Like many other industries, wealth management is undergoing enormous change. New business models and frameworks are being leveraged. Only those who recognize the indicators and seize the opportunity can grow. Money managers need a holistic and far-ranging vision to retain clients. Wealth managers must adjust their growth plans as client expectations, technology, alternative investments, and industry consolidation change the market.

Working with banking domain experts like Maveric Systems for radical industry solutions of wealth management is helping leading firms and banks create a differentiated value proposition for attracting new-age customers.

Emergent Trends in Wealth Management

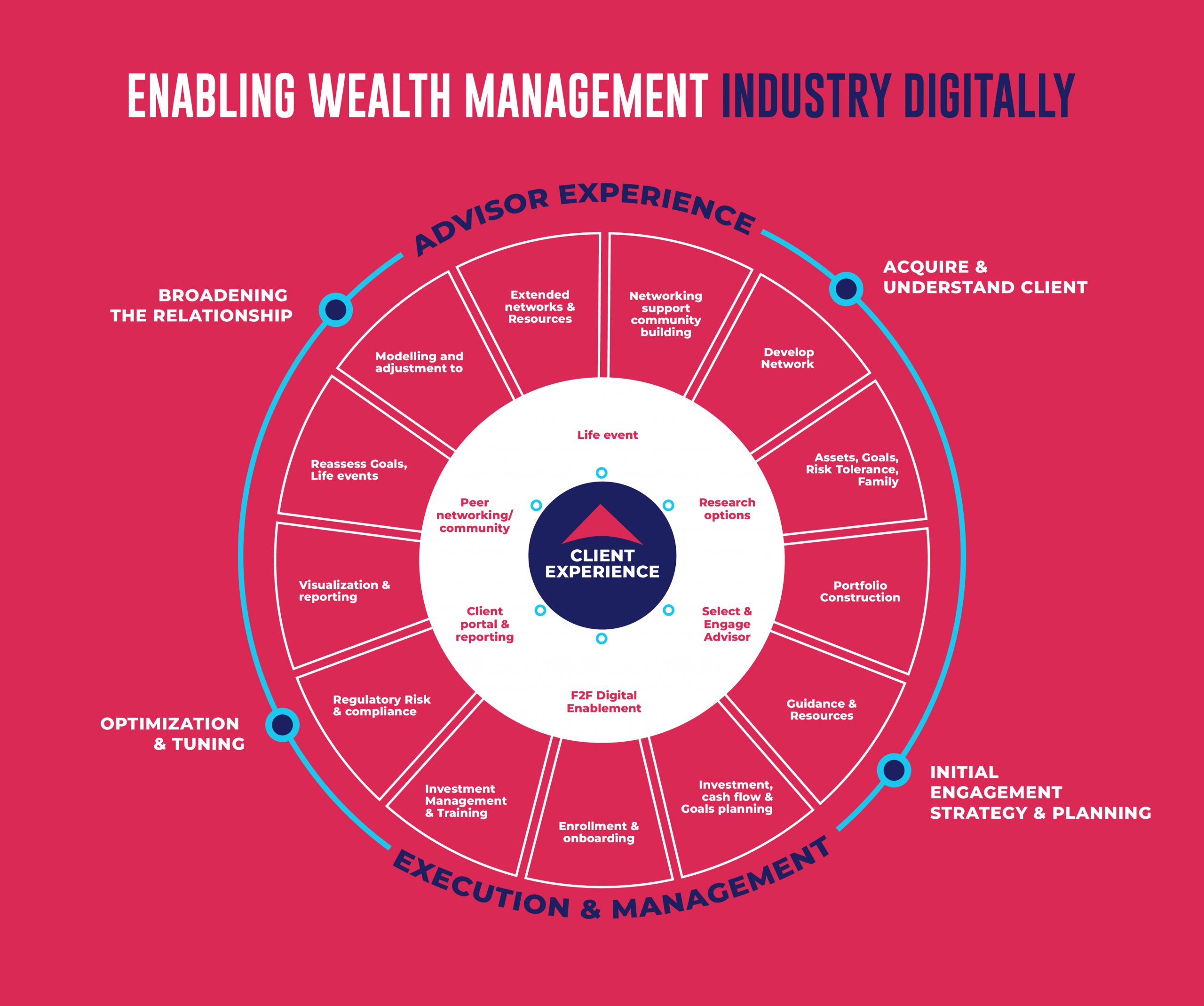

- Integration of client and adviser experiences: Forward-thinking organizations have invested in human-centered digital experiences that seamlessly combine client and advisor.

