Digital entrants eroding market shares across BANKING SEGMENTS, ECOSYSTEM COLLABORATIONS REWRITING PLAYBOOKS, AND HIGHER ESG COMMITMENTS are central themes for leading FIs.

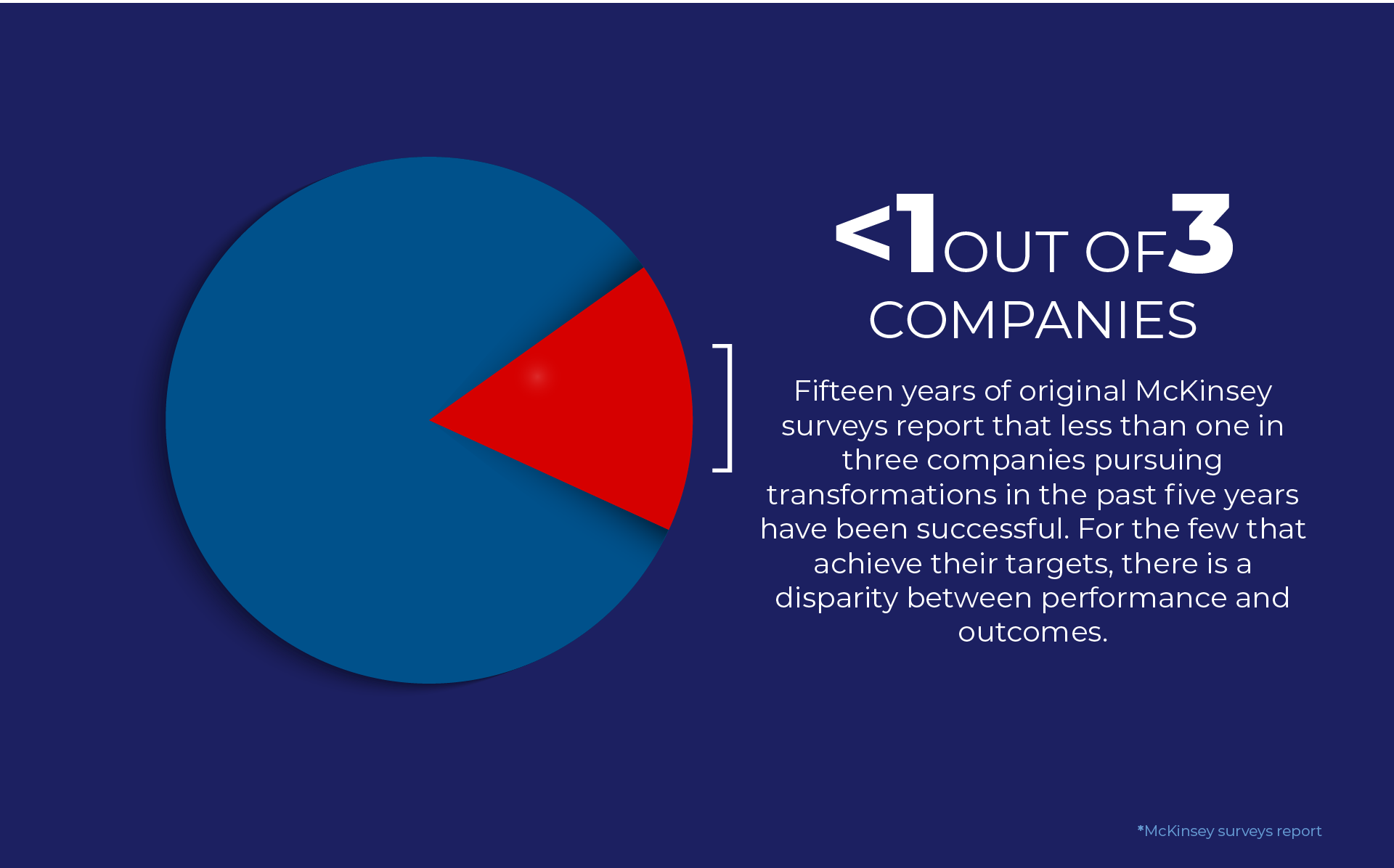

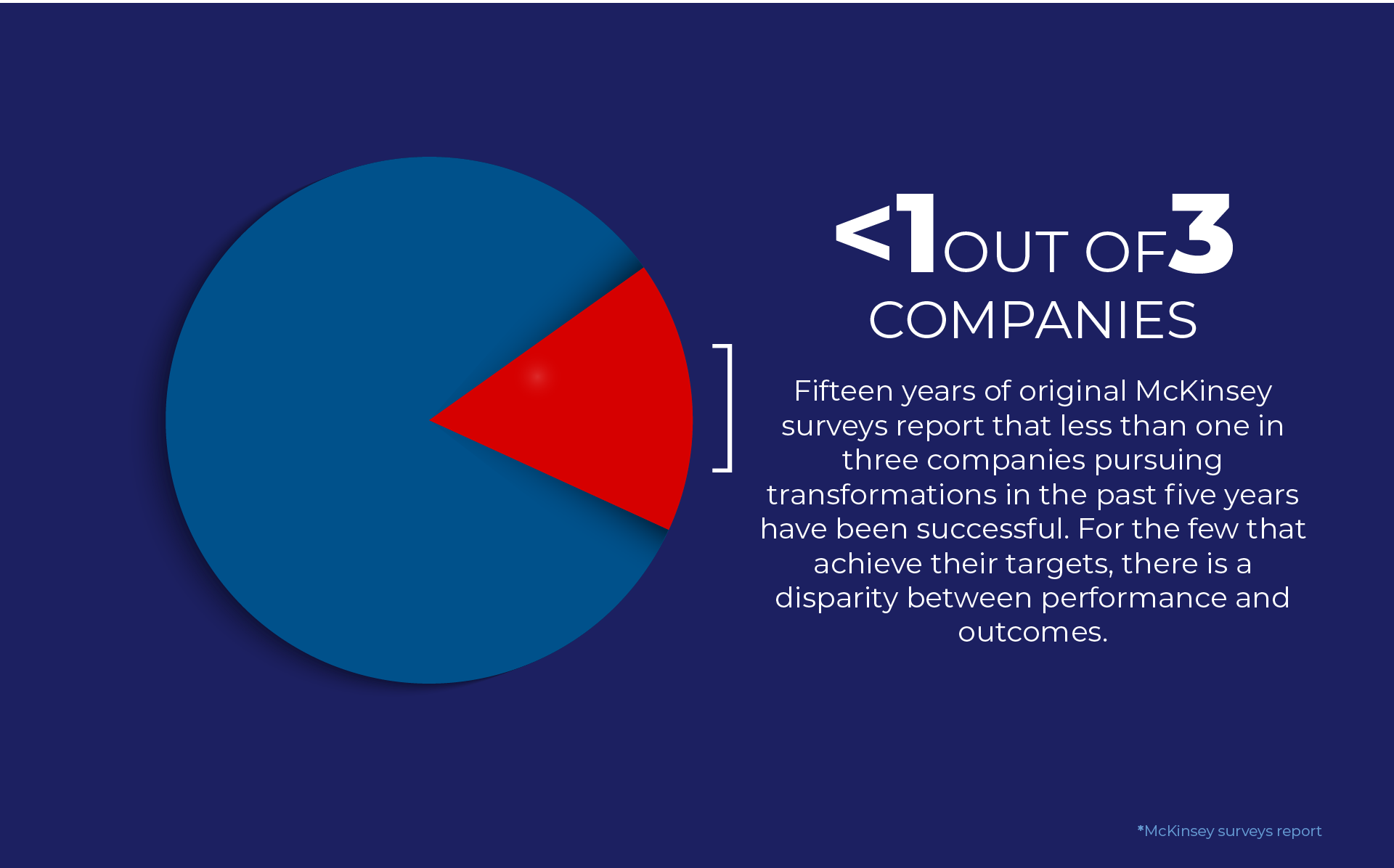

Fifteen years of original McKinsey surveys report that less than one in three companies pursuing transformations in the past five years have been successful. For the few that achieve their targets, there is a disparity between performance and outcomes.

