Revolutionizing Banking CX: Actionable Intel for Corporate, Retail, Wealth banking leaders

In today’s rapidly transforming banking industry, staying ahead requires more than just traditional strategies. Maveric’s Banking EDGE CX Report’ emerges as a crucial guide for business leaders navigating an ever-dynamic business and consumer behavior landscape. It illuminates the latest developments and successful approaches in customer experience, emphasizing why an informed, adaptable strategy is vital for thriving in the Corporate, Retail, and Wealth Management sectors. This report is thus an essential reading for banking executives looking to align with current trends, innovate, and maintain a competitive edge in a dynamic global market.

Why Read the Report:

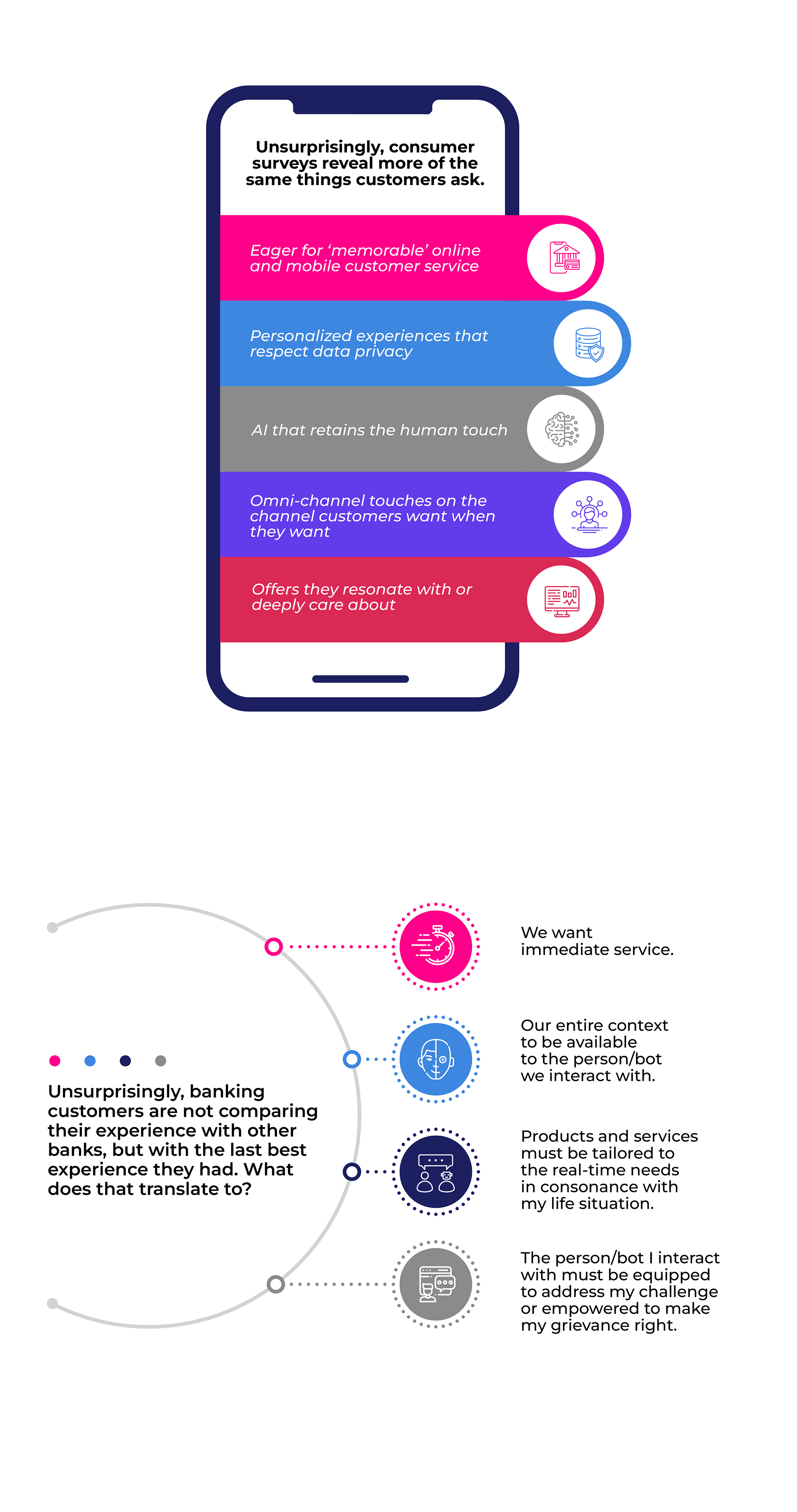

- In-Depth Market Analysis: Comprehensive analysis of CX in banking sectors across North American, UK, European markets; focusing on digital adoption, fintech impact, politico-regulatory environment, and socio-economic factors

- Sector-Specific Trends: Insights into Corporate, Retail, Wealth Management banking – their unique challenges and emerging trends.

