It’s reasonable to say that fintech’s potential for the future has entered the mainstream. However, elevated status brings with it heightened scrutiny from authorities. The new regulatory stance toward fintech startups is something that traditional financial institutions like banks and credit unions should pay special attention to.

Future of Fintech-Risk and Regulatory Compliance

The Current Landscape

Financial technology firms have had a hard time getting along with regulators, and the opposite is true. Banks and credit unions that work with Fintechs in specific sectors should be aware that Fintechs are still working out how they fit in with anti-money laundering (AML) legislation that governs the banking industry. Financial technology companies must be prepared to follow anti-money-laundering laws or face the repercussions.

The way forward

Even if Fintechs don’t consider themselves banks, they must adhere to all applicable safety and security standards. Partnerships between Fintechs and financial institutions are paving the path for banks to grow despite the industry’s apparent struggles with how new fintech inventions and their adopters will disrupt the marketplace.

For more market exposure from their current customer base, most Fintechs today have recognized the attractiveness of partnering with established banks and financial institutions, including Revolut and other neo-banks.

Fintech risks and compliance, on the other hand, allow Fintechs to sell their technologies and solutions to clients (likely banks and financial institutions) that don’t have the resources to create them on their own.

Partnership with domain experts

Businesses in the modern era must contend with an increasingly complex regulatory landscape and an operating environment that is frequently unstable. Reimagine the situation so that value is preserved and generated, and transform regulations into possibilities. With Maveric Systems, Gain expertise in leading, navigating, and disrupting to speed up results by mitigating legal and business dangers.

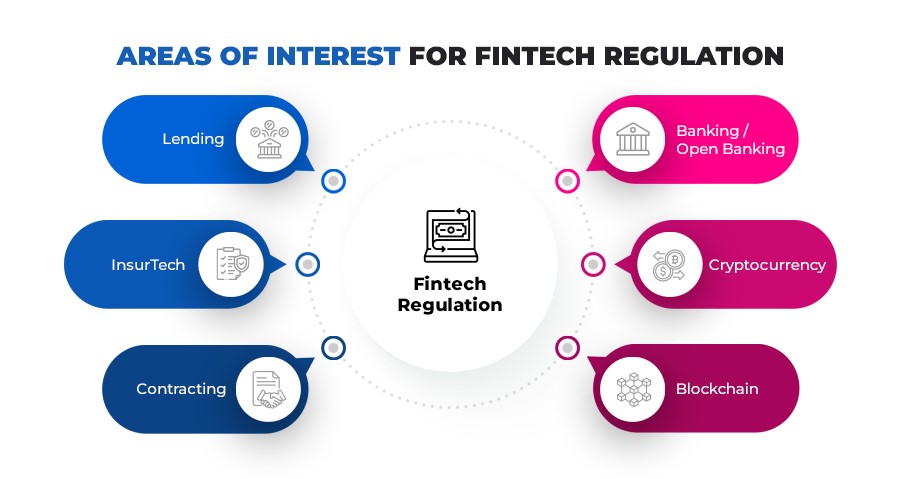

Importance of regulation for Fintech’s

While safety and conformity are crucial, there are other benefits to Fintechs being regulated.

1. Trust can only be built upon a solid foundation of regulation. Regulation compliance is integral to building credibility and confidence for any business in the financial sector.

2. Regulation creates parity in the marketplace. Businesses in the same market have similar obstacles, which is suitable for healthy competition.

3. Fintechs will be able to expand more quickly if they comply with regulations. To do so, they may introduce new goods and services, upgrade to a full banking license, or enter new markets.

The Tide is Turning

Recent developments in Fintech risk and compliance requirements have experts anticipating these shifts.

To compete in a larger market and avoid the varying regulatory requirements, several Fintechs are incorporating bank charters.

Financial institutions are actively pursuing Fintechs to serve modern customers’ needs better and reap operational efficiencies. Some commonalities can be seen between the many Fintech-based origins and fact patterns surrounding regulatory measures, including the following:

- They draw attention to the dangers to banks’ security and reputation that stem from operational, regulatory, and reputational factors.

- Several other measures have also been taken to ensure that customers of all Fintech services are afforded the necessary levels of legal protection.

- Like banks, but with an emphasis on speed and convenience, these businesses refrain from employing nonstandard distribution methods.

Conclusion

Success in regulated markets can be improved regardless of whether a fintech company becomes a chartered institution or continues to operate as it does today, but either way, sound risk management procedures should be in place. Compliance could make a business more appealing to consumers in light of rising regulatory scrutiny and the necessity for internal sound controls that allow for thorough client profiling and positive interaction.

About Maveric Systems

Starting in 2000, Maveric Systems is a niche, domain-led Banking Tech specialist partnering with global banks to solve business challenges through emerging technology. 3000+ tech experts use proven frameworks to empower our customers to navigate a rapidly changing environment, enabling sharper definitions of their goals and measures to achieve them.

Across retail, corporate & wealth management, Maveric accelerates digital transformation through native banking domain expertise, a customer-intimacy-led delivery model, and a vibrant leadership supported by a culture of ownership.

With centers of excellence for Data, Digital, Core Banking, and Quality Engineering, Maveric teams work in 15 countries with regional delivery capabilities in Bangalore, Chennai, Dubai, London, Poland, Riyadh, and Singapore.