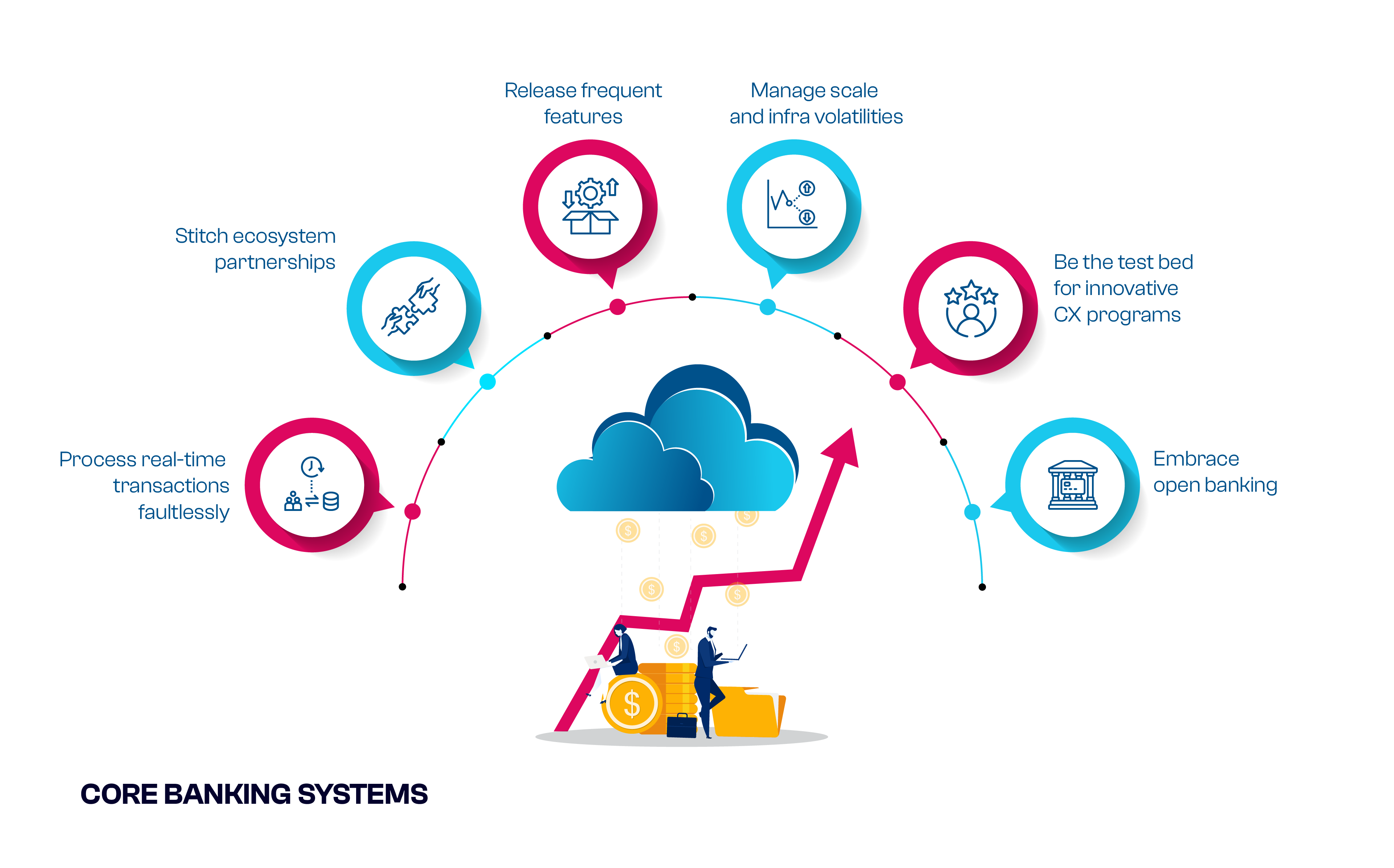

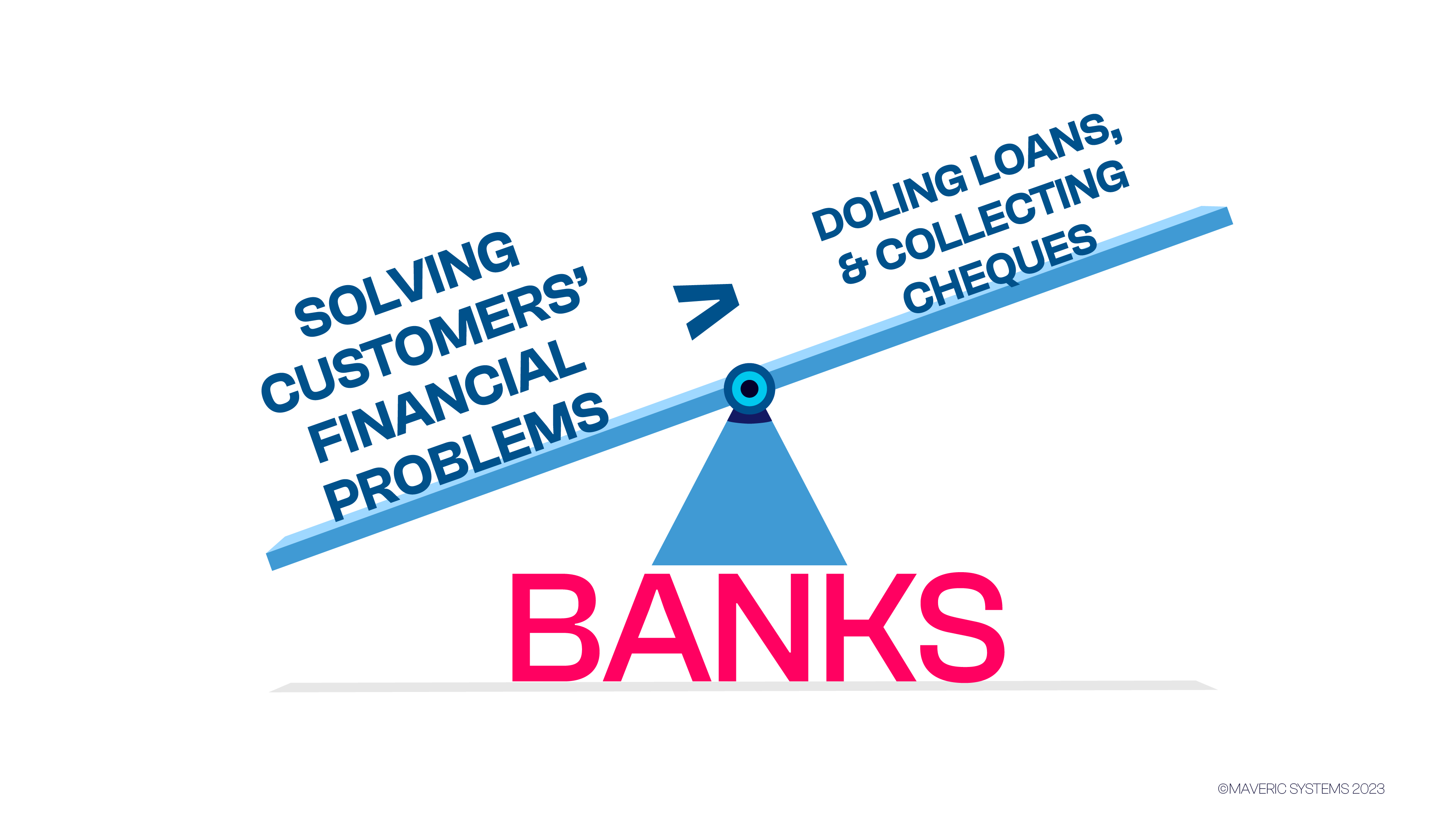

While growth spirals are unique for each of the BFSI players, there is consensus around what constitutes ‘bold banking innovation’: reinvent core businesses through digital and analytics, acquire or create new revenue streams and rehaul operating models that capture speed to the market.

