Redefine Testing for Bespoke Banking Solutions with Maveric’s Waterfall Approach

Overview

Banks today require bespoke applications to enhance operations, improve customer experiences, and stay competitive through continuous innovation while adhering to strict compliance standards. However, testing these custom applications within traditional waterfall models presents challenges such as fluctuating requirements due to inconsistent business-user involvement, knowledge silos from limited collaboration, and delayed integration testing with legacy systems that increase the risk of operational disruptions. The result? Latent defects, quality compromises, and escalating technical debt, hindering scalability and future upgrades.

Maveric eliminates technical debt for bespoke applications, ensuring zero debt and enabling seamless scalability and maintainability. Our component-based approach future-proofs regression testing, providing a solution that adapts effortlessly to your evolving needs.

Maveric’s Waterfall Solution

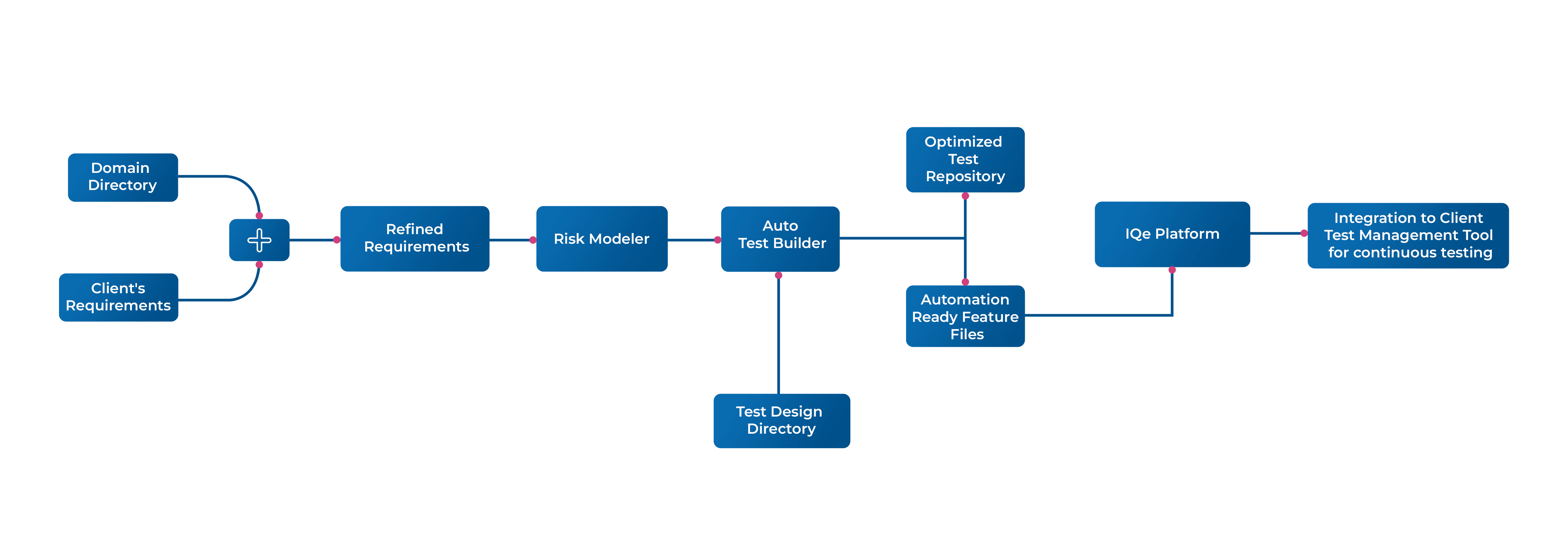

Functional Architecture

From optimizing test scenarios to automating continuous testing, we streamline development, enhance reliability, and accelerate time-to-market.

