Top Pillars for Successful Digital Transformation in Banking

Interstellar exploration begins to go mainstream with space tourism, fossil fuel cars make way for electric vehicles, and metaverse captures public imagination with its immersive reality just as the internet had cast its spell in the early 2000s. The winds of change blow heavy.

As business models in well-established industries change in the face of disruptive technologies and customer expectations, the banking industry leaders are hard at work. After all, creating new digital approaches offer both competitive differentiation and unrivaled economic value.

How is the banking landscape fundamentally changing?

Earlier banks owned each value chain layer – creating, packaging, and distributing its products. Neobanks offered a digital alternative to traditional offerings. Both entities had business models that were linear and vertically integrated.

Enter the digital-only players.

Fragmenting the value chain, they are unbundling traditional products into micro products or services and adding their offerings on top. The outcome of this vertical disintegration? More effective customer propositions.

This non-linear and adaptive business model is surfacing weaknesses of the incumbent banks like never before.

Today the challenger strategy can quickly configure and scale out innovative products with faster go-to-market speeds, lowering customer acquisition costs.

To make this all possible is, in a nutshell, the story of digital transformations in banking.

So, if digital-only players outperform their older peers via product componentization and respond quickly to market disruptions, what can we learn from them?

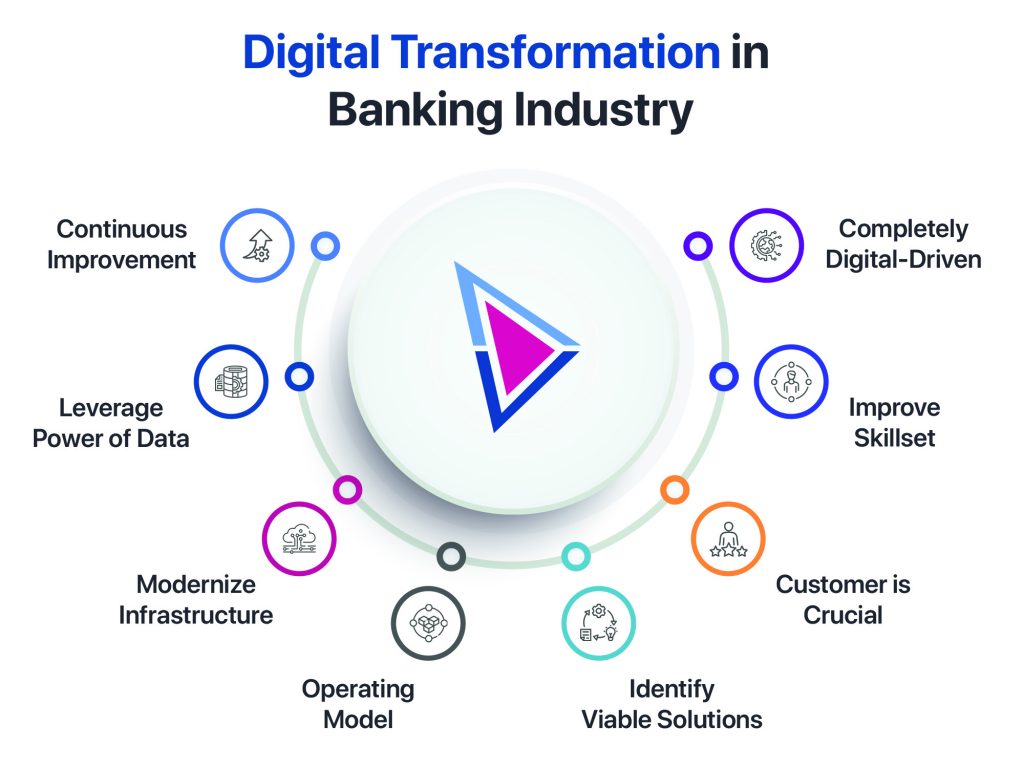

Successful digital transformation for banks rests on the following pillars.

1.) Meeting New-age Customer Expectations.

Recognize these players – Chime, Afterpay, Klarna, Stripe, Wise? Each has not only acquired tens of millions of customers but also created a product category by fulfilling a latent need that the more prominent players missed. Chime focussed on fee-free overdrafts and payroll accelerations. Afterpay and Klarna expanded the credit market with “buy now, pay later offerings,” Wise disrupted retail forex and debuted on London’s stock exchange with a market value of $11B.

The quick learning? Awaken to the customer who wants the best of “all” worlds.

Using digital transformation levers, the new players can offer the end customer the flexibility and transparency for their DIY (Do-it-yourself) Banking. DIY banking – combining services from different providers – is more than a trend; it promises to hardwire into a buyer purchase attribute.

2.) Adopting All-Inclusive (AI) Artificial Intelligence.

Slowly but surely, AI banks are populating the horizon. Understandably, AI initiatives emphasize technology, and data infrastructure is humongous.

It begins with a long-term robust business strategy that is hyper-focused on delivering superior omnichannel journeys and CX. To make the execution cost-efficient, investments are needed for modern, scalable platforms for D&A. Finally, along with military-grade secure access and cloud infrastructure, the banking cores have to be highly configurable and powerful enough to support scalable operations.

The learning that comes from AI banks? Reimagining customer engagement by unlocking new value through higher efficiency, expanding the market access, and increasing the customer’s lifetime value.

To make this pillar work, leading banks combine intelligent value propositions with seamless embedding into partner ecosystems and create more innovative experiences.

3.) Clarity on the transformation strategy.

Before the investment dollars are spent, and armies of technologists descend, banks must be clear about the fundamentals – what is the legacy we are chasing? Which consumer segments are must-haves, and which are good-to-haves? And what value is core to us as a bank?

Answering these questions sets the ball rolling to decide the scale and scope of the digital transformation. This clarity eases cost pressures, allays employee job anxieties, reaffirms risk appetite, and offers an accurate before-after assessment.

Basis the mentioned strategy, banks can go one of three ways: Skin – Tissue – Cell.

Firstly, it could work on the packaging or the ‘skin’ layer (self-service customer channels and models and digital interfaces for banks’ analog processes). The second approach goes more profound at the ‘tissue’ layer (APIs allow IT asset interfaces, incorporating data analytics, creating consistent omnichannel CX).

Finally, the third kind of transformation works deepest – the ‘cellular’ layer. This approach concerns digital native core, third-party and ecosystem partnerships, digital marketing, high-end data analytics, and bringing on board (or outsourcing) tech capabilities that are strategic to the banks’ core vision.

Conclusion

Along with the mentioned three pillars for successful digital transformation for banks, there are equally pertinent aspects to be taken care of. Like deep focus on creating a niche (or micro-segments) by experimenting with innovative offerings, renewing attention to the evolving ecosystem and the system aggregators landscape, and finally, constantly clearing the obstacles on the path to profitability by boosting the organizational readiness through financial education.

View