Breaking Barriers in Capital Markets: Maveric’s Strategic Approach to Modernization

- Core Platform Modernization

- Advanced Analytics

- Generative AI

- Tokenization & Digital Assets

- Regulatory Complexity

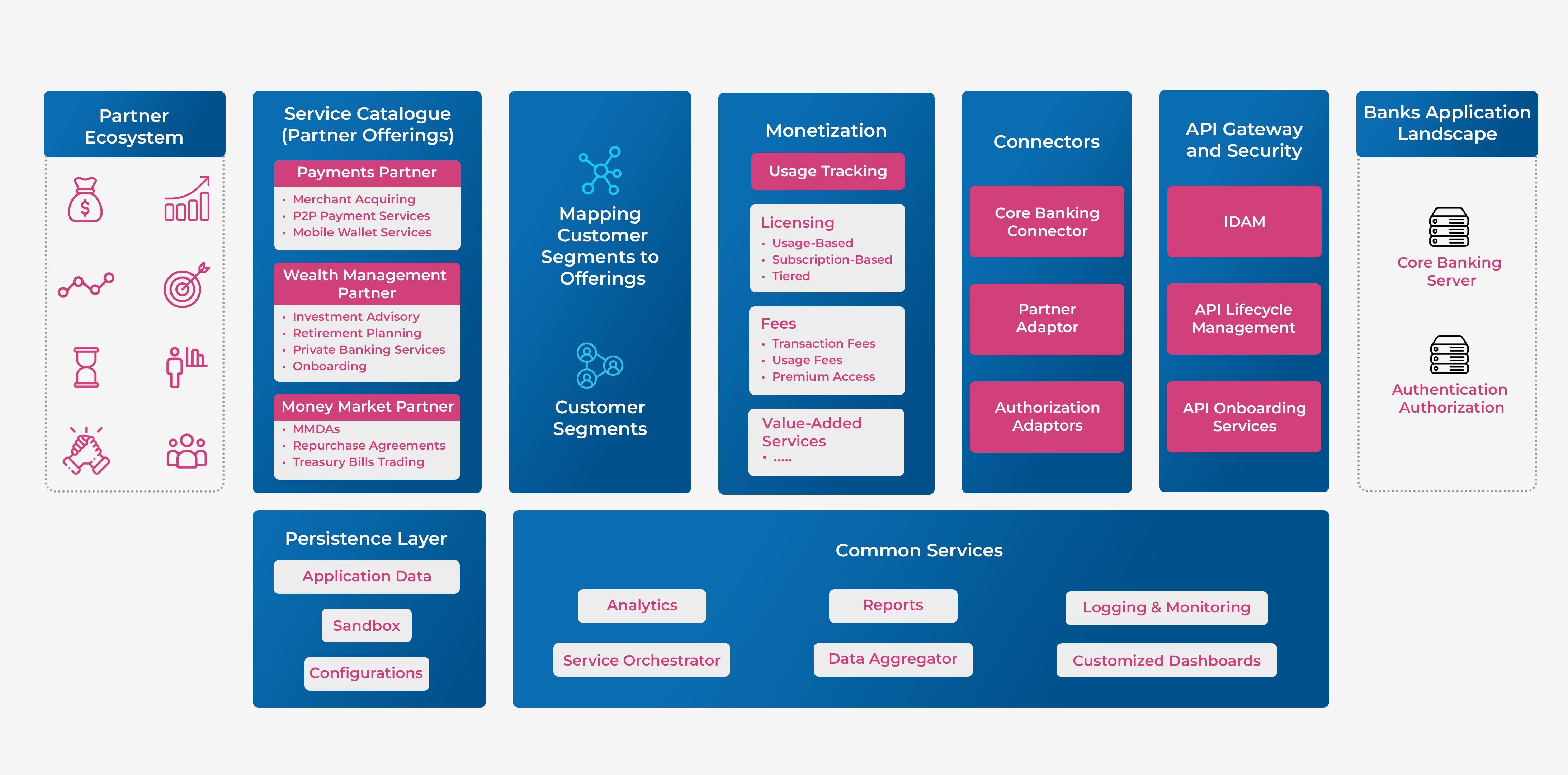

Core Platform Modernization

![]()

