Why you should use a Digital Wealth Management Platform

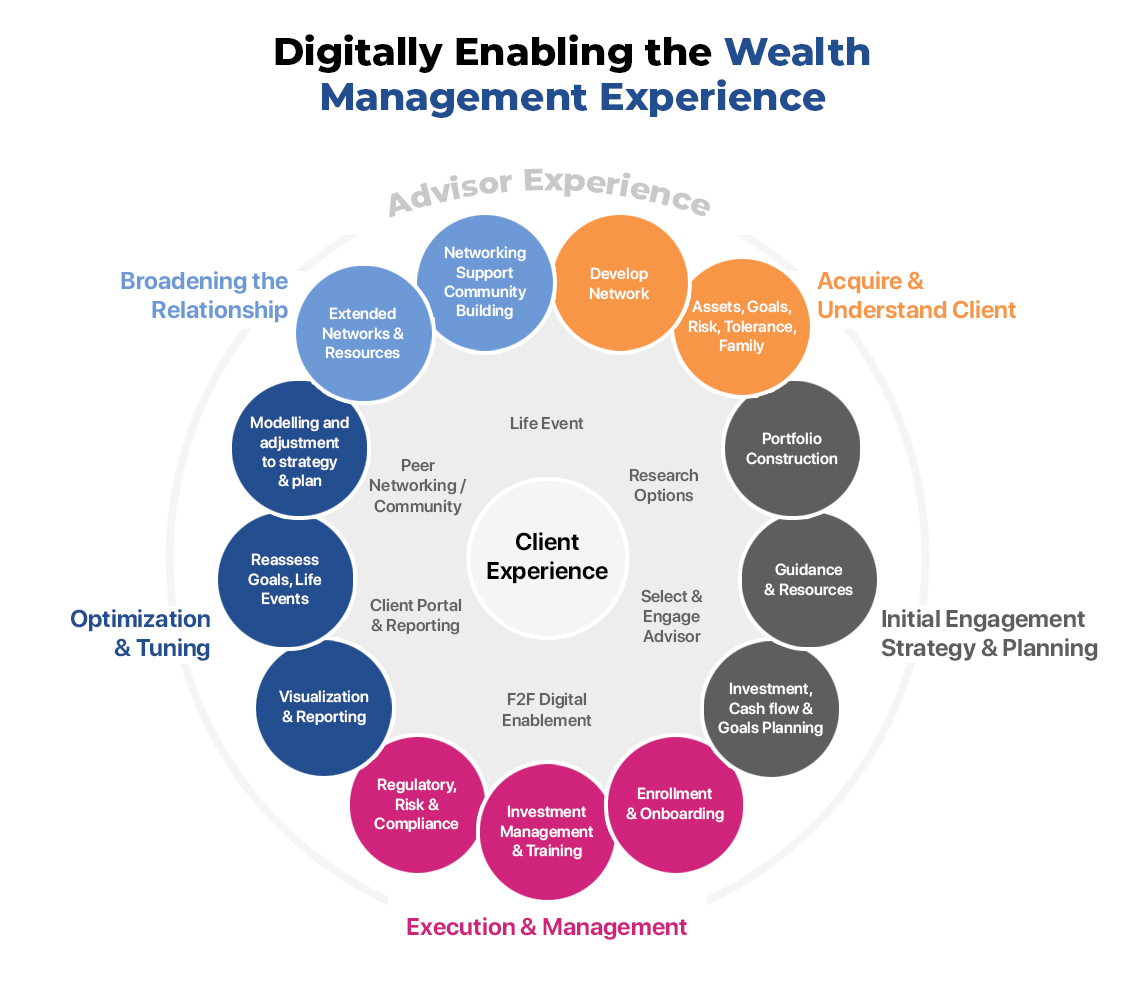

Digital wealth management systems equip financial institutions with the most up-to-date integrated tools and data-driven analytics necessary for empowering their advisors to give intelligent solutions. They allow advisors to better comprehend the needs of their clients and recommend appropriate portfolio allocations. Working with niche technology aggregators like Maveric Systems offers first-hand market-leading insights and a higher potential for transformation success.

Personalization Requirements post-COVID.

Digital wealth management solutions can utilize the most recent data analytics techniques to analyze the available data to develop bespoke wealth management solutions. For instance, the customer’s spending behavior and risk tolerance can be evaluated using real-time data, and customized investment solutions can be proposed. Each client has different investment needs. Some consumers may be interested in real estate investments, while others may be interested in foreign exchange or the stock market. Therefore, customers can be provided with tailored hints depending on their requirements. Digital wealth management systems may form partnerships with certain financing companies to facilitate investors’ leasing with financiers.

Speed is the new game changer in Wealth Management Solutions.

