Maveric’s framework for optimizing Digital Marketing Mix and Budget allocation

The latest report by Maveric Systems, titled: Optimizing Client Retention: Digital Marketing Blueprint for Banks. Provides comprehensive insights on why retention and expansion are becoming more critical in the banking industry. It documents a clear framework to build the right digital marketing mix and budgetary allocation specific to each sector to drive retention and expansion at scale. However, the success of these strategies lies in meticulous execution. This blog aims to articulate the channel-specific execution challenges and their respective mitigation measures. While the report details how to monitor performance and measure success, this blog will additionally discuss optimizing executions.

Channel-Specific Challenges and Mitigation Measures

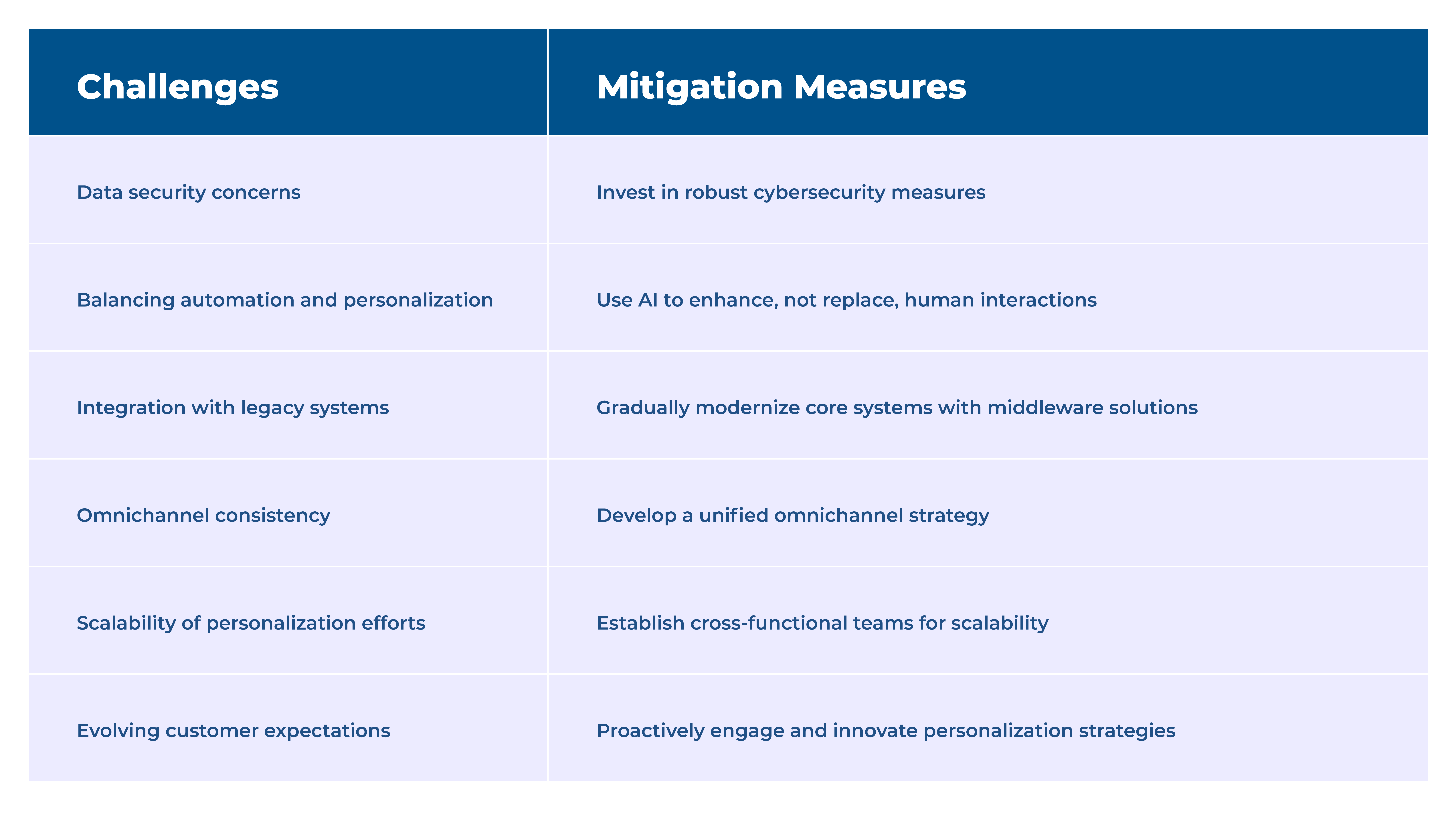

1. CX Personalization

Implementing CX personalization faces hurdles like data security, balancing automation with personalization, and integration with legacy systems.

