Digital transformation in Banking and Financial Services – Measuring up to the New Frontier.

As customers demand more online access, the availability of new technology capabilities (and their reducing costs) such as data analytics, the cloud, artificial intelligence, and a collaborative regulatory framework, banks have increased their investments in digital capabilities in the last five years. While the Pandemic has accelerated digital adoption, what have the investments yielded? Are they changing the very nature of banking? And what will it take for legacy FIs to transform their operations and deliver unprecedented consumer value?

These questions drive deep into the heart of Digital Experience Engineering – a niche practice that Banking Tech partner, Maveric Systems, pursues through its rich consulting engagements.

Banking on Digitalization?

Three indispensable pillars for Digital Transformation Journeys

Reimagining customer journeys – From growing emphasis on client centricity, deep tech possibilities, and end-to-end process optimization, the primary focus of any transformation must always be the customer. In a world of fast e-commerce and hyper-personalization, clients have less patience for untransparent and cumbersome processes. To be able to reimagine, Banks must digitize the entire customer journey and then adapt. From streamlining and distilling customer onboarding and other essential functions, banks will, in a short time, gain customer loyalty.

Driving through the power of data – Client targeting, increasing wallet and mindshare, boosting customer loyalty, pre-empting, and customer abandonment are some of the use cases that data analytics brings for digitally-savvy FIs. Unlocking data is crucial to amping up competitive vigor in multiple ways. It makes the data-powered banks act as partners to their clients by advising them of relevant offerings and matching needs even before they are acutely felt. Moreover, today, the power of data decides how FIs will capitalize on their ecosystem partnerships, add to their market segments and product portfolios, nail the GTM approaches, and finally, differentiate on their client’s user experience.

Powered by humans and enabled by technology- Scalable real-time event-driven digital banking platforms are a powerful way for banks to act on the insights their data informs them about a customer’s context and life situation. Two underlying drivers make this scenario possible – a future-focused operating model and the creation of a digitally driven organization. The operating model is indispensable to cost-effectively deliver products and services across channels and capitalizing on emerging deep tech possibilities. The second driver – the organization’s digital culture – is decided by leadership engagement, embracing an agile working philosophy, and infusing change management into the daily rhythms.

With the digital transformation pillars in place, the next logical question is: how will the new frontier be measured?

With the Pandemic behind us and the rising economic volatility, the top banking leaders continue focusing on three top transformational priorities.

Client and customer satisfaction: Mobile banking has already surpassed all other banking channels in popularity, as almost one-quarter of bank customers now cite mobile apps as their preferred method for banking activities.

Regulatory Compliance and controls: The sector’s regulatory framework is frequently an impediment to digital acceleration, so banks are turning to cloud-based platforms with flexible reporting capabilities that can adapt to ever-changing compliance standards. These platforms can give a more comprehensive set of data that helps banks comply with ever-changing rules and respond to audit requests swiftly and effectively.

Operational Resilience: As banks struggle to negotiate the volatility caused by health and humanitarian crises, social inequality, and climate risk, a comprehensive and effective environmental, social, and governance (ESG) approach is required. Additionally, banks are adopting technologies that can assist them in analyzing the environment and predicting potential consequences using predictive analytics.

Conclusion

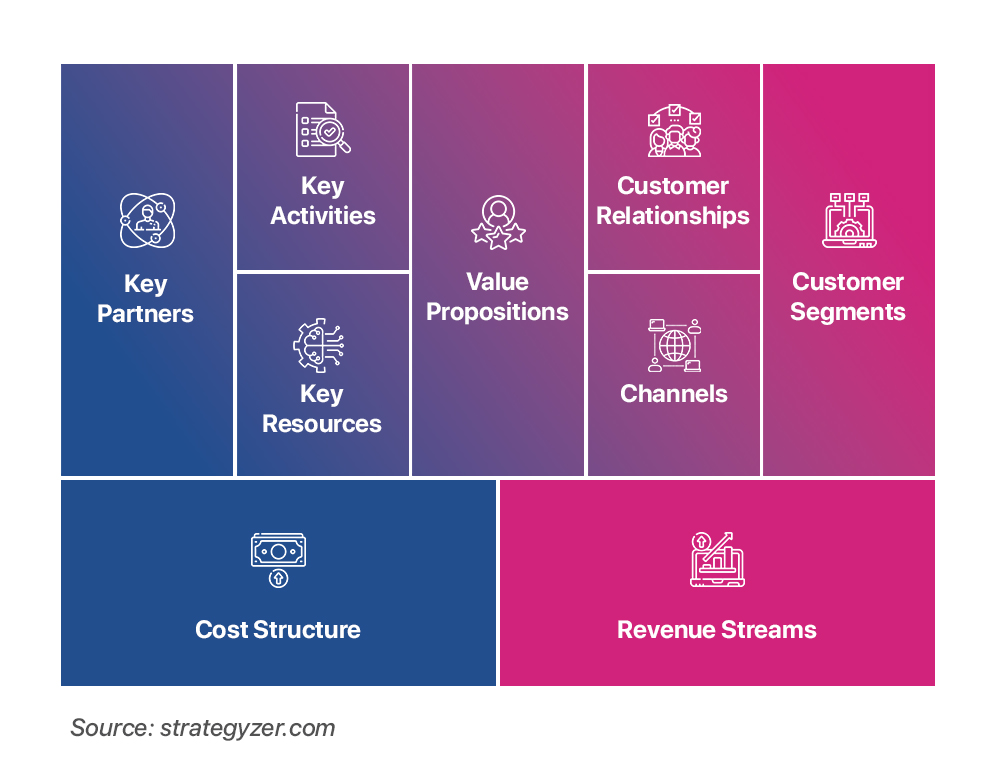

Digital transformation in the banking industry has direct benefits. From addressing the unique needs of new products and revenue streams, keeping pace with multi-generational consumer demands, and improving profitability – all depend on the operating and business models that FIs choose and execute.

While there would be matters of culture, leadership, and regulatory landscape that would determine the transformation strategy and digital approaches, in the long run, successful banking projects must integrate consumer, digital technology, and data analysis that creates new value to the customer experience. Additionally, banks will profit from adopting an ecosystem-based strategy.

About Maveric-Systems

Starting in 2000, Maveric Systems is a niche, domain-led Banking Tech specialist partnering with global banks to solve business challenges through emerging technology. 3000+ tech experts use proven frameworks to empower our customers to navigate a rapidly changing environment, enabling sharper definitions of their goals and measures to achieve them.

Across retail, corporate & wealth management, Maveric accelerates digital transformation through native banking domain expertise, a customer-intimacy-led delivery model, and a vibrant leadership supported by a culture of ownership.

With centers of excellence for Data, Digital, Core Banking, and Quality Engineering, Maveric teams work in 15 countries with regional delivery capabilities in Bangalore, Chennai, Dubai, London, Poland, Riyadh, and Singapore.

View