The Future of Wealth Advisory—How AI, Personalization, and Alternative Assets are Reshaping Financial Advice

The Wealth Advisory Shift in 2025

The wealth management industry is at a pivotal moment. Traditional advisory models are being disrupted by technology, shifting investor demographics, and a growing appetite for alternative assets. In 2024, the financial advisory landscape demands a personalized, tech-driven, holistic approach to cater to a new generation of investors.

According to Maveric’s latest report on Wealth Advisory Transformation, financial advisors must rethink their strategies, incorporating AI-powered insights, next-generation asset allocation, and hyper-personalized experiences to stay competitive. Here’s what’s driving this change and how advisors can future-proof their services.

1. AI and Personalization—The New Standard for Wealth Advisors

Today’s clients expect hyper-personalized financial advice that adapts to their evolving needs. AI-driven insights and dynamic financial planning replace traditional, static portfolio management.

A report by Accenture states that 91% of consumers prefer brands that offer relevant recommendations and personalized services.

How AI is Reshaping Wealth Advisory:

- Predictive Analytics – AI analyzes spending, investing, and market patterns to anticipate client needs.

- AI-powered financial assistants – Virtual assistants provide real-time insights and automate routine queries.

- Personalized portfolio rebalancing – AI suggests real-time adjustments to maximize returns and mitigate risks.

- Behavioral finance insights – AI detects emotional triggers that impact investment decisions, helping advisors coach clients more effectively.

Example: Morgan Stanley’s AI-powered assistant enables advisors to retrieve insights from over 100,000 reports, streamlining research and decision-making.

By leveraging AI-driven personalization, advisors can offer timely, proactive engagement that resonates with modern investors.

2. Alternative Assets—A New Frontier in Investment Advisory

The definition of “wealth” is expanding beyond traditional asset classes. Clients—especially Millennials and Gen Z—increasingly allocate capital toward private equity, tokenized assets, and fractionalization.

Alternative investments are projected to grow to $21.1 trillion by 2025, accounting for 15% of global AUM.

Key Trends in Alternative Asset Adoption:

- Fractional ownership – Investors can now buy portions of high-value assets like real estate and fine art.

- Tokenization of assets – Platforms like BlackRock’s BUIDL fund enable digital securities backed by real-world assets.

- ESG-focused investments – Sustainable investing is gaining traction, with 70% of Gen Z investors prioritizing impact-driven portfolios.

- Direct Indexing – A personalized approach that allows investors to customize their portfolios while optimizing for tax efficiency.

Advisors who fail to integrate alternative investments risk losing relevance with younger, digitally savvy investors.

3.The Role of Next-Gen Technology—Beyond Traditional Portfolios

Wealth management is not just about asset allocation—it’s about offering a comprehensive, data-driven financial experience.

- Cloud-based advisory platforms – Secure, real-time access to financial data enables seamless advisor-client interactions.

- Robo-advisors with human oversight – Hybrid advisory models combine AI-powered insights with expert human guidance.

- Digital client engagement tools – Interactive dashboards and mobile-first experiences enhance client involvement.

- Behavioral finance-driven tools – AI analyzes client biases, guiding them toward better financial decisions.

Case Study: A leading wealth management firm adopted AI-powered behavioral insights, leading to a 30% increase in client retention.

Conclusion: The Future of Wealth Advisory is Now

The shift toward AI-driven personalization, alternative asset integration, and digital-first advisory models is inevitable. Financial advisors who embrace these trends will be well-positioned to attract high-value clients and drive long-term retention.

Download Maveric’s “Redefining Wealth Advisory” report now to gain cutting-edge insights into the future of financial advisory.