- Retirement client closed-loop systems: Institutional retirement, consumer banking, wealth management, and commercial banking will collaborate more. Large, diversified banks must invest heavily to achieve this “closed-loop” objective, making smaller enterprises less competitive.

- Advice-driven retail banking-wealth management convergence: Wealth management organizations will develop lending and cash management capabilities to cross-sell to mass wealthy retail customers. Retail banks will invest and advise to retain these good customer connections.

- Quasi-client rises: Robo-advisors quickly give prospective clients a log-in to get advice. Many “quasi-clients” won’t transfer assets or pay management fees.

Millennial Mindsets towards Wealth Management

HNW and UHNW clients today demand and need holistic wealth management. They prefer broader financial advice for current, mid-life, and succession issues. This includes life and estate planning, after-tax asset preservation and performance, inter-generational education, legacy planning, cash flow management, charity, and considerable expenditure planning. Depending on family circumstances, cybersecurity, insurance, and emergency cash may also be needed.

Circular and gig economies, digital currencies, and changing demographics affect investor behavior. Wealth managers face high expectations as clients embrace technology like smartphones, apps, and virtual meetings. Other dynamic elements include self-education, low-interest rates, ETFs, and internet investment platforms. Clients are becoming more price-sensitive and want advisory-rich wealth education and support.

Today’s clients want holistic wealth management services, but firms that only focus on investments and products miss the chance to build deeper relationships. Failing to educate clients on trends and broaden client connections leads to faster wallet loss as clients are more inclined to leave or start their own family offices.

The Technology Touch for Asset Management

All customers and investors—not just millennials—expect full use of digital capabilities and instructional tools. Specific client interactions will remain personal and within the advice process. Hybrid wealth management may appeal to clients and advisers. These business models combine personalized counsel with intelligent, purposeful technology like biometric authentication, blockchain technology, and privacy-protected interactions.

Fintech can acquire “big data” from social media, banks, investment platforms, and lenders. It can improve compliance, batch transfers, financial planning, KYC, client onboarding, and transaction authentication. Algorithms can rebalance portfolios using accurate market data.

Wealth managers are partnering with fintech firms to develop new skills. User-friendliness and client satisfaction should guide the process. Wealth managers will likely become wealth doctors/requirements engineers/client managers supported by digital tools. Combining wealth management advice with technology value is crucial. This enhances a holistic view of the client’s wealth and well-being.

Conclusion

US wealth management (WM) is transforming. Changing consumer preferences, digital models, and demographic, macroeconomic, regulatory, and competitive dynamics have combined in a perfect storm to alter the WM experience for customers and advisers. Digitalization and goals-based wealth management have grabbed on faster than planned. Big data and widespread access to new assets and investment options have moved slower than expected. Yet, disruptive innovation and fundamental business shifts in wealth management are extraordinary.

Wealth management is changing dramatically. Post-pandemic business is a challenge for the entire sector. Wealth management organizations must improve real-time reporting on client portfolios and products. Market knowledge and portfolio trajectory drive wealth management. Data and unifying systems provide the rich foresight modern consumers and younger investors expect from Wealth Management institutions.

About Maveric Systems

Starting in 2000, Maveric Systems is a niche, domain-led Banking Tech specialist partnering with global banks to solve business challenges through emerging technology. 3000+ tech experts use proven frameworks to empower our customers to navigate a rapidly changing environment, enabling sharper definitions of their goals and measures to achieve them.

Across retail, corporate & wealth management, Maveric Systems accelerates digital transformation through native banking domain expertise, a customer-intimacy-led delivery model, and a vibrant leadership supported by a culture of ownership.

With centers of excellence for Data, Digital, Core Banking, and Quality Engineering, Maveric Systems teams work in 15 countries with regional delivery capabilities in Bangalore, Chennai, Dubai, London, Poland, Riyadh, and Singapore.