Unlocking the Potential: Benefits of Enterprise Data Warehouse for Financial Services

In the ever-evolving landscape of financial services, data reigns supreme. Harnessing the power of data is not just an option; it’s a strategic imperative for banks looking to thrive in the digital era. Enter the Enterprise Data Warehouse (EDW), a robust solution that has emerged as a cornerstone for financial institutions seeking to navigate the complex terrain of data management and analytics.

Embracing the Data Revolution – A historical perspective

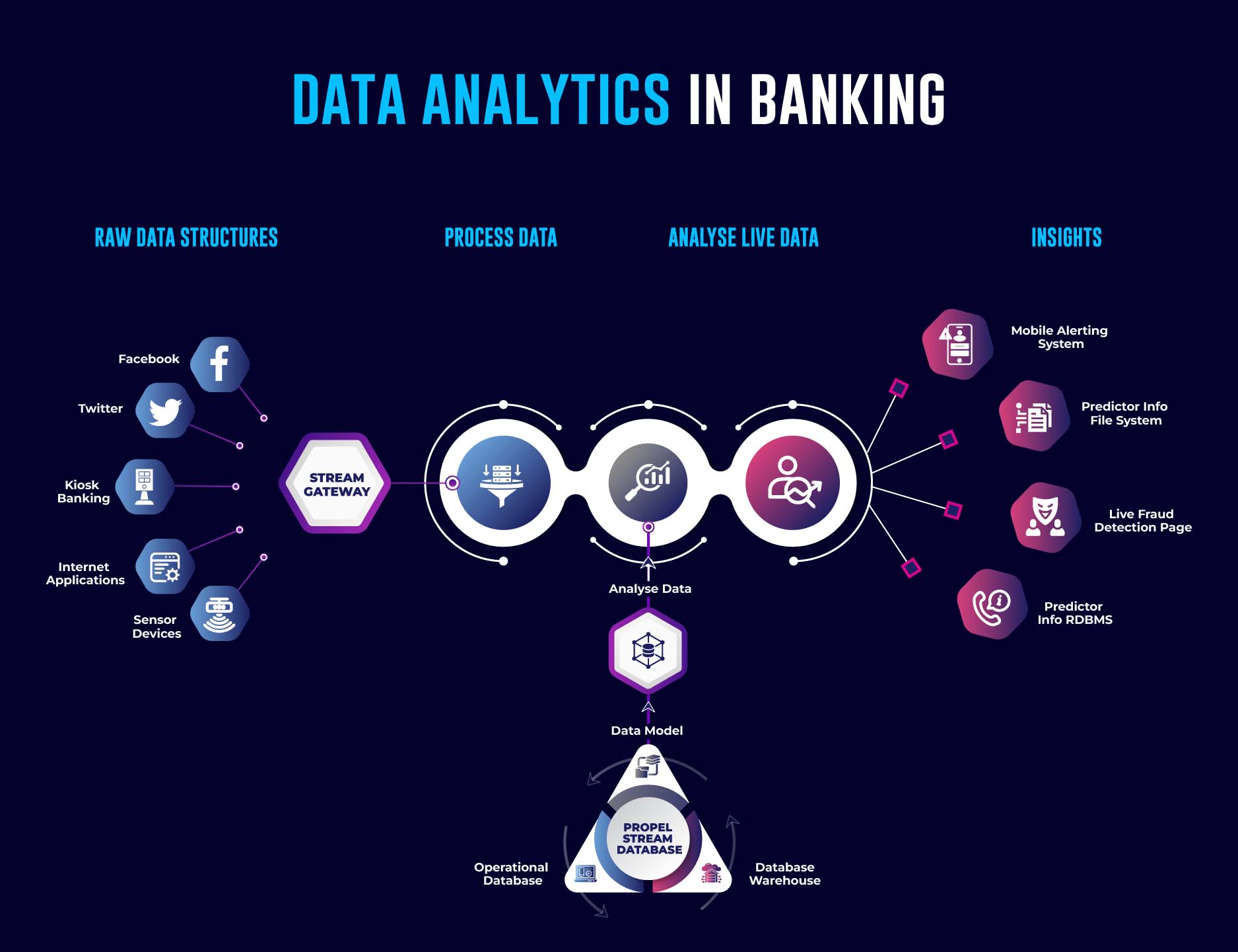

Recent statistics paint a compelling picture of the data landscape in financial services. According to a report by Statista, the global volume of data in the banking sector is expected to reach a staggering 122 exabytes by 2025, driven by the exponential growth of digital transactions, mobile banking, and emerging technologies. In this data-rich environment, the role of an Enterprise Data Warehouse becomes pivotal in extracting meaningful insights from the vast ocean of information.