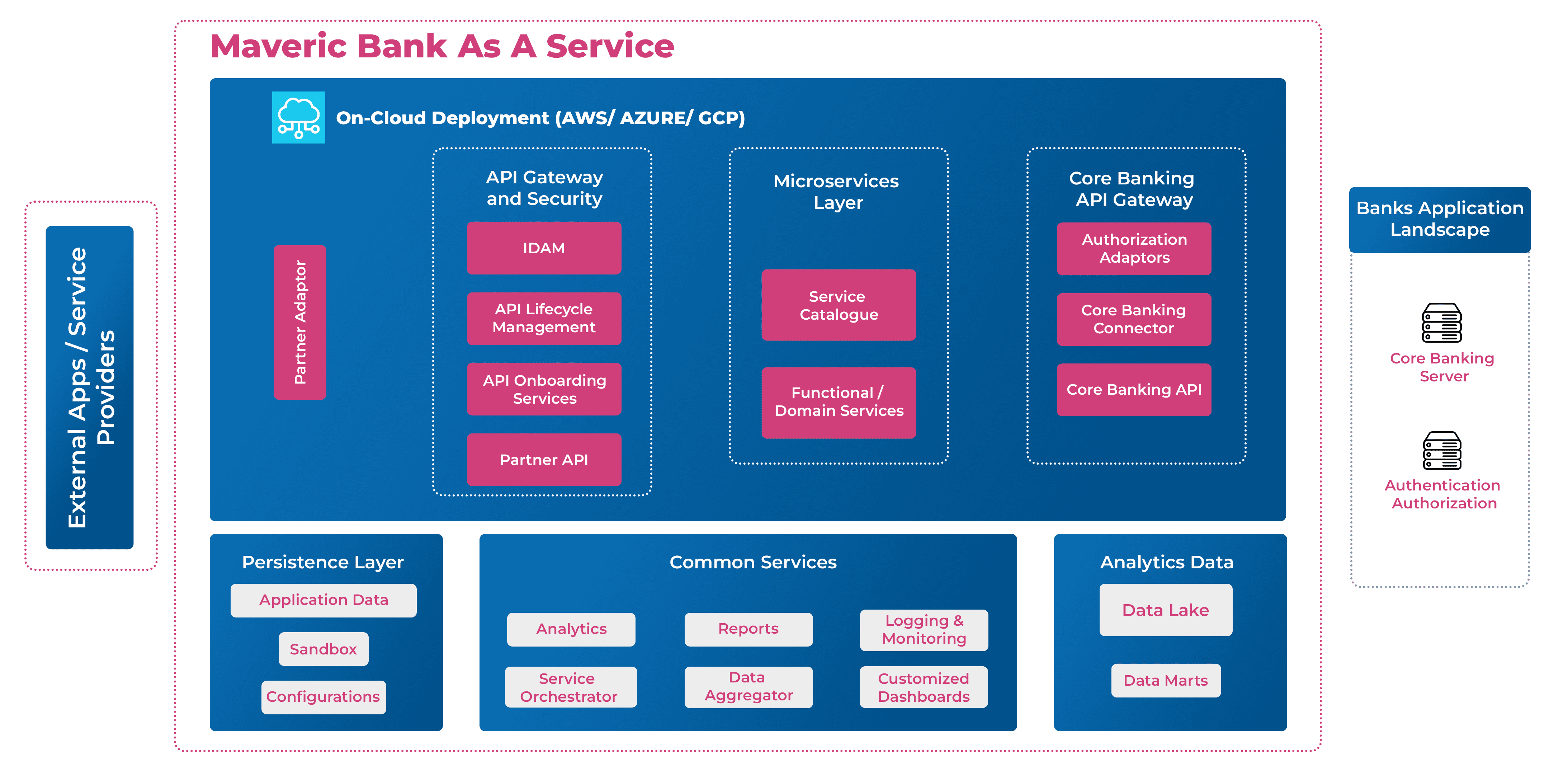

Financial institutions are accelerating the modernization of core platforms to improve scalability, enhance operational efficiency, and support evolving business models. Many firms are shifting from legacy systems to cloud-based, API-driven architectures, enabling greater automation, seamless integrations, and faster product innovation. Additionally, low-code/no-code platforms are gaining traction, allowing firms to rapidly deploy new features while reducing development complexity.