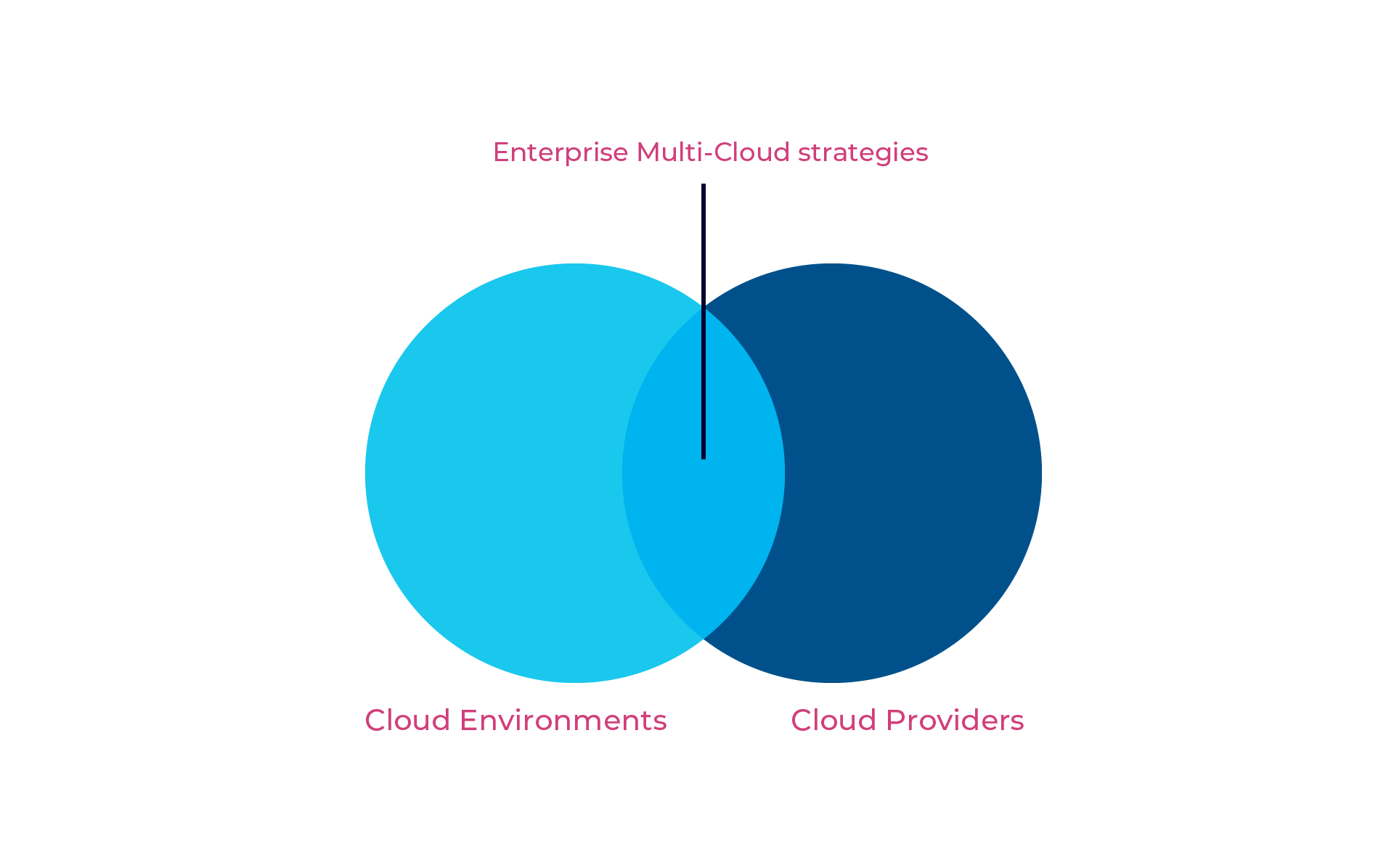

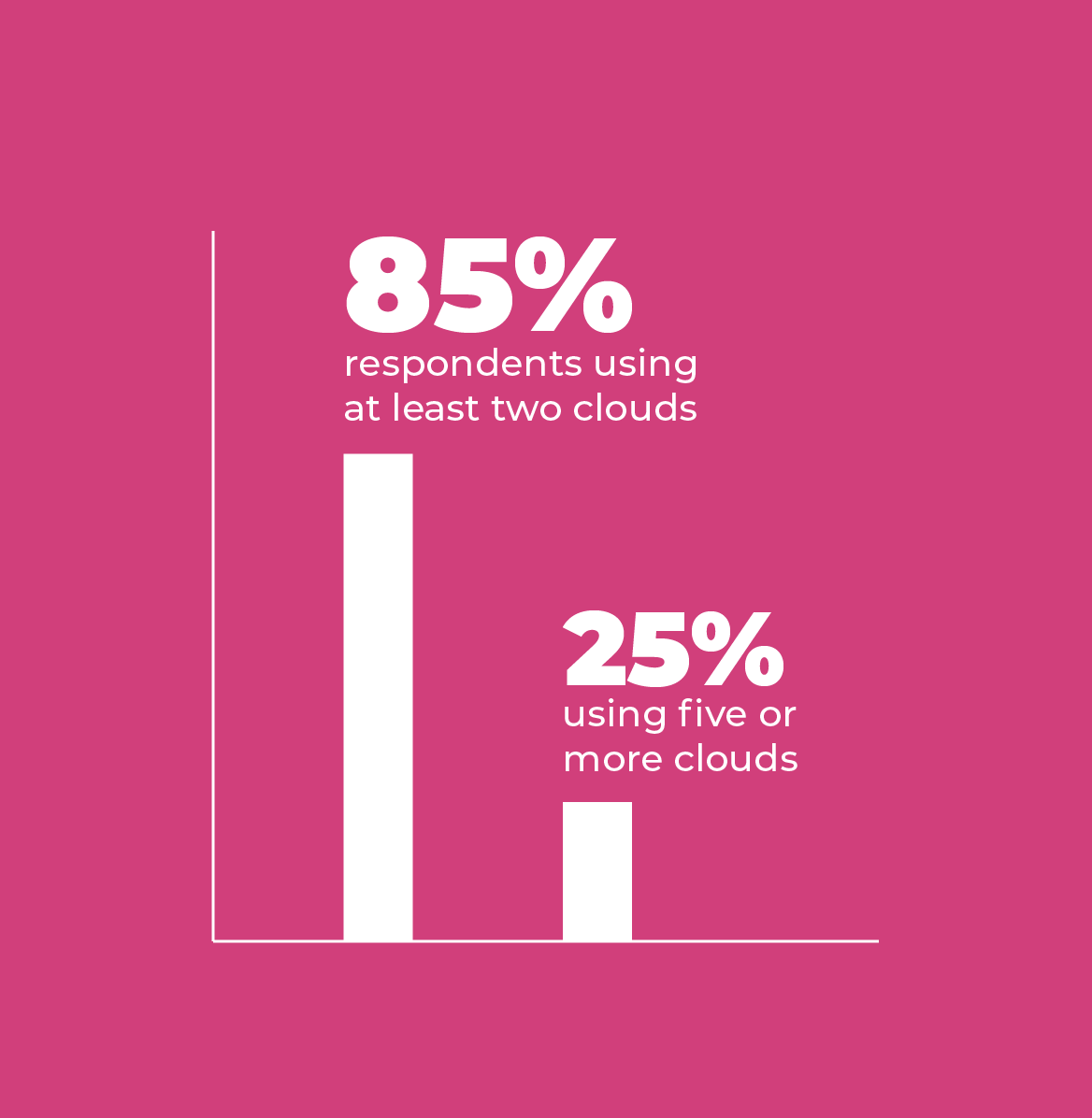

AGAINST THIS BACKDROP, ENTERPRISE ADOPTING MULTI-CLOUD STRATEGIES – A MIX OF CLOUD ENVIRONMENTS AND PROVIDERS – CONTINUES TO PROLIFERATE.

