Commercial banking is confronted with a potentially more complex environment than ever before: customer needs, rapid improvement in digital capabilities, digitization, and new sources of competition are compelling banks to innovate immediately.

For one, customers demand immediate, smooth, and omnichannel banking. Secondly, the pressures for product and service innovations are made more complex by the embedded demand for financial services in corporate processes.

Data, Digital, and Technology impact Business Banking and Empowers Customers

As superior technology systems integrators like Maveric would report, banks are preparing for cloud- and API-enabled ecosystems with the help of AI-enabled, networked technology.

Cloud and API technology adoption

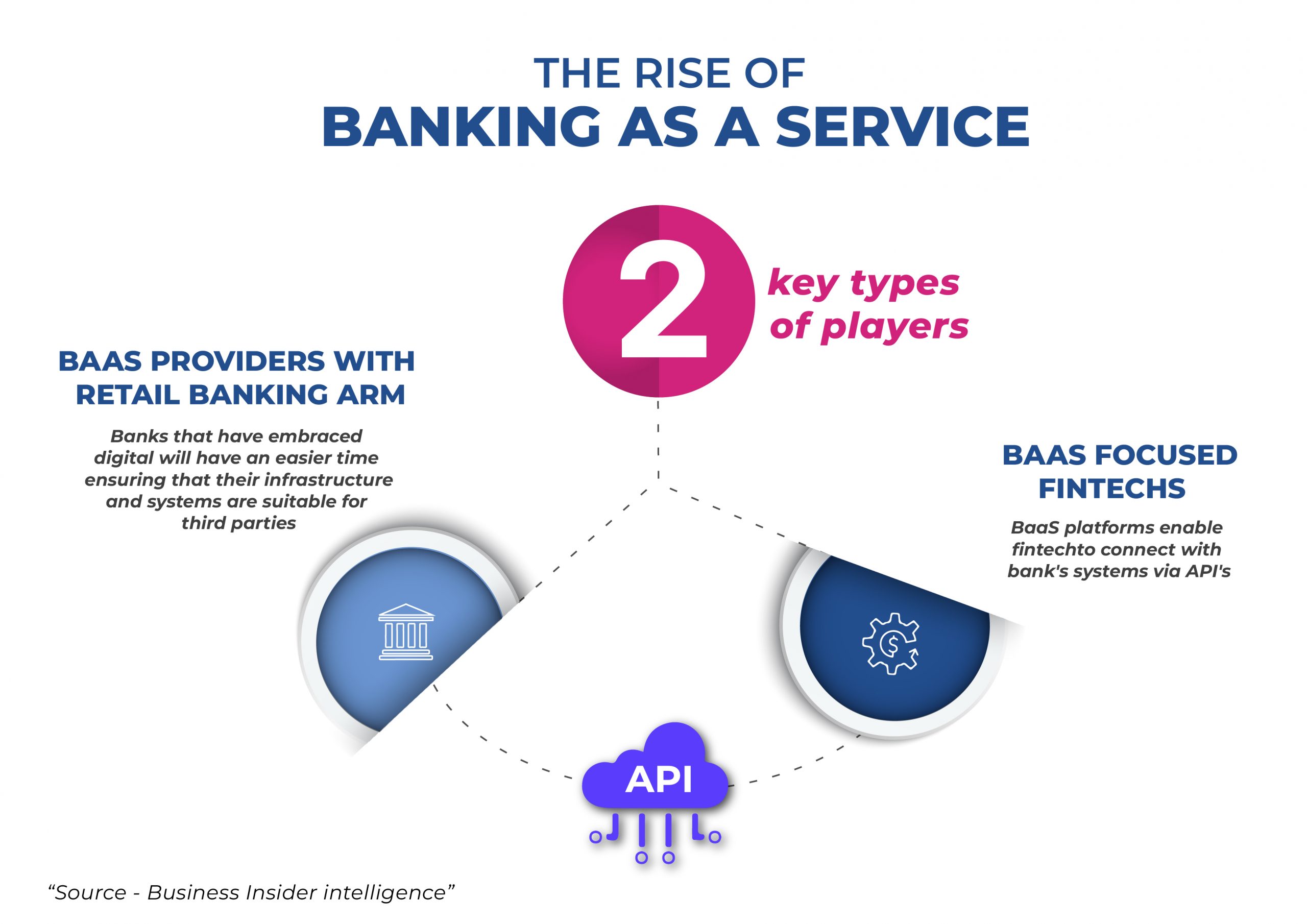

Commercial banks collaborate with modern infrastructure providers to upgrade or overhaul legacy technologies. Digital services, such as lending origination and onboarding, replace manual processes and antiquated systems with a single, end-to-end solution that serves SMEs, corporations, and commercial clients. As part of digital transformation, banks have made substantial investments in automating their origination platforms. Moreover, APIs facilitate new collaborations and partnerships between banks, digital banking enterprises, and Fintechs. Moreover, with lower entry barriers, new cloud-based lending services are being rapidly implemented.

There is an immediate need to accelerate the time to market

Digital disruptors innovate through automated document population, e-verification, and verified external data validation to ease servicing evaluations, financial spreading, and deal structuring. As a result, the time required to make a credit judgment quickly decreases.

Data value creation will differentiate performance

Leading commercial banks are transforming their roles to become both producers and consumers of data, for instance, by selling their payment, trade finance, and lending capabilities to other entities. The vast amounts of data created enable commercial banks to strengthen their client connections by personalizing digital experiences and sending highly customized, timely messages based on in-depth consumer information. Niche solutions can be incorporated in a data environment where rivals can be partners.

Integrating financial crime prevention, cybersecurity, data privacy, and regulatory requirements into the engineering and design lifecycle

By integrating new technologies, collaborating throughout the ecosystem, and focusing on data and client security, banks are altering their capacity to combat financial crime. Cybersecurity, once considered the final frontier is now the de-facto foundation of trust and an integral part of every product and service.

Architecting the modern-day commercial banking ecosystem

Leading commercial banks have created platform-based ecosystems that extend beyond traditional banking and cater to a broad spectrum of customers’ growing needs. The future of commercial banking is platform-based service models and competitive ecosystems enabled by data and cloud technology with API access. This situation allows banking systems of the next generation to service multiple individualized client segments. “Platformization” will increase the availability and velocity of innovation for products and services and dramatically cut the time required to gain mainstream adoption. It can also enhance banks’ data collection and analytical capabilities, giving them a significant advantage over non-financial competitors.

Conclusion

Commercial banking is undergoing fast change through digitization, more competition, and stricter regulation. Small and medium-sized commercial banks are adapting to remain competitive. The way forward for Banks and leading FIs lies in evaluating their maturity, shaping their transformation agenda and strategies, and deploying enterprise-wide enhancements to the goal of value maximization.

About Maveric Systems

Starting in 2000, Maveric Systems is a niche, domain-led Banking Tech specialist partnering with global banks to solve business challenges through emerging technology. 3000+ tech experts use proven frameworks to empower our customers to navigate a rapidly changing environment, enabling sharper definitions of their goals and measures to achieve them.

Across retail, corporate & wealth management, Maveric accelerates digital transformation through native banking domain expertise, a customer-intimacy-led delivery model, and a vibrant leadership supported by a culture of ownership.

With centers of excellence for Data, Digital, Core Banking, and Quality Engineering, Maveric teams work in 15 countries with regional delivery capabilities in Bangalore, Chennai, Dubai, London, Poland, Riyadh, and Singapore.