Advanced Analytics

![]()

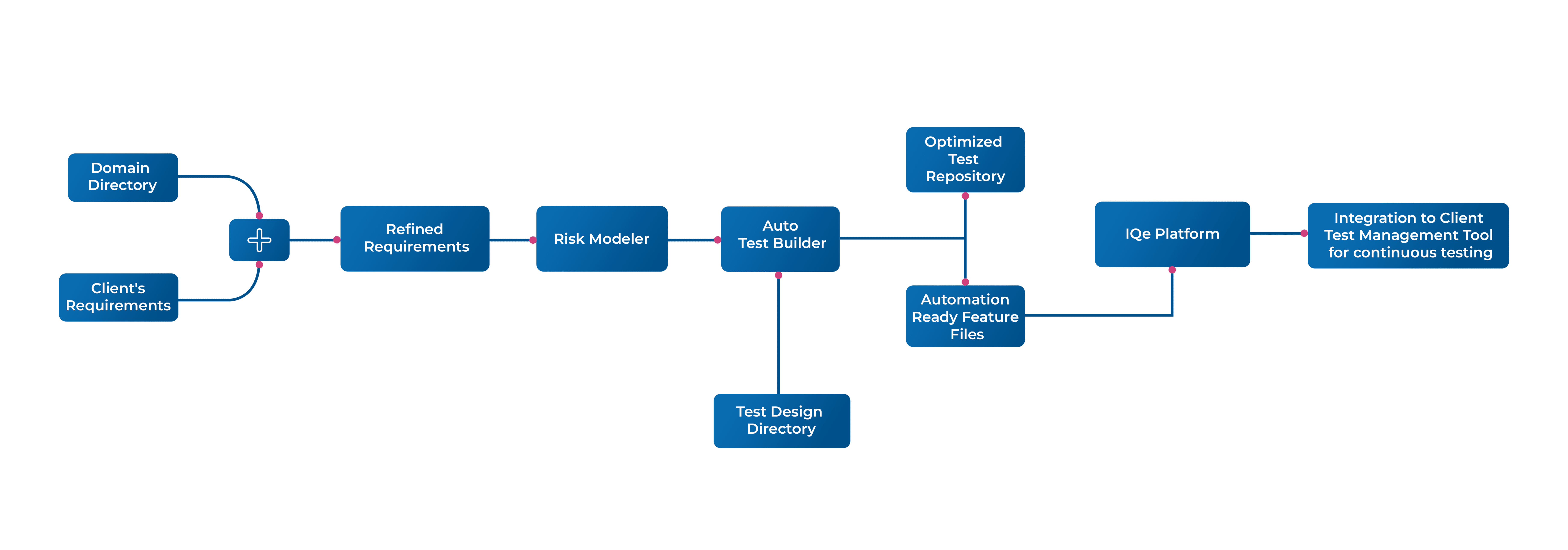

Investment management firms are increasingly leveraging AI, machine learning, and alternative data sources to enhance portfolio construction, risk assessment, advance research, and alpha generation. The rise of quantamental investing—a blend of quantitative modeling and fundamental analysis—is gaining traction, allowing asset managers to extract deeper insights and optimize decision-making.

