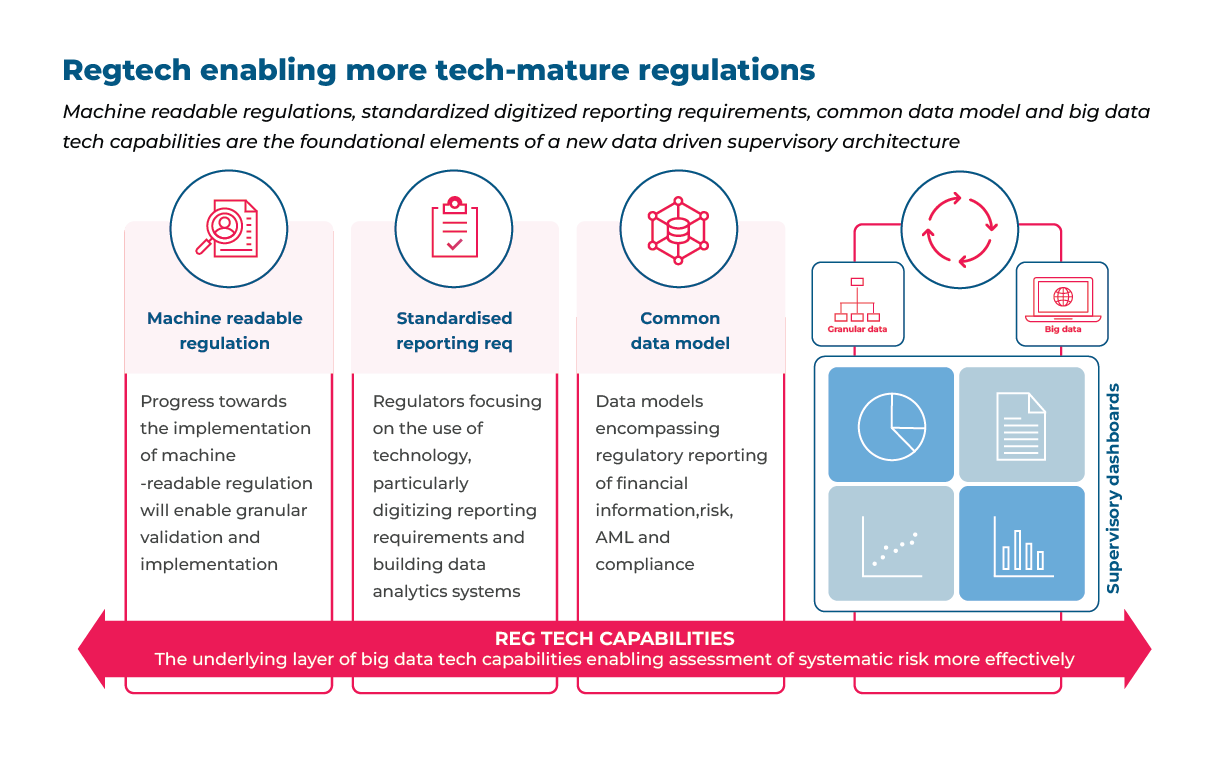

While regulators continue to demand newer data and increased data granularity, we also see regulation getting progressively more tech-mature. The regulators are gearing to digitize the regulations so that implementation can be validated at the granular level; also, they are trying to create a data model that would encompass risk, FCM, Regulatory reporting, and compliance.

Building a standard data model and standardized reporting requirements is a pre-condition for regulators to ensure they have reliable and comparable data for adequate financial supervision. For the regulatory objectives to be completed, it means that the coverage of CDM and initiatives like digital regulatory reporting is expanded to the majority of reporting entities and, therefore, be built on open standards and is technologically neutral. The technology and methodology must also be scalable across additional reporting domains to be viable.

Building a standard data model and standardized reporting requirements is a pre-condition for regulators to ensure they have reliable and comparable data for adequate financial supervision. For the regulatory objectives to be completed, it means that the coverage of CDM and initiatives like digital regulatory reporting is expanded to the majority of reporting entities and, therefore, be built on open standards and is technologically neutral. The technology and methodology must also be scalable across additional reporting domains to be viable.

Financial institutions also thus need to factor in these aspects while implementing data standards and solutions – building solutions on open standards, working with technology neutral standards and avoiding any potential vendor lock-ins. Achieving better data standardization and the ability to convert financial information into an interoperable digital form will mean the chances of regulatory misinterpretation.

Financial institutions can leverage ETL tools, Data lineage tools, Common data platforms, and regulatory intelligence platforms, which together are capable of ingesting structured and unstructured data across sources, provide massive storage and processing and are augmented by low code interfaces for users to do advanced analytics themselves as well as deliver reports externally to regulators. New technologies like AI, API, big data, and cloud computing help structure and move data across the organization.

Reporting entities thus achieve better data standardization and the ability to convert financial information into an interoperable digital form that can be quickly and efficiently reported to regulators. SnapLogic, Dell Boomi (ETL), Solidatus, Dremio SQL Lakehouse Platform (Data Lineage), Clever Tap, NG Data (CDP), and JWG’s RegDelta, OneSumX by Wolters Kluwer (Regulatory Intelligence) are all examples of vendor platforms which Financial institutions can utilize.

