The banking industry is transforming significantly, driven by technological advancements and changing customer expectations. For forward-thinking FIs, staying ahead of the curve and understanding the future trends in core banking systems is essential. This article will discuss the importance of open banking and API integrations in core banking technology and how they are shaping the industry’s future.

Partnering with award-winning banking core specialists, Maveric empowers leading FIs with 16+ years of Temenos product stack mastery and 550+ Temenos specialists.

Future Trends in Core Banking Systems:

Commoditization: All core systems from different vendors offer almost the same business functions. Business functions no longer set core systems apart, and banks can’t choose between other core systems by looking at the business functions they offer because there isn’t enough difference between goods on the market.

Composable technologies: As time passes, more core banking system goods are made up of smaller parts, making customization easier. Gartner calls the smaller pieces comprising CBS “packaged business components” (PBCs). These PBCs share centrally located business services, which is how CBS can fit your needs. This architecture lets banks be more flexible and choose from a wider range of tools.

Cloud: Core banking goes to the cloud, and banks worldwide are getting used to this change. In addition to making banking as a service (BaaS) possible, the CBS in the cloud can give you more flexibility in terms of design and cost structure.

Ecosystems: There’s more to choosing a new CBS than just the core. It’s about changing the whole ecosystem where this core will work and interact with other systems (inside and outside the bank, such as markets).

Standards: The market for banks is moving towards standards. With the rise of architectural core banking standards, more than internal operating agility is required. They can also help the bank in many other ways, such as making it more efficient, easier to serve CBS (that is, to do maintenance and development), and giving it an easy-to-manage architecture with best-of-breed features and scalability.

The Rise of Open Banking.

