“In the age of machines and wisdom, let technology guide your path, but never lose the human touch in your journey to prosperity.”

We live in an era of rising demand for wealth management, frequently without realizing it Many financial services organizations are advocating for investment management through tools like Robo-Advisors. These AI-powered systems are designed to grow our investments, enhance their security, and assist us in achieving our financial goals.

However, can AI powered Robo-Advisors truly replace wealth managers in terms of trust and portfolio balancing? What are the implications for financial services, particularly in the realm of wealth management?

The Modern Wealth Management Landscape

Modern wealth management is evolving, demanding advanced personalization, a comprehensive and holistic financial planning strategy, transparency, and a strong focus on emotional well-being. It also requires continuous portfolio rebalancing and, critically, the integration of cutting-edge technology like AI-powered Robo-Advisors. However, technology alone isn’t enough. Seamless collaboration between human expertise and AI, along with access to educational resources, are essential components for success.

The Role of Hybrid Robo-Advisory

To sustain success in wealth management with AI-powered Robo-Advisors, embracing digitization through Hybrid Robo-Advisory is crucial. Achieving true digital transformation in the industry hinges on adopting this approach. The main challenge for financial services lies in overcoming the limitations of AI-powered Robo-Advisors compared to traditional wealth or investment managers while steering the growth of the wealth management industry with technological advancements.

Why is AI-powered Robo-Advisory with human intervention essential for the wealth management and financial services industry?

Integrating human expertise, particularly wealth managers, into AI-powered Robo-Advisory systems forms a hybrid model that offers six significant advantages for financial services.

- Trust and Personalization: AI-powered Robo-Advisors excel in data-driven decision-making via algorithms, but human/wealth advisors offer nuanced insights and a deeper understanding of personal circumstances. This human touch helps build trust and rapport, which is vital for clients, especially during significant financial decisions or periods of market volatility.

- Emotional Support through In-Person Interaction: Human advisors provide emotional support that encourages long-term thinking and helps clients feel more secure and confident in their investment choices. This support is essential for avoiding impulsive decisions driven by fear or greed. Unlike Robo-Advisors, this emotional insight is distinctly human.

- Regulatory Compliance and Judgment: Although AI-powered Robo-Advisors adhere to regulatory guidelines, some investment decisions involve ethical considerations and complex judgments that algorithms can’t fully resolve. Here, the expertise of wealth managers and human judgment are vital.

- Client Segmentation and Differentiation: High-net-worth individuals often seek a combination of personalized guidance from wealth managers and automated solutions for complex financial strategies. This integrated approach maximizes effectiveness by leveraging the benefits of both methods. Human advisors can adapt strategies in response to real-time client feedback, keeping investment plans aligned with evolving goals and circumstances. Additionally, a hybrid model addresses the diverse needs and preferences of various client segments, offering automated services for simplicity and human expertise for more intricate financial requirements.

- Augmented Intelligence and Continuous Development: Wealth managers can use insights and recommendations from Robo-Advisors to refine their portfolio advice, blending data-driven precision with human intuition and experience. Simultaneously, ongoing feedback helps to continuously improve the algorithms and models of Robo-Advisors, enhancing the overall advisory service.

- Portfolio Rebalancing & Valuation: In response to market conditions, new financial goals, or emergency fund withdrawals, a hybrid advisory model allows for effective portfolio rebalancing. Human advisors can provide the necessary adjustments and personalized strategies to ensure that the portfolio remains aligned with the client’s evolving needs and circumstances.

Embracing the Future

The emergence of hybrid Robo-Advisors is rapidly transforming the traditional field of wealth management. This industry trend leverages AI-powered Robo-Advisors to revolutionize how advisors interact with and serve clients, creating new opportunities to expand their reach across various client segments and meet diverse expectations.

At Maveric, we recognize the significant potential of hybrid coverage in wealth management, particularly for clients who benefit from human advisors but may not require the intensive 1:1 advisory relationship typically offered through traditional methods. This approach allows for a more tailored service that meets the unique needs of different investors.