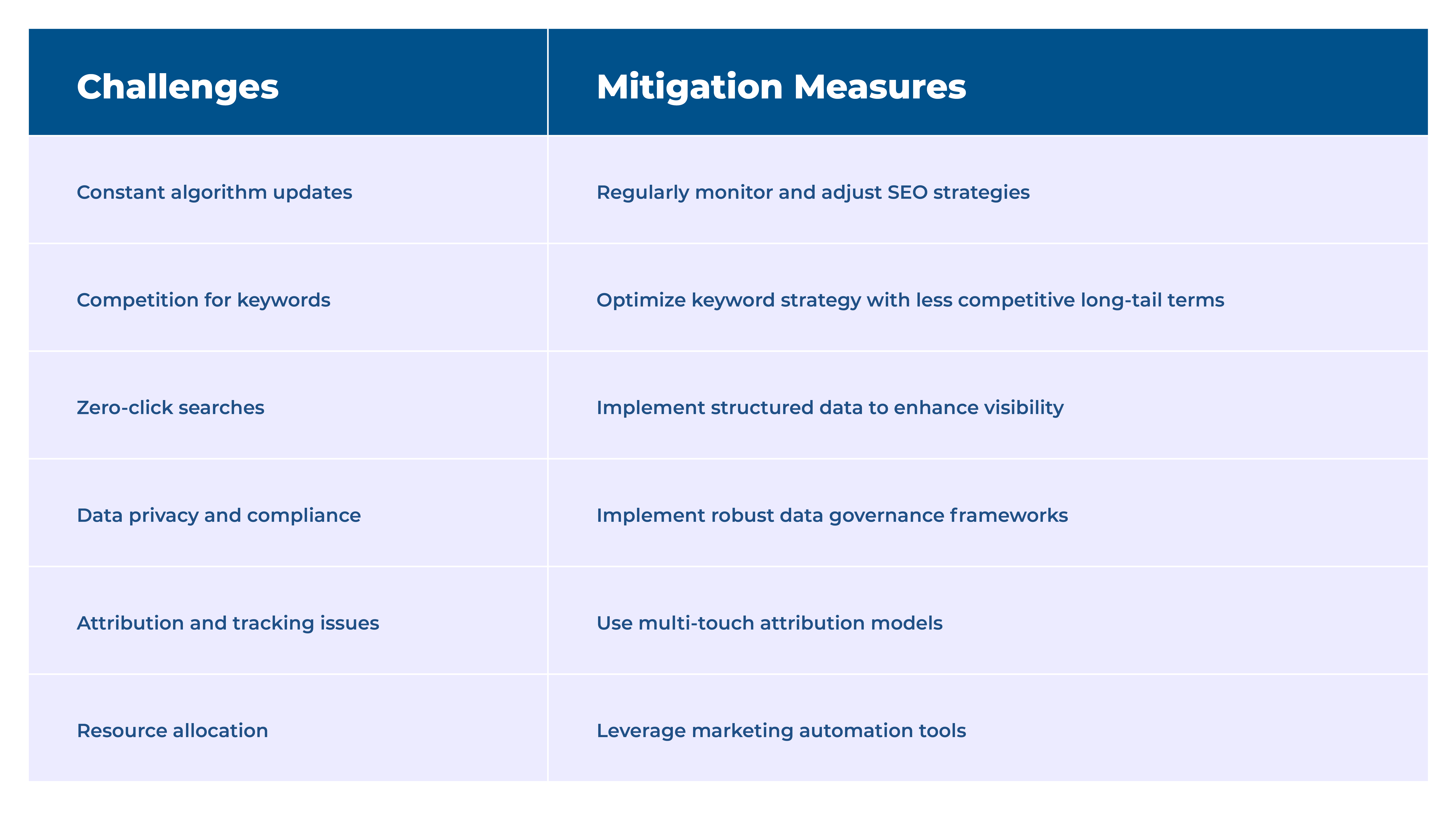

2. SEO/SEM/Paid Media

Maintaining SEO/SEM effectiveness involves dealing with algorithm updates, keyword competition, and zero-click searches