Generative AI

![]()

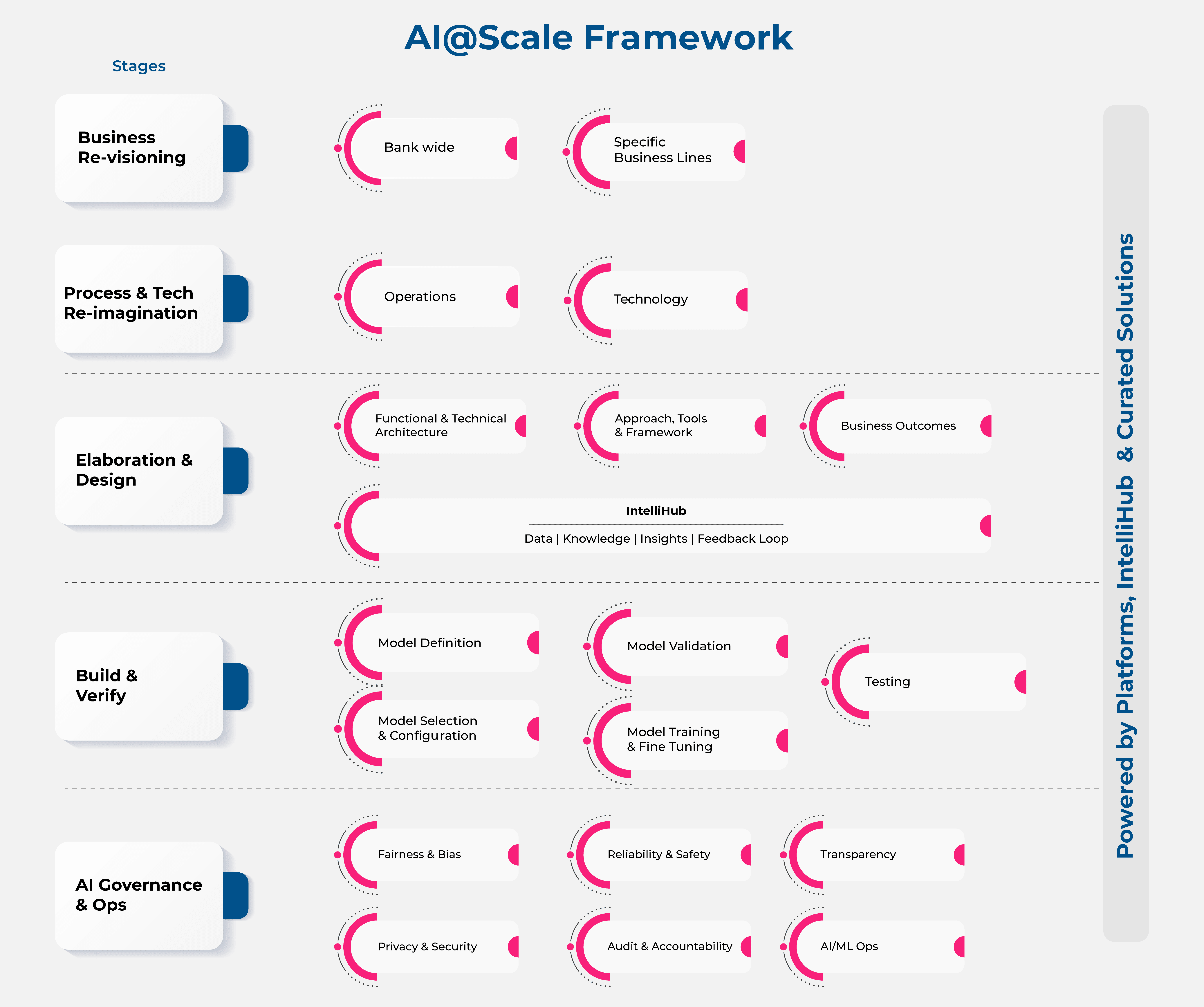

AI, particularly Generative AI, is transforming trading strategies, risk management, and regulatory compliance. With firms accelerating adoption, AI-driven automation is enhancing operational efficiency, reducing manual processes, and optimizing decision-making. GenAI is expected to become a critical enabler of predictive analytics, trade surveillance, and market intelligence.

Tokenization & Digital Assets

![]()

Tokenization of financial instruments, including equities, bonds, and alternative assets, is gaining momentum. Distributed Ledger Technology (DLT) is enabling fractional ownership, improving liquidity, and reducing settlement times. Institutional adoption of tokenized assets is expanding, with regulatory frameworks gradually evolving to accommodate digital securities.

