The banking industry faces a complex and ever-changing regulatory landscape shaped by technological advancements, global interconnectedness, and evolving customer expectations. Banks must proactively address these regulatory challenges by investing in robust risk management systems, cybersecurity measures, and compliance frameworks and embracing innovative solutions. Collaboration between banks, regulators, and other stakeholders is crucial to balance regulatory compliance, innovation, and sustainable growth in the banking sector.

Partnering with Regulatory Tech companies like Maveric, who bring deep domain knowledge, is an effective way to stay updated on how technology offers a powerful strategy to meet the frequently changing regulatory mandates.

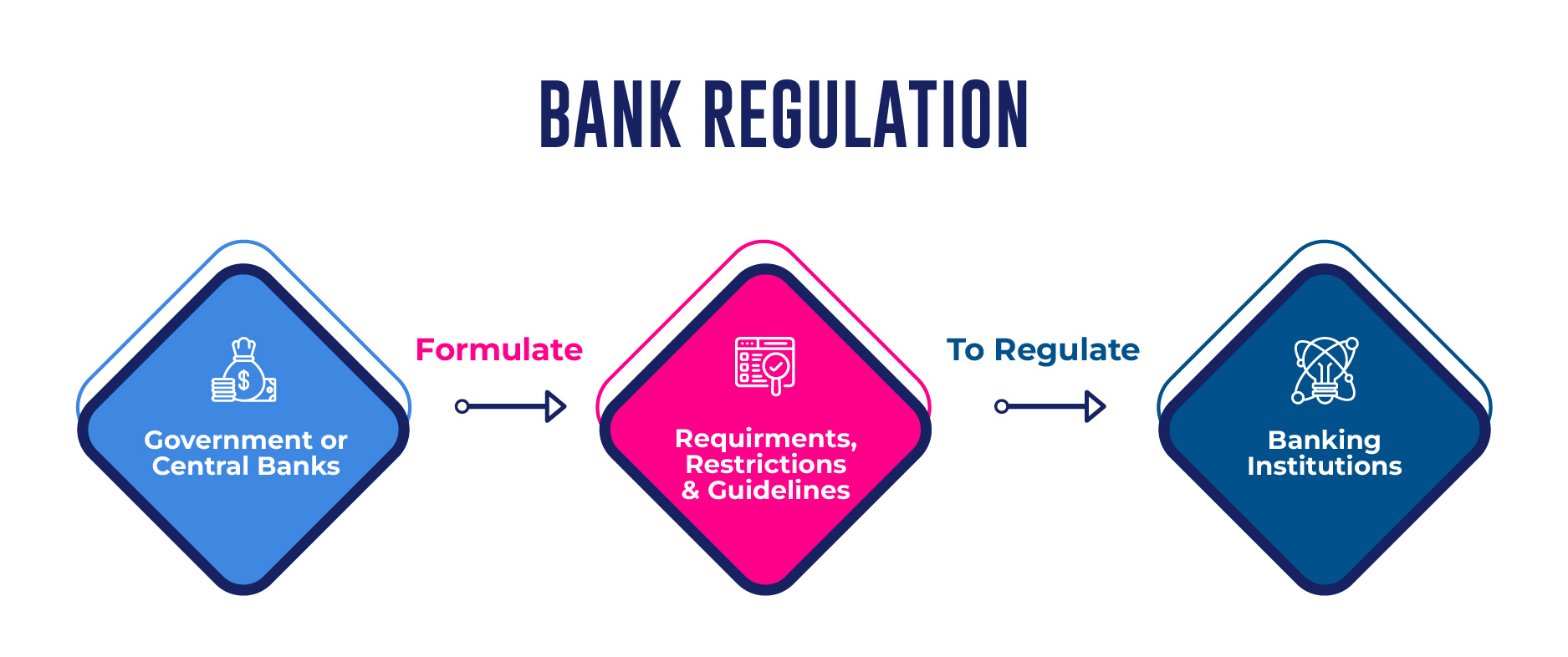

Role of Regulatory Bodies in Banking

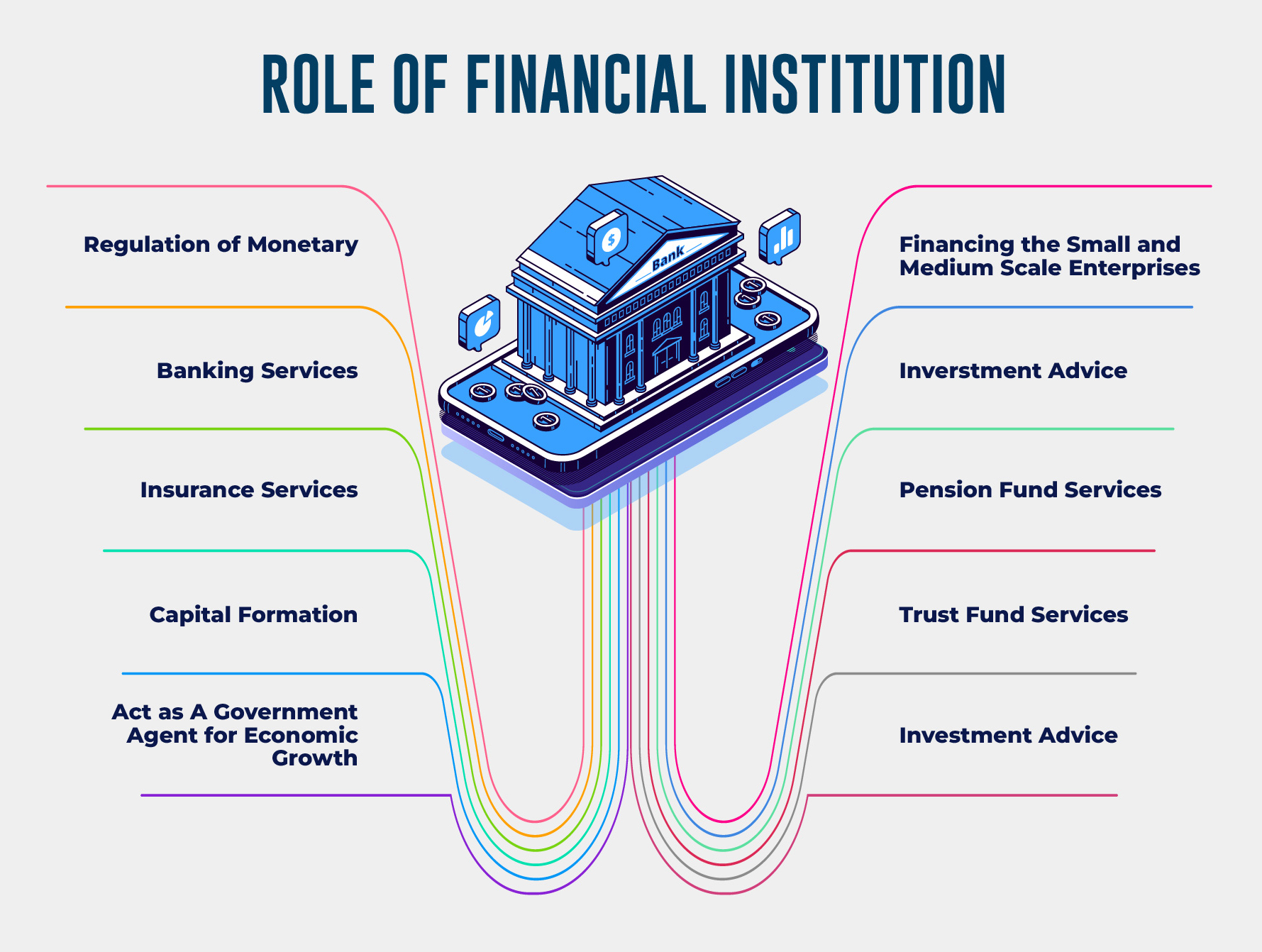

The banking industry is vital in the global economy, providing essential financial services and intermediation between savers and borrowers. To ensure the stability, integrity, and proper operation of the banking sector, various regulatory bodies have been established worldwide. These organizations set and enforce rules, monitor compliance, and supervise banks to maintain a sound financial system.