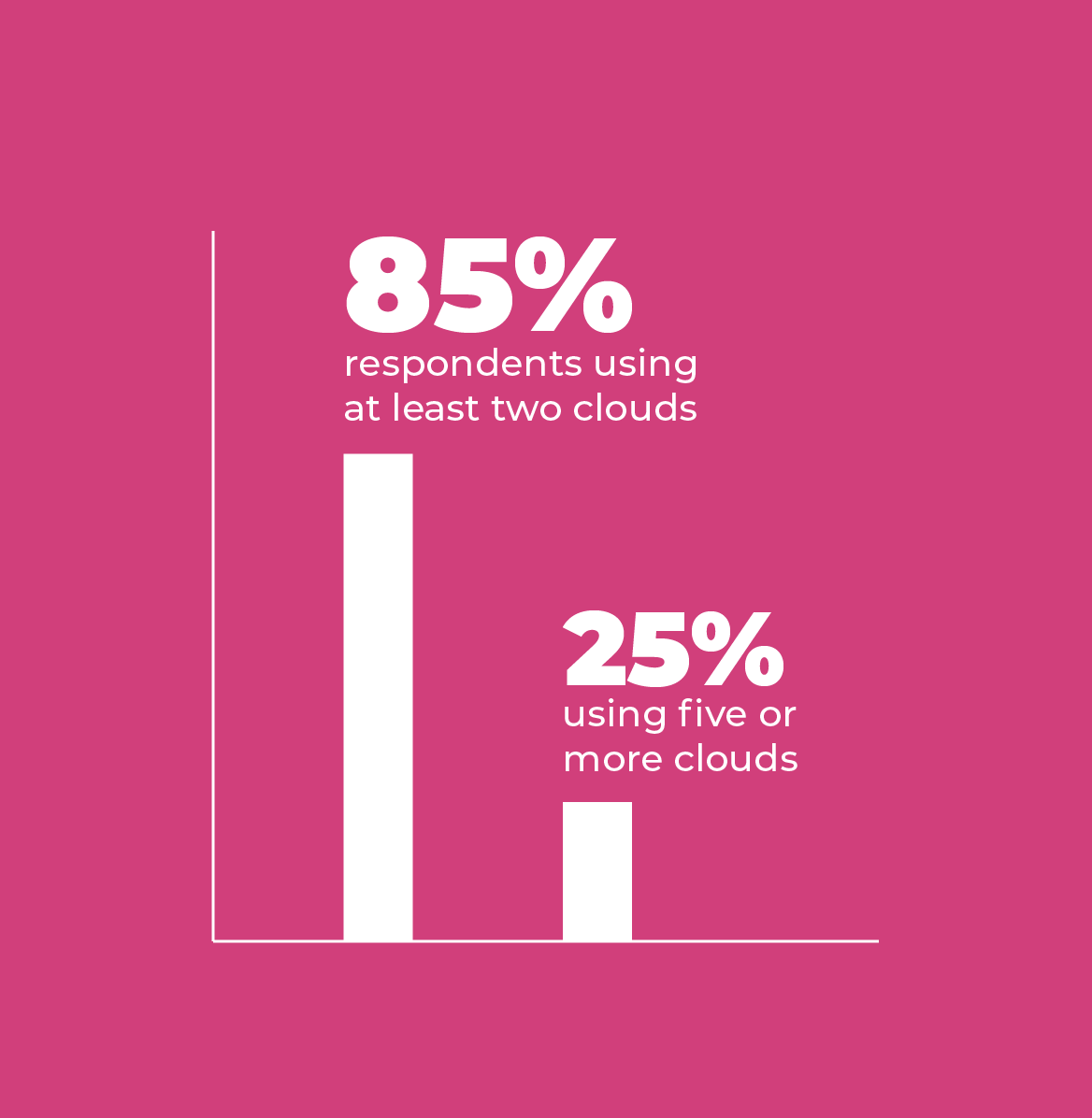

As enterprises move their application and data workloads, hybrid and distributed cloud environments quickly become the norm. An hbr analytic survey talks about 85% percent of respondents using at least two clouds and a quarter using five or more.

