CXO Today has engaged in an exclusive interview Mr. NN Subramanian, COO & Co-founder Maveric Systems Ltd.

How is Maveric Systems assisting their clients in becoming more technologically and digitally advanced?

A thin line exists between being technologically advanced and digitally advanced. In many cases, digitally advanced refers to how everything translates into the customer experience and technology forms. The components used to make this happen. With a specialized focus in the banking domain, Maveric Systems deeply understands the requisites to be digitally and technologically agile in the banking space. Combining these factors has helped us develop a mastery of digital transformation in the banking ecosystem, which has enabled us to deliver successful banking transformation projects for several clients. To stay ahead of the curve, provide contextual solutions, and truly accelerate the next in banking for our clients, Maveric Systems has been focusing on the following key aspects to assist our clients in becoming more technologically and digitally advanced:

- Creating a Digital Twin – In its truest sense, Digital Twin is a virtual replica of any physical asset, process, system, or environment, a look-alike that can behave identically like its real-time counterpart. In the banking nuance, this would mean making the core system a system of records and all the transactions driven by an event-based architecture tool to move to either a big data or a data lake on a real-time basis. It can enable FIs to manage customer queries on a real-time basis. In the case of the digital twin, event-based architecture is the technology that delivers the digital twin, improving the customer experience.

- Integrating AI into portfolios – Today, AI has become omnipresent across the banking conundrum, translating more into a customer CX experience in the real world with multiple AI components in the background. We are seeing a new wave of leveraging AI. regarding customer classification. Customer classification is predominantly based on portfolio values such as deposits, account balances, etc., and their revenue value is ascertained indirectly. In the present tech era, several FIs are evaluating the customers’ stickiness and retention worthiness differently. Some customers may not have a substantial balance yet have higher transaction rates which bring in more revenues for the bank. Be it payment or share transactions, these transactions would add significant value to the bank irrespective of the net worth of their portfolio. Today, AI tools can enable FIs to analyse customers based on their transaction rates and deduce their revenue, identify customers likely to stay longer and connect with the bank for their financial needs. Such behavioural analysis and classification of customers are rampant, and we see this trend increasing. Here AI is the technology, customer classification is the process, and it enhances the customer experience. Such classification can help in targeted marketing to increase success rates.

- Migrating to cloud-native solutions – Service providers have realized that legacy banking systems will only take them so far in delivering the best customer experience. They stand to lose much more than just the cost of migrating to the cloud. Hence, we see more service providers pivoting to cloud-native banking solutions. Maveric Systems transforms itself in tandem with the growth and evolution of the banking industry. Migrating to cloud-native solutions can be done in two ways. The old technology could be based on service-oriented architecture, which can be easily decomposed into microservices and APIs and then moved to the cloud. The second case is a non-service-oriented architecture where the transactions can be listened to, turned into an API, and then moved to the cloud. In either of the cases, this migration to a cloud-native application is a massive technology shift that we anticipate occurring at a larger scale globally.

What major digital transformations have Maveric Systems noticed in Asset and Wealth Management (AWM)?

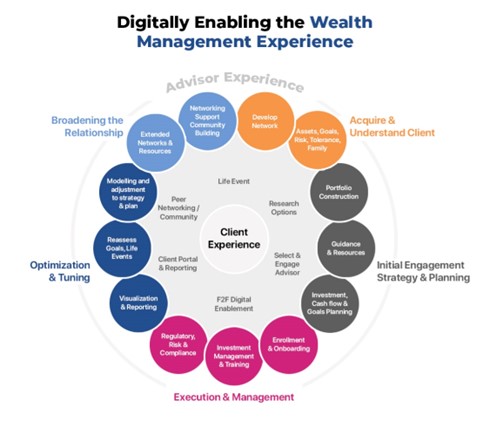

Digital transformation is revolutionizing AWM, creating new capabilities through mobile interaction, analytics, and service delivery. Today, hardly any process in the wealth management chain remains untouched by technology. We are witnessing a change, starting with acquiring and understanding the client, initiating and engaging strategy and planning, execution and management, optimizing and tuning, and further broadening the relationship.

At a global level, the primary trend we witness is a change in the client portfolio. From the demographic perspective, there is a significant shift in the millennial group, and we also notice a substantial inheritance being passed on to women. Both millennials and women exhibit similar characteristics – they are moderate risk takers where the deep commitment and willingness to go through the process are co-related.

The overall customer experience in wealth lags when compared to retail. There is a significant challenge concerning asset class information. Many companies are global, and there is a need to compile their asset class information. Several corporates are investing, and there is a holding structure within the corporates. The hierarchy needs to be established at a global level. Performing the test of KYC and politically exposed people becomes a challenge. Quite often, this lack of information impacts the customer experience. Emerging platforms can accomplish this with the ability to do it across regions – the validations in establishing the hierarchy in the first place and carrying out the KYC test for the people associated with that hierarchy.