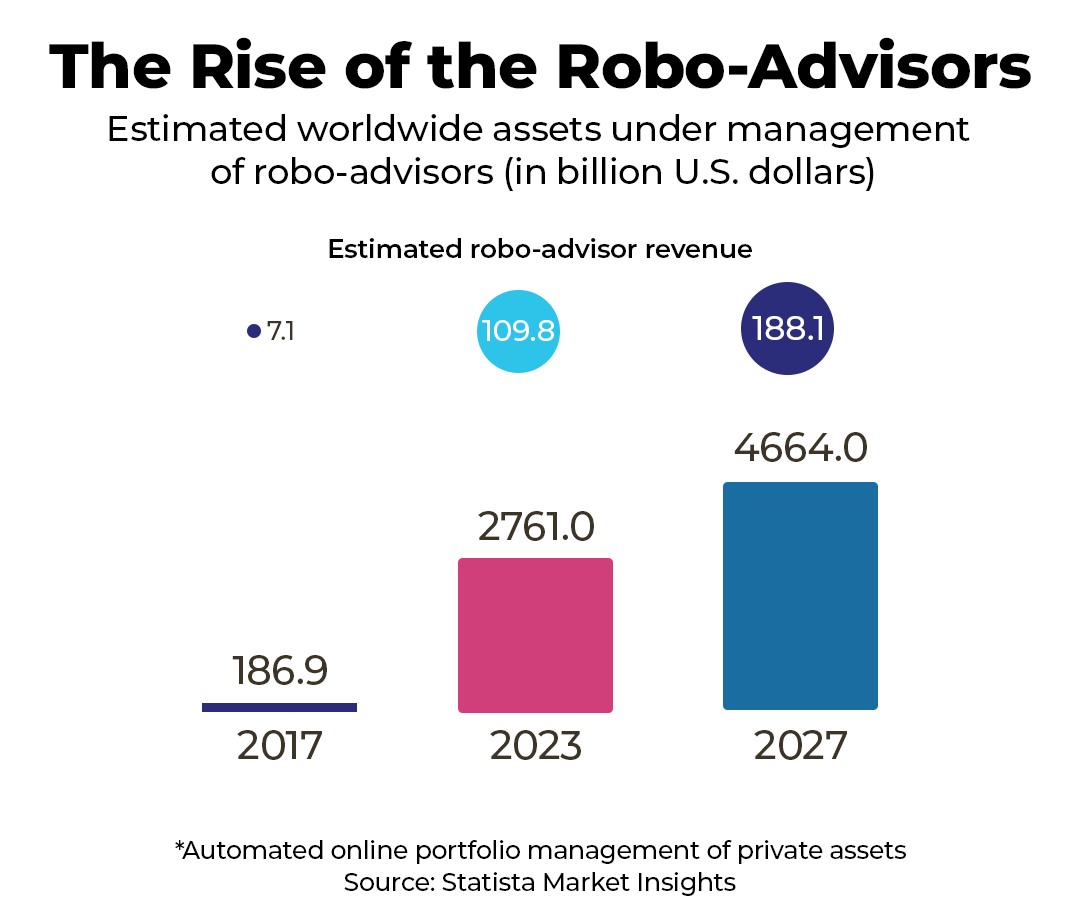

According to a recent report by Grand View Research, Robo-Advisors dominated the market in 2023, accounting for 63.8% of global revenue. The growing demand for hybrid Robo-Advisors is fuelled by their ability to merge the efficiency and consistency of AI-driven algorithms with the personalized guidance of human advisors. This powerful combination is poised to drive substantial growth in the wealth management sector.

As we look to the future, the integration of human expertise with technological innovation will play a pivotal role in shaping the wealth management industry. By providing clients with the best of both worlds, hybrid Robo-Advisory models will deliver enhanced value and a more dynamic, responsive approach to managing wealth.

Maveric Systems – Your Partner in Success

Maveric Systems is a leading provider of IT solutions specifically for the BFSI & NBFC sector. With our deep domain expertise and a comprehensive portfolio of AI-powered solutions, we can help your institution navigate the evolving technological landscape. We offer solutions for:

- Customer Experience

- Process Excellence

- Regulatory & Compliance

- New Age Application Management System

- Assurance

Email us at indiasales@maveric-systems.com to initiate a conversation about your unique requirements. Let’s explore together how we can tailor our solutions to meet your specific needs effectively.

Author:

Krithiga Kasiraman is a Lead Technical Consultant at Maveric Systems who works primarily in wealth management and capital markets sectors, particularly in Temenos Wealth.