Creating a Culture of Lifelong Learning: The Cornerstone of Banking’s Digital Resurgence

The world is changing at an unprecedented pace and it has its impact for the banking industry as well. Only 44% of customers report satisfaction with their banking experience. The World Economic Forum predicts 85 million jobs may be displaced by 2025 due to evolving roles between humans and machines 97 million new roles may emerge.

This highlights a pressing need for innovation and adaptation. In an era where AI and technological advancements drive rapid change, the half-life of skills lasts less than five years. Embracing a lifelong learning mindset and culture is critical for staying competitive, not only for individuals but also for organizations. Companies fostering lifelong learning achieve 52% higher productivity, 17% increased profitability, and a higher employee and customer satisfaction.

Maveric Systems exemplifies this approach by championing a lifelong learning culture to become a trailblazer in learning and development. Through AI-driven personalized learning solutions and diverse training opportunities, Maveric empowers its workforce to thrive amidst rapid change. In this blog, we explore how a robust learning culture acts as a critical differentiator in the banking sector, driving innovation, compliance and customer satisfaction.

The Learning Imperative: Beyond Buzzwords to Bottom Lines

Organizations with strong learning cultures report 52% more productivity and 17% higher profitability. This is especially crucial in banking, where regulatory complexities meet fast-paced technological advancements. According to Deloitte, banks investing in continuous learning programs see a 37% increase in employee retention and a 58% improvement in customer satisfaction.

The stakes are clear: Lifelong learning is not just a buzzword but a business imperative for banking institutions aiming to lead the market.

Maveric’s Masterclass: Architecting the Future of BankTech Talent

Maveric Systems, with its vision of being among the top three global BankTech specialists by 2025, integrates lifelong learning into its organizational DNA.

Key elements of Maveric’s learning culture include:

1.) Regulatory Rigor:

Courses on information security, risk management, and compliance ensures workforce alignment with industry standards and provides secure service to our customers.

2.) College-to-Corporate Transition:

Focused three-month program covering domain, tech and soft skills help fresh talents seamlessly transition from academia to the corporate world.

3.) Continuous Upskilling:

Design customized learning programs aligning with customer roadmap, thus enabling associates to deliver consistent value to customers. Encourage Industry certifications to further endorse skill proficiency and improve customer confidence.

4.) Leadership Focus:

Invest in our leadership team (current and future leaders) through focused workshops, webinars and customized programs thus developing them not to be just tech-savvy leaders but also as holistic leaders.

5.) Digital Dexterity:

A comprehensive digital learning ecosystem, supported by LMS platform and partnerships with content providers like Udemy catering to Gen Z’s learning preferences.

Beyond the Boardroom: Industry-Wide Implications

A robust learning culture delivers benefits beyond individual organizations:

1.) Innovation Acceleration:

Banks with strong learning programs are 3.5 times more likely to lead in innovation.

2.) Regulatory Resilience:

Comprehensive training reduces compliance incidents by 42%.

3.) Enhanced Customer Experience:

Employees engaged in learning are 58% more likely to excel in delivering exceptional customer service.

