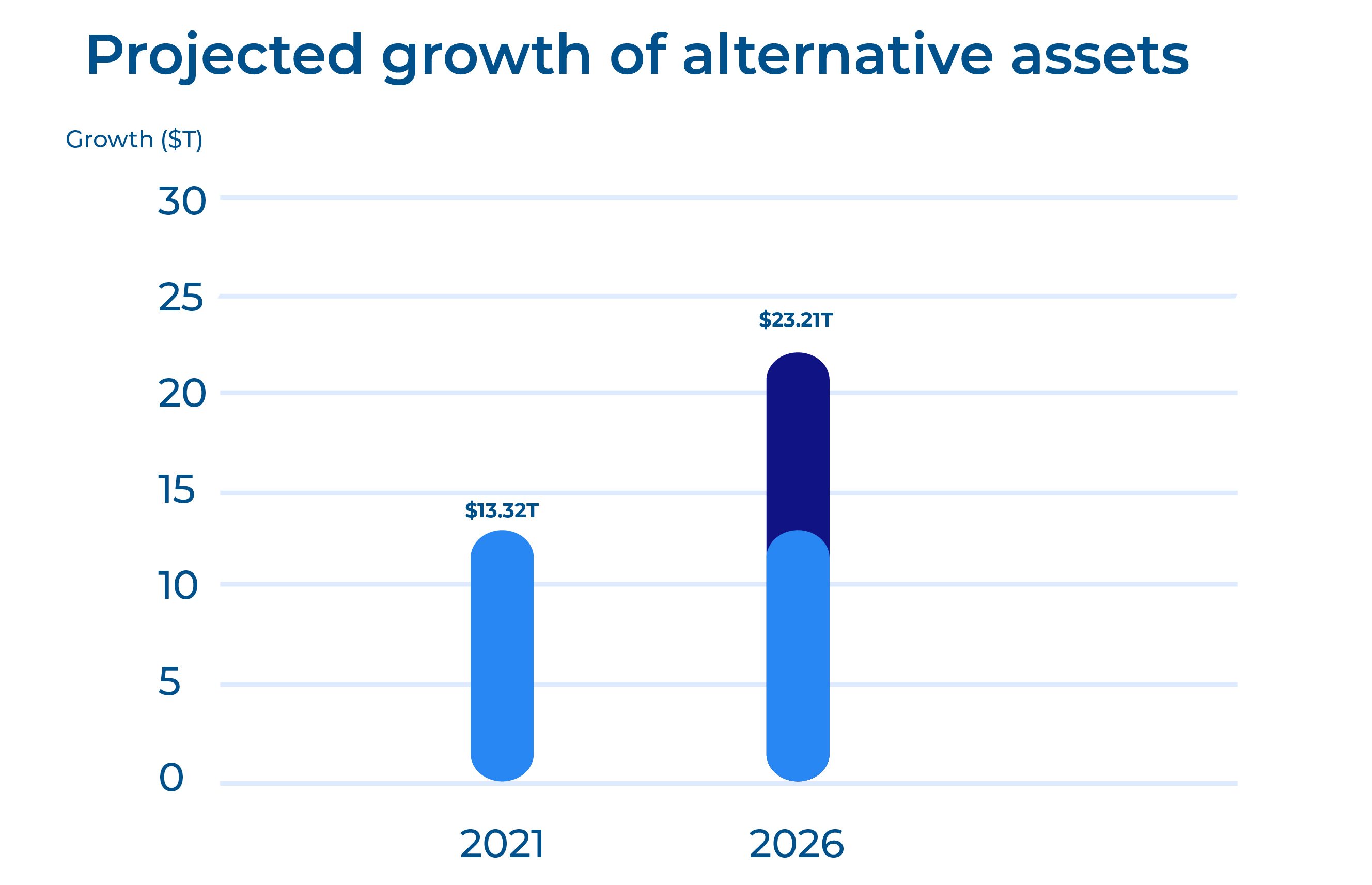

The financial advisory landscape is witnessing a remarkable shift, with alternative assets projected to surge to $23.21 trillion in global assets under management by 2026, up from $13.32 trillion at the end of 2021. This dramatic growth underscores a pivotal change in how investors view their portfolios and advisors’ strategies. As traditional investments face increasing scrutiny and volatility, alternative assets are gaining traction as essential tools for diversification, inflation hedging, and meeting the demands of a tech-savvy investor base.

This blog examines the rise of alternative assets in the next 12 months and their transformative impact on financial advisory practices.