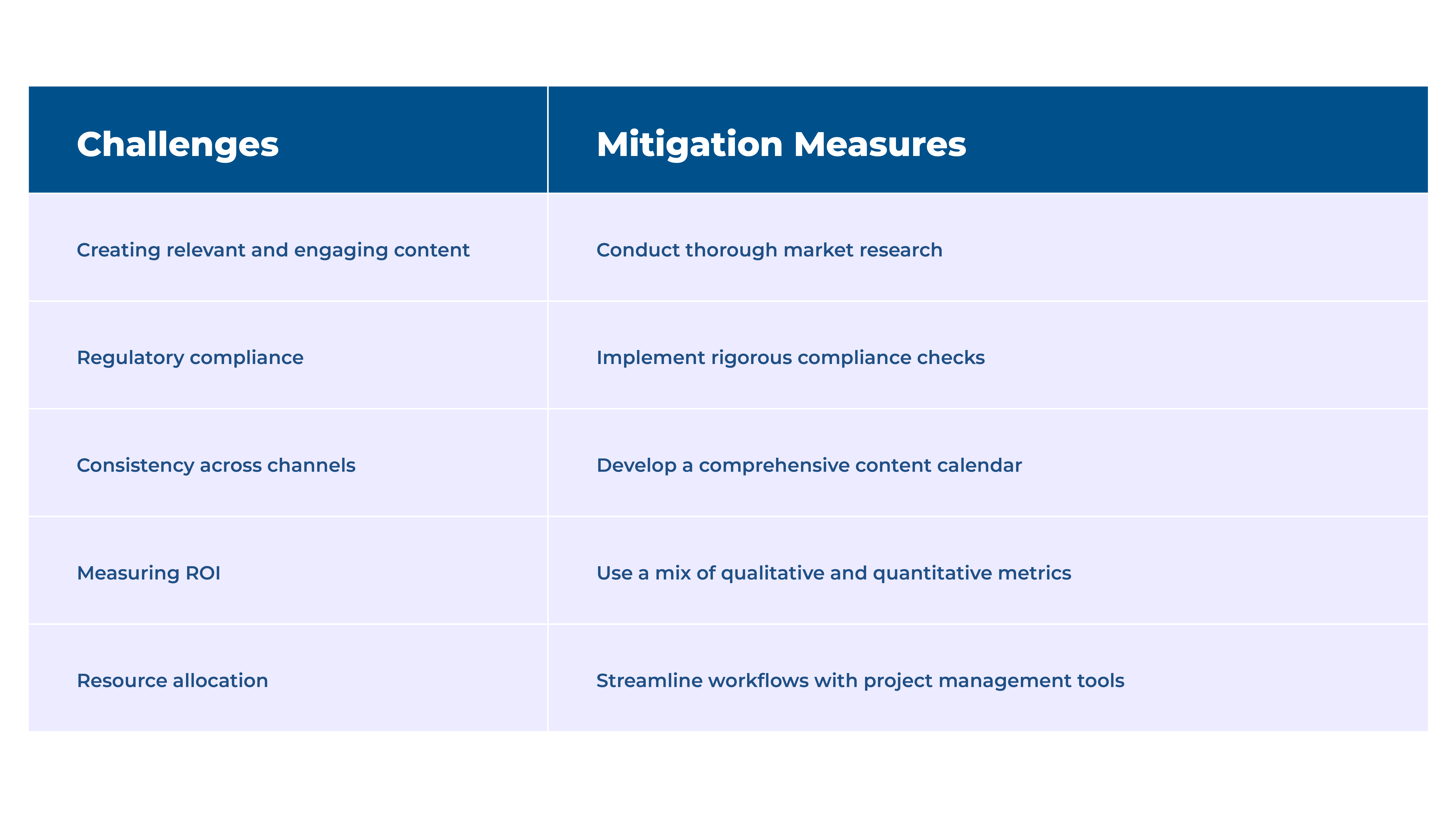

3. Content Marketing

Creating engaging, compliant, and consistent content is challenging but crucial for customer engagement.