Charting the Course: 8 Strategic Imperatives for Banking’s Learning Revolution

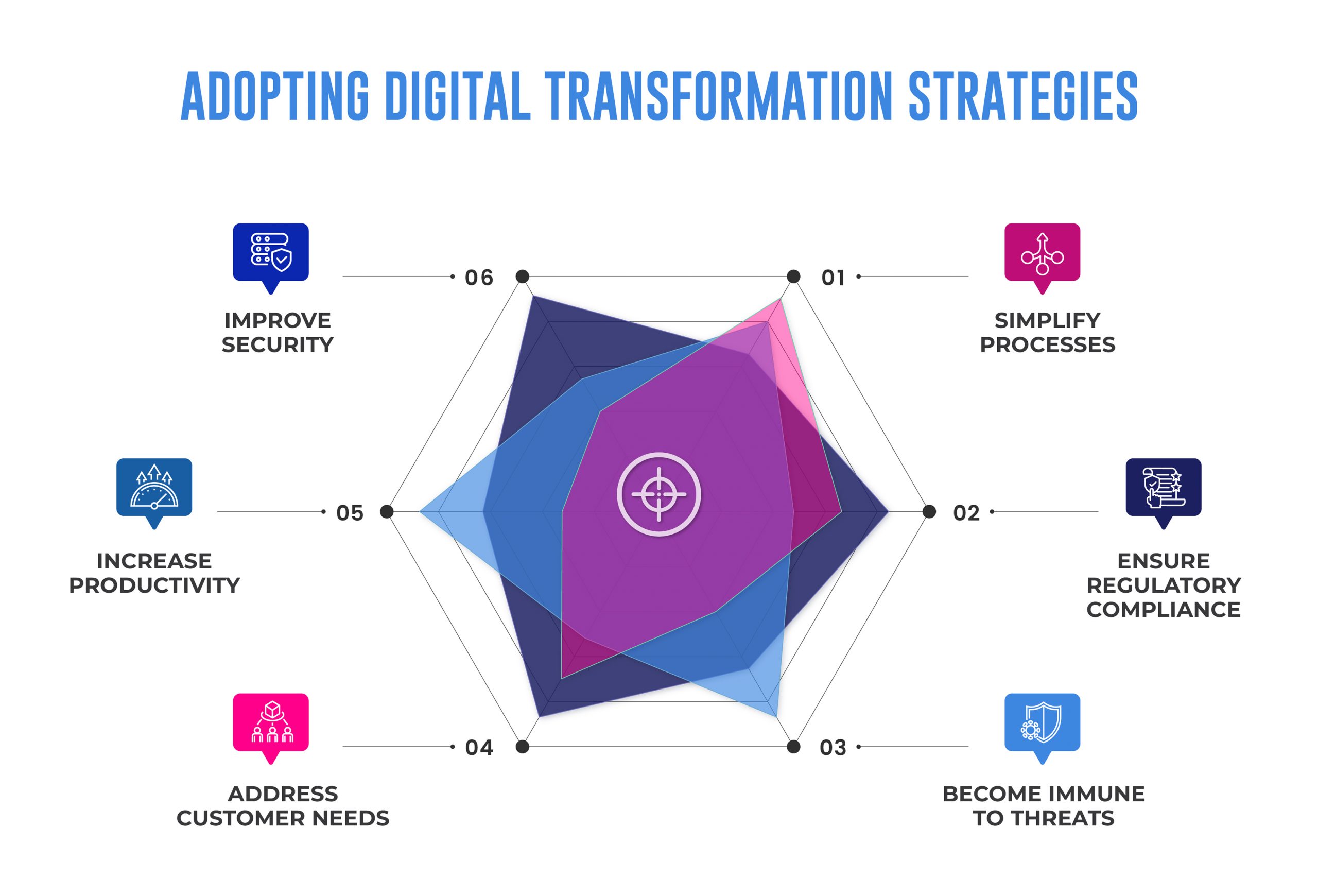

To create a thriving learning ecosystem, we recommend banking leaders to adopt the following strategies:

1.) Personalization at Scale:

