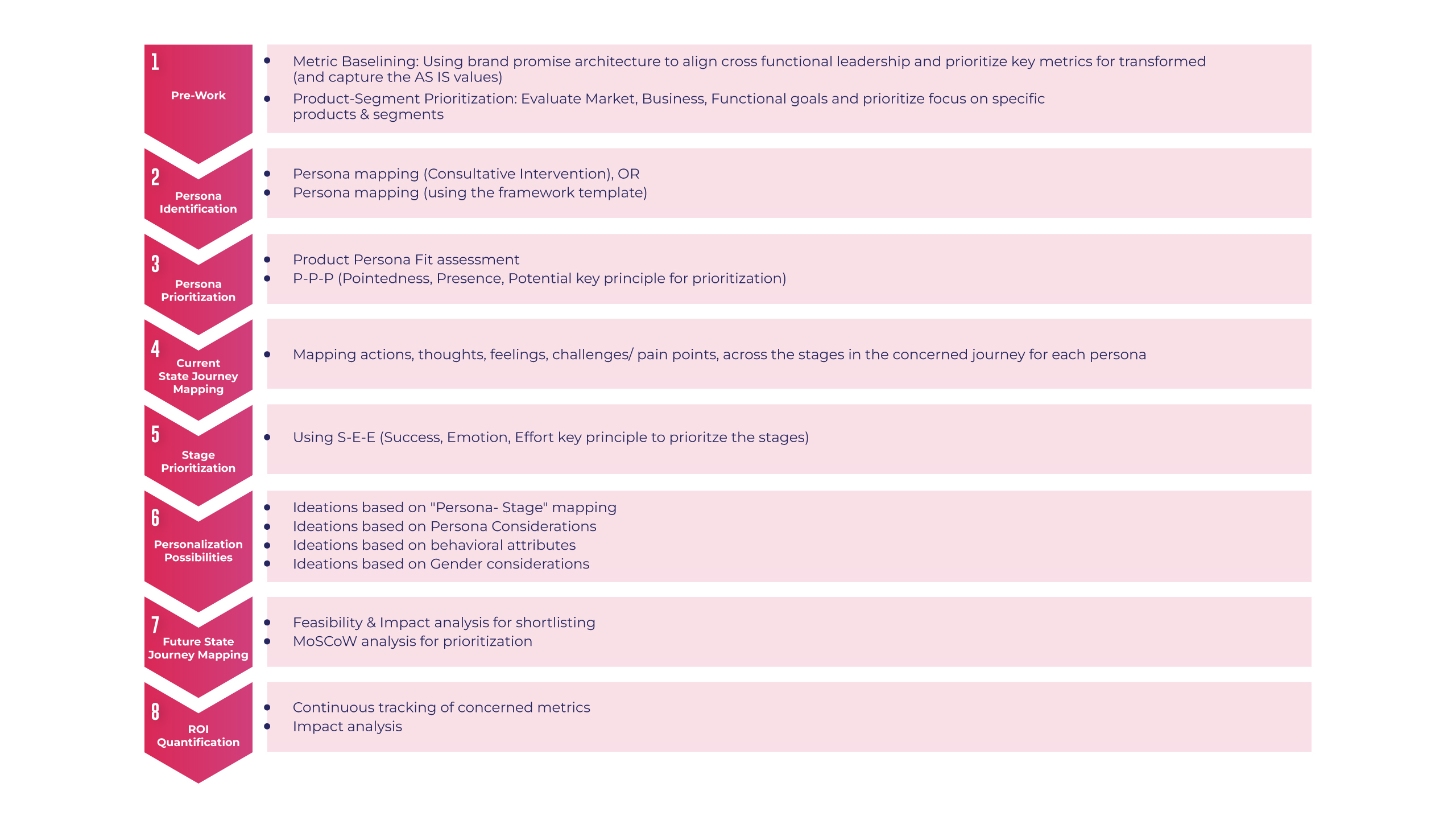

A Step-by-Step Approach

Our framework is not just a theoretical construct; it’s a practical guide designed to navigate the intricacies of personalization in the wealth management sector. Here’s a step-by-step breakdown of its execution:

Pre-work: Analyzing existing client data to understand investment behaviors, preferences, and the current journey.

Persona Identification: Segmenting clients into distinct personas based on shared preferences, goals, and behaviors.

Persona Prioritization: Applying the “Pointedness-Presence-Potential” key principle to prioritize personas based on volume, identifiability, and financial impact.

Current State Journey Mapping: Identifying client journey pain points and areas ripe for personalization enhancement.

Stage Prioritization: Using the “Success-Emotion-Effort” key principle to prioritize crucial stages in the client journey.

Personalization Possibilities: Listing tailored interventions to enhance client experiences at specific touchpoints.

Future State Journey Mapping: Envisioning an optimized client journey post-personalization interventions.

ROI Quantification: Ensuring personalization strategies are both impactful and economically sound.

Integration with AI: Leveraging our framework as focus & priority input for real time data analytics for efficient and effective hyper-personalization.

The Road Ahead

Our framework offers a structured approach to hyper-personalization, guiding wealth management firms in their quest for personalization excellence. But the journey doesn’t end here. In our next blog, we’ll explore an illustrative case study, showcasing the framework in action and highlighting its potential benefits.

Co-authored by Ashutosh Karandikar, and Venkatesh Padmanabhachari

Maveric’s thought leadership series – E.D.G.E (Experiences Delivered by Global Experts) – handpicks the game-changing technology ideas and pressing functional questions Banks and financial institutions must solve today.

These features – reports, whitepapers, podcasts, flyers, blogs, and infographics – are for Banking leaders and Technology evangelists to apply profound trends, the latest opinions, and transformational analyses to boost the performance of their organizations.