Partner Integration Platform

Seamless Open Banking API Solution for Fintech Integration and 3X Faster Launch

Why Banks need Secure, Scalable and Compliant API Strategy for Open Banking?

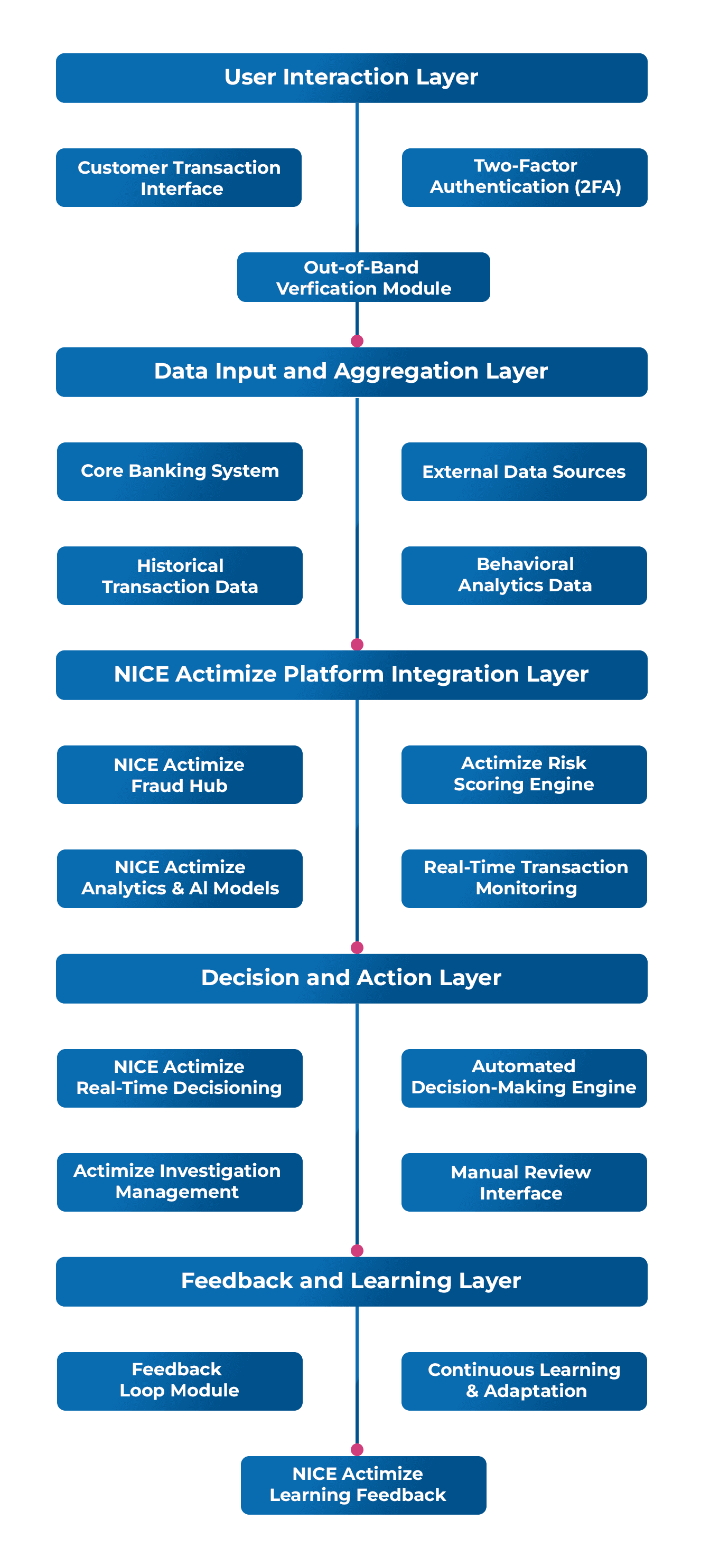

Banks take anywhere between 3-9 months to launch a new product. While some product categories like deposits take 3-6 months, others like lending take 6-9 months on account of the need to adhere to compliance and risk frameworks. On the contrary, Fintech product launches happen in 2-3 weeks giving them a competitive edge over traditional banking players.

