The promise of hyper-personalization in wealth management is undeniable. As we’ve explored in our previous blogs (Blog 1 , Blog 2 , Blog 3 , Blog 4), a structured framework can guide firms in their quest for personalization excellence. But how does this framework translate into real-world results? Let’s delve into a case study that showcases the tangible impact of our hyper-personalization framework.

Context Setting

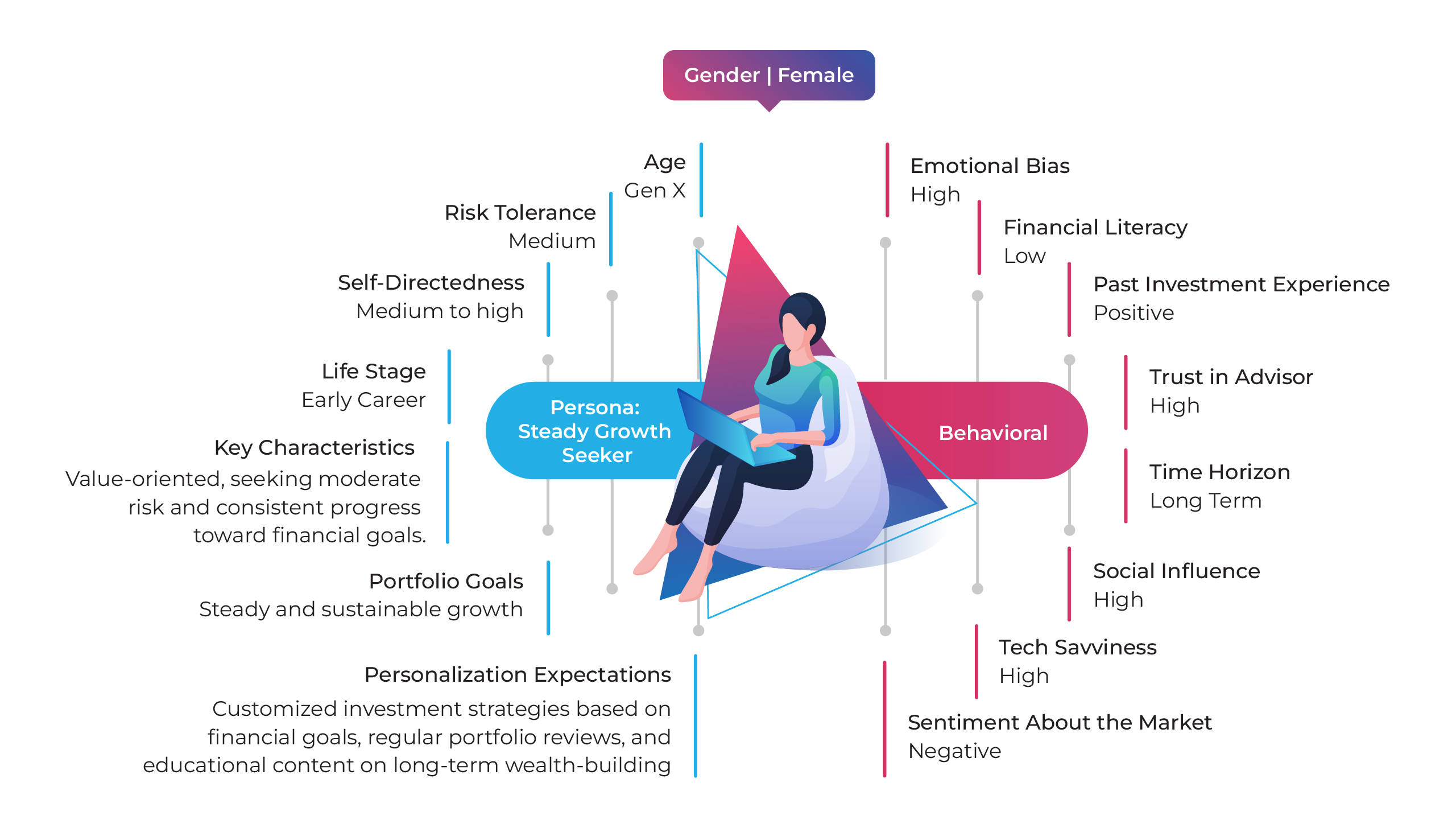

For our illustrative case study we chose a company facing a unique challenge. They observed a specific set of clients within their HNI segment demonstrating a strong affinity to their digital asset product. Interestingly, these clients hadn’t engaged with prior digital communications about this product. A deeper dive revealed a common persona: the “Steady State Growth Seeking – Female.” This persona, characterized by tech-savviness, a long-term investment perspective, and high trust in advisors, presented a significant opportunity.