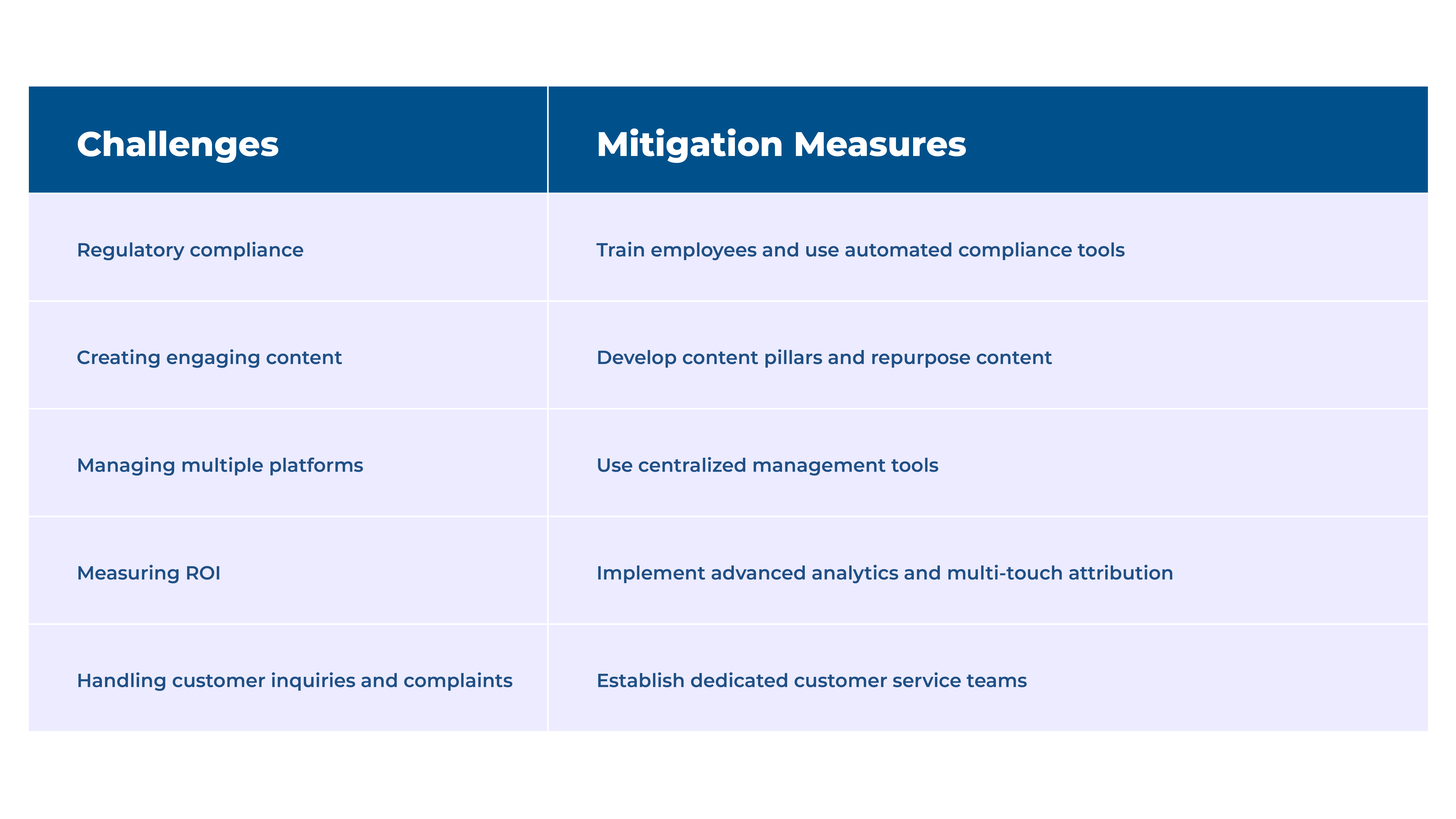

4. Social Media Marketing

Effective social media marketing requires regulatory compliance, engaging content, and efficient platform management.