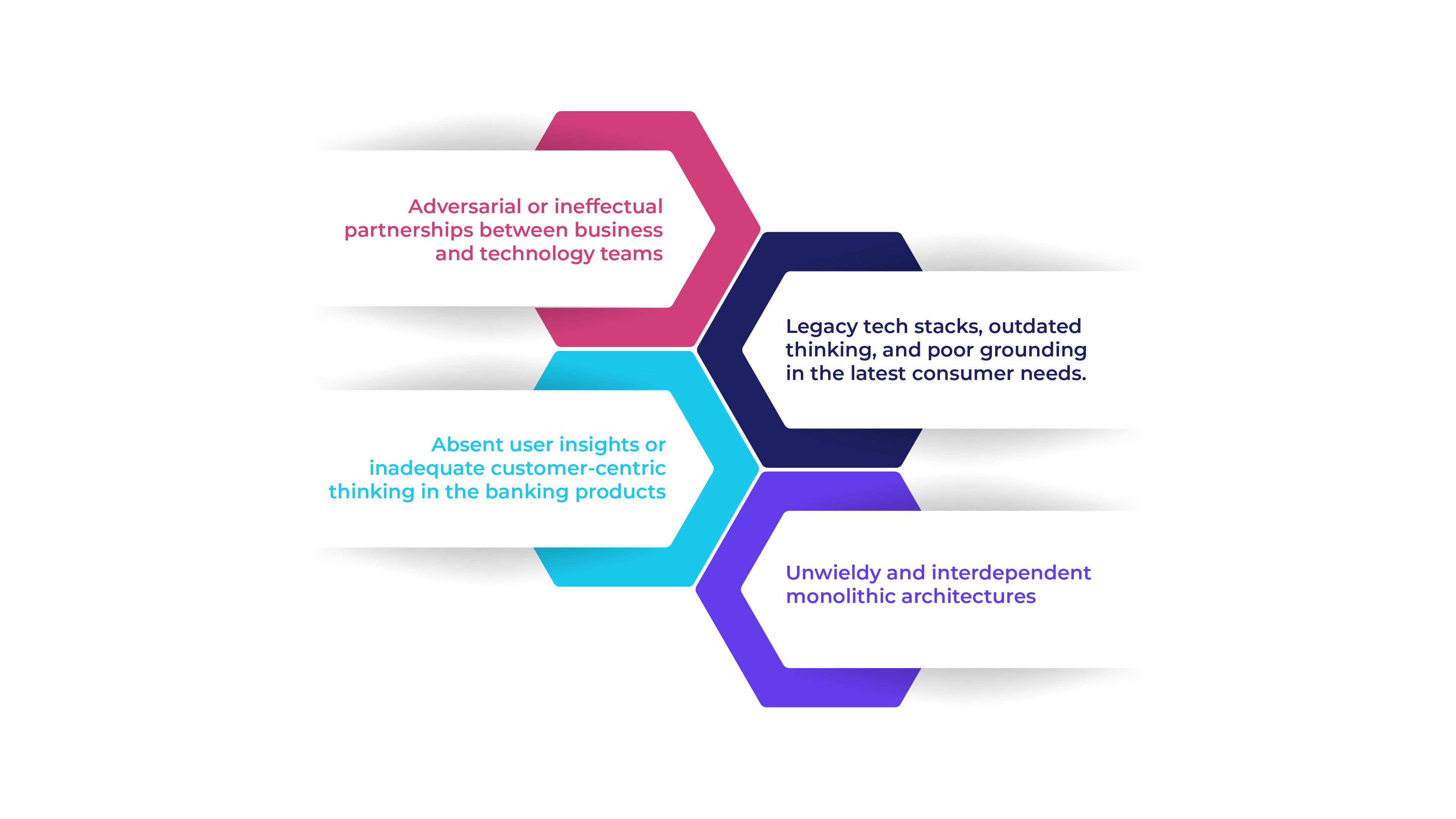

The Problem Statement

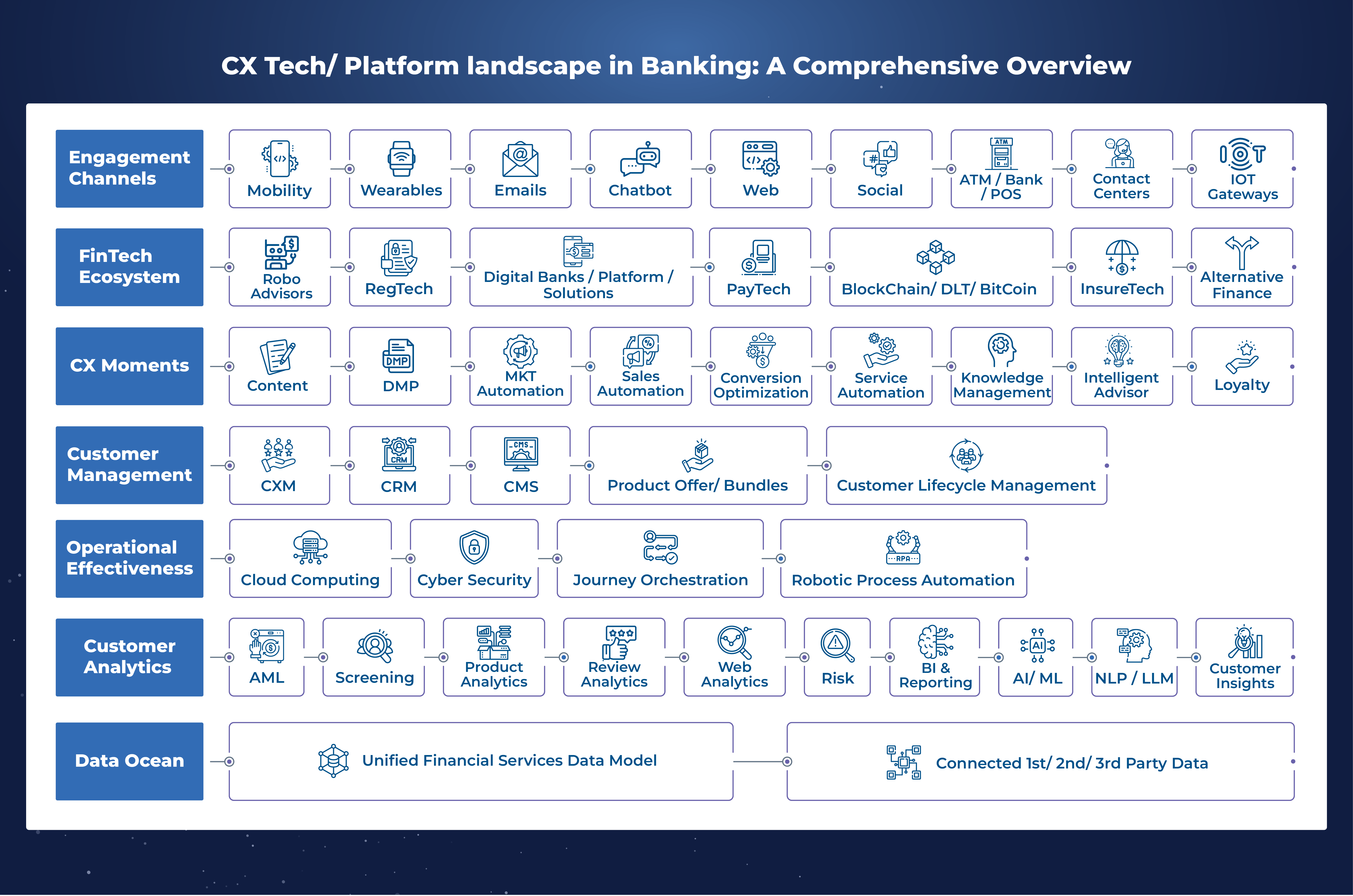

Embracing greater agility via such expanding ecosystems necessitates accepting more complex architectures. This has evolved in the form of microservices, event-driven and serverless. Furthermore, other jigsaw pieces – application and data architectures, infrastructure, and development methodologies – have significantly modernized.

However, ‘traditional operations’ remain silos of applications, data, and infrastructure. Consequently, enterprises are challenged to maintain and operate cloud workloads cost-efficiently without sacrificing reliability and availability.

What’s the way for banks to accelerate to their next?

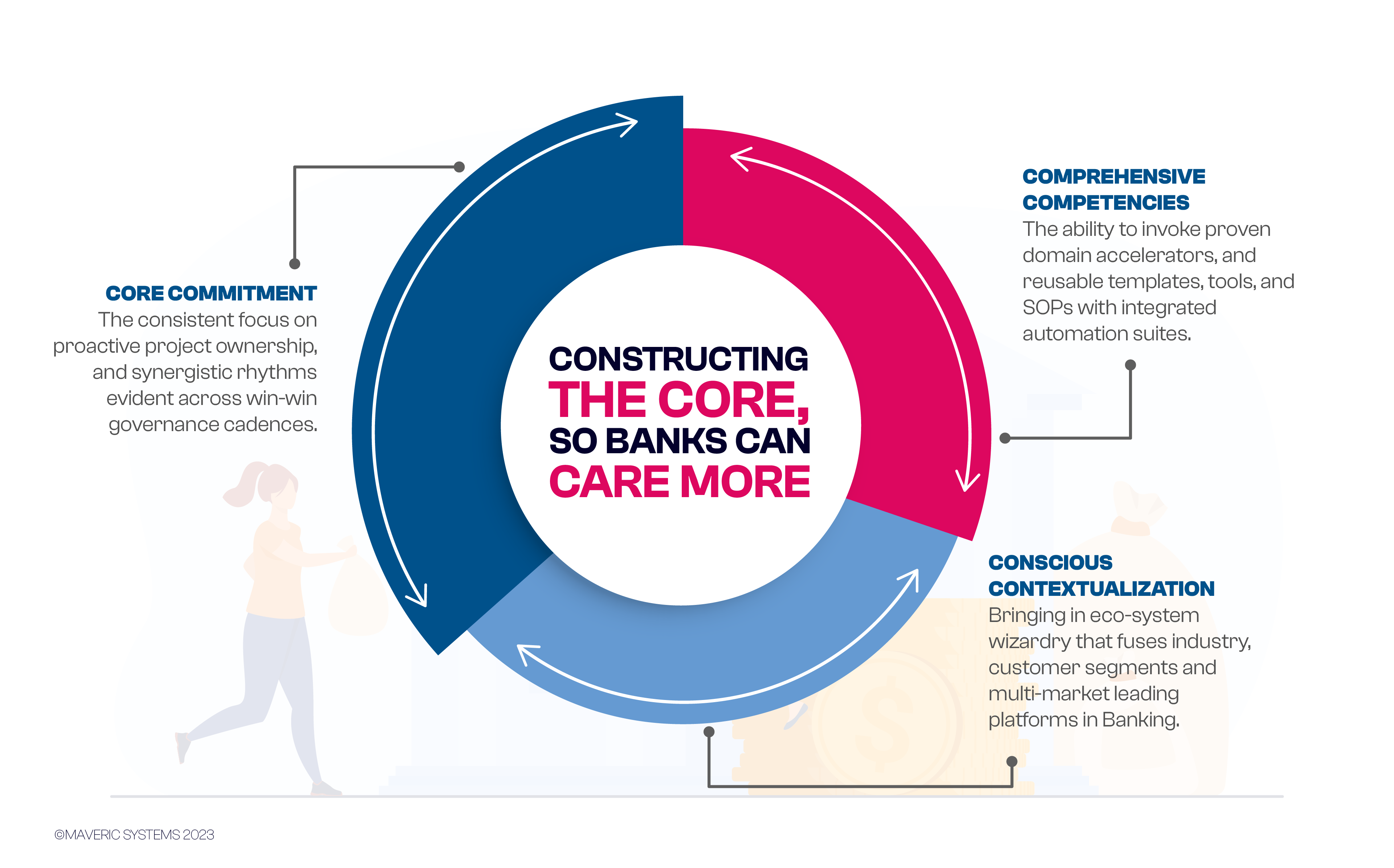

Engineering-led operations that refine Cloud-work management strategies are the next step to reduce the Cloud’s complexity and accelerate innovation that keeps pace with customer expectations.

Banks must invest in consistent means to determine the place, timing, and mechanics to run their cloud workloads to capture the Cloud benefits. This comes from the ability to contextualize consciously.

Whether supporting data storage and analytics solutions, unleashing employee productivity, or automating AI/ML and CRM systems, decision-making that contextualizes tech with business strategy is non-negotiable. The downsides of poor (or absent) decision-making show up in two ways – paying for redundant services and plugging security holes.

So, how does contextualization reflect in Cloud for Banking?

Said simply, prioritizing the FIs goals of operational efficiency, cutting expenses, increasing productivity, and boosting security by streamlining spending and usage.

The DevOps Advantage for Banks

Not the strongest or the most intelligent, but the most sensitive (and adaptive) to change will come through as the winners.

Just as every activity in modern banking is fuelled by digital applications, guided by advanced analytics, or augmented by automation, calling DevOps the new management science for technology delivery is not out of line.