Personalization Possibilities

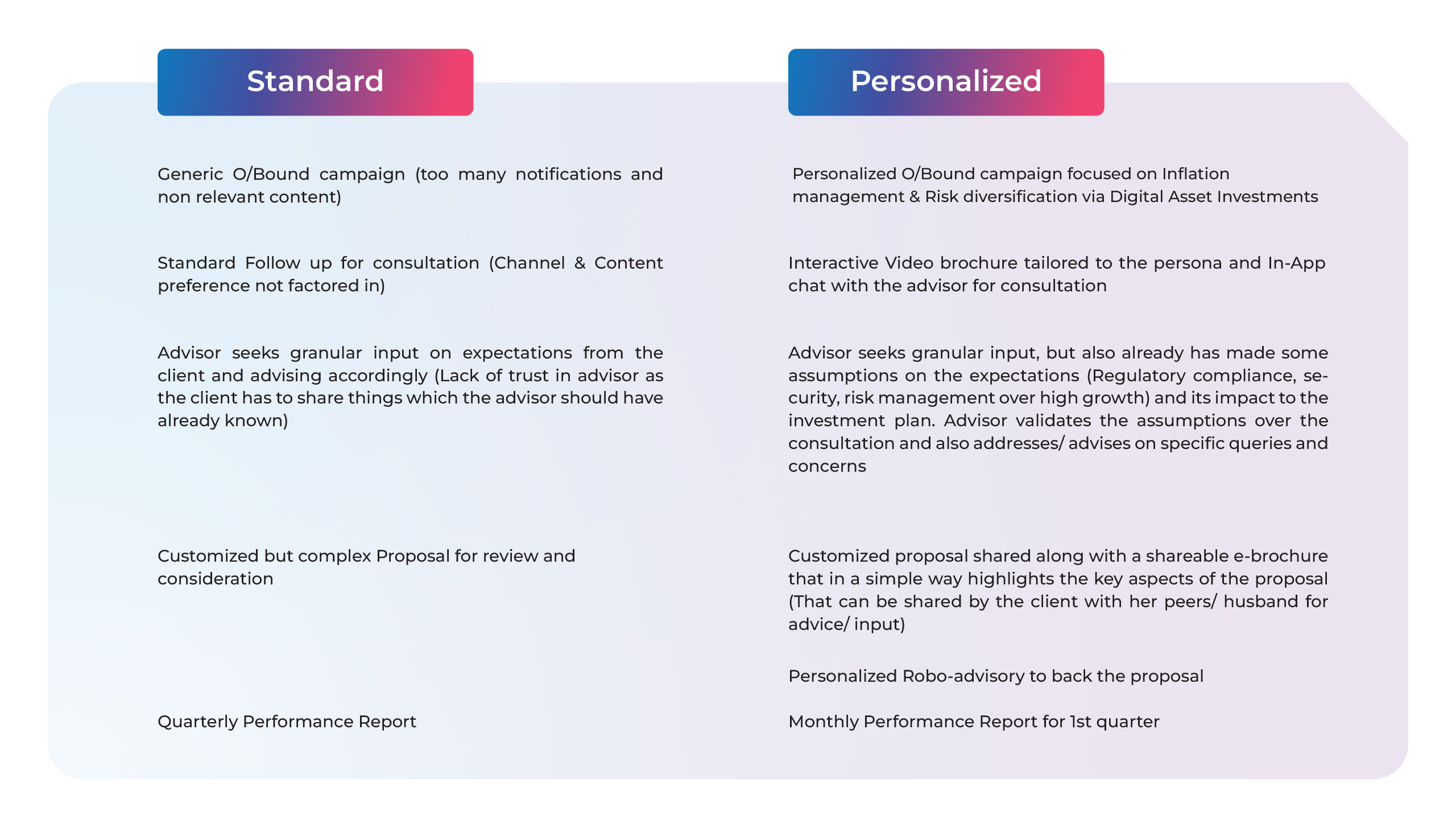

With the persona validated, the next step was mapping the existing client journey. This journey, spanning awareness to decision-making, was riddled with pain points and missed opportunities. The challenge was to tailor this journey, addressing pain points and optimizing touchpoints.

The personalization possibilities were vast. From tailored communications that resonate with the persona’s tech-savviness to personalized investment strategies aligned with their long-term goals, the opportunities to enhance the client experience were evident.