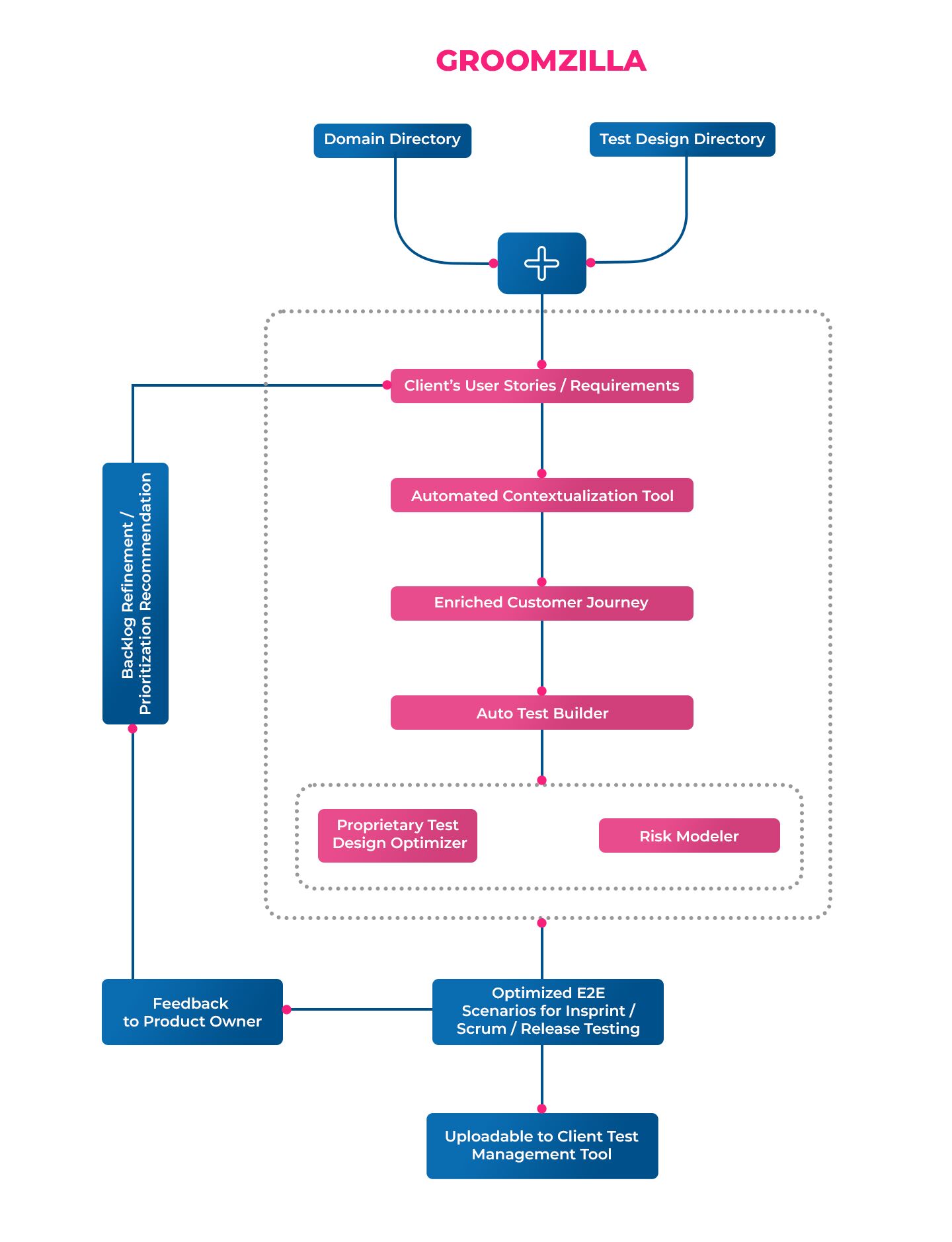

Banking Directory

A comprehensive repository of business processes, user roles and workflows, allowing early identification of gaps and enabling seamless test planning.

Risk Modeler

Identifies integration failure points with proactive impact analysis, creating heatmaps that improve system stability and support risk mitigation.

Auto Test Builder

An AI-powered tool that generates automation-ready test design repositories, streamlining the testing process for greater efficiency.

IQe Platform

Automates continuous testing across integration, UI and business layers, enabling service virtualization to accelerate development and validate key endpoints.

Business Benefits

Maveric’s bespoke application testing isn’t just a solution—it’s your strategic partner for robust, future-proof applications.

Accelerate Delivery by 30%

Streamlined processes and automation reduce development time by 30%.

95% Automation Coverage

Extensive automation through the Auto Test Builder and IQe Platform enhances efficiency and quality.

Minimize Disruptions and Maximize Reliability

Continuous testing and proactive risk management minimize disruptions and improve system stability.

Boost Requirement Stability by 90%

Accurate requirement capture and validation ensure better alignment with business goals.

Zero Technical Debt Starts Here!

The Maveric Edge

Leverage Maveric’s contextualization depth, extensive domain competencies, and over two decades of multi-geography award-winning commitment.

Contextualized Solutions

An innate ability to bring together domain, platform, and technology expertise to craft contextual solutions to support transformation programs.

Impactful Delivery Model

A customer centric model geared for high delivery impact.

New Service Line Development

Proven ability to develop and scale new service lines aligned to customer growth areas.

Differentiated Engagement

Technical engagement led customer value creation.

Ready to transform your banking ecosystem?

Contact us today to learn how Maveric’s “Maveric’s Waterfall Approach” can accelerate your innovation journey and position your bank for long-term success.