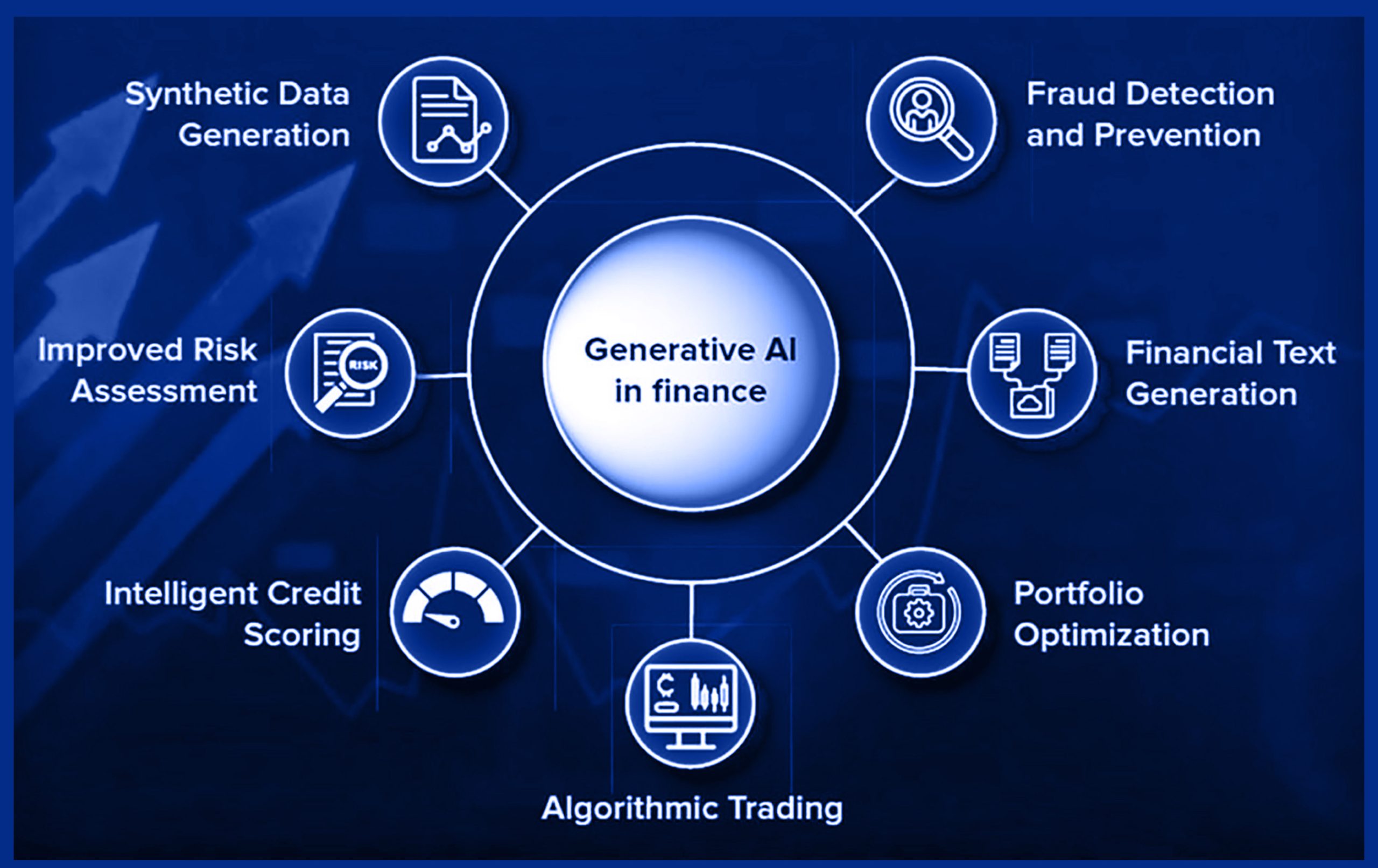

Use AI to develop individualized learning pathways tailored to employee roles and aspirations. Example: Use machine learning algorithms to analyze an employee’s role, performance, and career goals to suggest tailored learning modules.

2.) Cross-Departmental Knowledge Sharing:

Implement rotation programs to foster holistic banking expertise. Example: Implement a “rotation program” where employees spend time in different departments, gaining diverse skills and perspectives.

3.) Real-Time Learning:

Integrate micro-learning modules into daily workflows for immediate knowledge application. For example, integrate micro-learning modules into daily workflows, such as quick compliance updates before processing certain transactions.

4.) Collaborative Learning:

Encourage sharing of best practices and insights gained from real-world projects. For example, create communities through internal Yammer or other channels to learn collaboratively and support each other.

5.) Outcome Measurement:

Use analytics to tie learning outcomes to business KPIs, demonstrating clear ROI. For example, employee retention, customer satisfaction and employee satisfaction.

6.) Industry Ecosystem Engagement:

Partner with fintech startups, universities, and regulatory bodies to create adaptive learning environments. For eg., Partnering with industry bodies like “Indian Institute of Banking & Finance”, “National Institute of Securities Markets” etc.,

7.) Cognitive Diversity:

Offer diverse courses like design thinking or behavioral economics to complement technical banking skills.

8.) Ethical Learning:

Address ethical challenges, such as AI-driven decision-making, through specialized case studies.

Conclusion: The Learning Journey

As the banking industry stands at the threshold of a digital renaissance, the importance of lifelong learning is undeniable. Those who embrace it will not merely survive disruptions but will define the future of the industry. The question is no longer whether to invest in learning but how to do it effectively. Maveric Systems is working towards setting benchmarks for the industry by integrating continuous learning into our strategy and ensuring we remain future-ready.

About the Author

Srinivasan Sundararajan brings over 30 years of IT industry experience, with 25 years focused on delivering global QA and QE projects. He has strong experience in delivering Banking projects in Core banking and private banking space. Recognizing the importance of talent development, Srini transitioned into a Learning and Development (L&D) role six years ago.

Srinivasan Sundararajan brings over 30 years of IT industry experience, with 25 years focused on delivering global QA and QE projects. He has strong experience in delivering Banking projects in Core banking and private banking space. Recognizing the importance of talent development, Srini transitioned into a Learning and Development (L&D) role six years ago.

As the head of L&D at Maveric Systems, Srini leads the company’s commitment to continuous learning and skill enhancement. Maveric invests heavily in L&D through leadership programs, technical workshops, and mentorship initiatives, ensuring associates are equipped to meet the evolving demands of technology and banking. Under Srini’s leadership, Maveric’s L&D strategies are closely aligned with business goals, driving both talent growth and measurable business impact.