AI-Powered Fraud Detection Solution

Achieve 70% Fraud Reduction with Real-Time Monitoring

Overview

Authorized Push Payments (APP) is the fastest growing fraud type. According to Scamscope, a report by ACI Worldwide and GlobalData, Authorised Push Payment (APP) scam losses are expected to rise to $ 6.8 billion by 2027. With the increase in prevalence of digital payments channels, banks need to adopt enhanced vigilance and preventive measures to combat APP fraud. For banks, the effort involved in monitoring fraud instances far outweigh the benefits on account of a large proportion of low value transactions, not to mention navigating complex recovery processes for fraud incident resolution. Manual mode of fraud alert monitoring leads to human errors, resulting in a high volume of undetected fraudulent transactions amounting to $ 1.48 billion as per Federal Trade Commission, and escalating customer disputes.

Maveric’s solution is built to meet stringent regulatory standards, reducing fraudulent transactions by 70%, significantly lowering bank liability by up to 40%.

Maveric’s AI-Powered Fraud Detection Solution

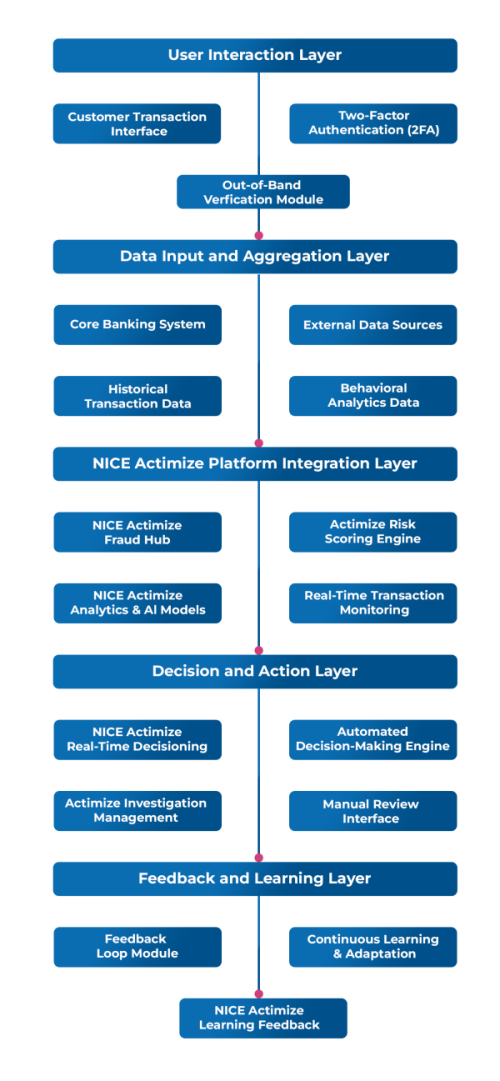

Our solution can be implemented in 12-16 weeks. It commences with a requirement gathering and analysis phase, followed by the design of the architecture and integration points between real-time APP fraud detection solution and NICE Actimize. The connectors are then built, focused on the main fraud detection engine and its integration with Actimize, followed by extensive testing and validation.

AI-Powered Fraud Detection

Machine learning detects anomalies and evolves with new fraud tactics, continuously improving accuracy.

Real-Time Monitoring and Automated Decisions

Instantly analyzes transactions, assigns risk scores, and minimizes manual review with AI-driven decisions.

Behavioural Analytics and Seamless Integration

Assesses risk based on user behavior across channels and integrates smoothly with existing systems.

Effective Case Management and Alerts

Streamlined tools for managing flagged transactions and proactive customer notifications to enhance trust.

Regulatory Compliance and Reporting

Automates compliance and reporting, ensuring adherence to industry standards and smooth audits.

Business Benefits

Enhanced Fraud Detection Accuracy

Achieves 80% accuracy in detecting APP transaction fraud and securing user consent.

Improved Decision-Making

Transparent, explainable AI models accelerate decision making processes.

Operational Efficiency

Doubles agent productivity, leading to significant operational cost savings.

Customer Satisfaction

Proactively addresses inquiries and delivers hyper-personalized experiences, fostering deeper customer loyalty.

Significant Time Savings

Reduces time spent on fraud investigations by 70%, allowing for quicker resolution.

Dynamic Risk Scoring

Provides effective response management based on a wide range of factors.

Regulatory Compliance

Ensures adherence to regulatory standards, minimizing legal risks and penalties.

Seamless Integration

Rapid integration with existing systems ensures minimal disruption and quick deployment.

Boost your competitive edge

The Maveric Edge

Leverage Maveric’s contextualization depth, extensive domain competencies, and over two decades of multi-geography award-winning commitment.

Contextualized Solutions

An innate ability to bring together domain, platform, and technology expertise to craft contextual solutions to support transformation programs.

Impactful Delivery Model

A customer centric model geared for high delivery impact.

New Service Line Development

Proven ability to develop and scale new service lines aligned to customer growth areas.

Differentiated Engagement

Technical engagement led customer value creation.

Meet the Experts

Kishan Sundar

Senior Vice President, Chief Technology Officer – Key Accounts

Arindam Ray

Vice President – Central Engagement

Sriram Sivaraman

Associate Vice President – Engagement Anchor

Ready to transform your banking ecosystem?

Contact us today to learn how Maveric’s “AI-powered fraud detection solution” can accelerate your innovation journey and position your bank for long-term success.