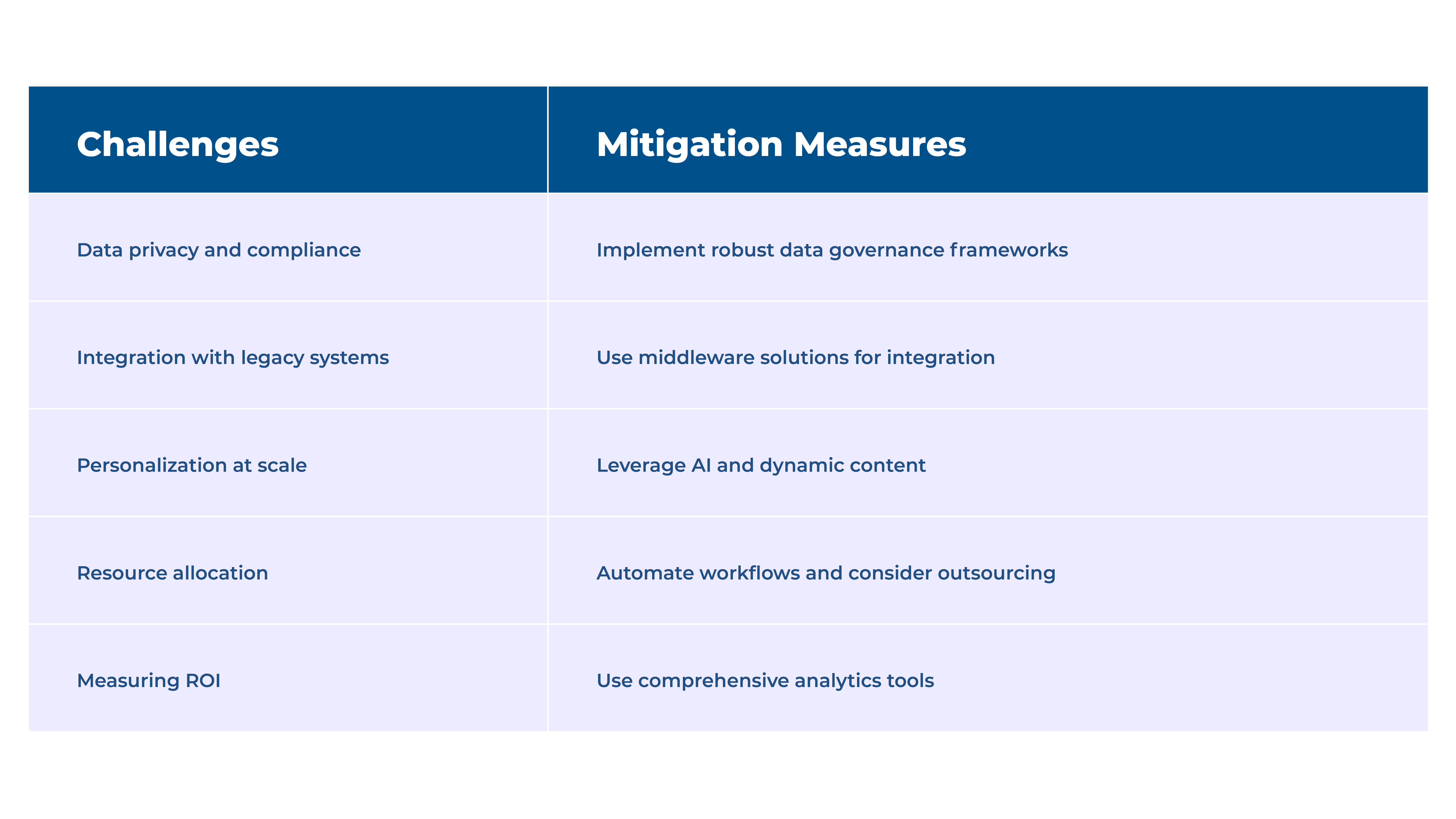

5. Marketing Automation

Ensuring data privacy, integrating legacy systems, and achieving personalization at scale are key challenges.