Quantified Business Outcomes

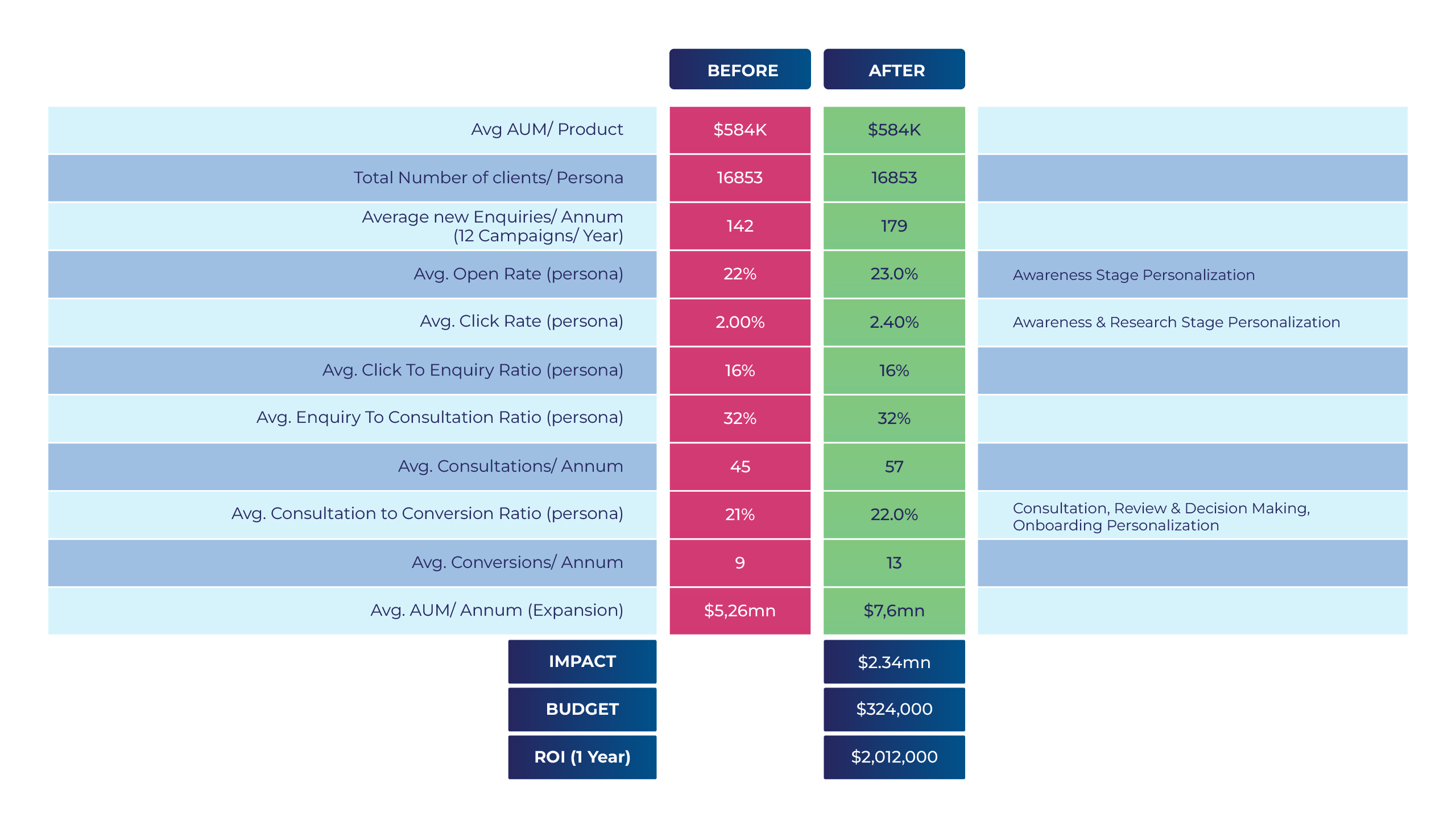

The true measure of any strategy lies in its outcomes. By implementing the personalizations, the wealth management firm could significantly improve key metrics, from open rates to conversion ratios. This, in turn, had a direct impact on the Average Assets Under Management (AUM) per annum.

By focusing on the “Steady State Growth Seeking – Female” persona, the firm could drive a personalization-driven 1% point change in open rate, 0.4% point change in click rate, and 1% point change in consultation/conversion ratio. This translated to a staggering $2.92 million increase in AUM per annum.

Cautionary Insights

While the case study underscores the power of personalization, it’s crucial to understand the broader context. Personalization is not a one-size-fits-all solution. It demands a deep understanding of client personas, a commitment to continuous learning, and the agility to adapt to evolving client needs.

Our framework’s real-world impact underscores its potential. As the wealth management industry evolves, firms equipped with a structured approach to hyper-personalization will undoubtedly lead the way. Stay with us as we wrap up our series in our concluding blog, discussing the future prospects of hyper-personalization in wealth management.

Co-authored by Ashutosh Karandikar, and Venkatesh Padmanabhachari

Maveric’s thought leadership series – E.D.G.E (Experiences Delivered by Global Experts) – handpicks the game-changing technology ideas and pressing functional questions Banks and financial institutions must solve today.

These features – reports, whitepapers, podcasts, flyers, blogs, and infographics – are for Banking leaders and Technology evangelists to apply profound trends, the latest opinions, and transformational analyses to boost the performance of their organizations.