Now is the time for global banks to make their cores stronger. By adopting or switching to a new core banking platform or upgrading to the latest version of their current system, financial institutions can create a more straightforward and flexible IT environment, improve their efficiency, and lower their total cost of ownership. New core banking systems can also make a bank faster and more responsive. They can also make it easier for a bank to adapt to new financial regulations, such as Basel III and customer protection and capital adequacy laws.

The Context and the top five T24 Advantages

Banks that survived the financial crisis are now trying to gain a competitive edge through mergers and acquisitions. This makes it even more important to standardize platforms and update core systems.

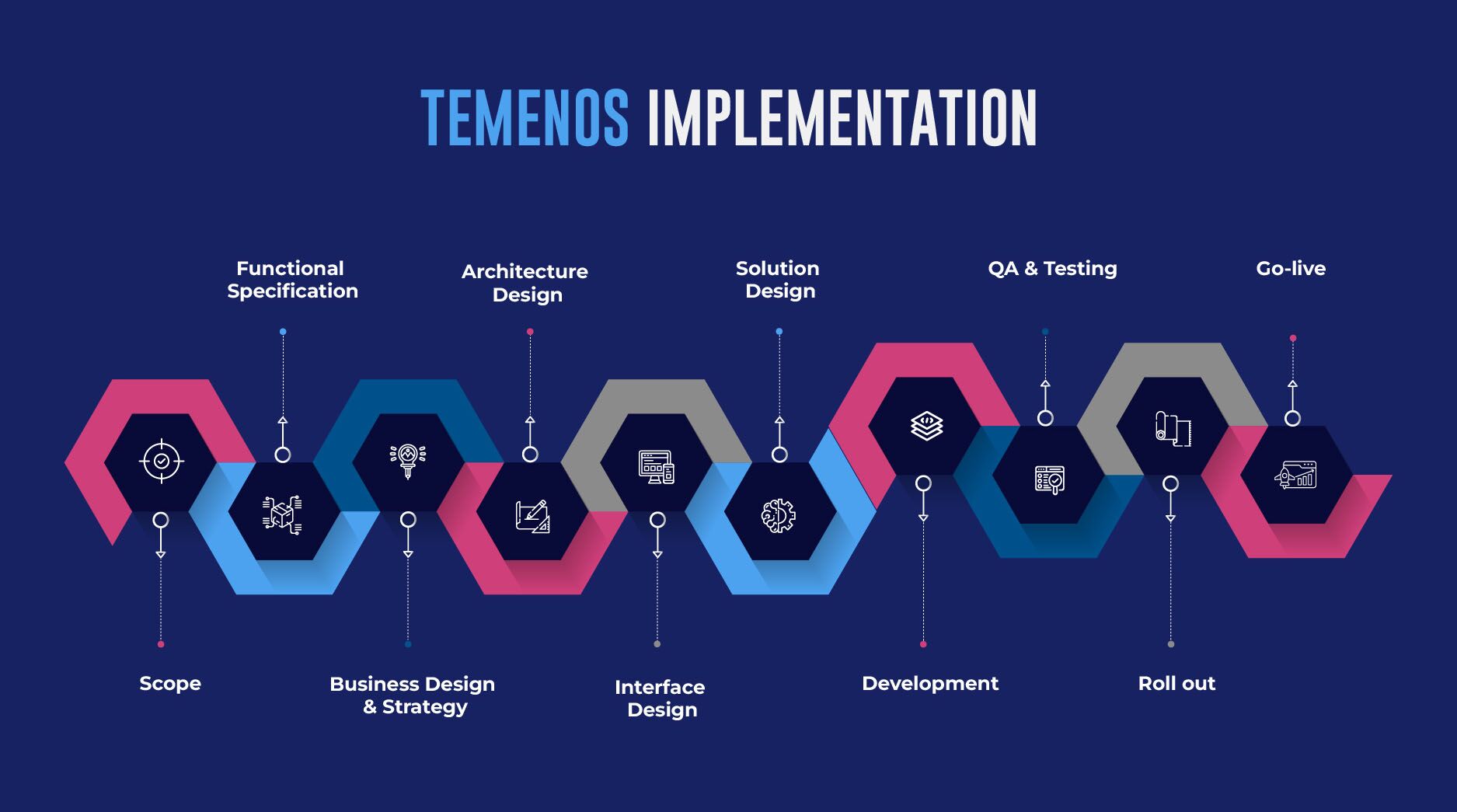

- Many banks that want to improve their core banking systems go first with TEMENOS T24 (T24). T24 is one of the most technically advanced banking systems out there. It combines flexible business features with a scalable design to help banks deal with opportunities and problems now and in the future. T24 has an open layout, low ownership costs, and uses standards like HTTP, XML, and J2EE. Its modular design allows banks to tailor the system’s capabilities to their changing business requirements.

Partnering with Temenos domain experts like Maveric Systems offers banks and FIs the latest advantages to their overall growth strategy.

- Customers of Temenos T24 can use open, modern technology to speed up innovation, making it easier and faster to create new goods and services. This makes it possible for front-line staff to give better customer service at a lower total cost of ownership because operations are more efficient.

- Take advantage of the vital time for operations: Downtime is good for business, especially in banking. The smooth running of their businesses is too critical for financial companies to take risks. Constant, unplanned outages hurt the bank’s income, market share, and customers’ trust, exposing the bank to stiff regulatory fines. The Temenos core banking system audit is crucial for performance and upkeep.

- Temenos T24 Transact is the core banking product that uses the most advanced cloud-native technology. Temenos T24 Transact moves the in-depth and extensive banking features of Temenos T24 Core Banking, the world’s number one core banking product used by over 700 banks in all banking sectors, to a new cloud-native and cloud-agnostic platform. Temenos Goods are known for separating the banking functions from the technology platform. This has kept Temenos the most technologically advanced and feature-rich product globally for the past 25 years.

- Temenos is used by more than 3,000 clients and 41 of the world’s top 50 banks, serving more than 500 million people daily. This is because it has many features and uses cutting-edge technology. The platform is made to help retail, corporate, and private banks handle transactions, risk, enterprise credit, and more.

Conclusion

Financial companies need to connect their core banking system data to a high-value banking application to use robust data analysis and get the benefits that come with it. Temenos T24 is an example of a market-leading transaction processing system that offers critical financial services. However, like many other systems, it often needs more analytical flexibility that banks and credit unions need to gain a competitive edge.

After all, integrations of banking tools change things. They help information flow, improve business data, give necessary reporting tools, and give insight into how customers act.

About Maveric Systems

Starting in 2000, Maveric Systems is a niche, domain-led Banking Tech specialist partnering with global banks to solve business challenges through emerging technology. 3000+ tech experts use proven frameworks to empower our customers to navigate a rapidly changing environment, enabling sharper definitions of their goals and measures to achieve them.

Across retail, corporate & wealth management, Maveric accelerates digital transformation through native banking domain expertise, a customer-intimacy-led delivery model, and a vibrant leadership supported by a culture of ownership.

With centers of excellence for Data, Digital, Core Banking, and Quality Engineering, Maveric teams work in 15 countries with regional delivery capabilities in Bangalore, Chennai, Dubai, London, Poland, Riyadh, and Singapore.