Demographic shifts catalyze a profound transformation of the rapidly evolving financial advisory landscape. As global population dynamics undergo unprecedented changes, financial advisors must swiftly adapt to meet their client’s diverse needs and evolving expectations.

This blog delves into the key demographic trends in the coming year and their far-reaching impact on financial advisory services, exploring how these shifts reshape wealth management’s foundations.

The Silver Tsunami: Aging Population and the Great Wealth Transfer

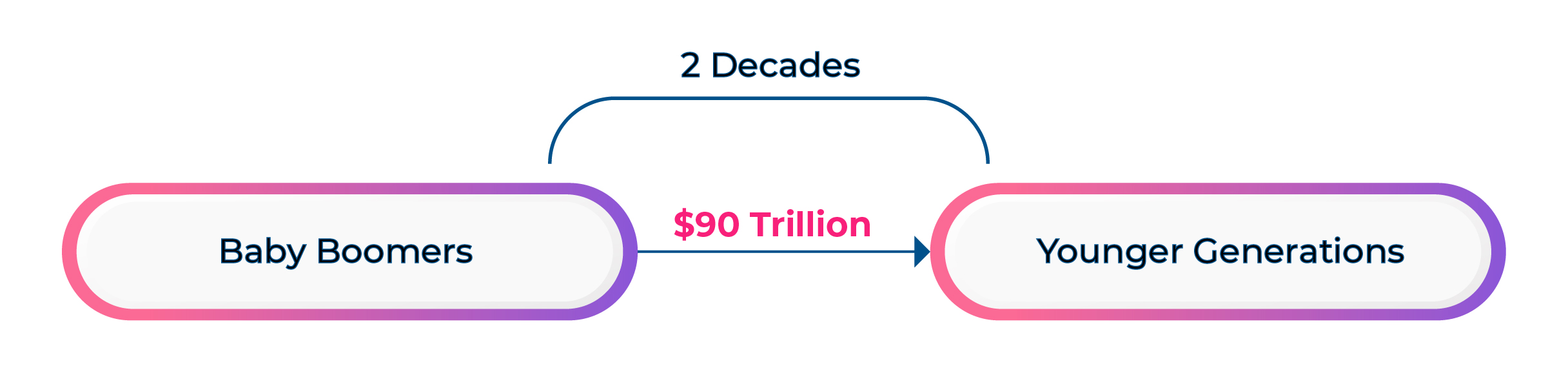

One of the most significant demographic shifts is the aging population, often called the “Silver Tsunami.” As baby boomers transition into retirement, we witness a monumental wealth transfer. According to a groundbreaking study by Knight Frank, an astounding $90 trillion in assets will change hands between generations over the next two decades. This unprecedented wealth transfer presents both formidable challenges and exciting opportunities for financial advisors.

To navigate this seismic shift, advisors must provide meticulously tailored services encompassing:

- Comprehensive retirement planning

- Sophisticated estate planning strategies

- Innovative philanthropy solutions

These services are crucial in helping clients manage their wealth effectively as they enter their golden years. Moreover, the aging population demands increasingly specialized advice on healthcare financing and long-term care planning, ensuring their financial needs are met throughout their extended retirement years.

A study by Cerulli Associates projects that by 2045, $84.4 trillion in wealth will be transferred across generations in the United States alone. This staggering figure underscores financial advisors’ critical role in guiding wealth transferors and inheritors through this complex process.

The Digital Natives: Millennials and Generation Z Reshape the Investment Landscape