- Strategic Competitive Edge: Guidance on enhancing customer satisfaction, loyalty, and revenue through innovative CX strategies backed by several success stories and relevant case studies

Value for Business Leaders:

- Data-Driven Decision-Making: Leverage the latest research and market data for strategizing and actioning CX

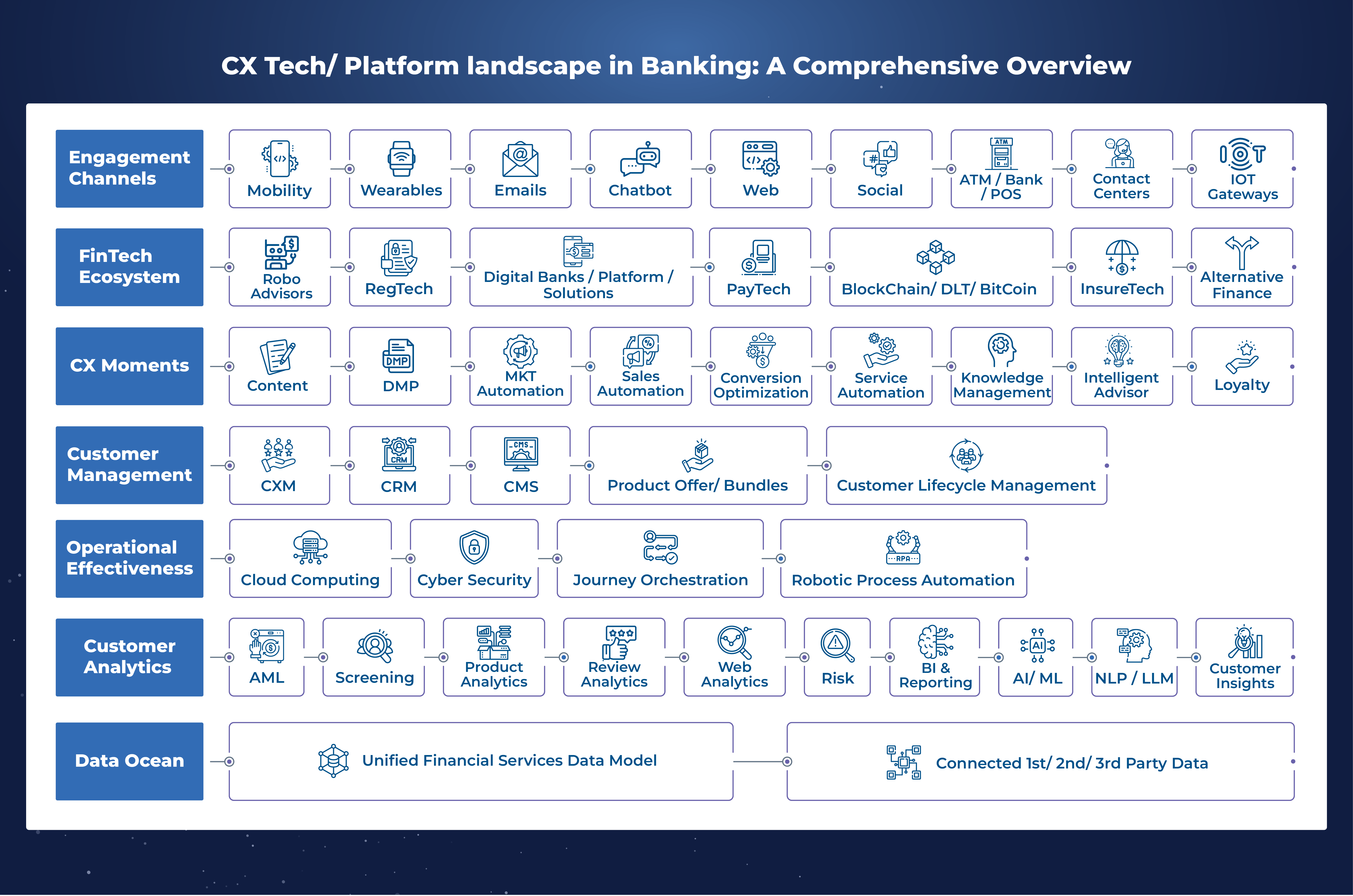

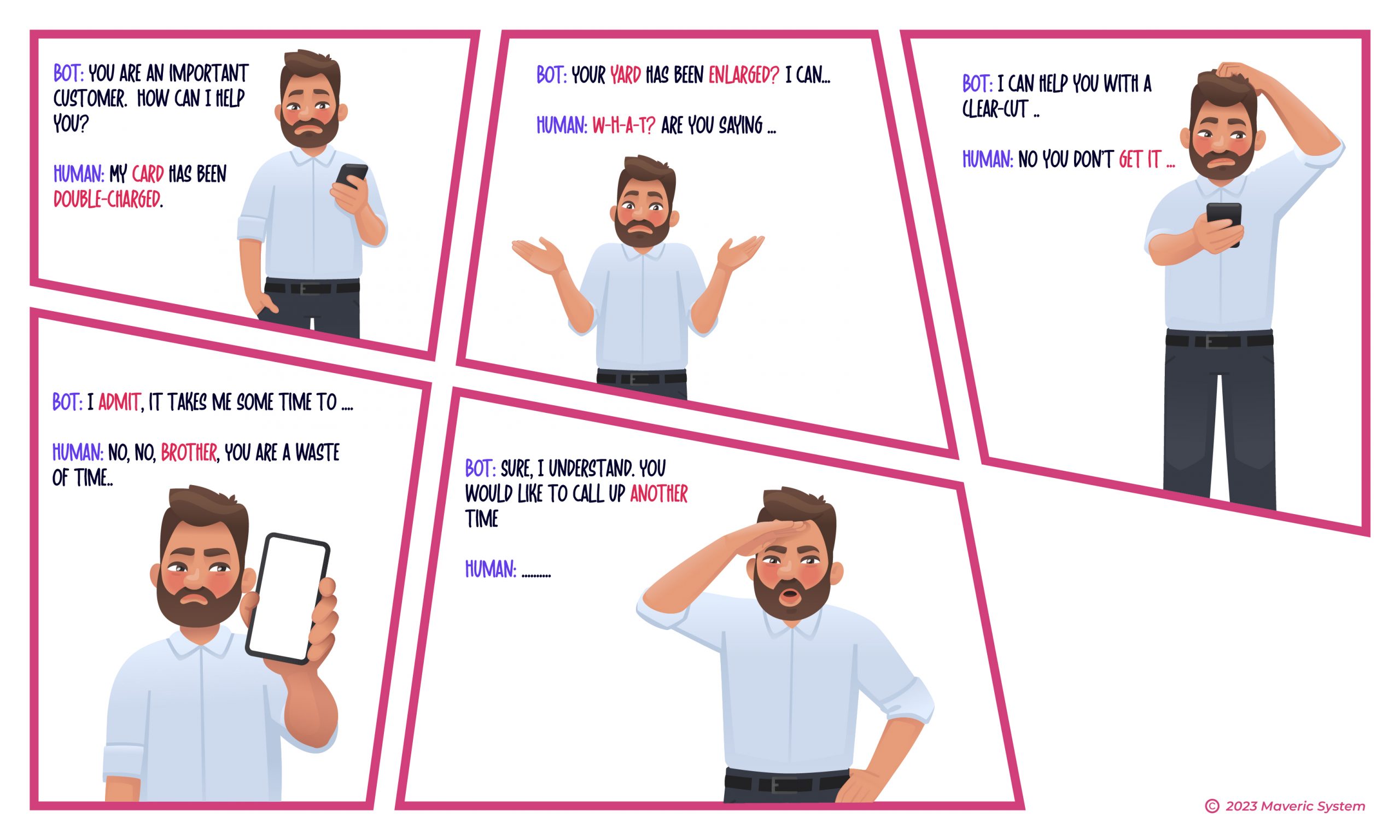