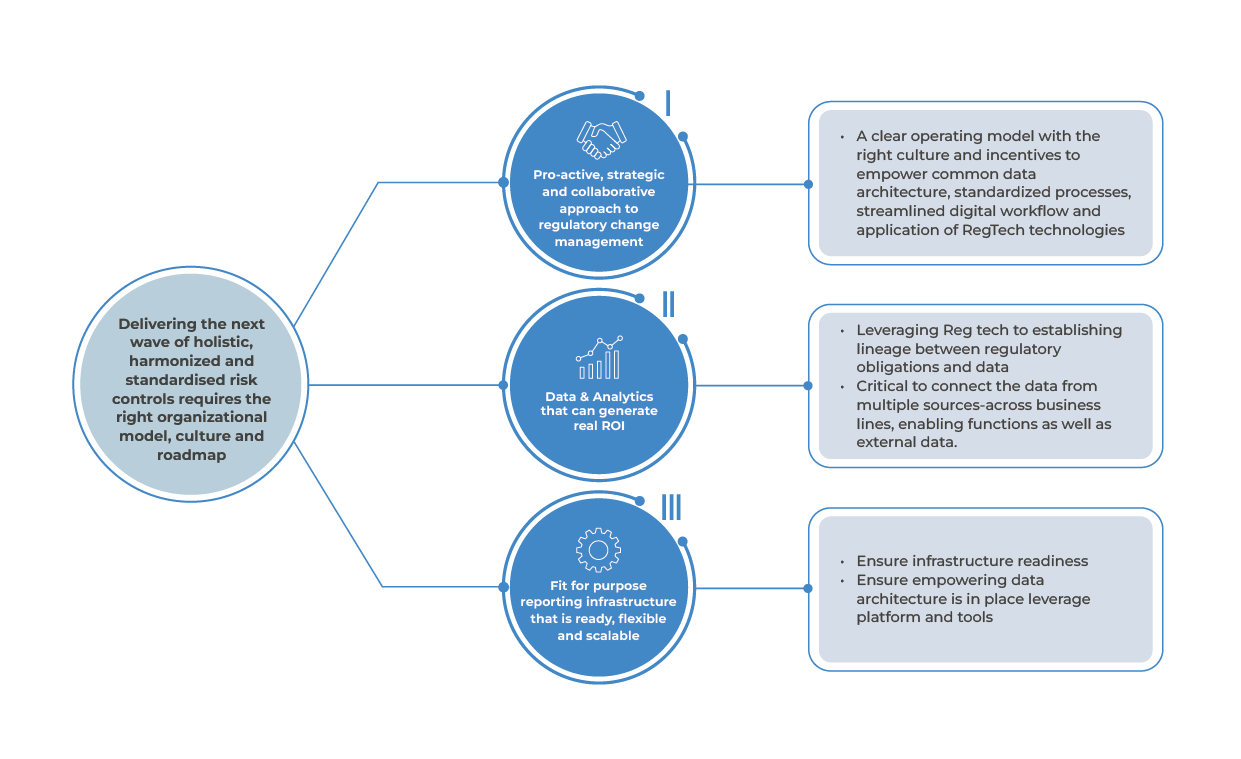

The CIO, CDO, and business teams in the Financial institution need to be better aligned with business and regulatory teams across jurisdictions and not operate in silos. They must also ensure that the infrastructure and data architecture are ready, flexible, and scalable to meet these requirements.

Ensure infrastructure readiness

Ensure infrastructure readiness

Newer reporting requirements may necessitate identification and categorization of new data categories, calculations of more granular risk data, and newer data from the supply chain for third-party or ESG requirements

Ensure empowering data architecture is in place

Financial institutions must ensure architectural support facilitating APIs that allow data to be exchanged between applications and integration with legacy systems, low code platforms enabling business-led customizations, etc. Modern API-based products from reg tech solution providers can be chosen and integrated into legacy systems.

Leverage platforms and tools

In the areas of data lineage, ETL, common data platforms, and regulatory intelligence to reduce the operational burden of data remediation, transformations, and regulatory reporting and focus on gaining better business insights leveraging data

Co-authored by Deepak Bhatter, and Venkatesh Padmanabhachari

Maveric’s thought leadership series – E.D.G.E (Experiences Delivered by Global Experts) – handpicks the game-changing technology ideas and pressing functional questions financial institutions must solve today.

These features – reports, whitepapers, podcasts, flyers, blogs, and infographics – are for Banking leaders and Technology evangelists to apply profound trends, the latest opinions, and transformational analyses to boost the performance of their organizations.

About Maveric Systems

Established in 2000, Maveric Systems is a niche, domain-led, BankTech specialist, transforming retail, corporate, and wealth management digital ecosystems. Our 2600+ specialists use proven solutions and frameworks to address formidable CXO challenges across regulatory compliance, customer experience, wealth management and CloudDevSecOps.

Our services and competencies across data, digital, core banking and quality engineering helps global and regional banking leaders as well as Fintechs solve next-gen business challenges through emerging technology. Our global presence spans across 3 continents with regional delivery capabilities in Amsterdam, Bengaluru, Chennai, Dallas, Dubai, London, New Jersey, Pune, Riyadh, Singapore and Warsaw. Our inherent banking domain expertise, a customer-intimacy-led delivery model, and differentiated talent with layered competency – deep domain and tech leadership, supported by a culture of ownership, energy, and commitment to customer success, make us the technology partner of choice for our customers