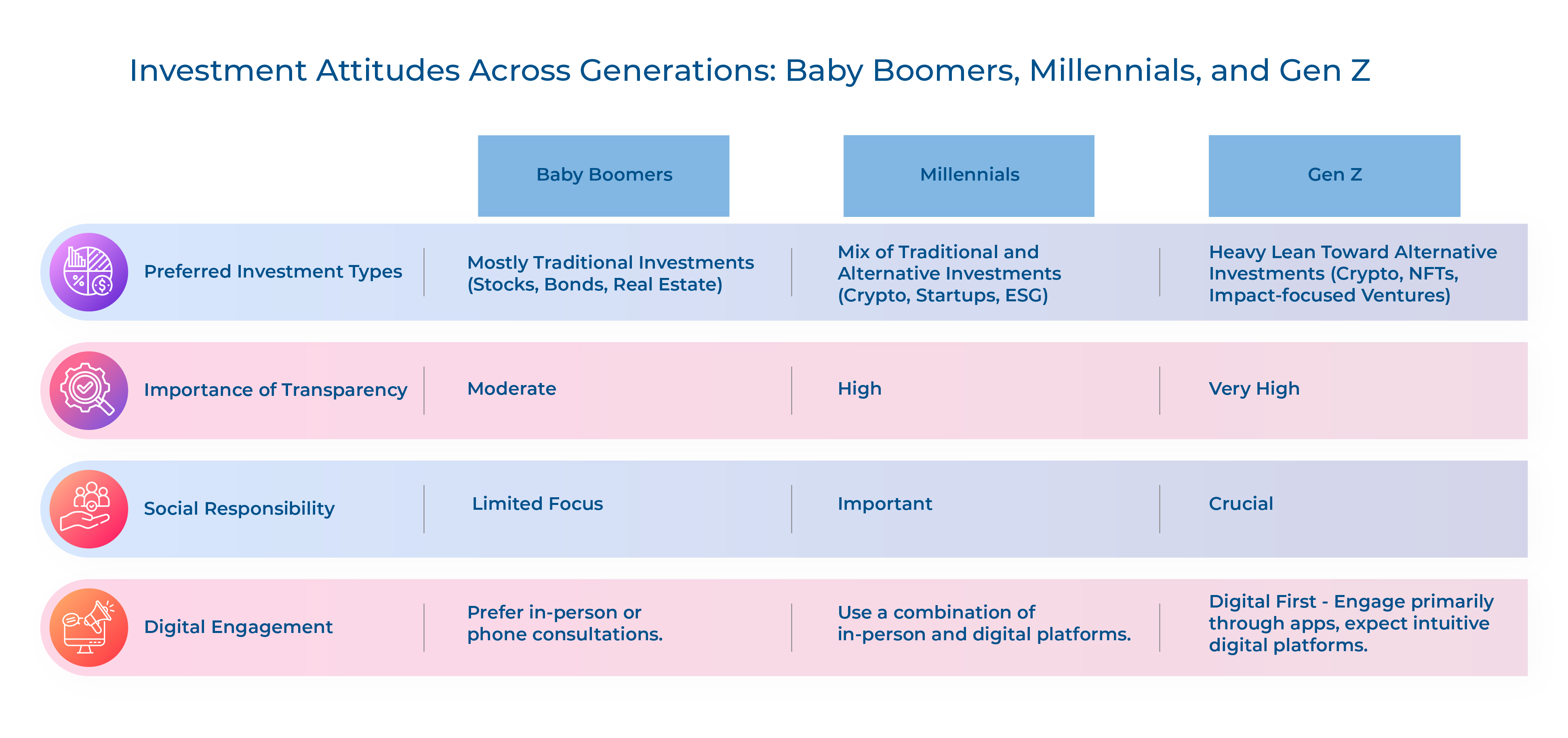

Millennials and Generation Z are emerging as powerhouse investors, bringing revolutionary perspectives and expectations to the financial advisory industry. These tech-savvy generations place a premium on transparency, hyper-personalization, and socially responsible investing. A recent Forbes survey revealed that 72% of millennials and 85% of Gen Z allocate a significant portion of their portfolios to alternative investments.

Financial advisors must embrace cutting-edge digital tools and platforms to engage with these younger clients effectively. Offering personalized investment strategies that align with their deeply held values, such as ESG (Environmental, Social, and Governance) investing, is no longer optional it’s imperative for advisors seeking to build enduring relationships with this demographic.

According to an Accenture report, millennials and Gen Z will inherit over $30 trillion of wealth in North America alone by 2030. This immense transfer of wealth to digital natives will fundamentally reshape the financial advisory landscape, demanding a radical rethinking of traditional service models.