The Alternative Asset Revolution

Alternative assets encompass vast and diverse investment opportunities beyond stocks, bonds, and cash. This burgeoning sector includes private equity, hedge funds, real estate, commodities, infrastructure, and the rapidly expanding universe of digital assets such as cryptocurrencies and tokenized assets.

The allure of alternative assets lies in their potential for:

- Superior returns: Alternative investments have historically outperformed traditional assets, with private equity delivering an average annual return of 14.2% over the past 20 years, compared to 9.9% for the S&P 500.

- Enhanced diversification: By incorporating non-correlated assets, portfolios can achieve greater resilience against market volatility.

- Inflation protection: Real assets like real estate and commodities often appreciate during inflationary periods, safeguarding purchasing power.

Catalysts Fueling the Shift

Several powerful forces are propelling the rise of alternative assets in financial advisory:

- The Millennial and Gen Z Effect: Younger investors are revolutionizing the investment landscape with their appetite for innovation and higher yields. 94% of millennials are interested in sustainable investing, while 87% believe corporate success should be measured by more than just financial performance.

- The Digital Asset Tsunami: Blockchain technology and asset tokenization have unleashed a wave of innovation, democratizing access to previously illiquid assets. The global tokenization market is projected to reach $5.6 trillion by 2026, growing at a CAGR of 19.5%

- The Diversification Imperative: Traditional 60/40 portfolios are no longer sufficient to navigate today’s complex market dynamics. Alternative assets offer a lifeline, with studies showing that allocating just 20% to alternatives can potentially enhance returns by 2% annually while reducing volatility.

- The Inflation Hedge Imperative: With inflation rates soaring to multi-decade highs, investors are flocking to tangible assets as a safeguard. Gold, often considered the ultimate inflation hedge, has surged over 500% in the past two decades.

The Evolving Role of Financial Advisors

Financial advisors are at the forefront of this revolution, adapting their strategies to harness the power of alternative assets:

- Mastering Digital Asset Complexities: Advisors are rapidly upskilling to navigate the intricate world of blockchain and cryptocurrencies. A recent survey found that 94% of financial advisors received questions about crypto from clients in 2021, up from 81% in 2020.

- Elevating Client Education: Transparent communication is paramount in demystifying alternative assets. Advisors leverage cutting-edge tools and platforms to provide real-time insights and foster informed decision-making.

- Crafting Bespoke Investment Strategies: The era of one-size-fits-all portfolios is over. Advisors harness advanced analytics and AI-powered tools to create hyper-personalized investment strategies tailored to each client’s unique risk profile and goals.

The Future is Alternative

As we stand on the cusp of a new era in financial advisory, integrating alternative assets is not just a trend – it’s a necessity. By embracing this paradigm shift, financial advisors can unlock unprecedented opportunities for their clients and position themselves at the vanguard of the industry’s evolution.

The future belongs to those who can harness the power of alternative assets to deliver superior returns, enhance diversification, and meet the evolving needs of a new generation of investors. Are you ready to lead the charge?

Citations and Further Reading

Co-authored by Venkatesh Padmanabhachari, Avinash Dave, and Sagar Rathore

Maveric’s thought leadership series – E.D.G.E (Experiences Delivered by Global Experts) – handpicks the game-changing technology ideas and pressing functional questions Banks and financial institutions must solve today.

These features – reports, whitepapers, podcasts, flyers, blogs, and infographics – are for Banking leaders and Technology evangelists to apply profound trends, the latest opinions, and transformational analyses to boost the performance of their organizations.

About Maveric Systems

Established in 2000, Maveric Systems is a niche, domain-led, BankTech specialist, transforming digital ecosystems across retail, corporate, wealth management, cards & payments and lending domains. Our 2600+ specialists use proven solutions and frameworks to address formidable CXO challenges across Customer Experience, Assurance, Regulatory Compliance, Process Excellence and New age AMS.

Our competencies across Data, Digital, Cloud, DevOps, AI and automation helps global and regional banking leaders as well as Fintechs solve next-gen business challenges through emerging technology. Our global presence spans across 3 continents with regional delivery capabilities in Amsterdam, Bengaluru, Chennai, Dallas, Dubai, Kingdom of Saudi Arabia, London, New Jersey, Pune, Riyadh, Singapore, Sweden, Dubai and Warsaw.

Our inherent banking domain expertise, a customer-intimacy-led delivery model, and differentiated talent with layered competency – deep domain and tech leadership, supported by a culture of ownership, energy, and commitment to customer success, make us the technology partner of choice for our customers.