Regulatory Complexity

![]()

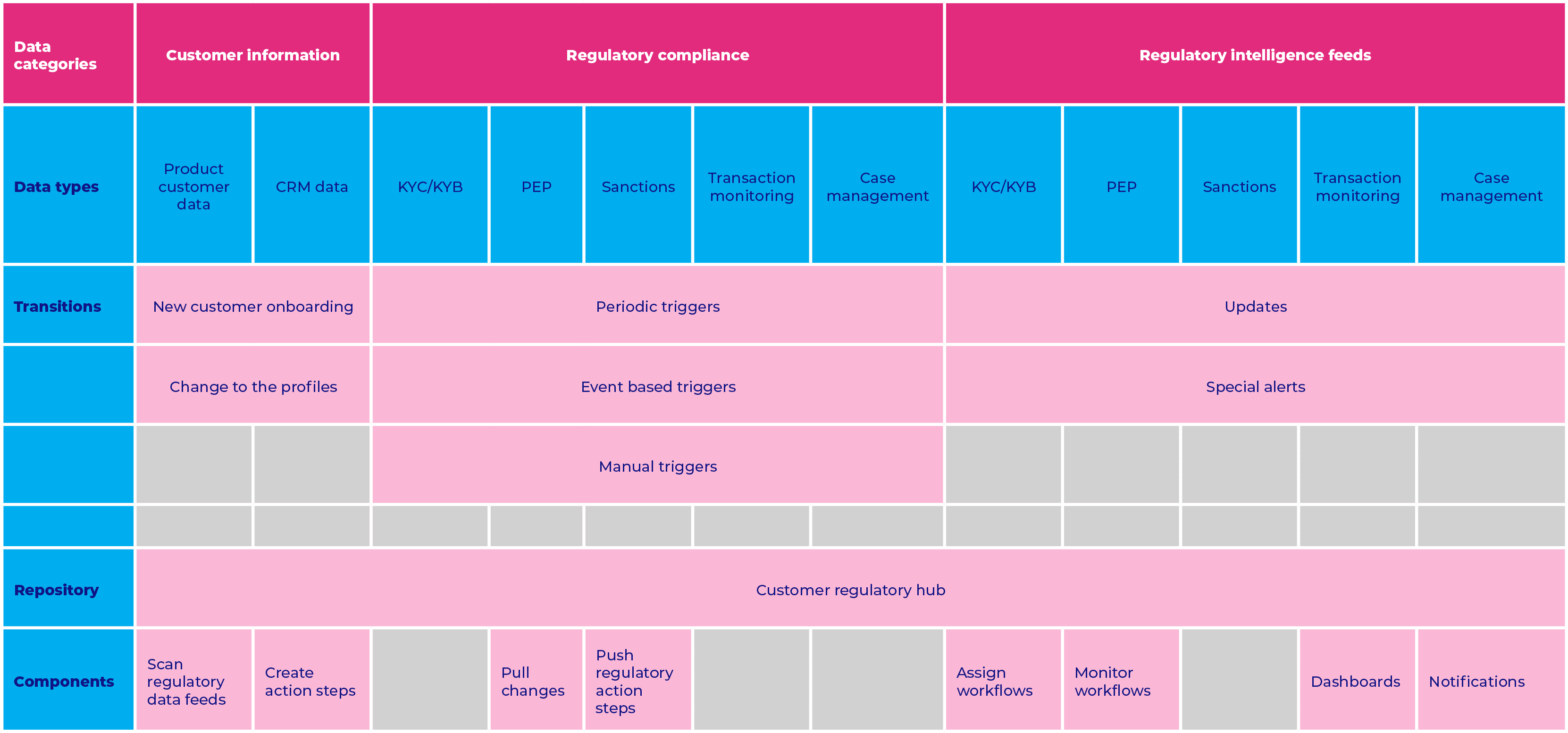

The geopolitical and regulatory landscape is shifting, leading to heightened compliance requirements. Firms are investing in RegTech solutions, real-time reporting tools, and automated compliance frameworks to navigate evolving mandates. The use of AI-driven regulatory reporting and risk assessment is set to accelerate, improving transparency and reducing compliance costs.

