The Next-Gen Bank Is a Platform: Are You Ready to Build an Ecosystem?

“Banks were built to protect vaults. Platforms are built to unlock value.” That’s the defining divergence BFS leaders face today.

The Shift: From Products to Experiences

For decades, banks controlled the full value chain. But today’s customer is experience-driven — and increasingly agnostic to whether it’s delivered by a bank, fintech, or super app. The real competition isn’t across the street. It’s across the ecosystem forming around your customer’s screen.

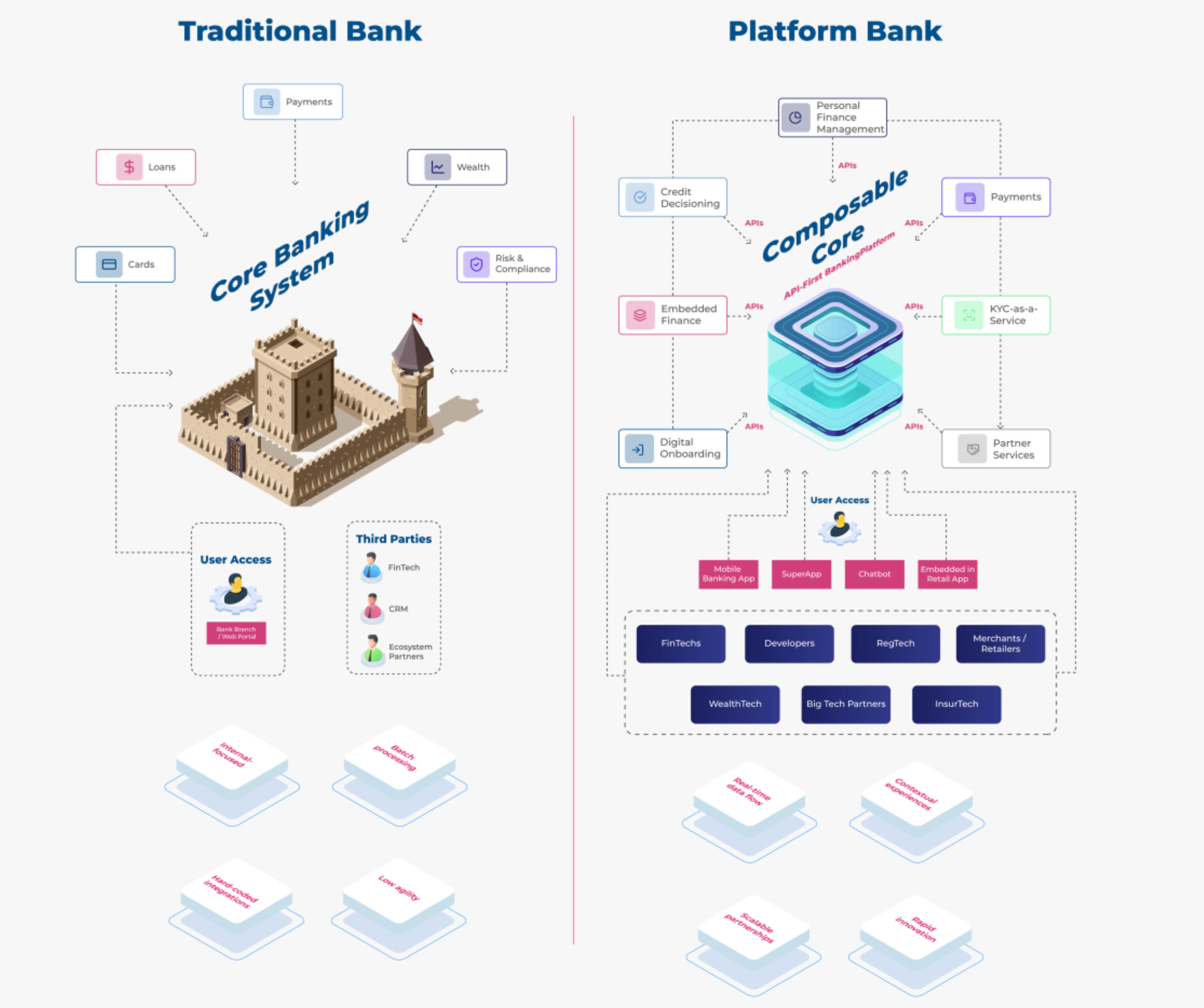

From Product Pipelines to Platform Architectures

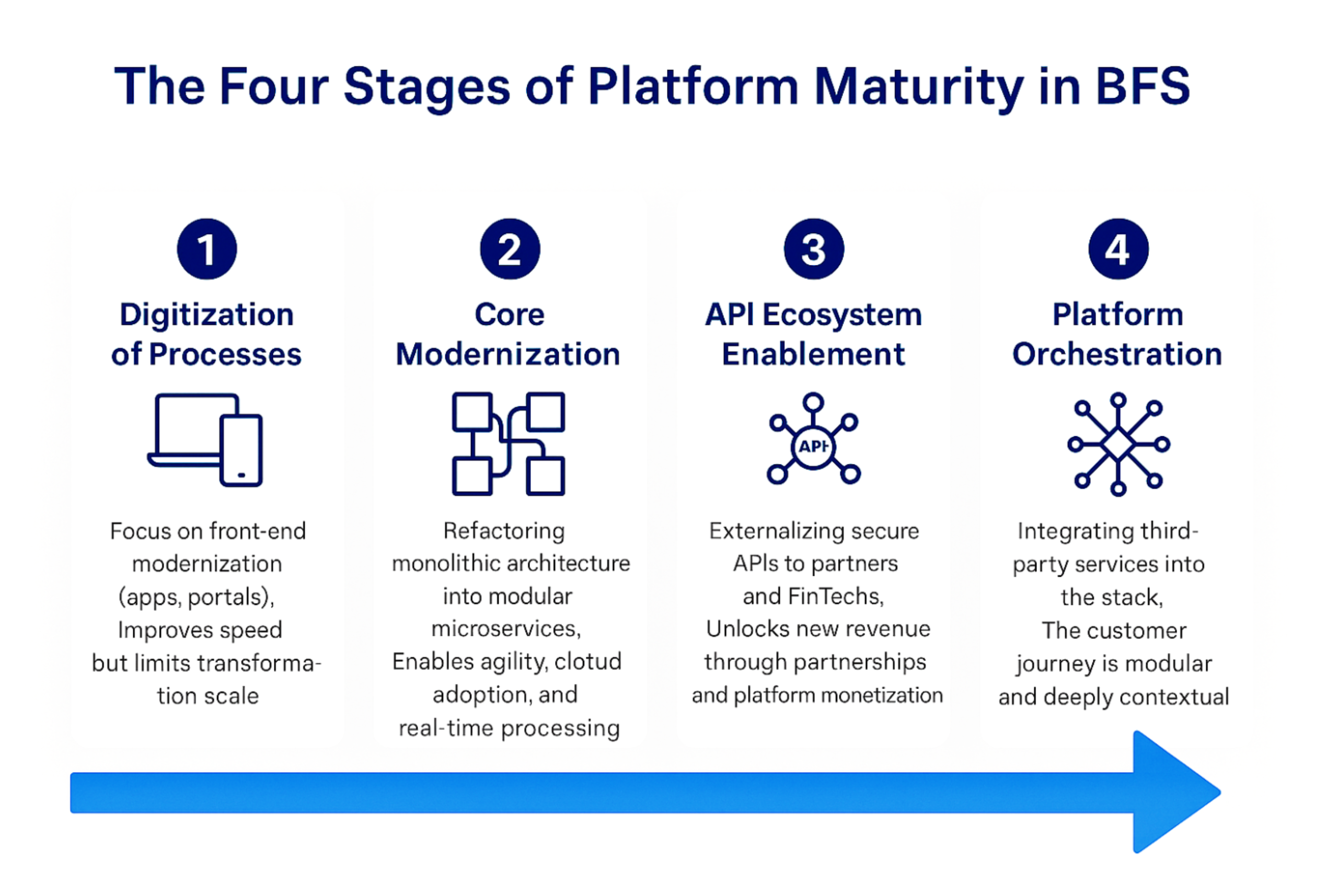

Historically, banks operated as vertically integrated service providers. Core systems were monoliths, built for compliance and control – not composability. Products were built in-house, journeys were rigid, and customer expectations followed suit.

But today, that architecture feels archaic.

Modern financial institutions are reimagining themselves – not as monolithic builders, but as agile orchestrators. It’s no longer about owning the entire value chain, but enabling innovation through APIs, composable services, and ecosystem partners.

This pivot isn’t cosmetic. It’s structural.

A platform approach transforms the bank into an enabler. Rather than producing every offering internally, platform banks curate a network of third-party services – from lending to wealth, insurance to identity verification – and expose them through standardized APIs. This allows them to innovate faster, deliver contextual offerings, and scale with far less friction.

Deloitte’s 2024 Global Banking Outlook underscores this shift – driven by the convergence of open finance, embedded banking, digital identity, real-time infrastructure, and AI-led compliance. The banks that lead tomorrow will think less like factories and more like marketplaces.