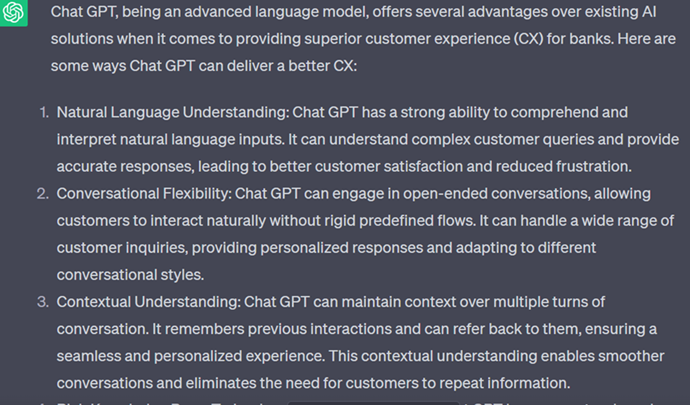

- Technological Innovations: Explore how AI, Blockchain, data analytics, BI and other CX Tech/ Platforms are transforming customer interactions and operations.

Embrace the future of banking with strategic and actionable insights from Maveric’s Banking EDGE CX Report – your key to navigating and excelling in a rapidly evolving industry!

To get more updates, subscribe to our Monthly Newsletter

View