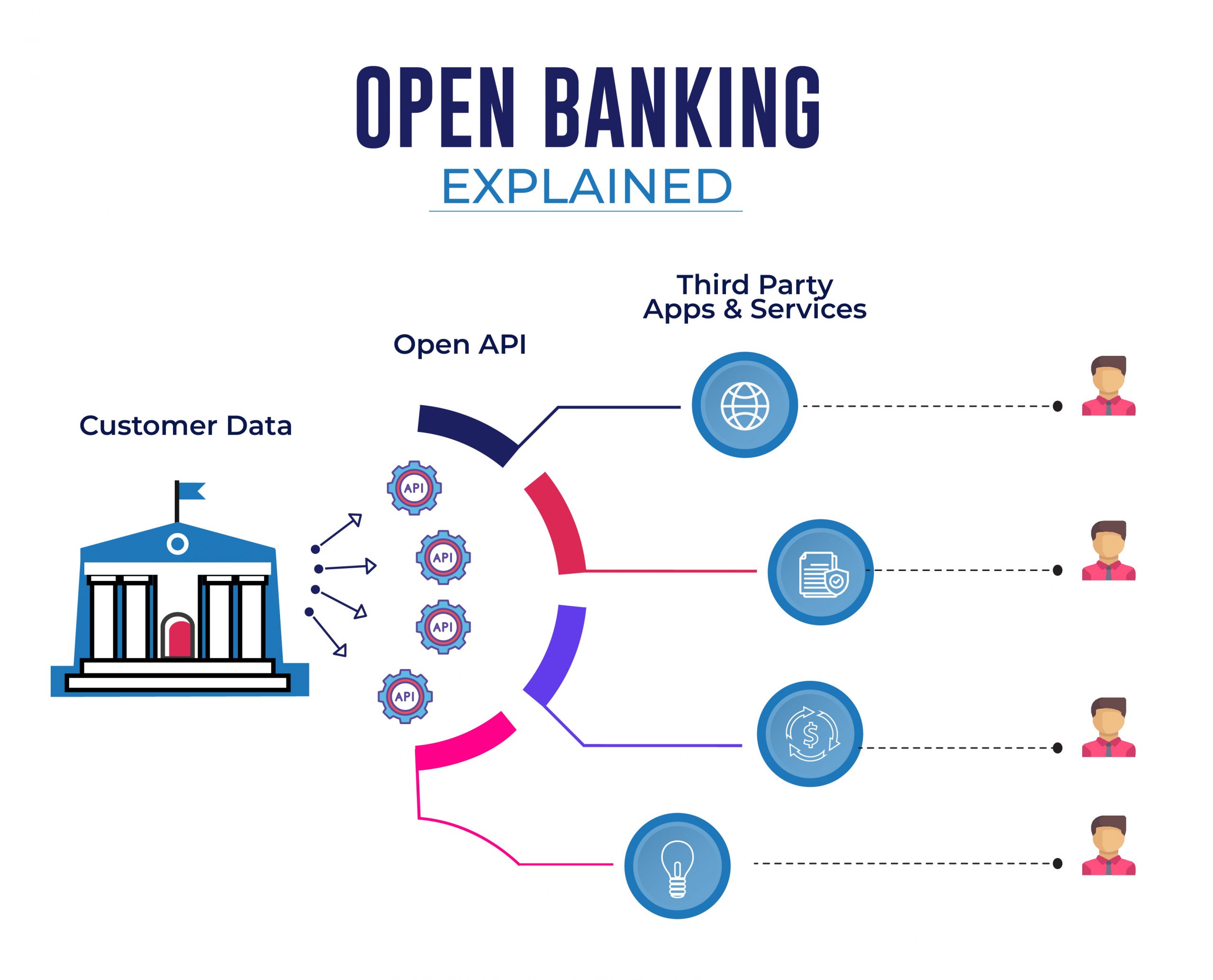

Open banking is a paradigm shift that allows customers to take control of the financial data they would like to share securely with third-party providers through open APIs (Application Programming Interfaces). It promotes competition, innovation, and collaboration within the banking ecosystem, benefiting customers with enhanced services and personalized experiences.

Open banking allows banks to expand their product offerings by collaborating with fintech companies, leveraging their specialized capabilities. It enables banks to provide customers with broader financial solutions beyond traditional banking services, such as personalized financial management tools, digital lending platforms, and investment advisory services.

API Integrations and Core Banking Technology.