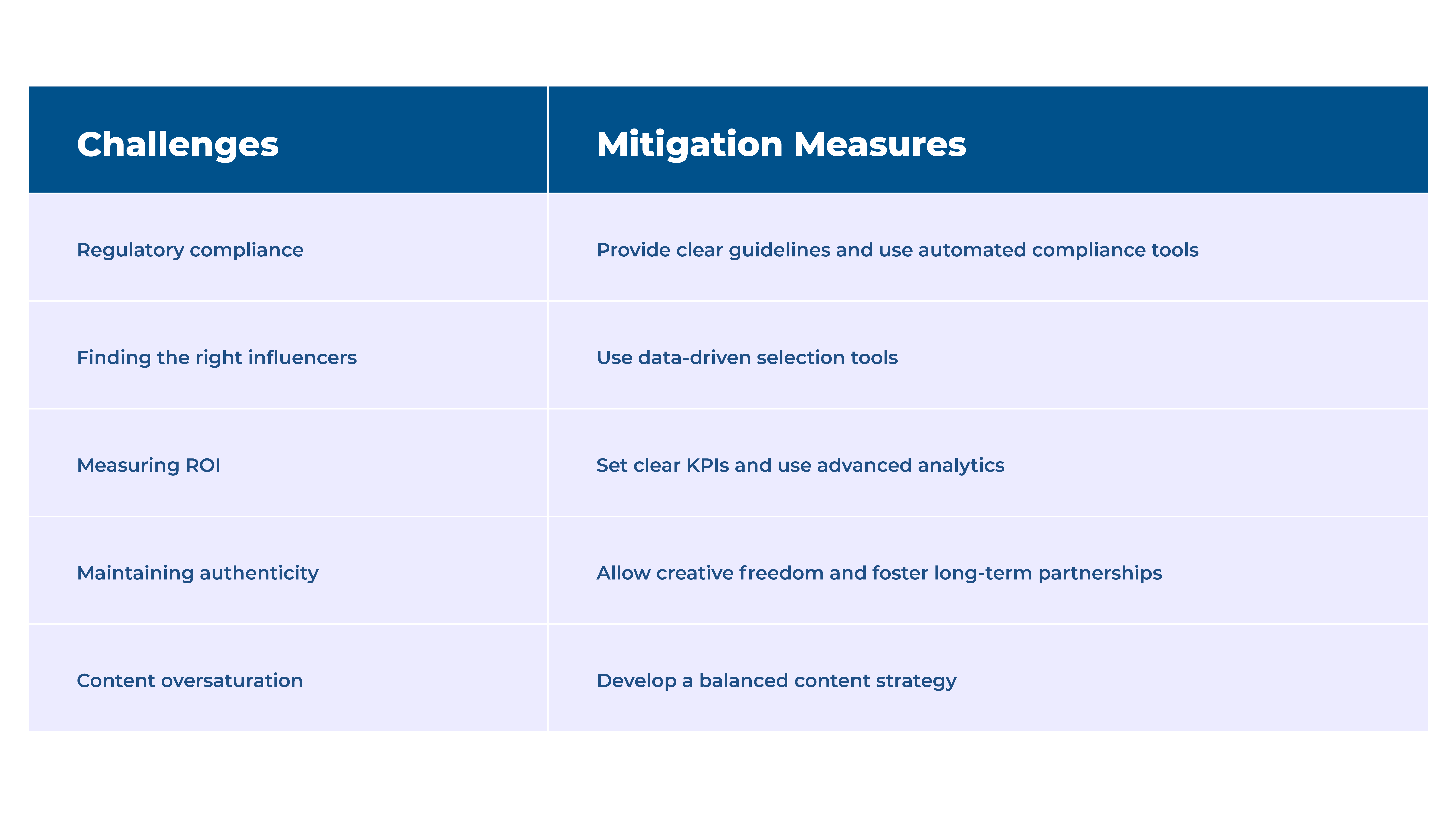

6. Influencer Marketing

Regulatory compliance and maintaining authenticity are critical for influencer marketing success.