View

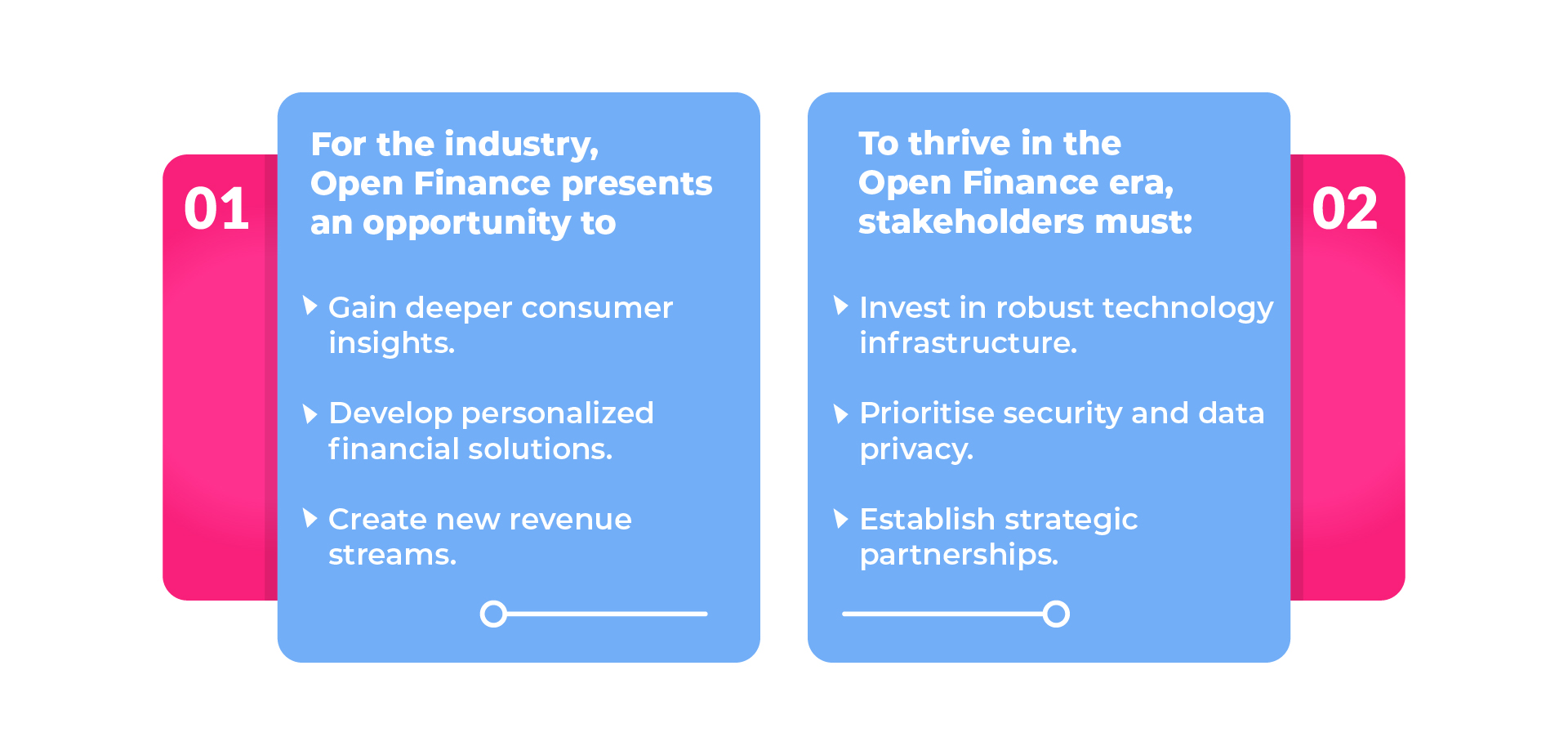

Open Finance represents a significant leap forward from Open Banking by addressing consumers’ expectations for greater control, convenience, and customization.

Open Finance represents a significant leap forward from Open Banking by addressing consumers’ expectations for greater control, convenience, and customization. Consumers want to make informed decisions based on a complete picture of their financial health, and Open Finance makes this possible. It is about putting consumers in the driver’s seat and empowering them to manage their financial lives more effectively.

Consumers want to make informed decisions based on a complete picture of their financial health, and Open Finance makes this possible. It is about putting consumers in the driver’s seat and empowering them to manage their financial lives more effectively. Avinash brings expertise in strategic delivery, innovative solutioning, and leadership in banking technology. At Maveric Systems, he focuses on advancing BankTech solutions in Wealth Management and Capital Markets, crafting transformative solutions to address client-specific challenges.

Avinash brings expertise in strategic delivery, innovative solutioning, and leadership in banking technology. At Maveric Systems, he focuses on advancing BankTech solutions in Wealth Management and Capital Markets, crafting transformative solutions to address client-specific challenges.

Financial institutions that embrace Open Finance initiatives and collaborate with experienced partners like

Financial institutions that embrace Open Finance initiatives and collaborate with experienced partners like  Avinash brings expertise in strategic delivery, innovative solutioning, and leadership in banking technology. At Maveric Systems, he focuses on advancing BankTech solutions in Wealth Management and Capital Markets, crafting transformative solutions to address client-specific challenges.

Avinash brings expertise in strategic delivery, innovative solutioning, and leadership in banking technology. At Maveric Systems, he focuses on advancing BankTech solutions in Wealth Management and Capital Markets, crafting transformative solutions to address client-specific challenges.