Credit risk management is a critical aspect of banking operations, and accurate assessment and modeling of credit risk are essential for maintaining a healthy loan portfolio. In recent years, the advancement of analytics and technology has revolutionized credit risk modeling. Advanced analytics techniques have enabled banks to enhance credit risk assessment accuracy, efficiency, and effectiveness. In this blog, we explore how credit risk modeling is dependent on advanced analytics and the benefits it brings to the banking industry. Collaborating with deep domain experts and a proven data technology prowess, like Maveric, helps leading banks hone their credit risk modeling strategy.

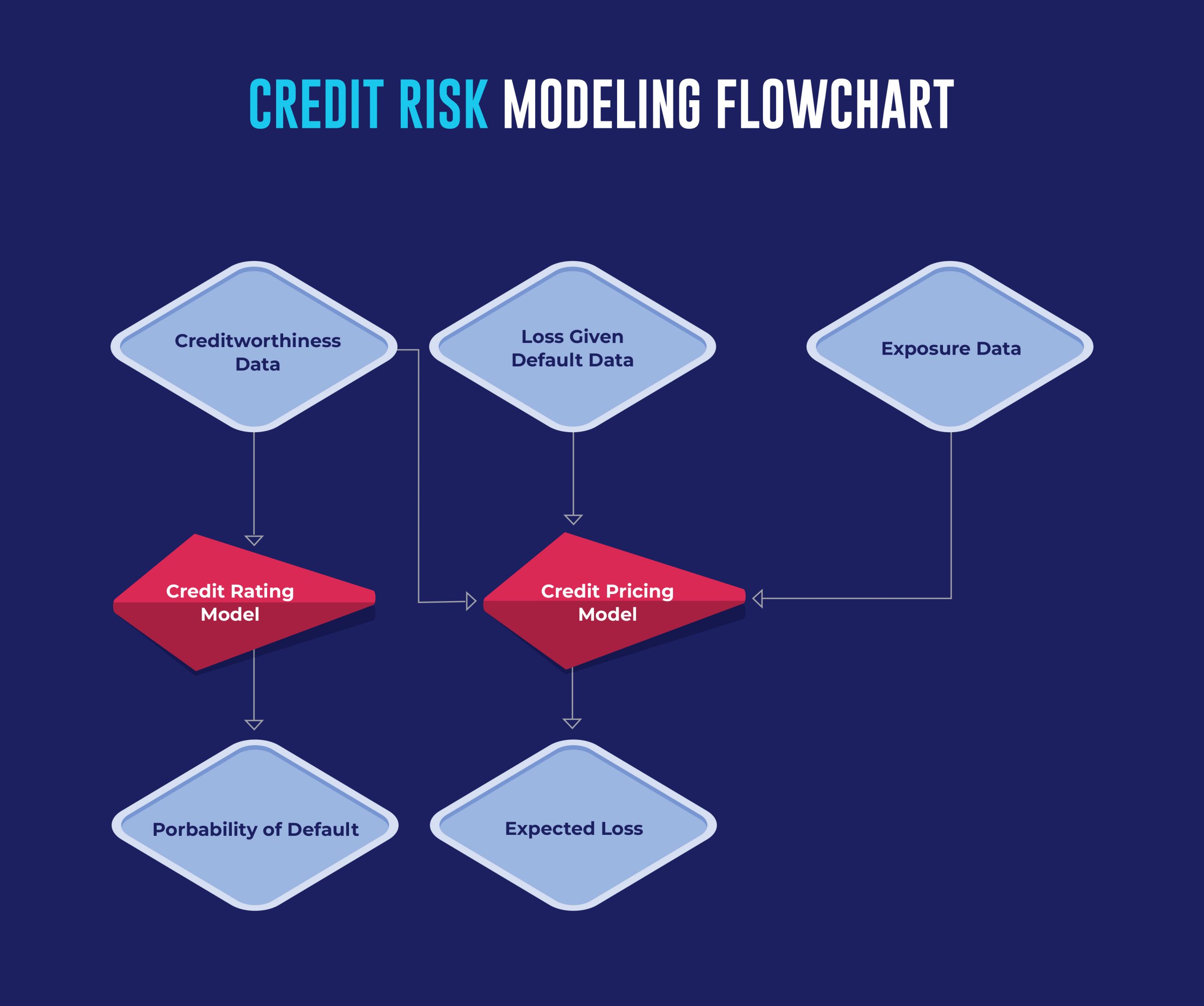

Understanding Credit Risk Modeling:

Credit risk modeling involves assessing the likelihood of default and estimating potential losses associated with lending activities. Traditionally, credit risk models relied on historical data, basic statistical techniques, and subjective judgment. However, technological advancements and the availability of vast data have opened up new opportunities for credit risk modeling using advanced analytics.