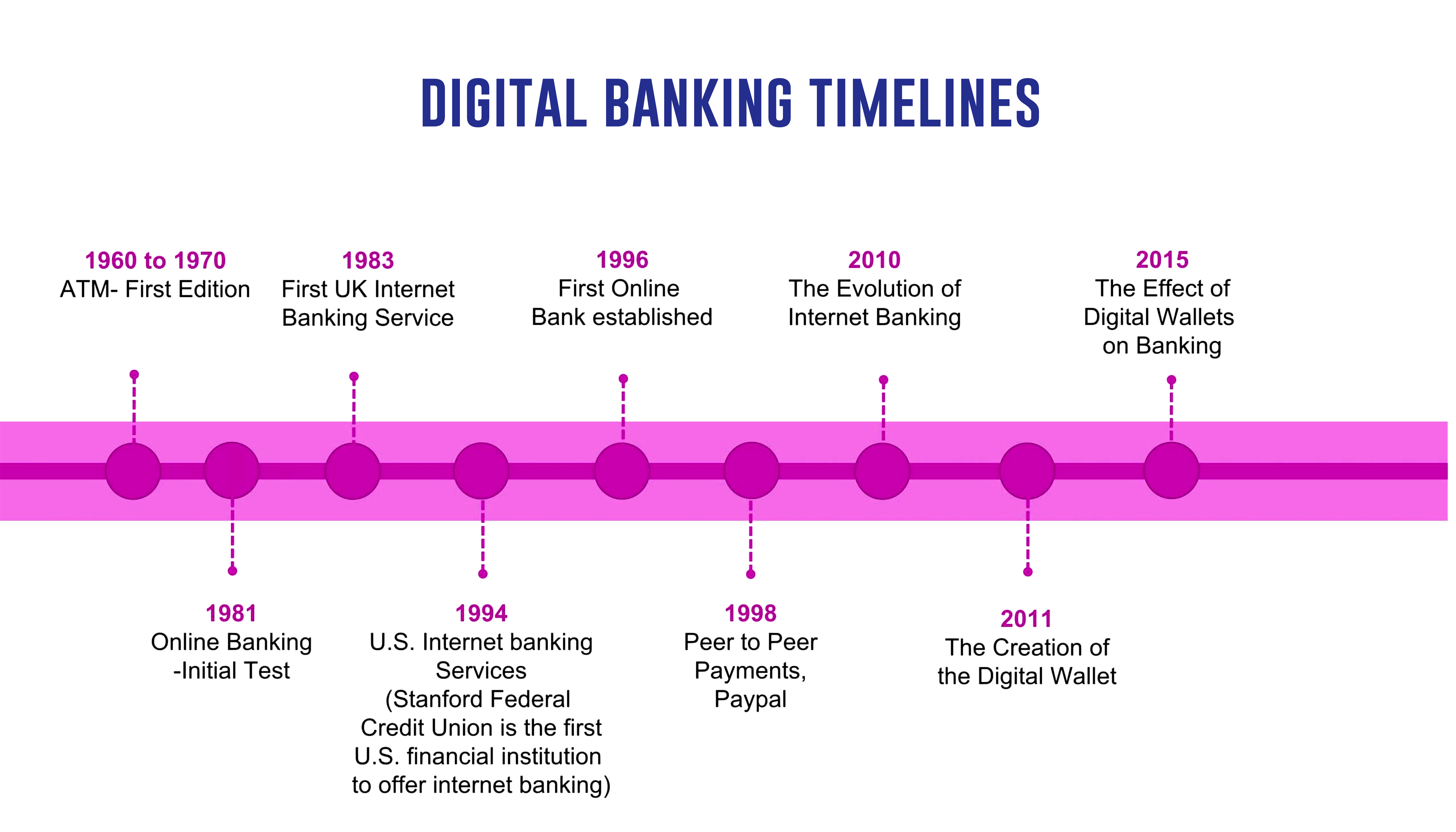

1960s – The Emergence of Mainframes

In the 1960s, the BFSI sector witnessed the advent of mainframe computers, marking the beginning of electronic data processing. This era saw a shift from manual record-keeping to automated systems, laying the foundation for data-driven decision-making.