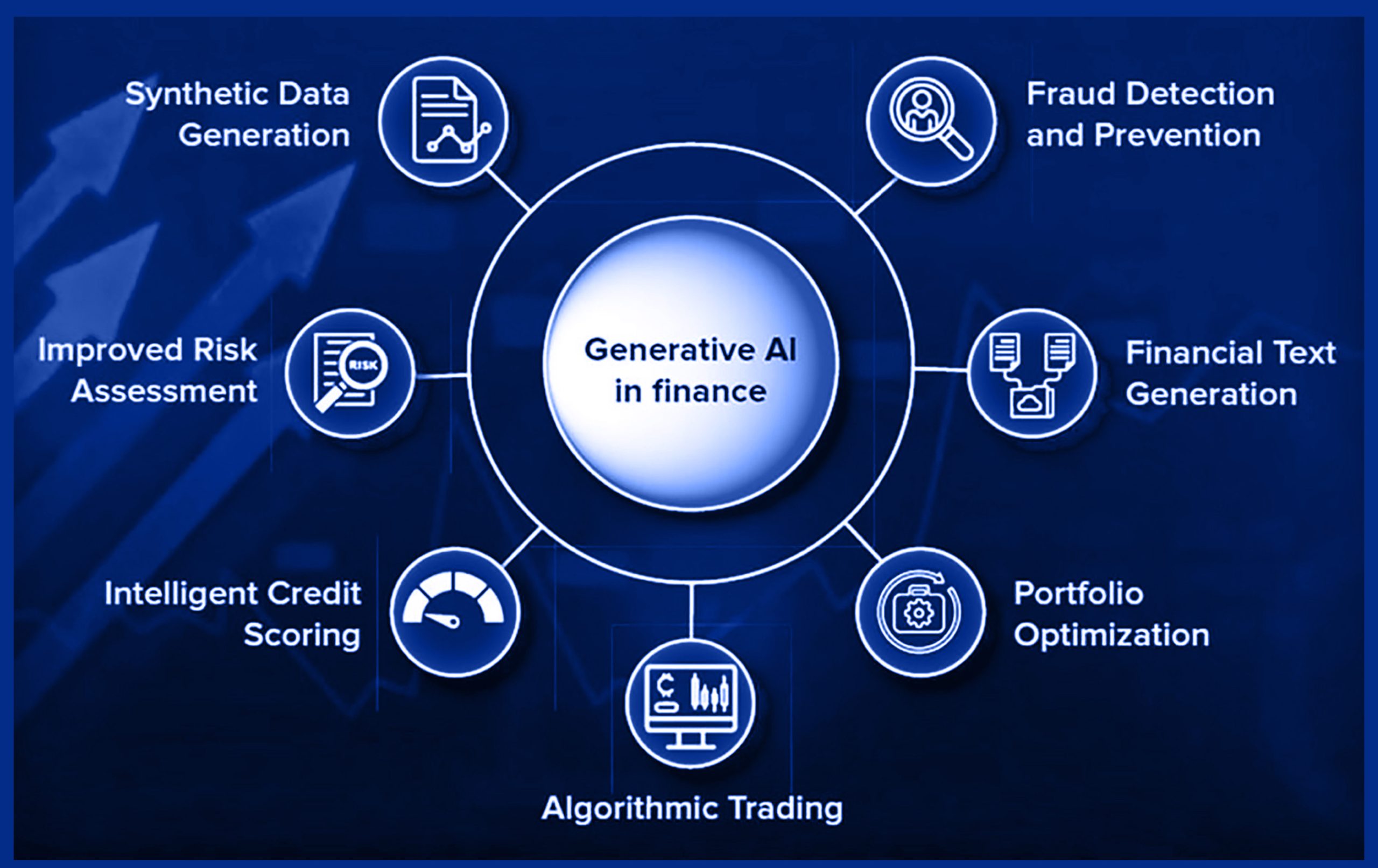

Agentic AI: The Next Frontier in Platform Banking

As platform banks evolve, the next leap isn’t just composability — it’s autonomy.

Enter Agentic AI: intelligent agents capable of reasoning, decision-making, and initiating actions independently.

In the banking context, Agentic AI can:

- Orchestrate personalized customer journeys across services

- Initiate proactive compliance, fraud, or risk workflows

- Assist RMs with real-time insights and portfolio nudges

- Automate operations through intelligent triggers across ecosystems

While traditional AI augments decisions, Agentic AI operationalizes them — becoming value-generating nodes in your digital ecosystem.

At Maveric Systems, we are embedding intelligent agents across modernization journeys, enabling institutions to evolve from digitized entities into self-adaptive ecosystems powered by Data, Design, and AI.

Maveric’s Role in Ecosystem Acceleration

At Maveric Systems, we help financial institutions accelerate every stage of this journey – from re-architecting brittle legacy systems to enabling intelligent platform orchestration.

With over 85+ transformation engagements and 25 years of banking technology focus, we bring an engineering-first approach to platform banking:

- Core modernization through domain-driven design, containerization, and real-time processing

- API-first architectures enabling secure partner integration and monetized digital assets

- Cloud-native platforms built with compliance, scalability, and auditability by design

- Ecosystem-readiness for open banking, embedded finance, and contextual productization

We do this across global banking hubs – North America, UK, Europe, APAC and GCC.