The Role of Advanced Analytics in Credit Risk Modeling:

Enhanced Data Processing and Analysis:

Advanced analytics techniques, such as ML enable banks to efficiently process and analyze huge volumes of structured and unstructured data. This includes financial statements, credit reports, social media data, and macroeconomic indicators. By harnessing the power of advanced analytics, banks can uncover hidden patterns, identify emerging risks, and make more accurate credit risk assessments.

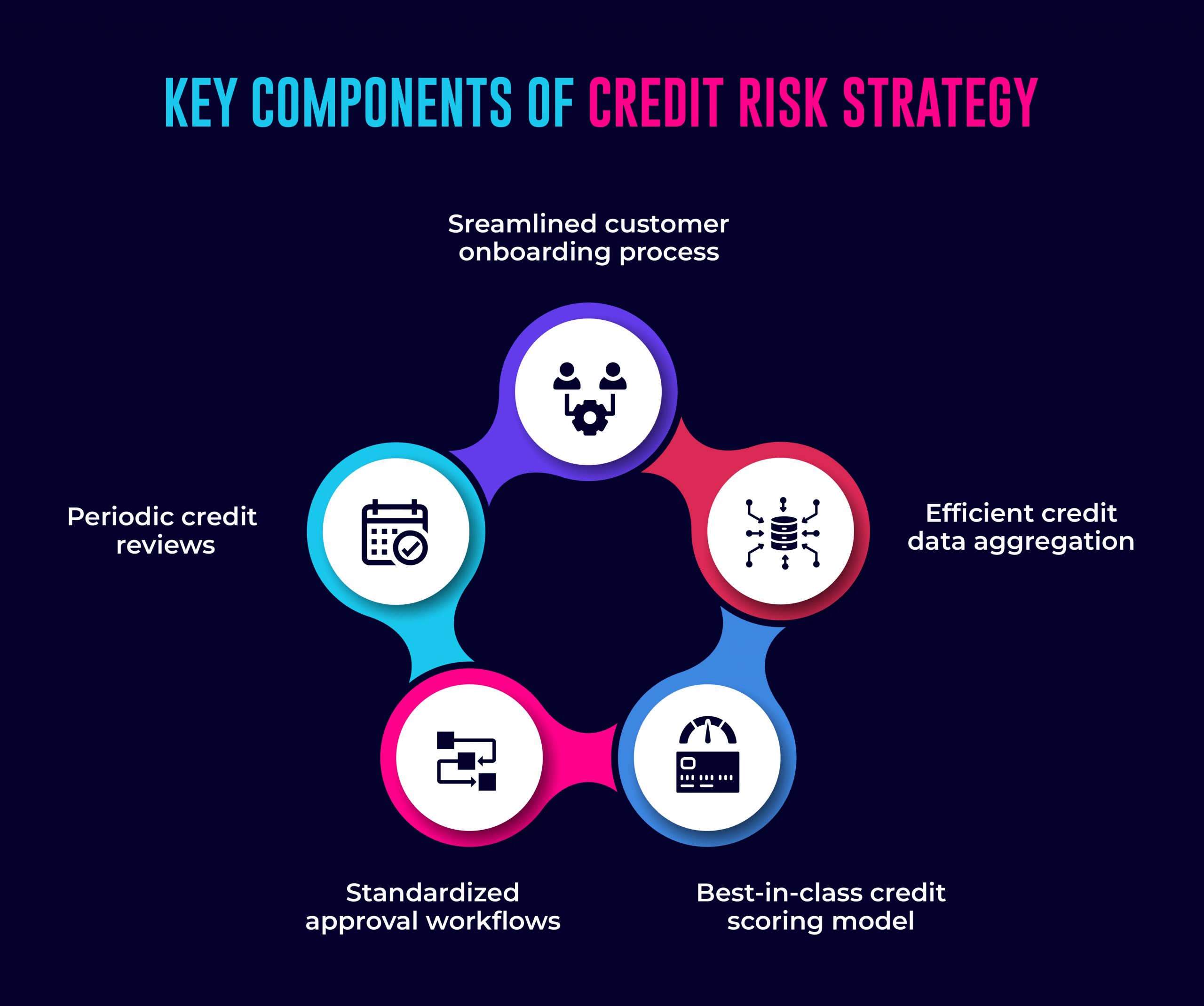

Improved Risk Identification and Scoring:

Advanced analytics techniques enable banks to develop sophisticated risk identification and scoring models. Machine learning algorithms can identify relevant risk factors and assign appropriate weights based on their predictive power. This enables banks to develop more accurate credit scoring models, leading to better-informed credit decisions and reducing the likelihood of default.

