In an era of rapid technological advancements, wealth management firms must be at the forefront of innovation to fulfill the evolving needs of their clients. The digitization of wealth management is not just a trend; it’s the future. This blog explores how wealth management firms can ascertain that their Technology is future-ready to provide their clients with the best possible Wealth Management Solutions and services.

Embracing the Digital Revolution

Wealth management has traditionally been associated with personal relationships and in-person consultations. However, this landscape is shifting with the emergence of digital wealth management platforms. Here’s how wealth management firms can ensure they are well-prepared for the digital future.

Investing in Next-Gen Technology Solutions

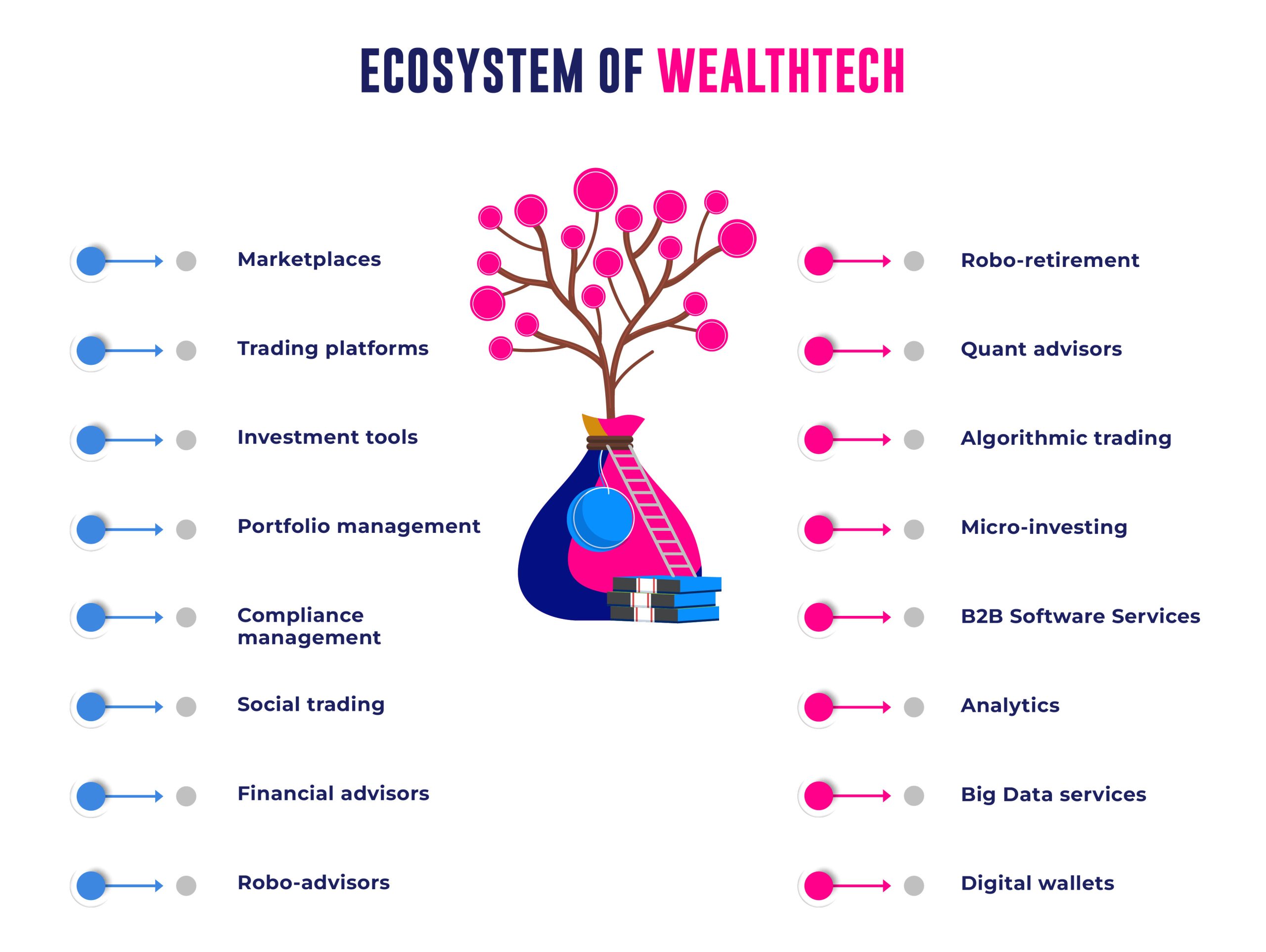

Wealth management firms that are future-ready invest in cutting-edge technology solutions. This includes advanced software for portfolio management, client communication, and data analytics. For instance, adopting robo-advisors and AI-powered tools can enhance the efficiency of managing portfolios and offering personalized recommendations.

Enhancing the Client Experience

Digital wealth management is all about delivering an exceptional client experience. Wealth management firms must create user-friendly platforms that allow clients to access their accounts, receive updates, and communicate with their advisors seamlessly. Mobile apps, secure messaging systems, and intuitive interfaces are crucial elements.

Data Security and Compliance

With the digitalization of wealth management, data security, and regulatory compliance become paramount. Firms must implement robust cybersecurity measures to protect sensitive client information. Ensuring adherence to industry regulations is non-negotiable.

Examples of Future-Ready Firms

Let’s look at a few noteworthy examples of wealth management firms that have embraced digital transformation:

Betterment: Betterment is a pioneer in the robo-advisory space. Their platform uses algorithms to create diversified portfolios tailored to individual goals and risk tolerances. They have successfully blended Technology with human expertise to provide an excellent client experience.

Wealthfront: Wealthfront uses AI and machine learning to offer automated financial planning and investment advice. They leverage Technology to build low-cost, diversified portfolios for clients.

Charles Schwab: Charles Schwab’s digital offering, Schwab Intelligent Portfolios, combines robo-advisory services with access to human advisors. This hybrid approach bridges the gap between Technology and personalization.