The Rise of Women Investors: A Paradigm Shift in Wealth Management

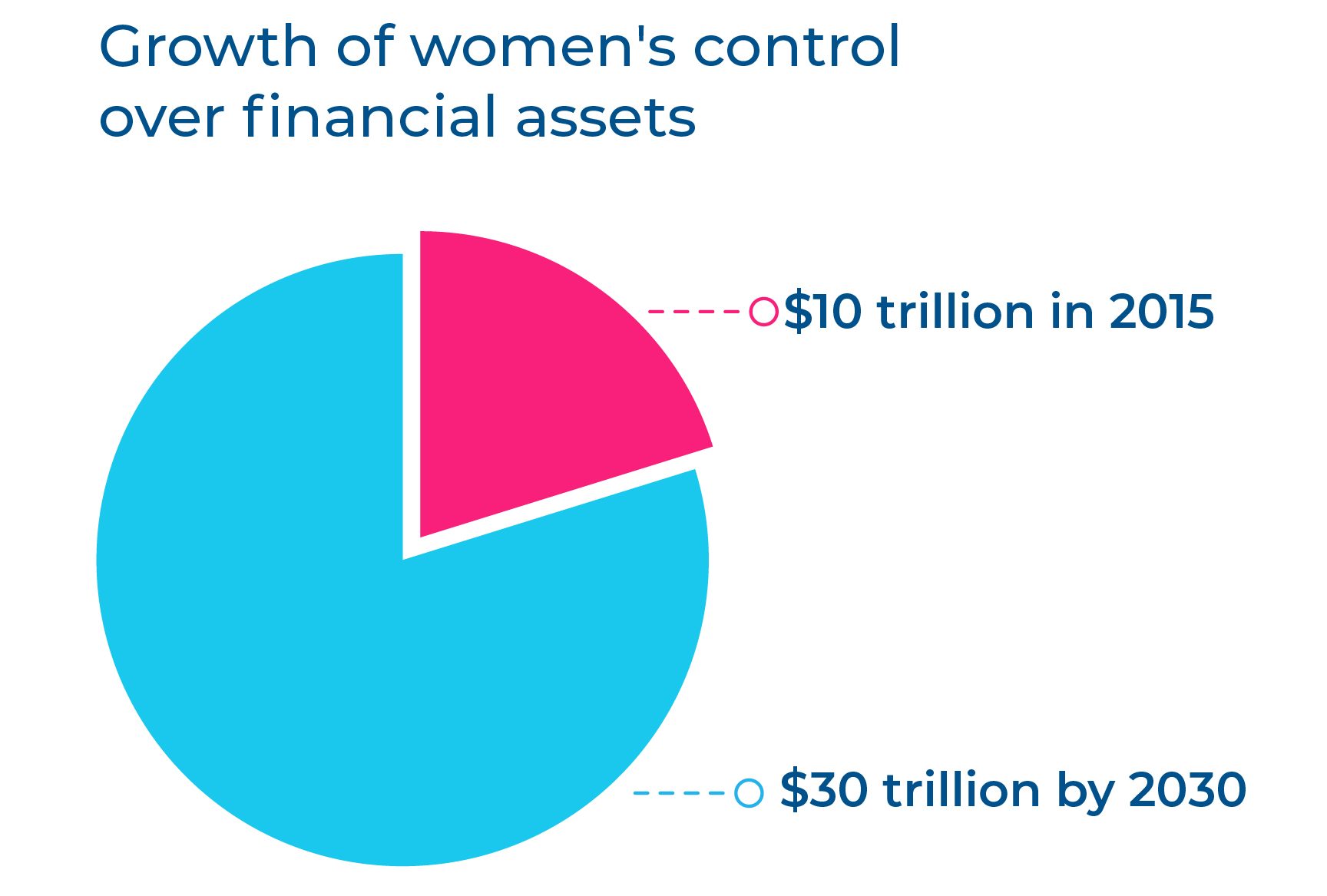

Women are rapidly becoming a formidable force in the investment world. They seek a holistic approach to wealth management that transcends traditional financial planning. Women investors prioritize comprehensive lifestyle management, legacy planning, and investments that resonate with their core values. According to a groundbreaking study by Fidelity, more than two-thirds of women are actively saving for retirement, and 60% are investing in the stock market. Financial advisors must recognize and adapt to the unique needs of women investors, providing tailored advice that addresses their specific goals and preferences. Building unshakeable trust and fostering robust client-advisor relationships are paramount in serving this burgeoning demographic effectively.