Key regulatory bodies with their responsibilities.

Basel Committee on Banking Supervision (BCBS):

The BCBS is an international standard-setting body comprising central banks and regulatory authorities from different countries. Its primary objective is to enhance global financial stability by developing and promoting regulatory standards and guidelines. The committee is best known for the Basel Accords, a series of recommendations on capital adequacy, risk management, and liquidity requirements, which member countries incorporate into their national banking regulations.

Financial Stability Board (FSB):

The FSB is an international organization that coordinates and promotes global financial stability. It brings central banks, regulatory authorities, and international standard-setting bodies together to develop and implement policies to safeguard the financial system. The FSB conducts assessments of vulnerabilities and risks, proposes reforms, and monitors their implementation. It also serves as a forum for cooperation and information exchange among regulatory bodies.

Federal Reserve System (FRS):

The Federal Reserve, often referred to as the “Fed,” is the central banking system of the United States. Its primary responsibilities include conducting monetary policy, supervising and regulating banks, and maintaining the financial system’s stability. The Federal Reserve has several regional banks across the country. It works with other regulatory bodies, such as the Office of the Comptroller of the Currency (OCC) and the Consumer Financial Protection Bureau (CFPB), to ensure the safety and soundness of the banking industry.

European Central Bank (ECB):

The ECB is the central bank for the Eurozone countries and plays a pivotal role in the regulation and supervision of European banks. It formulates and implements monetary policy, conducts stress tests, and assesses the financial health of banks through the Single Supervisory Mechanism (SSM). The SSM, in collaboration with national regulatory authorities, is responsible for supervising significant banks, while smaller banks fall under the direct supervision of federal regulators.

Financial Conduct Authority (FCA)

The FCA is the regulatory body responsible for overseeing the conduct of financial firms in the United Kingdom. Its main objectives are to protect consumers, maintain market integrity, and promote competition in the interest of consumers. The FCA sets rules and standards for financial institutions, enforces compliance, and takes disciplinary action against firms that breach regulations. It works alongside the Prudential Regulation Authority (PRA), which focuses on ensuring the safety and soundness of banks.

Conclusion

The banking industry operates under the scrutiny and guidance of various regulatory bodies to maintain stability, protect consumers, and mitigate systemic risks. The organizations mentioned above represent a fraction of the global regulatory landscape, each uniquely shaping and enforcing banking regulations. By setting standards, conducting supervision, and promoting cooperation, these bodies strive to create an environment conducive to trust, transparency, and long-term sustainability in the banking sector.

Given the frequent changes, senior banking leaders must stay informed about the specific regulations applicable to their regions and actively engage with regulatory bodies to ensure compliance and contribute to the continued development of a robust banking industry.

About Maveric Systems

Starting in 2000, Maveric Systems is a niche, domain-led Banking Tech specialist partnering with global banks to solve business challenges through emerging technology. 3000+ tech experts use proven frameworks to empower our customers to navigate a rapidly changing environment, enabling sharper definitions of their goals and measures to achieve them.

Across retail, corporate & wealth management, Maveric accelerates digital transformation through native banking domain expertise, a customer-intimacy-led delivery model, and a vibrant leadership supported by a culture of ownership.

With centers of excellence for Data, Digital, Core Banking, and Quality Engineering, Maveric teams work in 15 countries with regional delivery capabilities in Bangalore, Chennai, Dubai, London, Poland, Riyadh, and Singapore. Get in touch with Maveric Systems today!