Challenges and Approaches to Success

While wealth management firms are keen to embrace Technology, they face several challenges:

1) Cybersecurity:

The increasing reliance on digital platforms exposes firms to cybersecurity risks. Implementing strong security measures is crucial.

2) Integration:

Many firms use legacy systems and new digital tools. Integration can be a challenge but is necessary for a seamless client experience.

3) Regulatory Compliance:

Maintaining financial regulations while adopting digital solutions is complex. Firms must allocate resources to ensure they meet all requirements.

To ensure their Technology is future-ready, wealth management firms can consider the following approaches:

1) Regular Technology Audits:

Conduct periodic assessments of the firm’s technology stack to identify areas for improvement and ensure they remain up-to-date.

2) Invest in Training:

Provide continuous training to employees to keep them updated on the latest Technology and its applications in wealth management.

3) Collaboration:

Collaborate with fintech partners and industry experts to leverage external knowledge and resources for innovation.

Conclusion

The digital transformation of wealth management is not a matter of if but when. Wealth management firms that wish to stay competitive and meet the needs of tech-savvy clients must invest in next-gen technology solutions and services. Challenges will persist, but success is within reach with a solid commitment to cybersecurity, regulatory compliance, and a user-centric approach.

In this rapidly evolving landscape, being future-ready is not just an option; it’s a necessity. Wealth management firms embracing digital wealth management will be better positioned to provide their clients with the best Wealth Management Solutions and Wealth Management Services in the coming years.

About Maveric Systems

Starting in 2000, Maveric Systems is a niche, domain-led Banking Tech specialist partnering with global banks to solve business challenges through emerging Technology. 3000+ tech experts use proven frameworks to empower our customers to navigate a rapidly changing environment, enabling sharper definitions of their goals and measures to achieve them.

Across retail, corporate, and wealth management, Maveric accelerates digital transformation through native banking domain expertise, a customer-intimacy-led delivery model, and a vibrant leadership supported by a culture of ownership.

With centers of excellence for Data, Digital, Core Banking, and Quality Engineering, Maveric teams work in 15 countries with regional delivery capabilities in Bangalore, Chennai, Dubai, London, Poland, Riyadh, and Singapore.