A combination of outdated technology, siloed teams, ecosystem integration challenges, testing difficulties, slow performance analysis, and user-centric design impediments significantly hamper the banks’ ability to launch new products quickly and effectively.

Pioneering pathways for seamless compliance, unified data standards, dynamic ecosystem integration, and lucrative monetization.

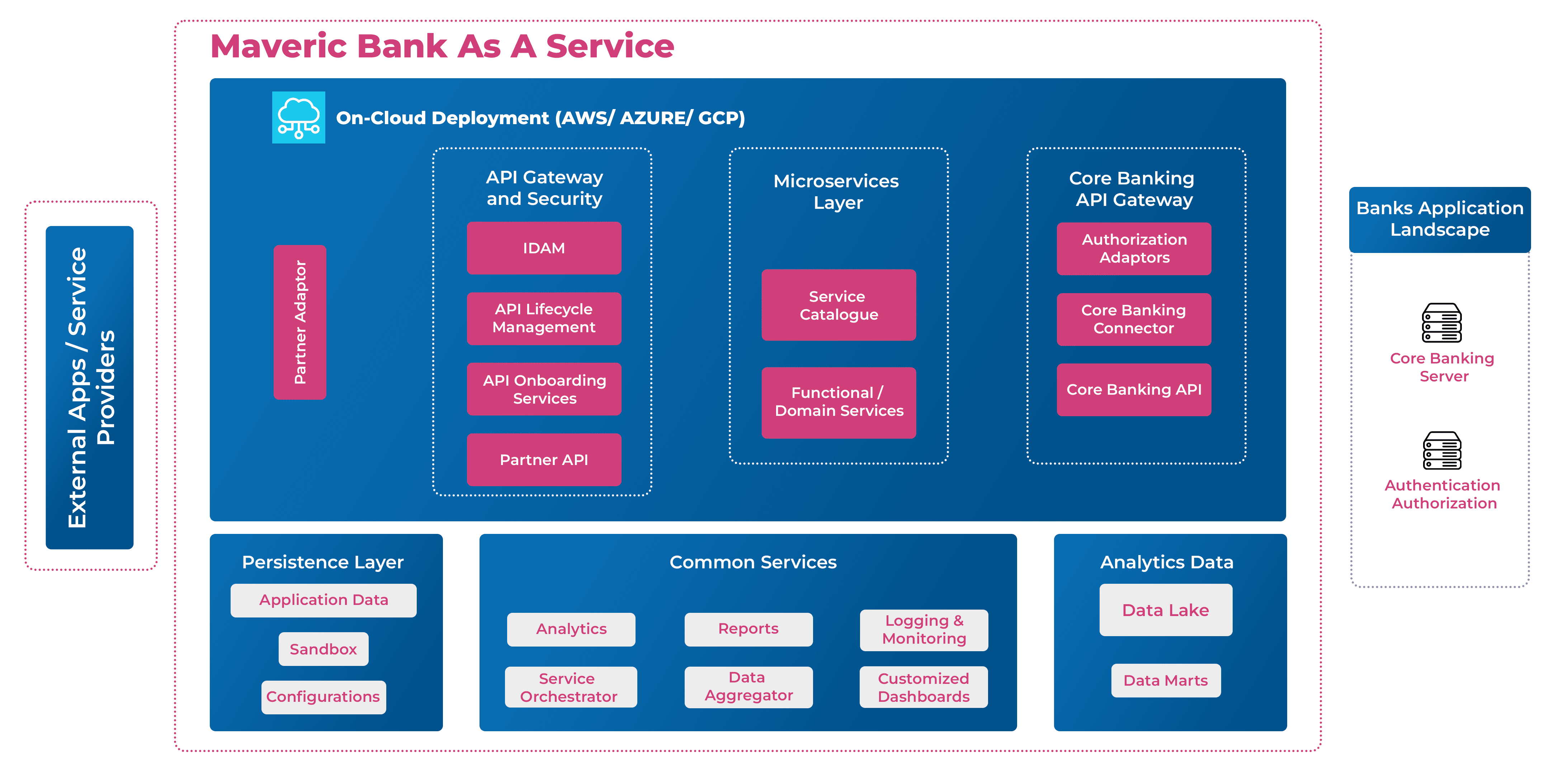

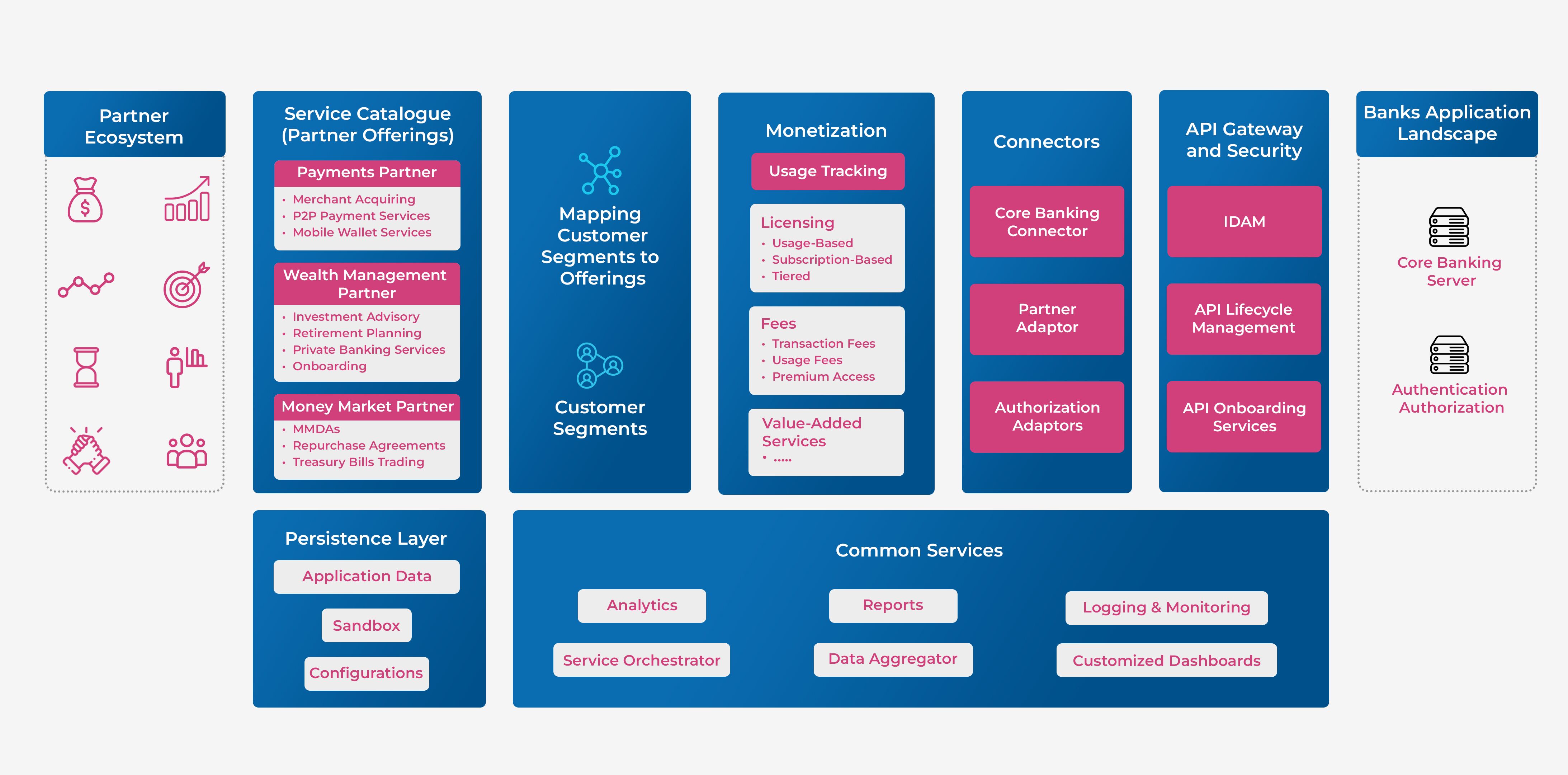

Maveric’s Partner Integration Platform

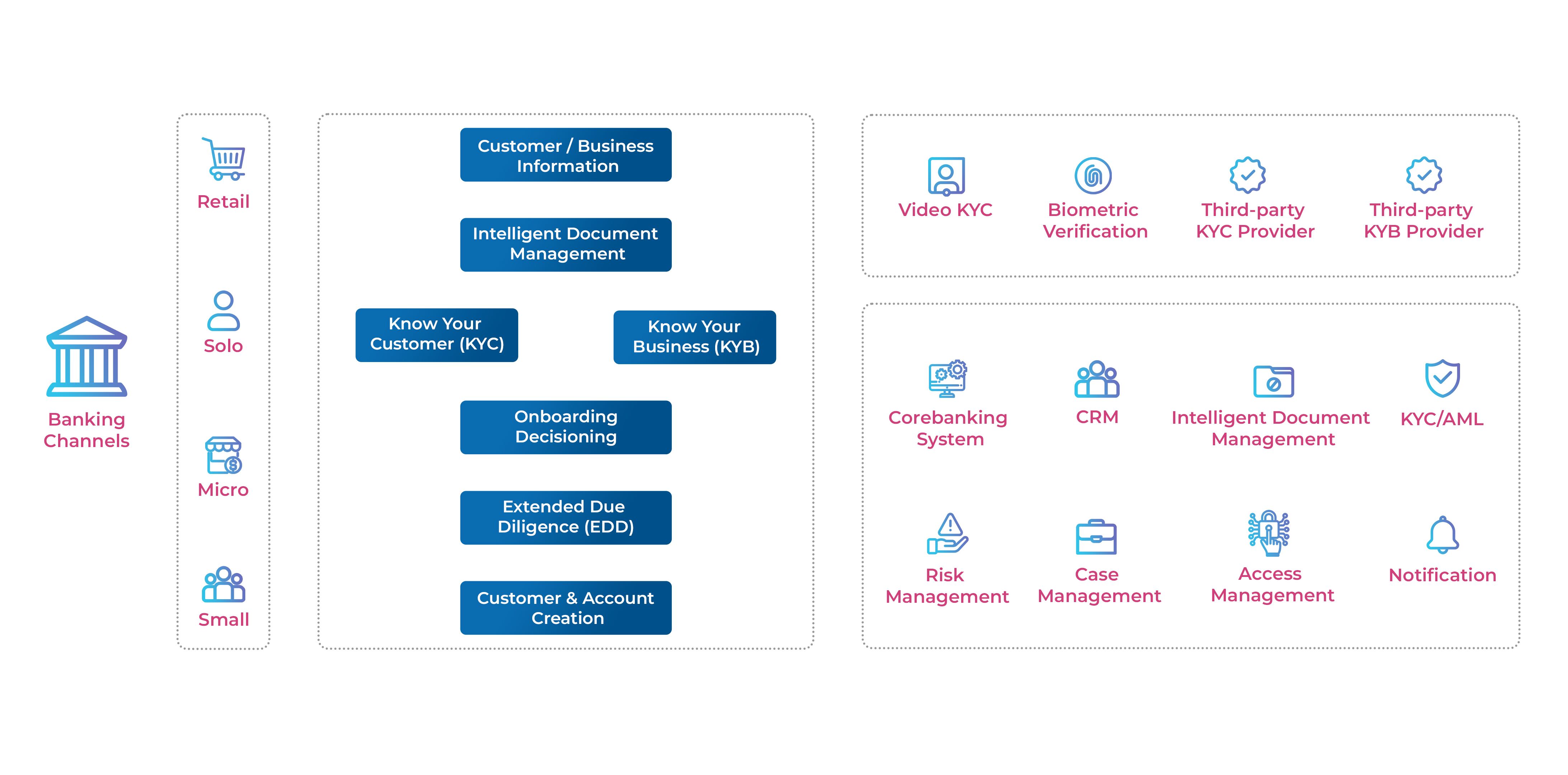