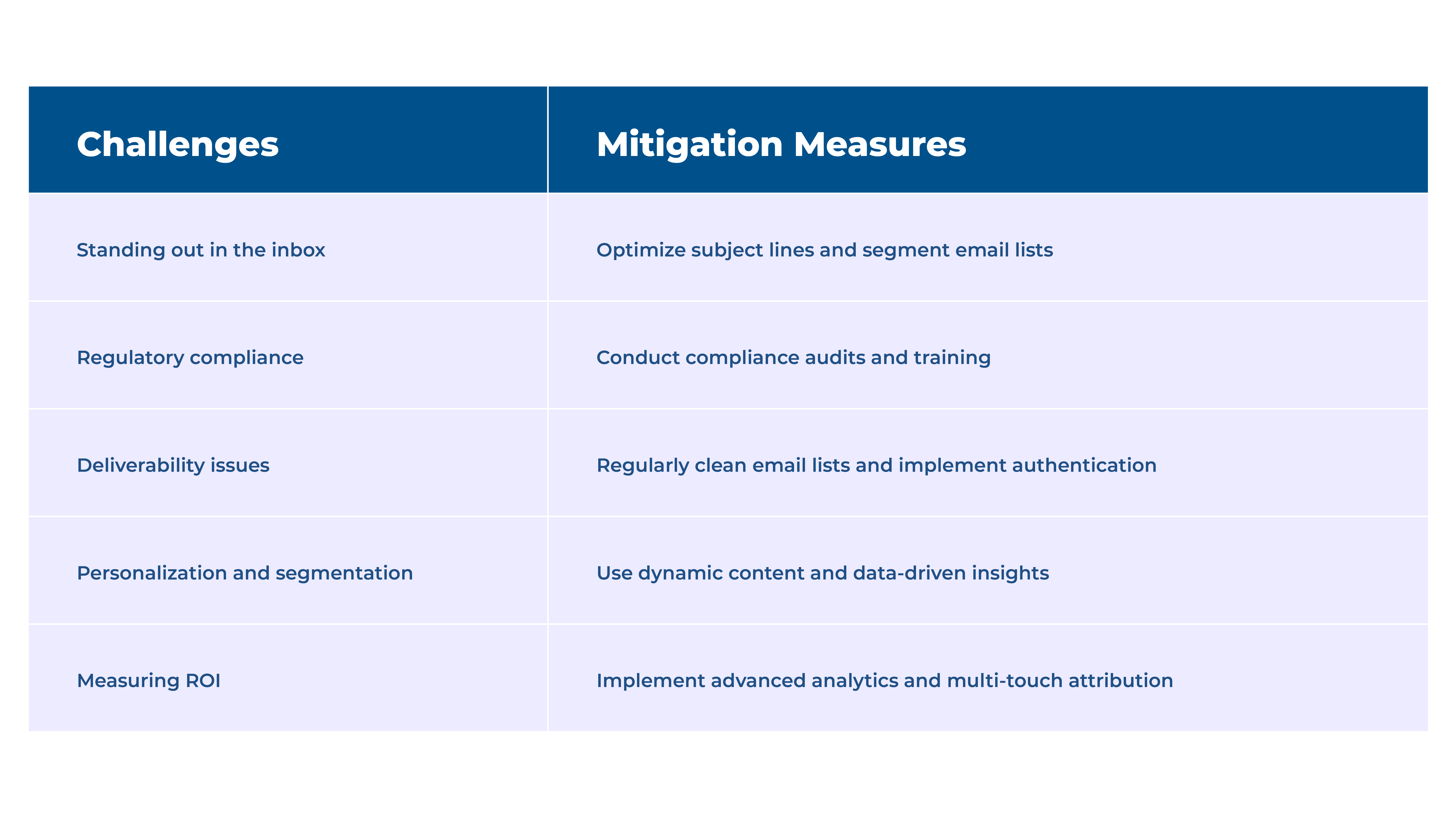

7. Email Marketing

Standing out in the inbox and ensuring compliance are key hurdles in email marketing.