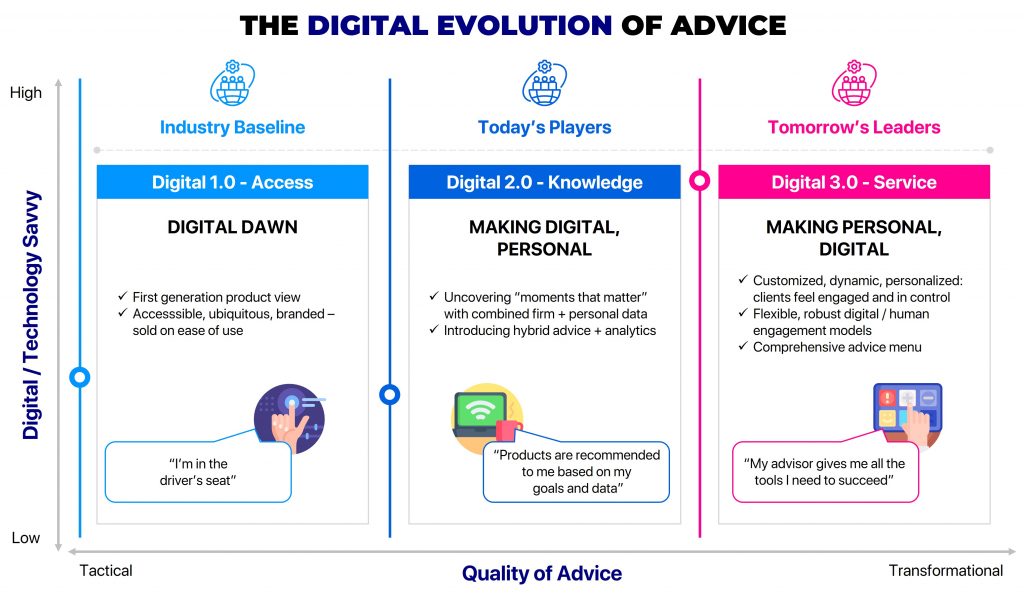

The wealth management industry is continually evolving. Clients and advisors have heightened expectations for the optimal digital experience. The speed with which financial institutions adapt to these demands will determine whether they survive and thrive. Digital wealth management enables leading wealth management firms to swiftly create a linked digital experience that advisors and clients anticipate for developing robust and successful businesses.

Managing Risks with Technology

Risk management is a crucial component of wealth management. Manually addressing risk and compliance can be difficult, error-prone, and time-consuming. By utilizing digitalization to manage these areas, DIY investment apps can rapidly grow and keep up with the times. Wealth managers can receive early warning signals regarding risks and credit defaults via automated checks. Digital technologies can also simulate various risk-reward situations, allowing investors to make more educated decisions regarding how they intend to manage and grow their wealth.

Four Advantages of Digital Wealth Management Platforms

- Enhance customer interaction using self-service and automation. The digital transformation of the wealth management business has produced enhanced digital client engagement experiences. While automated services may only partially replace the advisor-client relationship, adopting a robo-advisor or automated investing provides clients with a customized, real-time approach to achieving their individual goals while drastically decreasing expenses.

- Increase efficiency. Using artificial intelligence (AI) and machine learning, investment management organizations automate customer communications, document verification, and financial background checks. Using these tools, a wealth manager may swiftly go through essential data to provide clients with more in-depth, individualized portfolio advice and financial plans.

- Free up time for growth-driving, value-creating activities. Due to the transactional nature of the financial services business, wealth management organizations tend to operate in isolation. Using AI and machine learning to automate simple, repetitive procedures and transactions frees up staff time for more value-adding tasks. Utilizing the intelligence and analytics-driven insight acquired from automating client interactions can also improve organizational decision-making.

- Streamline the storage, retrieval, and protection of data. Financial organizations engage in innumerable transactions characterized by a massive paper trail. Digital files are easier to keep, retrieve, and safely transfer across businesses in seconds. Using automated methods to archive or destroy these files at a predetermined time aids in the organization, preservation, and retention of helpful information and prompt disposal of irrelevant material.

Conclusion

Wealth Management is the administration of one’s investments, funds, assets, tax, and other liability planning. No longer is the word “wealth management” only linked with the ultra-wealthy. With an expansion in the working-class population and a rise in the average salary across all developing nations, wealth management has also become vital for salaried middle-class employees. Distance is no longer a factor in investments, estate management, etc., due to the interconnectedness of global markets and the growing number of globetrotters.

About Maveric Systems

Starting in 2000, Maveric Systems is a niche, domain-led Banking Tech specialist partnering with global banks to solve business challenges through emerging technology. 3000+ tech experts use proven frameworks to empower our customers to navigate a rapidly changing environment, enabling sharper definitions of their goals and measures to achieve them.

Across retail, corporate & wealth management, Maveric accelerates digital transformation through native banking domain expertise, a customer-intimacy-led delivery model, and a vibrant leadership supported by a culture of ownership.

With centers of excellence for Data, Digital, Core Banking, and Quality Engineering, Maveric teams work in 15 countries with regional delivery capabilities in Bangalore, Chennai, Dubai, London, Poland, Riyadh, and Singapore.

View