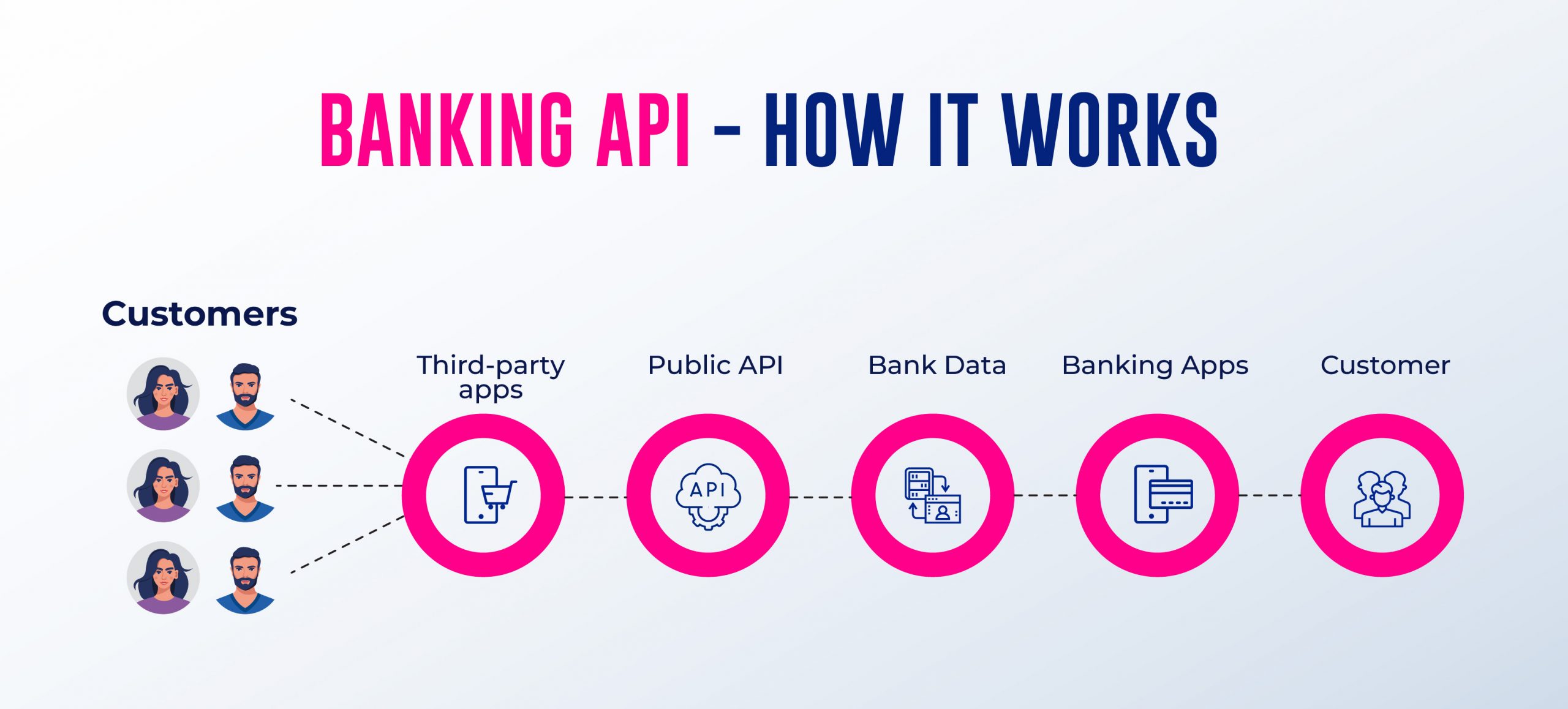

API integrations play a pivotal role in realizing the potential of open banking. APIs allow various software systems to share data seamlessly, enabling banks to integrate their core banking systems with external applications and services. Here are a few key reasons why API integrations are vital for the future of core banking technology:

Enhanced Customer Experience: API integrations enable banks create seamless CX across various touchpoints. By integrating core banking systems with third-party applications, banks can give customers real-time access to their financial data, personalized recommendations, and convenient self-service options. For example, customers can view their account balances, initiate transactions, and access financial planning tools through their preferred banking apps.

Agility and Innovation: API-driven architectures enable banks to innovate quickly to fluctuating market demands. By exposing their core banking functionalities through APIs, banks can collaborate with fintech startups, technology partners, and developers to create new products and services. This fosters a culture of innovation and allows banks to rapidly deploy new features and functionalities without requiring extensive system overhauls.

Scalability and Cost Efficiency: API integrations enable banks to leverage external capabilities without reinventing the wheel. Instead of building everything in-house, banks can connect with specialized third-party providers for specific services, such as payment processing, fraud detection, or credit scoring. This approach reduces development costs, accelerates time to market, and allows banks to scale their operations efficiently.

Regulatory Compliance: APIs and open banking facilitate compliance with evolving regulatory requirements, such as Europe’s Second Payment Services Directive (PSD2). By securely sharing customer data through standardized APIs, banks can ensure compliance with data protection and consent management regulations. Additionally, APIs enable the secure exchange of information between banks and regulatory bodies, simplifying reporting processes and reducing administrative burdens.

Conclusion

Open banking and API integrations are revolutionizing the banking industry, reshaping the future of core banking systems. Embracing these trends is crucial for senior banking leaders to stay competitive, deliver exceptional customer experiences, and drive innovation. By leveraging open APIs, banks can seamlessly integrate their core banking systems with various external services, collaborate with fintech partners, and provide customers with personalized, data-driven solutions.

The future of core banking lies in embracing open banking principles and building flexible, API-driven architectures. As senior banking leaders, it is essential to foster a culture of innovation, invest in robust API frameworks, and forge strategic partnerships to unlock the full potential of open banking. By embracing these trends, banks can position themselves as agile, customer-centric financial institutions ready to thrive in the digital era.

About Maveric Systems

Starting in 2000, Maveric Systems is a niche, domain-led Banking Tech specialist partnering with global banks to solve business challenges through emerging technology. 3000+ tech experts use proven frameworks to empower our customers to navigate a rapidly changing environment, enabling sharper definitions of their goals and measures to achieve them.

Across retail, corporate & wealth management, Maveric accelerates digital transformation through native banking domain expertise, a customer-intimacy-led delivery model, and a vibrant leadership supported by a culture of ownership.

With centers of excellence for Data, Digital, Core Banking, and Quality Engineering, Maveric teams work in 15 countries with regional delivery capabilities in Bangalore, Chennai, Dubai, London, Poland, Riyadh, and Singapore.