Corporate banks can establish a successful digital strategy by following digital business rules: digital experience, operations, innovation, and ecosystems. Enterprise clients want improved service and innovation. Corporate banks that value real-time analytics and innovation over cost are digital leaders. These banks have insights-driven CFOs.

Every second CFO in leading FIs prioritized cloud, data and analytics, and legacy business app upgrades. Corporate banks are upgrading their finance and accounting software to manage their finances better.

The Disruptors Gameplan

Emerging fintech rivals are eating away at “conventional banks” from all angles and steadily eroding their century-old defenses. These digital banking innovators challenge the banking and financial business in payments, cash, loans, money transfer, investment management, and more.

Consider a few.

- Apple, Amazon, Google, Paytm, WeChat, and Alipay are replacing credit card/online payments.

- Digital wallets are replacing cash/cards/ATMs.

- Real-time payment services that eliminate cheques and internet payments.

- P2P lending services like Lending Club are growing more attractive than conventional financing.

- Monzo and N26 offer mobile-first current accounts.

Working with banking domain experts like Maveric Systems for corporate banking solutions helps leading banks create decisive momentum to grow their market share and boost customer loyalty.

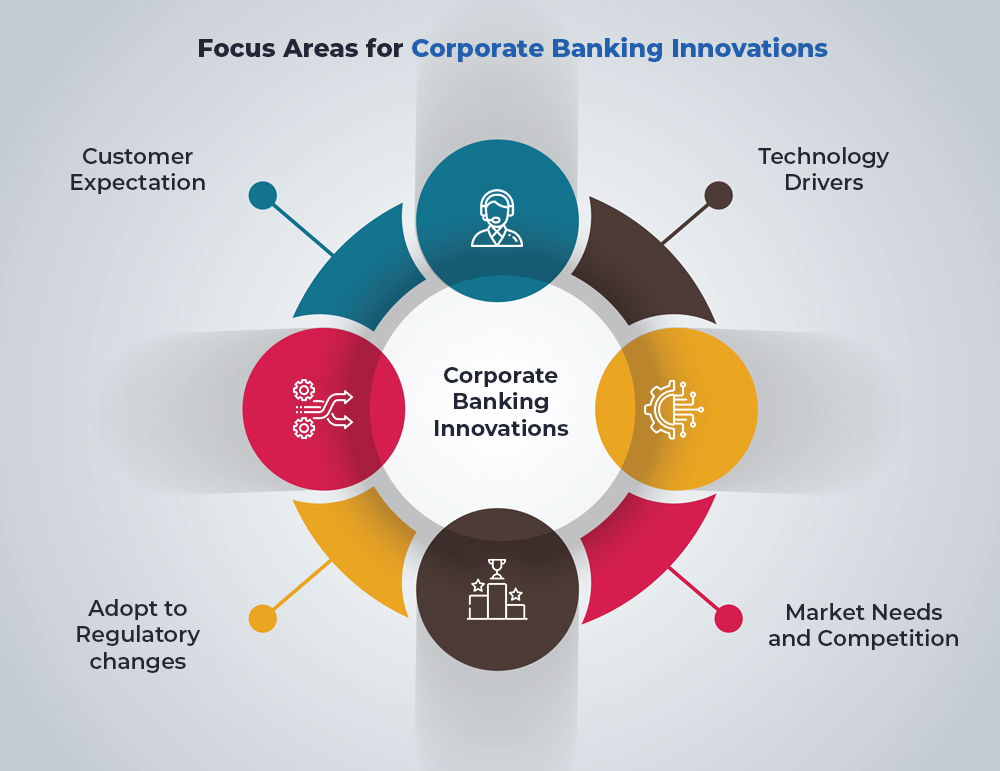

Four-Pronged Approach for Digital Innovation in Corporate Banking

- Digital ecosystems: Create platforms and alliances to scale. Ecosystems help banks focus on their strengths and decide what to borrow. Corporate banks must cultivate partner ecosystems. APIs, internet connectivity, and digital delivery methods have made integrating company capabilities with suppliers, distributors, and partners cheaper.

- Digital experience: Easy, effective, and emotionally engaging. Digital disruptors employ technology to improve customer outcomes. Corporate bank digital teams need a variety of capabilities to enhance the digital client experience.

- Digital innovation: Keep pushing the digital frontier. Design thinking, agile development, fast prototyping, or continuous delivery—start small and adjust with rapid releases to transform product and experience development.

- Digital operations: Optimize products and capabilities. Modern business apps and functionalities let corporate clients have outstanding end-to-end experiences. If a corporate bank increases digital experiences by investing in customer-facing skills but not operations, it will be imprisoned in a Potemkin village.

Guiding Trends influencing Corporate Banking

- Internet-enabled solutions improve demand, supply, and supply chain fulfillment operations.

- Mobile Connection – Mobile networks are cheaper than fixed-line ones and have permitted rapid infrastructure build-up, bringing vast segments of a previously unreachable audience into the “consumption” economy.

- Data Availability – Digital methods have increased data availability, both financial and non-financial (social media, geotagging, AI-based models, etc.)

- Decreased Cost of Acquiring and Serving Customers – By process automation, digital technologies are helping banks lower their client acquisition and service expenses.

- Trust-based Transactions: Digital social identities enable new ways to identify, monitor, assess, score, engage, and track customers. A digital footprint’s objectivity provides strong incentives to play fair and align transactional parties.

- Cloud > Physical Infrastructure – Most firms, especially services, can now develop geographically. Businesses can now serve customers in various countries.

- Cloud-based distributed and “pay-as-you-go” scalable infrastructure makes scaling businesses faster and cheaper.

Conclusion

Corporate banks must accelerate their digital transformation after Covid-19. Corporate banking is behind retail banking in change. To succeed, corporate banking teams need a digital vision and plan that considers cash and liquidity management, payables and receivables, and trade and supply finance trends.

About Maveric Systems

Starting in 2000, Maveric Systems is a niche, domain-led Banking Tech specialist partnering with global banks to solve business challenges through emerging technology. 3000+ tech experts use proven frameworks to empower our customers to navigate a rapidly changing environment, enabling sharper definitions of their goals and measures to achieve them.

Across retail, corporate & wealth management, Maveric Systems accelerates digital transformation through native banking domain expertise, a customer-intimacy-led delivery model, and a vibrant leadership supported by a culture of ownership.

With centers of excellence for Data, Digital, Core Banking, and Quality Engineering, Maveric Systems teams work in 15 countries with regional delivery capabilities in Bangalore, Chennai, Dubai, London, Poland, Riyadh, and Singapore.