How is Maveric Systems, with its more than two decades of experience, responding to the shifting needs of its clients? What significant problems have you observed recently?

In our two decades of experience, Maveric Systems has been transforming itself in tandem with the growth and evolution of the banking industry. We can see three major shifts in the needs of our clients.

- In traditional banking, transactions, customer experience, and analytics were independent processes. Across the BFSI spectrum, service providers are rapidly shifting from conventional siloed processes to an integrated platform that combines CX, domain, and analytics. We see a surging demand for an integrated platform connecting all three functions rather than independent platforms.

- Applications must be scalable across countries and compliant with various regulatory and security requirements of each country.

- The number of releases is increasing with monthly or fortnightly scheduled releases along with daily or weekly updates. There is a need to orient to this change and requires a banking technology specialist to manage such changes.

There is no single integrated platform today. Service providers need to partner with specialists like Maveric Systems and construct an integrated platform capable of delivering customer experience, applications, and analytics altogether. Cloud DevOps SRE needs to be integrated as the underlying foundation for these to ensure scalability, security, and regional deployment. It will automate a substantial portion of the functions to gear toward frequent releases and updates.

What are the key risks associated with digital transformations in Asset and Wealth Management AWM, and how can firms mitigate these risks?

Rigid Legacy Systems– Service providers are often reactive to adopting technology and addressing current trends and issues rather than being futuristic and embracing holistic transformations. Such piecemeal implementations lead to a pile of rigid legacy systems, making adding newer services and technology even more challenging. Modernizing the core banking systems with a focus on interoperability and long-term cost-effectiveness can help negate these risks.

Siloed Data Sources – When service providers opt for the piecemeal addition of technology to existing legacy systems, they risk doing business with data housed in silos. They miss out on a 360-degree view of a customer, which is detrimental to providing contextualized and personalized experiences. Such siloed approach to storing sensitive data also risks non-compliance. A consolidated approach would facilitate a seamless flow of information, enabling easier access to business intelligence across the organization.

Risk in managing digital assets – We have seen a proliferation of digital assets such as cryptocurrencies, stablecoins, non-fungible tokens (NFTs), and central bank digital currencies (CBDC), to name a few. Significant regulatory and risk management issues are attached to such assets. These have become the targets for cybercriminals. Reports indicate that scams accounted for nearly 55% of crypto-currency crimes in 2022. Digital assets are vulnerable and prone to abuse, becoming easy soft targets for fraud and scams. Technology specialists must be aware of the various international standards, such as those set by FATF, clearly defining the role of VASPs and several other open regulatory considerations.

What new technologies and innovations can we expect to see emerge in the banking industry in the next few years?

Composable banking solutions: Akin to a Lego structure where the core banking engine can coordinate with independent components via open APIs. Such a solution allows the agility to extend functionalities based on the maturity and needs of customers with the ability to add or swap unlimited components as required. This tech approach will allow FIs to hyper-personalize client journeys and design differentiated customer experiences while driving newer digital business capabilities. Composable banking solutions are a future-proof technology with an easy selection of a best-for-purpose solution, allowing for a new fractional transformation with lesser risk.

Decision Intelligence – As technology becomes more prevalent in the banking and finance domain, there is a greater requirement to leverage analytics for enhanced Decision Intelligence. Protection from fraud, customer experience, and risk management are areas where we can see greater use of analysis driven by big data, AI, ML, blockchain, and the like. Augmented intelligence and automated decision-making would see a greater acceptance as we witness a more structured approach to datafication in this domain. Such a harmonized collective decision outcome is aligned with the latest omnichannel, digital-only, and neo-banking trends.

Intelligent Applications– Providing customers with contextualized experiences, features, and processes is at its peak in the banking industry. It has given birth to a breed of Intelligent Applications augmented with AI with connected data from across transactions and external sources. These applications are trained to continually learn, adapt and improve. Upgraded chatbots, robo advice, credit scoring/direct lending, intelligent customer onboarding – we can expect more innovative AI-based applications with enhanced features.

About the Author

As a co-founder of Maveric Systems and its current COO, N. N Subramanian’s (Subbu) mandate is to scale operations and establish winning governance rhythms that deliver on the organization’s strategic priorities. His endeavors are critical to Maveric’s quest to become one of the leading Bank-Tech providers across global top-15 banks, regional banking leaders, and fintech providers.

As a co-founder of Maveric Systems and its current COO, N. N Subramanian’s (Subbu) mandate is to scale operations and establish winning governance rhythms that deliver on the organization’s strategic priorities. His endeavors are critical to Maveric’s quest to become one of the leading Bank-Tech providers across global top-15 banks, regional banking leaders, and fintech providers.

Originally Published in CXO today.