An Open Banking Framework for Secure and Scalable Solution for Banks

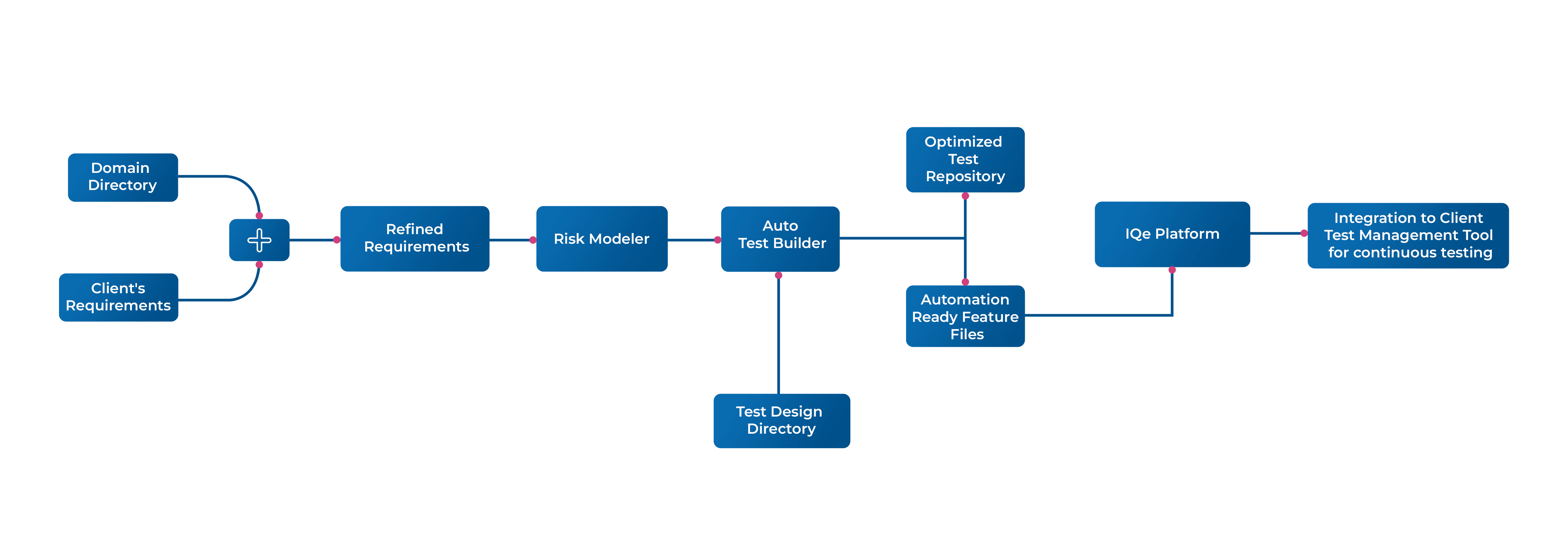

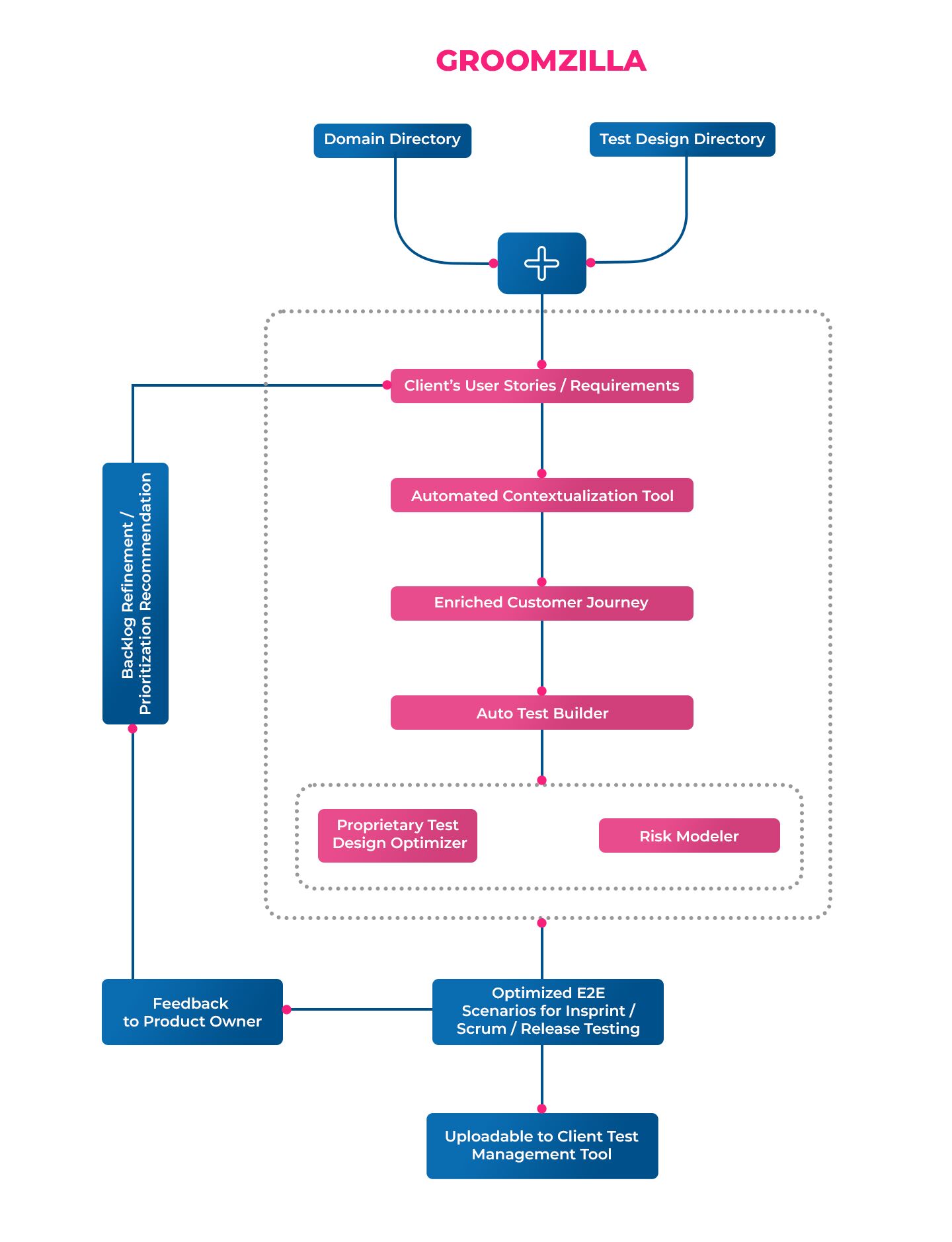

Collapsing the 3 – 9 months for new product launches to 2 – 3 weeks means that Maveric’s Partner Integration Platform simplifies automated partner onboarding, seamless data exchange, and process streamlining. From accelerating time to market, reducing operating costs, and overcoming performance testing complexities, the Partner Integration Platform solution delivers new service integration with relative ease.

Accelerated Releases:

Speeds up product launches and revenue growth by leveraging partner capabilities.

Rapid Onboarding:

Pre-built service catalogs ensure quick partner integration and targeted service offerings.

Flexible Monetization:

Enables effective billing for licenses and services while allowing partners to expand their reach.