The Platform Advantage: Rethinking Revenue

In the traditional banking model, revenue streams predominantly stem from interest income and transaction fees. However, the emergence of platform-based banking introduces diversified income avenues. By integrating third-party services through APIs, banks can earn from ecosystem participation – such as fees from partners, commissions on third-party sales, data monetization, and embedded finance offerings.

McKinsey highlights the transformative potential of ecosystems, projecting that by 2030, the total revenue pool of these ecosystems could range between $70 to $100 trillion, representing approximately 30% of the global economy. This shift underscores the substantial economic opportunities that platform models can unlock for banks.

Furthermore, Accenture’s research indicates that organizations embracing technology transformation and platform strategies can achieve up to 1.5 times higher shareholder returns over a three-year period compared to their peers.

A practical illustration of this is DBS Bank in Singapore. By developing an API platform that supports over 1,000 ecosystem partners, DBS has not only expanded its service offerings but also contributed to significant revenue growth in its digital channels.

These insights collectively demonstrate that apart from technology upgrade, transitioning to a platform-based model is a strategic move towards sustainable and diversified revenue generation.

APIs: The Infrastructure of Ecosystems

At the heart of the platform strategy lies one word: API.

APIs are the new distribution rails for financial services. They allow banks to expose core services securely and programmatically to external developers, partners, and ecosystem participants. But they also allow banks to consume capabilities from others – creating two-way value flows.

Open Banking, which began as a regulatory nudge in Europe, has become a global strategic lever. In India, the Account Aggregator framework handled over 13 billion transactions in 2023, powering innovations in credit scoring, personal finance, and SME lending.

Overall trend indicates a significant increase in Open Banking API usage globally. For instance, in the UK, the Open Banking Implementation Entity (OBIE) reported that API call volumes reached approximately 6 billion in 2020, up from 66.8 million in 2018.

APIs are not just IT components. To enable true platform banking, they must be: Productized , Governed , Discoverable (via developer portals, documentation, analytics)

This demands not just tools, but a culture of openness and design thinking.

Core Modernization: The Platform’s Spine

A platform is only as powerful as the infrastructure that supports it. And most banks are still running on aging cores – built for batch processing, closed ecosystems, and siloed channels.

This is where core modernization becomes essential. Containerization, domain-driven design, cloud-native microservices, and real-time processing are not buzzwords. They are prerequisites for platform banking.

At Maveric Systems, we partner with banks, credit unions, and FinTechs globally to help lay the foundational spine of platform banking. Our engineering-first approach to core modernization empowers institutions to move from brittle, legacy systems to resilient, cloud-native, API-first architectures. Whether enabling open banking frameworks, re-platforming legacy integration layers, or building partner orchestration gateways – our focus remains clear: making financial institutions composable, compliant, and ecosystem-ready.

The goal isn’t just digital transformation. It’s ecosystem acceleration.

Are You Building a Bank or an Ecosystem?

In the end, the shift from bank to platform isn’t just technical or economic. It’s existential.

The customer has already moved on – from branch to app, from app to ecosystem. The real question is whether your institution will follow suit.

Ask yourself:

- Are we building every feature in-house, or plugging into smarter partners?

- Are our APIs simply compliance artifacts, or monetized capabilities?

- Is our core system a barrier – or a launchpad?

Because the institutions that will matter most tomorrow aren’t the ones that offer the most products. They are the ones that build the most value through others.

Where is your bank in this journey? If you’re reimagining your platform strategy, let’s explore how we can help — from core modernization to ecosystem orchestration.

Learn more about Maveric’s AI & Platform Modernization Capabilities

About the Author

As the Director and Regional Head of the North America region at Maveric Systems, Pankaj Misra is responsible for driving strategic growth, scaling accounts, building new client relationships, and forming industry partnerships. He is also entrusted with spearheading the marketing initiatives to establish a strong brand presence for Maveric.

As the Director and Regional Head of the North America region at Maveric Systems, Pankaj Misra is responsible for driving strategic growth, scaling accounts, building new client relationships, and forming industry partnerships. He is also entrusted with spearheading the marketing initiatives to establish a strong brand presence for Maveric.

View

Srinivasan Sundararajan brings over 30 years of IT industry experience, with 25 years focused on delivering global QA and QE projects. He has strong experience in delivering Banking projects in Core banking and private banking space. Recognizing the importance of talent development, Srini transitioned into a Learning and Development (L&D) role six years ago.

Srinivasan Sundararajan brings over 30 years of IT industry experience, with 25 years focused on delivering global QA and QE projects. He has strong experience in delivering Banking projects in Core banking and private banking space. Recognizing the importance of talent development, Srini transitioned into a Learning and Development (L&D) role six years ago.