A report by McKinsey & Company predicts that women will control $30 trillion in financial assets by 2030, up from $10 trillion in 2015. This monumental shift in wealth control underscores the urgency for financial advisors to recalibrate their strategies to serve women better investors.

Empowering the Next Generation: Young Investors and Financial Literacy

Young investors, particularly millennials and Gen Z, demonstrate an insatiable appetite for personal finance and wealth accumulation. They are more likely to conduct extensive research and connect with businesses online, emphasizing transparency and seamless digital engagement. A comprehensive study by Deloitte found that 68% of investors, including a staggering 74% of Gen Y/Z, expect their investment providers to offer digital experiences on par with leading tech companies.

This presents a unique opportunity for financial advisors to educate and guide young investors, helping them make informed and strategic investment choices. By providing robust financial literacy resources and leveraging state-of-the-art digital tools, advisors can significantly enhance the client experience and foster long-term loyalty.

A survey by the CFA Institute revealed that 65% of millennials believe financial education is a critical life skill, yet only 35% feel confident in their financial knowledge. This gap presents a golden opportunity for financial advisors to position themselves as indispensable educators and mentors to this demographic.

The Philanthropy Revolution: Integrating Purpose-Driven Advisory Services

Philanthropy is rapidly becoming integral to wealth management, particularly for younger generations. Gen Y/Z clients increasingly expect their financial advisors to offer services far beyond traditional financial advice, including guidance on effective giving strategies and facilitating connections with impactful charitable organizations.

Wealth management firms can attract and retain clients by seamlessly integrating philanthropic advisory services into their offerings, prioritizing social impact and sustainability. A study by Fidelity Charitable found that 77% of affluent millennials consider their charitable giving an essential part of their identity.

Conclusion: Embracing the Future of Financial Advisory

The demographic shifts reshaping the financial advisory landscape present unprecedented challenges and extraordinary opportunities for advisors. By deeply understanding and swiftly adapting to the unique needs of different client segments, financial advisors can provide more personalized, effective, and impactful services.

Embracing cutting-edge digital tools, offering meticulously tailored advice, and integrating comprehensive philanthropic services are no longer optional strategies – they are essential for thriving in this rapidly evolving industry. As the demographic landscape continues its dramatic transformation, financial advisors who stay ahead of these seismic trends will be uniquely positioned to succeed and redefine the very nature of wealth management for generations to come.

The future of financial advisory belongs to those who can navigate these demographic shifts with agility, insight, and unwavering commitment to client success. Are you ready to take charge of this new era of wealth management?

Citations and Further Reading

- Morningstar Wealth

- Precise FP

- CPF Board

- Deloitte

- Thought Lab

- Mckinsey & Company

- LGT Wealth Management

Co-authored by Venkatesh Padmanabhachari, Avinash Dave, and Sagar Rathore

Maveric’s thought leadership series – E.D.G.E (Experiences Delivered by Global Experts) – handpicks the game-changing technology ideas and pressing functional questions Banks and financial institutions must solve today.

These features – reports, whitepapers, podcasts, flyers, blogs, and infographics – are for Banking leaders and Technology evangelists to apply profound trends, the latest opinions, and transformational analyses to boost the performance of their organizations.

About Maveric Systems

Established in 2000, Maveric Systems is a niche, domain-led, BankTech specialist, transforming digital ecosystems across retail, corporate, wealth management, cards & payments and lending domains. Our 2600+ specialists use proven solutions and frameworks to address formidable CXO challenges across Customer Experience, Assurance, Regulatory Compliance, Process Excellence and New age AMS.

Our competencies across Data, Digital, Cloud, DevOps, AI and automation helps global and regional banking leaders as well as Fintechs solve next-gen business challenges through emerging technology. Our global presence spans across 3 continents with regional delivery capabilities in Amsterdam, Bengaluru, Chennai, Dallas, Dubai, Kingdom of Saudi Arabia, London, New Jersey, Pune, Riyadh, Singapore, Sweden, Dubai and Warsaw.

Our inherent banking domain expertise, a customer-intimacy-led delivery model, and differentiated talent with layered competency – deep domain and tech leadership, supported by a culture of ownership, energy, and commitment to customer success, make us the technology partner of choice for our customers.