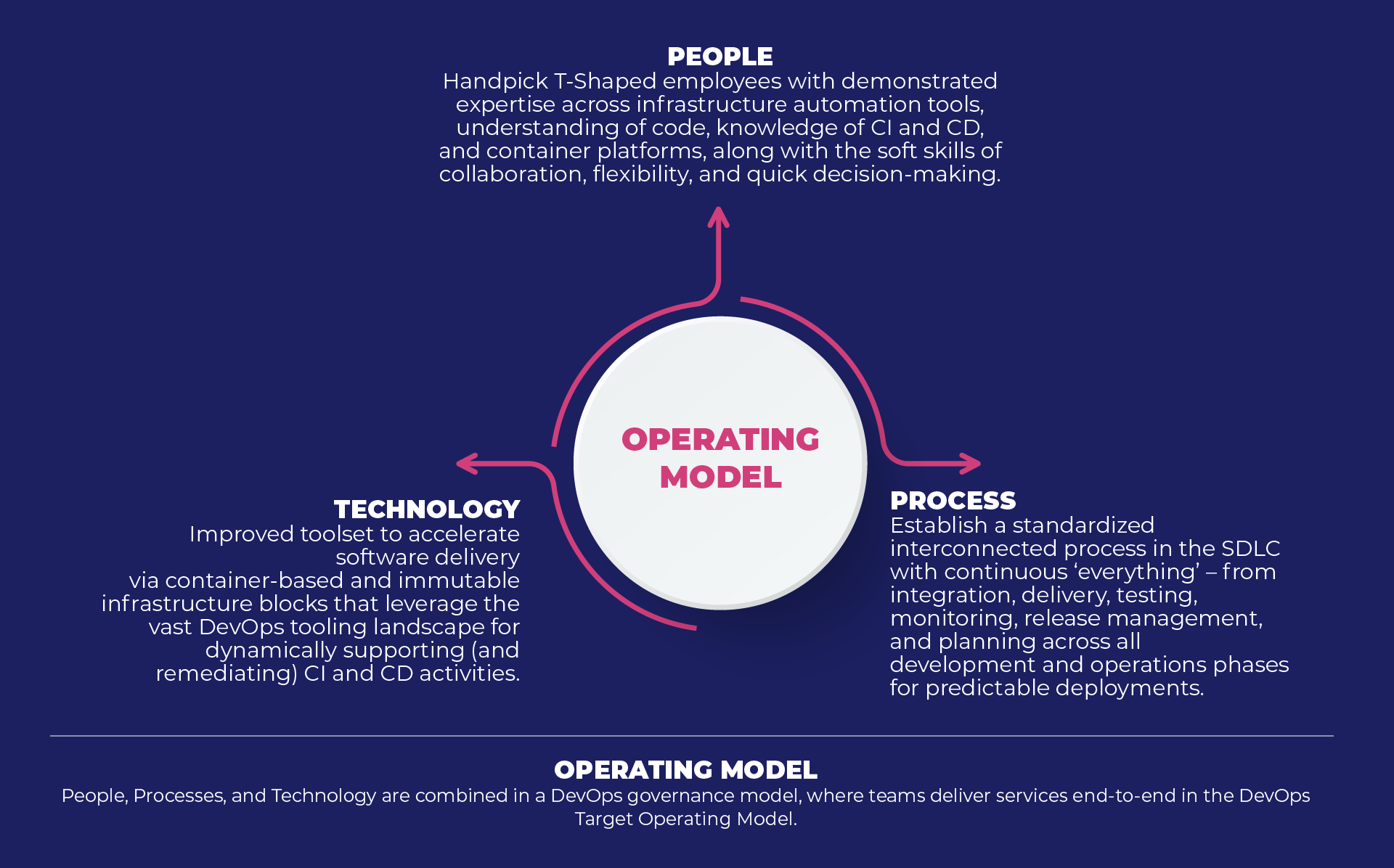

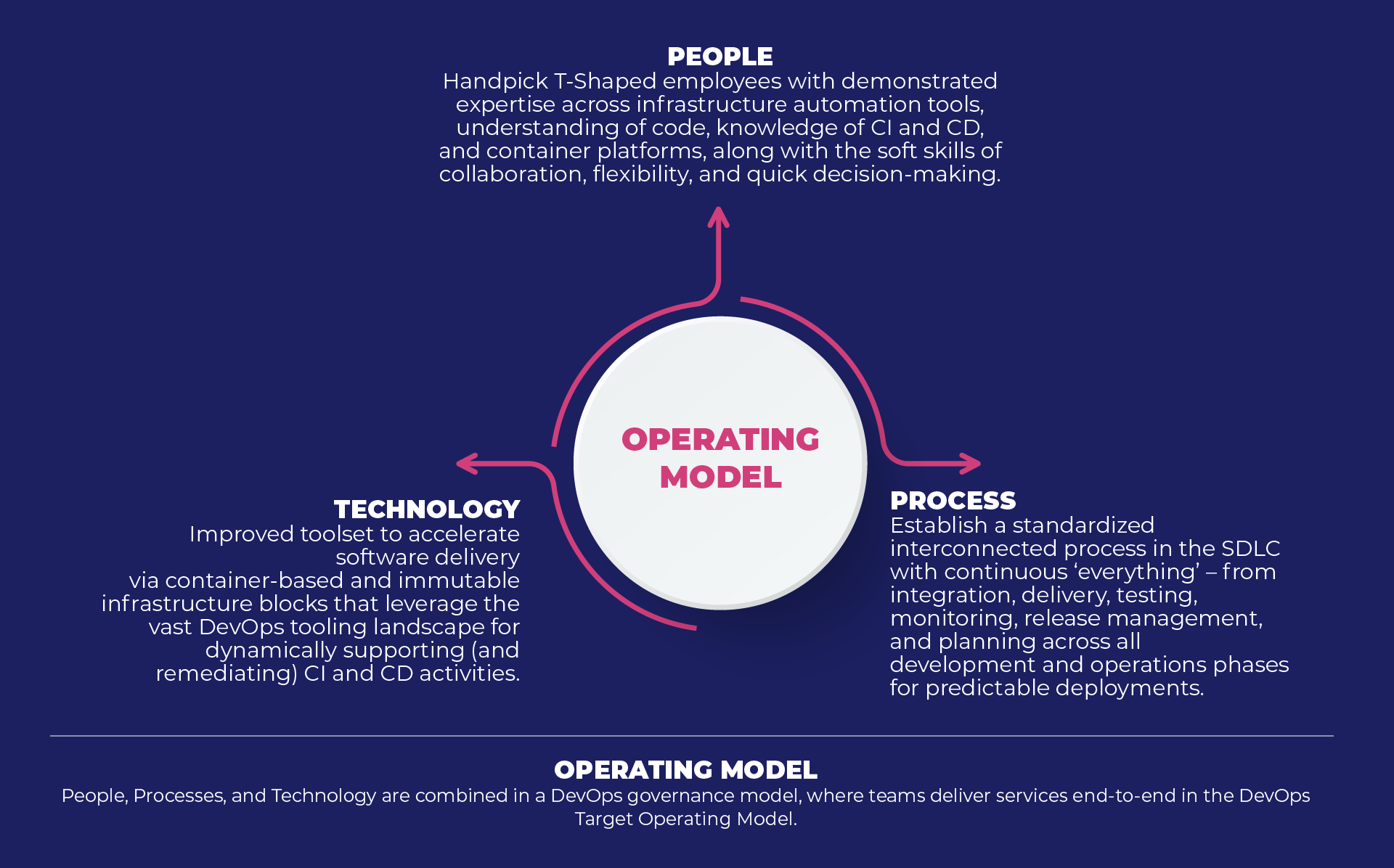

While the GOAL of DevOps (improve the flow of an idea to customer value via multidisciplinary teams), BENEFITS (increased quality and frequency of deployments and improved innovation & risk-taking), and PRACTICES (continuous-integration, testing, delivery, and operations) are well-known, this article highlights the three-dimensions (people, process, and technology) necessary for successful DevOps.

Learnings from the field.