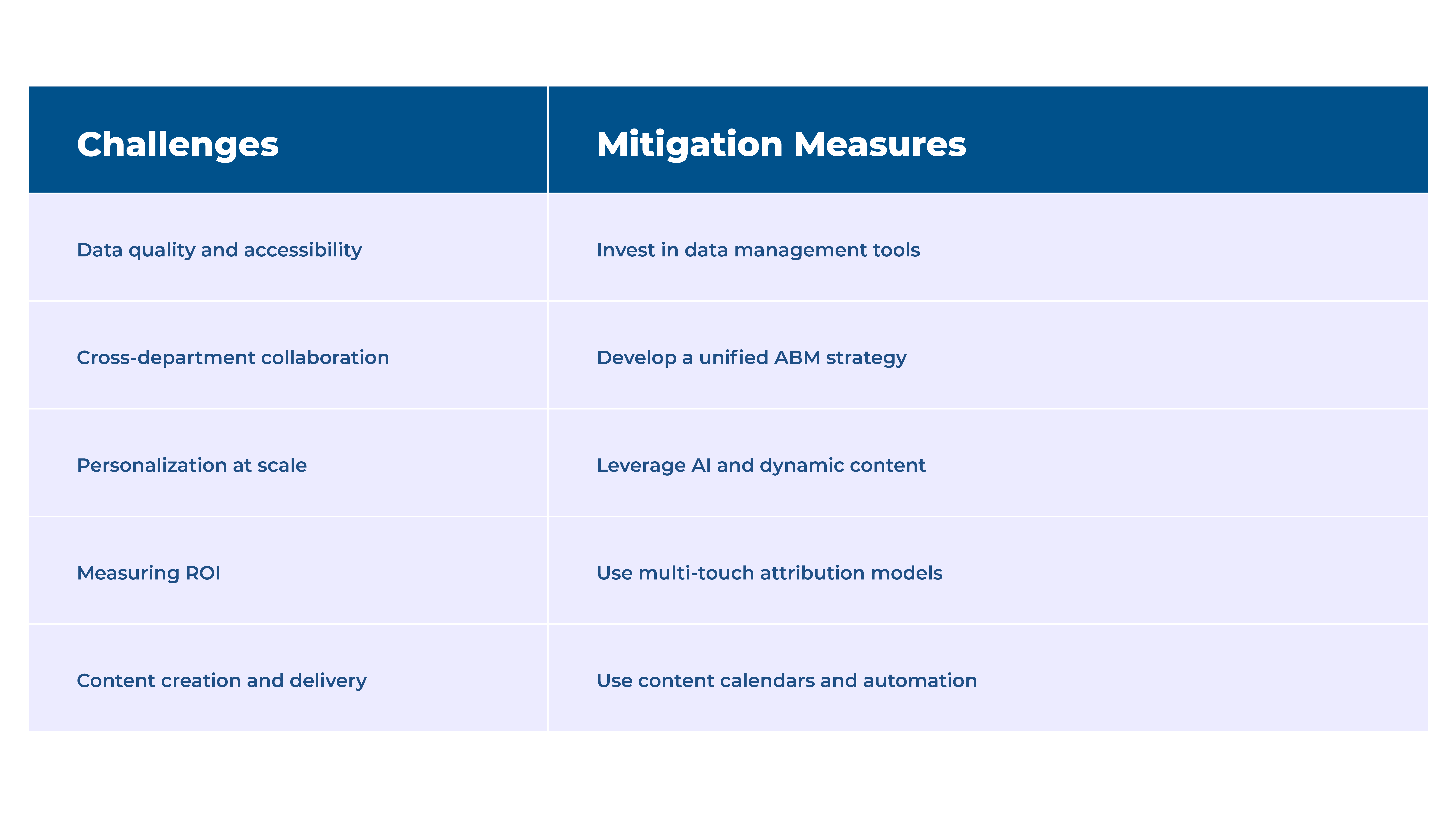

8. Account-Based Marketing (ABM)

Data quality, cross-department collaboration, and personalization at scale are crucial for ABM. While not exhaustive, the above listing highlights the importance of monitoring performance, measuring success, and maintaining a closed-loop feedback system to ensure strategies remain effective. For detailed insights and a comprehensive overview of how to measure success and validate marketing mix and budgetary allocation, refer to the latest report by Maveric Systems, titled: Optimizing Client Retention: Digital Marketing Blueprint for Banks.

While not exhaustive, the above listing highlights the importance of monitoring performance, measuring success, and maintaining a closed-loop feedback system to ensure strategies remain effective. For detailed insights and a comprehensive overview of how to measure success and validate marketing mix and budgetary allocation, refer to the latest report by Maveric Systems, titled: Optimizing Client Retention: Digital Marketing Blueprint for Banks.

Co-authored by Ashutosh Karandikar, and Venkatesh Padmanabhachari

Maveric’s thought leadership series – E.D.G.E (Experiences Delivered by Global Experts) – handpicks the game-changing technology ideas and pressing functional questions Banks and financial institutions must solve today.

These features – reports, whitepapers, podcasts, flyers, blogs, and infographics – are for Banking leaders and Technology evangelists to apply profound trends, the latest opinions, and transformational analyses to boost the performance of their organizations.

About Maveric Systems

Established in 2000, Maveric Systems is a niche, domain-led, BankTech specialist, transforming digital ecosystems across retail, corporate, wealth management, cards & payments and lending domains. Our 2600+ specialists use proven solutions and frameworks to address formidable CXO challenges across Customer Experience, Assurance, Regulatory Compliance, Process Excellence and New age AMS.

Our competencies across Data, Digital, Cloud, DevOps, AI and automation helps global and regional banking leaders as well as Fintechs solve next-gen business challenges through emerging technology. Our global presence spans across 3 continents with regional delivery capabilities in Amsterdam, Bengaluru, Chennai, Dallas, Dubai, Kingdom of Saudi Arabia, London, New Jersey, Pune, Riyadh, Singapore, Sweden, Dubai and Warsaw.

Our inherent banking domain expertise, a customer-intimacy-led delivery model, and differentiated talent with layered competency – deep domain and tech leadership, supported by a culture of ownership, energy, and commitment to customer success, make us the technology partner of choice for our customers. Contact Maveric Systems today!

View