Predictive Modeling and Early Warning Systems:

Advanced analytics techniques enable banks to build predictive models that forecast the probability of default or delinquency. By analyzing historical data and incorporating various risk factors, such as income, employment history, and debt-to-income ratios, these models can provide early warning signals for potential credit default. This allows banks to take proactive measures and mitigate potential risks in their loan portfolio.

Portfolio Optimization and Stress Testing:

Advanced analytics techniques facilitate portfolio optimization and stress testing. Banks can assess the robustness of their credit risk models by simulating various economic scenarios and analyzing the impact on the loan portfolio. This helps banks identify potential vulnerabilities, allocate resources effectively, and optimize their portfolio for risk and return.

Fraud Detection and Prevention:

Advanced analytics is crucial in detecting and preventing fraudulent activities in credit portfolios. Machine learning algorithms can identify patterns of fraudulent behavior by analyzing historical transaction data. By incorporating these algorithms into credit risk models, banks can better detect and prevent fraudulent applications, reducing financial losses and enhancing the overall credit risk management process.

Benefits of Advanced Analytics in Credit Risk Modeling:

Enhanced Accuracy and Efficiency:

Advanced analytics techniques improve the accuracy of credit risk models by incorporating a broader range of risk factors and analyzing larger datasets. This leads to more precise credit risk assessments, reducing the likelihood of default and potential losses. Additionally, advanced analytics streamlines the credit risk modeling process, enabling banks to make faster and more informed credit decisions.

Better Customer Segmentation and Personalization:

Advanced analytics allows for more granular customer segmentation based on risk profiles, enabling banks to tailor products and services to specific customer segments. This leads to better-targeted marketing campaigns, personalized credit offers, and improved customer experiences.

Regulatory Compliance:

Advanced analytics helps banks comply with regulatory requirements by providing robust and transparent credit risk models. Regulators increasingly emphasize the importance of data-driven and forward-looking credit risk assessments. Advanced analytics techniques enable banks to demonstrate compliance by providing accurate risk measurements and documentation.

Competitive Advantage and Business Growth:

Banks can earn a competitive edge in the market by leveraging advanced analytics in credit risk modeling. Accurate credit risk assessments allow banks to make well-informed lending decisions, attracting low-risk borrowers and reducing the overall cost of credit. This strengthens the bank’s reputation, builds customer trust, and supports sustainable business growth.

Conclusion:

Advanced analytics has transformed credit risk modeling in the banking industry. By harnessing the power of machine learning, data mining, and predictive modeling, banks can make more accurate credit risk assessments, enhance portfolio optimization, detect and prevent fraud, and improve overall decision-making. The benefits of advanced analytics in credit risk modeling are manifold, including improved accuracy and efficiency, better customer segmentation, regulatory compliance, and a competitive advantage in the market. As the banking industry evolves, embracing advanced analytics in credit risk modeling is vital for banks to thrive, manage risks effectively, and drive sustainable growth.

Conclusion

As smartphones, tablets, and other mobile devices increase, users now want their banking services to be more accessible and flexible. IT solutions for banks have also helped them lower their running costs. With technology, banks can do their jobs with fewer staff, reducing overhead costs. This could mean more money in the bank and more competition in the market.

One study (from Moneytransfer.com) says that by 2025, there will be 216.8 million digital banking customers in the US alone, and by 2024, there will be more than 3.6 billion online banking customers and users worldwide. The numbers can show how quickly people are using digital banking solutions, and they can also show why everyone should use Banking IT Solutions.

About Maveric Systems

Starting in 2000, Maveric Systems is a niche, domain-led Banking Tech specialist partnering with global banks to solve business challenges through emerging technology. 3000+ tech experts use proven frameworks to empower our customers to navigate a rapidly changing environment, enabling sharper definitions of their goals and measures to achieve them.

Across retail, corporate & wealth management, Maveric accelerates digital transformation through native banking domain expertise, a customer-intimacy-led delivery model, and a vibrant leadership supported by a culture of ownership.

With centers of excellence for Data, Digital, Core Banking, and Quality Engineering, Maveric teams work in 15 countries with regional delivery capabilities in Bangalore, Chennai, Dubai, London, Poland, Riyadh, and Singapore.