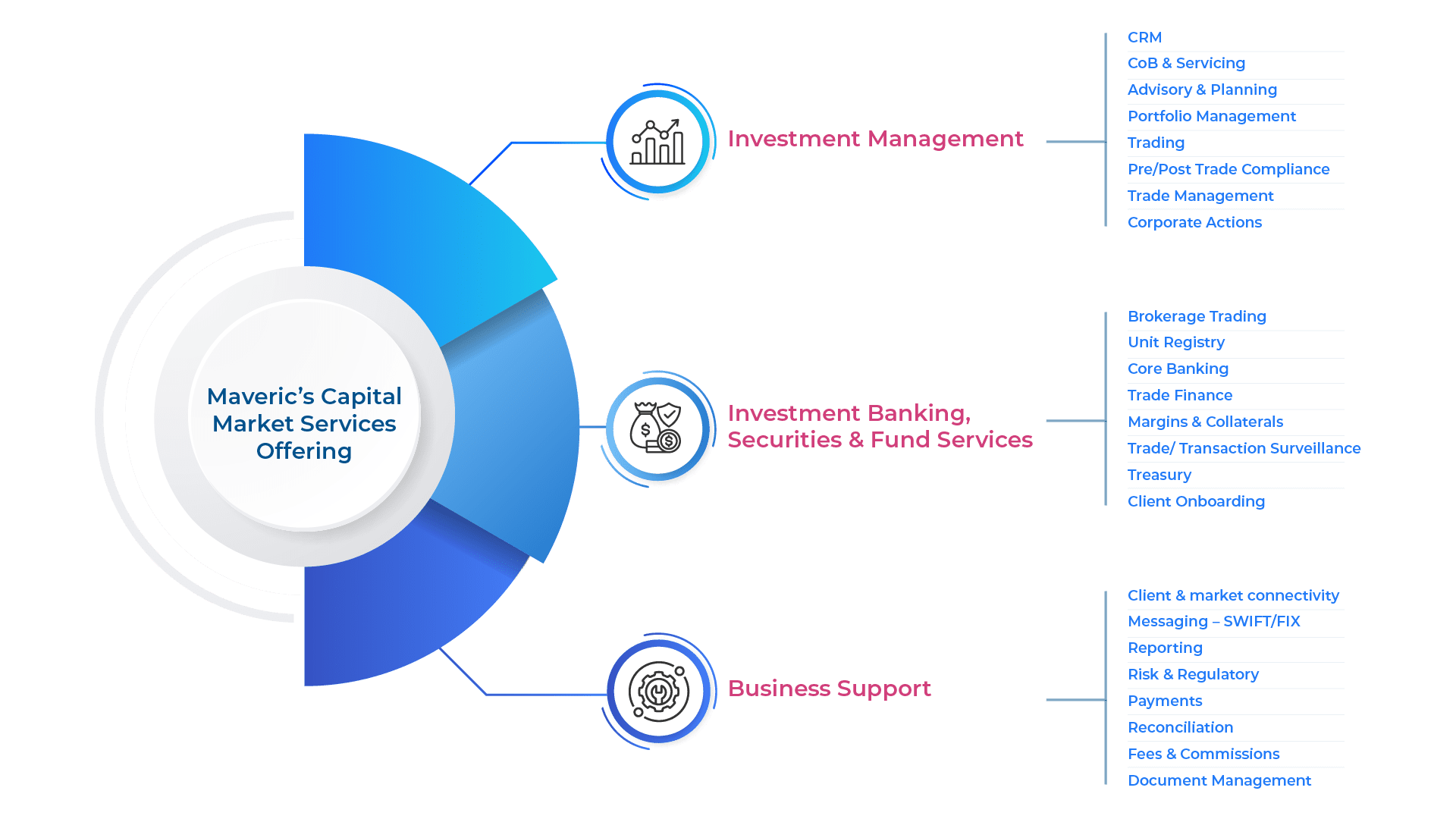

Our Focus

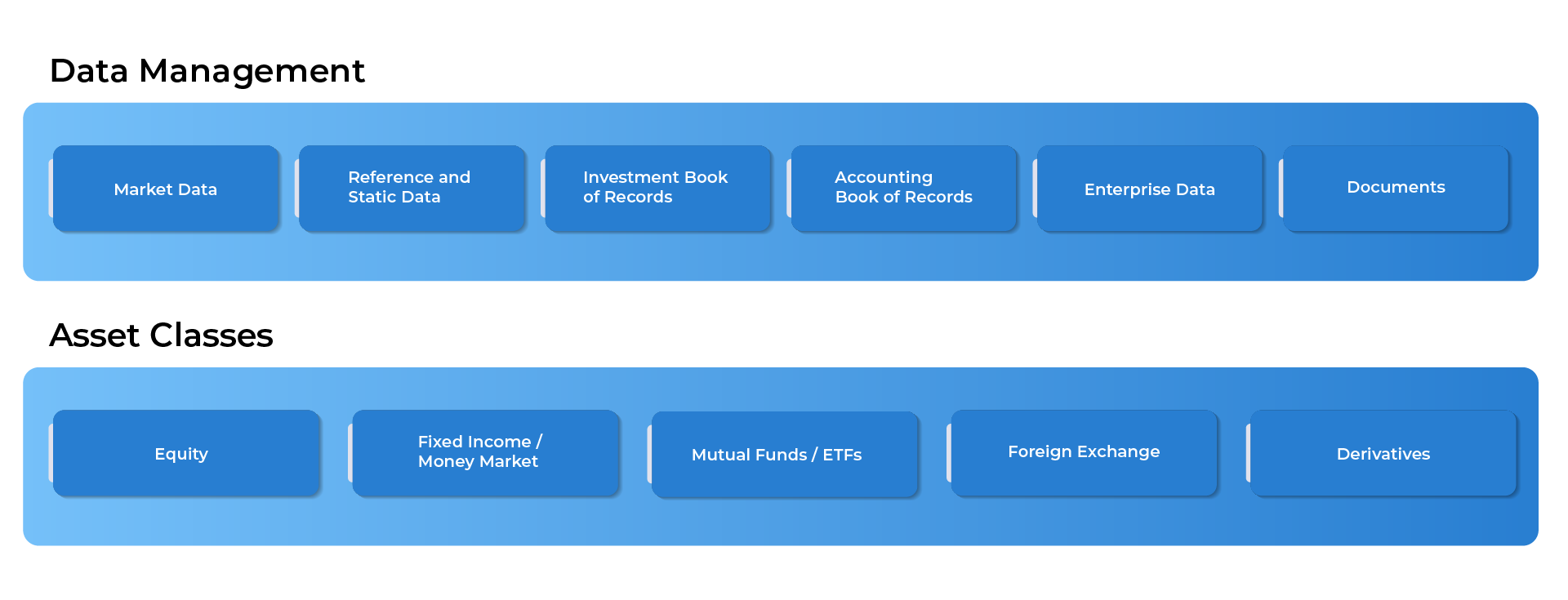

By virtue of working for some of the esteemed global Investment Banks for over 15 years in the Capital Markets landscape, Maveric Systems is at the forefront of enabling financial institutions to successfully navigate the business changes through technology adoption.

Branch Banking

Account opening and maintenance, transaction banking, general operations and centralized back office functions

Reporting

Management control, regulatory reporting and customer profitability

Online and Mobile Banking

Account management, electronic bill payment and presentment and mobile banking

Mortgages and Consumer Lending

Loan origination, account servicing, secondary marketing and delinquency handling

Personal wealth management

Investment advisory services

From Complexity to Clarity: A Leading Middle Eastern Bank’s Tech Transformation

Facing outdated systems, compliance challenges, and limited expansion, a leading Middle Eastern bank partnered with Maveric Systems to modernize its capital markets operations. Through next-gen trading platforms, AI-driven fraud detection, and automation-led testing, Maveric helped the bank reduce transaction processing time by 30%, cut testing cycles by 50%, and enable seamless multi-country expansion. Read to know how the BankTech experts successfully navigated this transformation and delivered a future-ready capital markets ecosystem.

Read More