1980s – Rise of Database Management Systems

With the rise of Database Management Systems (DBMS) in the 1980s, banks started organizing and managing vast volumes of data more efficiently. This era saw the emergence of relational databases, providing a structured framework for storing and retrieving financial information.

1990s – Internet Banking and Customer Data

The 1990s ushered in internet banking, enabling customers to access financial services remotely. This shift increased the volume of data generated and highlighted the importance of securing customer information in the digital realm.

The early 2000s – Analytics and Business Intelligence

In the early 2000s, BFSI institutions began leveraging analytics and BI tools to extract insights from their growing datasets. This marked a strategic shift towards using data not just for operational purposes but also for strategic decision-making.

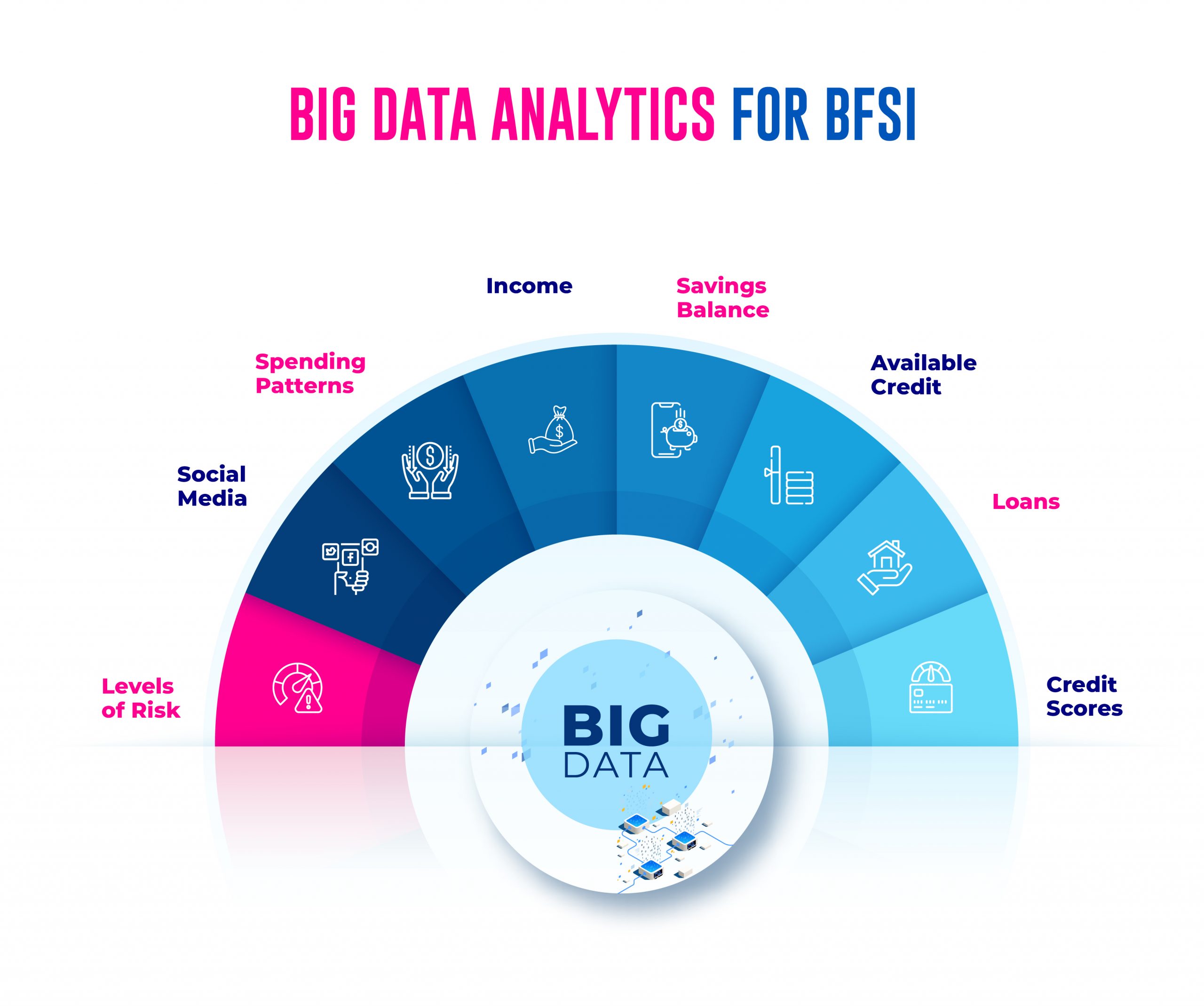

2010s – Big Data and Advanced Analytics

The proliferation of Big Data technologies in the 2010s allowed BFSI players to harness the power of massive datasets. AA, including ML and predictive modeling, became instrumental in risk management, fraud detection, and personalized customer experiences.

Present – AI, Machine Learning, and Digital Transformation

In the present era, Artificial Intelligence (AI) and Machine Learning (ML) are reshaping the BFSI landscape. Predictive analytics, chatbots, and robo-advisors exemplify how data-driven technologies enhance customer interactions and operational efficiency.

The impact of the data revolution is evident in the numbers. According to a McKinsey report, data analytics in banking can unlock $200 billion in value annually globally1. Moreover, a study by Statista predicts that global spending on AI in the banking industry will reach $12 billion by 2025.

The Fourfold Benefits

1. Unified Data Repository:

An EDW serves as a centralized repository, consolidating data from disparate sources within a financial institution. This unified view enhances data quality, reduces redundancy, and provides a holistic perspective crucial for informed decision-making.

2. Advanced Analytics and Reporting:

Leveraging the analytical capabilities of an EDW, financial institutions can derive actionable insights. Whether predicting customer behavior, managing risks, or complying with regulatory requirements, the EDW catalyzes advanced analytics.

3. Operational Efficiency:

Streamlining operations is a perennial goal for financial services. An EDW optimizes data management processes, offering a more efficient way to ingest, store, and retrieve data. This efficiency provides cost savings and improved agility.

4. Regulatory Compliance:

The financial sector operates in a highly regulated environment. An EDW facilitates compliance by providing a comprehensive and auditable data trail, ensuring that regulatory reporting requirements are met seamlessly.

Realizing the Vision: Noteworthy Examples

Several banks have embraced the EDW paradigm to innovate and edge ahead of their competition. JPMorgan Chase, for instance, invested significantly in an Enterprise Data Warehouse to enhance its data analytics capabilities, enabling better risk management and customer insights. Similarly, HSBC leveraged EDW to create a unified data platform, streamlining its operations and bolstering its ability to comply with regulatory standards.

Navigating the Challenges

Despite the myriad benefits, challenges abound in implementing Enterprise Data Warehouses. These include data security concerns, the need for skilled personnel, and the complexity of integrating legacy systems with modern data architectures.

Approaches to Success

To address these challenges, financial institutions must adopt a comprehensive approach. This involves investing in robust cybersecurity measures, upskilling their workforce, and gradually transitioning from legacy systems to more agile and scalable technologies. Collaboration with industry partners and leveraging cloud-based solutions are critical strategies for success.

Conclusion: The Path Forward

As financial services continue to traverse the data-driven landscape, the role of Enterprise Data Warehouses becomes increasingly indispensable. The benefits, from unified data repositories to advanced analytics, reshape how banks operate and strategize. To overcome the challenges ahead, a commitment to innovation, investment in talent, and a proactive stance towards evolving technologies will be crucial for financial institutions aiming to unlock the full potential of Enterprise Data Warehousing.

About Maveric Systems

Starting in 2000, Maveric Systems is a niche, domain-led Banking Tech specialist partnering with global banks to solve business challenges through emerging technology. 3000+ tech experts use proven frameworks to empower our customers to navigate a rapidly changing environment, enabling sharper definitions of their goals and measures to achieve them.

Across retail, corporate, and wealth management, Maveric accelerates digital transformation through native banking domain expertise, a customer-intimacy-led delivery model, and a vibrant leadership supported by a culture of ownership.

With centers of excellence for Data, Digital, Core Banking, and Quality Engineering, Maveric teams work in 15 countries with regional delivery capabilities in Bangalore, Chennai, Dubai, London, Poland, Riyadh, and Singapore. Contact Maveric Systems today!

View