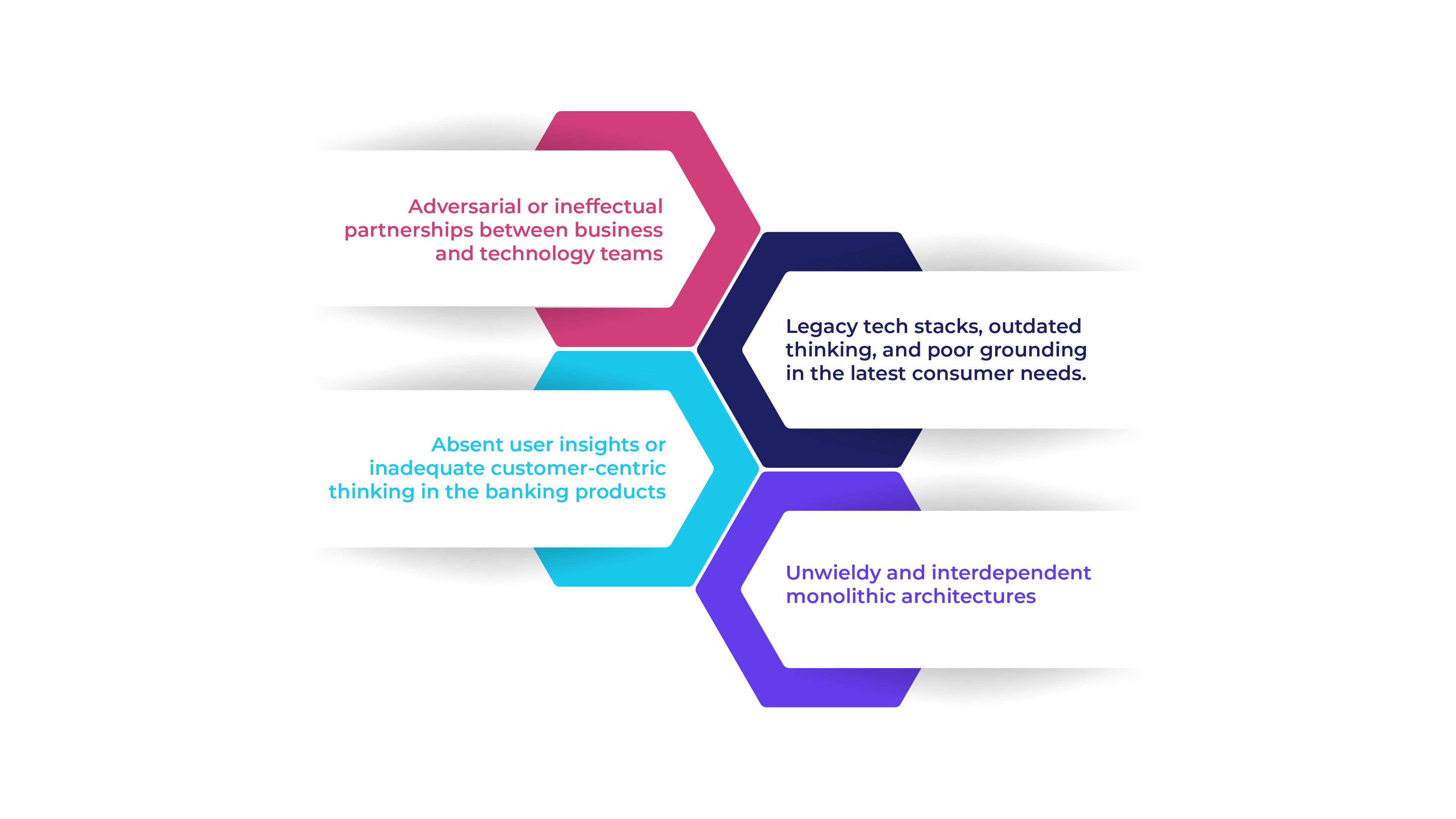

For FIs to create substantial competitive advantage and outthink the competition, they must operate and deliver at a speed more significant than the pace of incoming disruption. While CloudOps and DevOps will drive value with accelerated GTM, superior quality, and reduced costs and waste—the enterprise-wide adoption of these methodologies can get complicated:

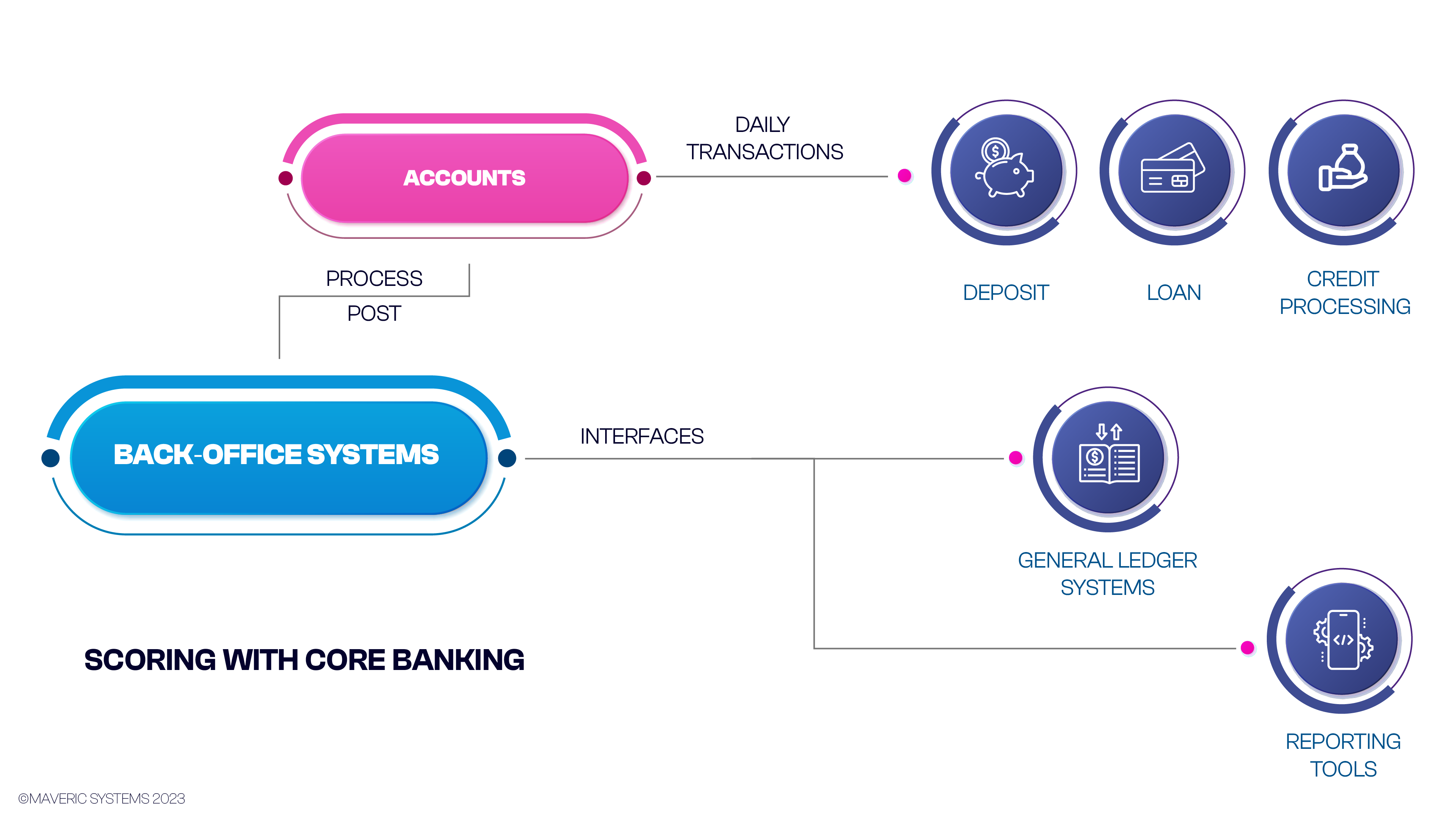

BFSI organizations must invest in scalable digital operations that integrate multi-channel customer interactions through front, mid, and back-office solutions to meet customer expectations.

BFSI organizations must invest in scalable digital operations that integrate multi-channel customer interactions through front, mid, and back-office solutions to meet customer expectations.

After all, Banking in the new normal is about operating through a data-driven digital mindset bolstered by a foundational-quality rigor.