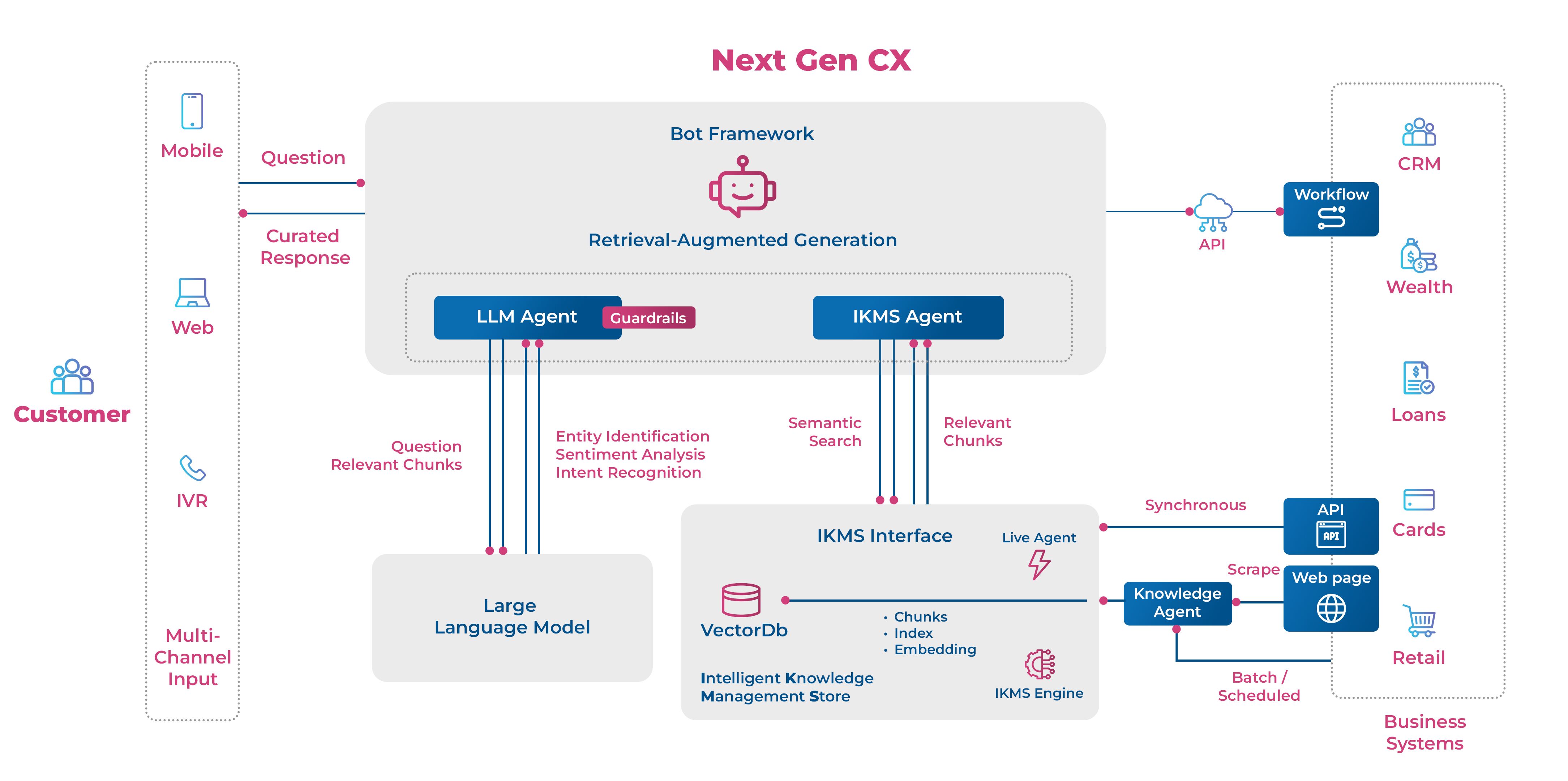

Secure API Integration:

Connects seamlessly with partner and bank systems via secure, managed APIs.

Insightful Analytics:

Offers data aggregation, analytics, and customizable dashboards for real-time monitoring and platform health.

Business Benefits

Maveric’s ‘Partner Integration Platform‘ is a strategic enabler for banks looking to lead the future of finance.

With 25 years of expertise in BankTech, Maveric is your ideal partner in transforming your banking ecosystem into a dynamic, customer-centric platform that drives revenue and enhances customer satisfaction.

Quick adoption and deployment of new financial products and services without the need for extensive in-house development.

Significant reduction in development and maintenance costs by using pre-built fintech solutions instead of building everything from scratch.

Effective API monetization by charging for usage of partner access to data and services, such as account aggregation, payment processing etc.

Boost your competitive edge

The Maveric Edge

Leverage Maveric’s contextualization depth, extensive domain competencies, and over two decades of multi-geography award-winning commitment

Contextualized Solutions:

An innate ability to bring together domain, platform, and technology expertise to craft contextual solutions to support transformation programs.

Impactful Delivery Model:

A customer centric model geared for high delivery impact.

New Service Line Development:

Proven ability to develop and scale new service lines aligned to customer growth areas

Differentiated Engagement:

Technical engagement led customer value creation.

Ready to transform your banking ecosystem?

Contact us today to learn how Maveric’s “Partner Integration Platform” can accelerate your innovation journey and position your bank for long-term success.