To get more updates, subscribe to our Monthly Newsletter

View

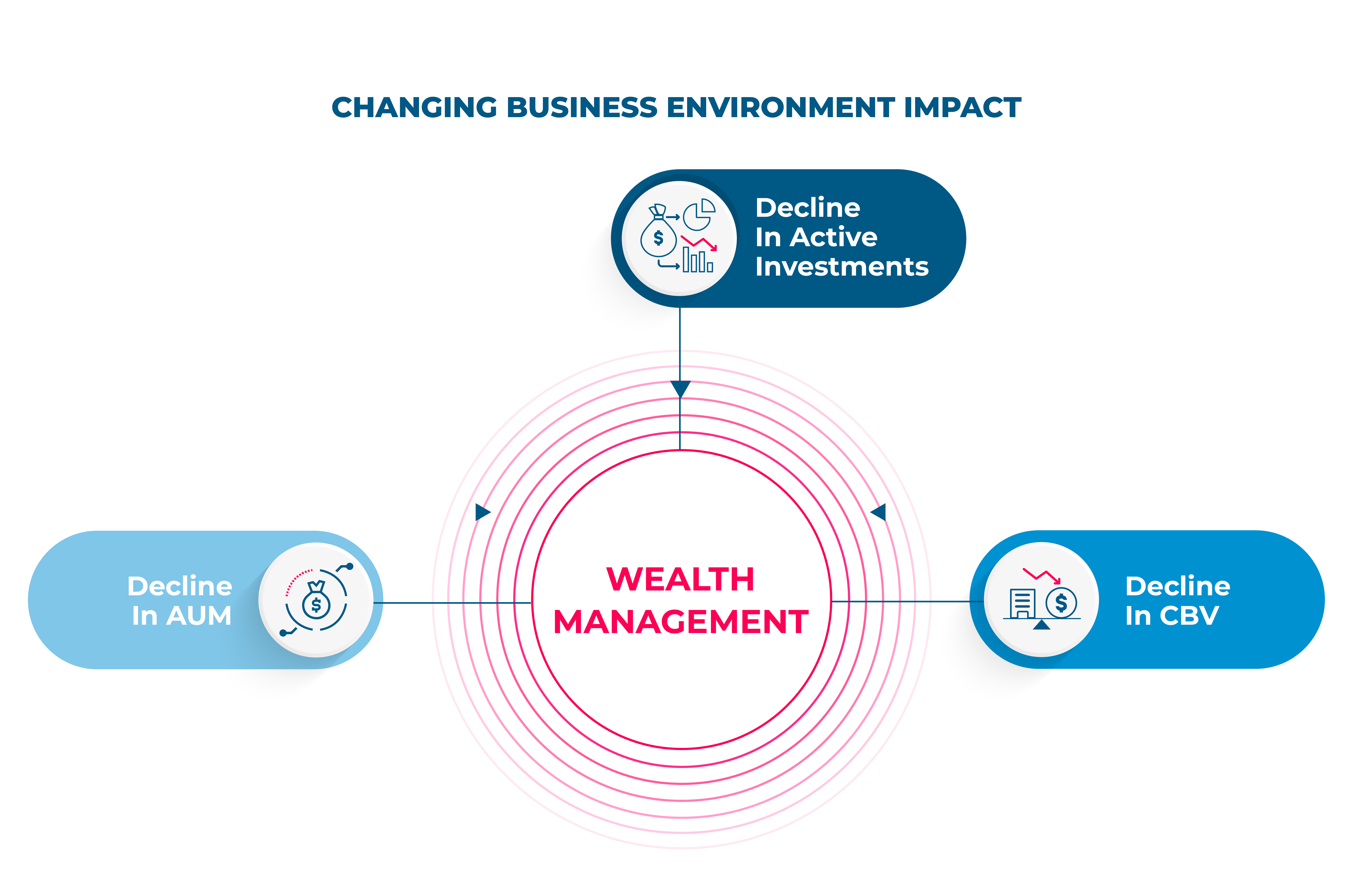

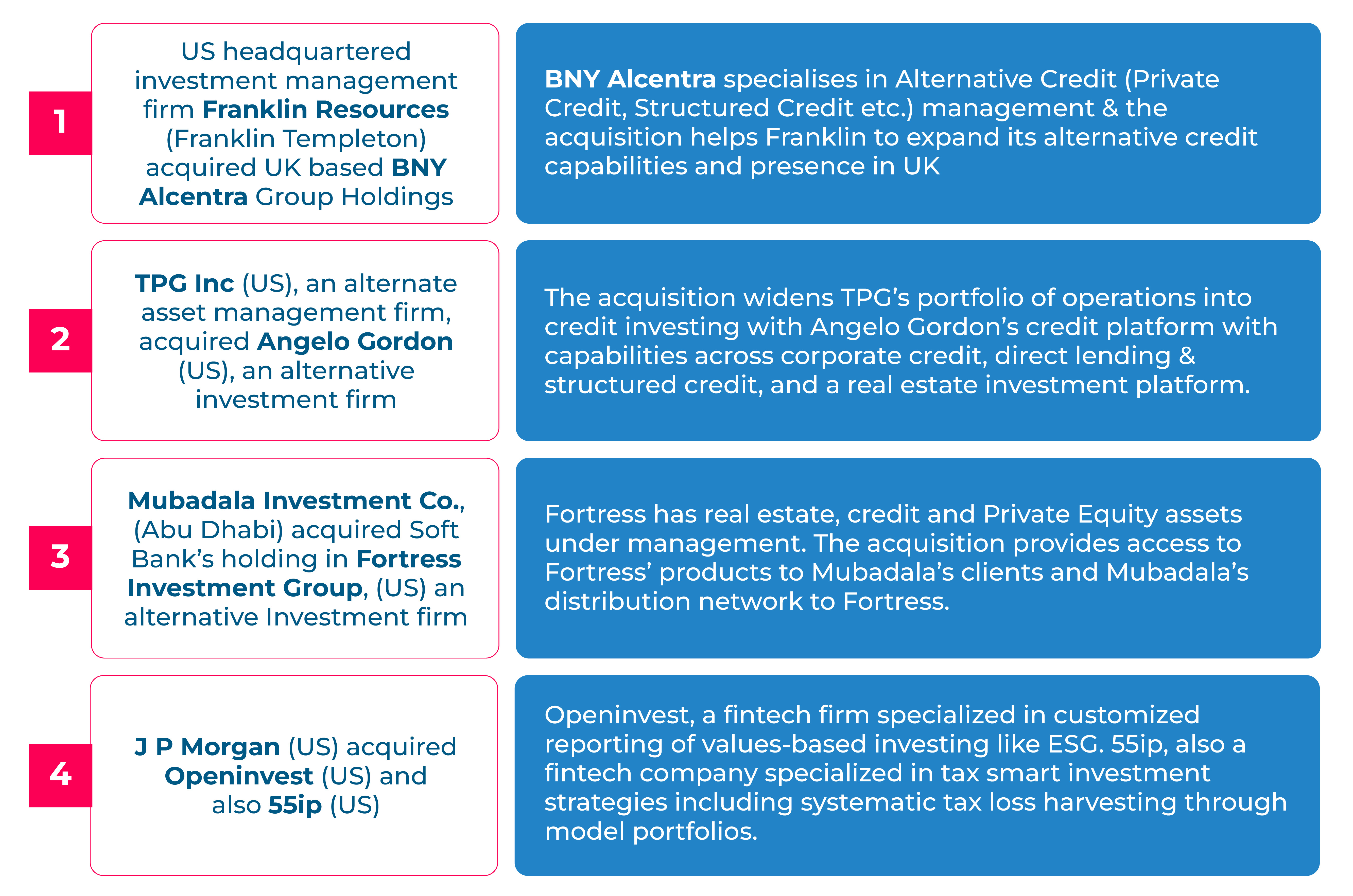

investment capabilities presents an opportunity to WM firms to grow their business & also avenues for increasing fee income.

investment capabilities presents an opportunity to WM firms to grow their business & also avenues for increasing fee income.

BFSI organizations must invest in scalable digital operations that integrate multi-channel customer interactions through front, mid, and back-office solutions to meet customer expectations.

BFSI organizations must invest in scalable digital operations that integrate multi-channel customer interactions through front, mid, and back-office solutions to meet customer expectations.