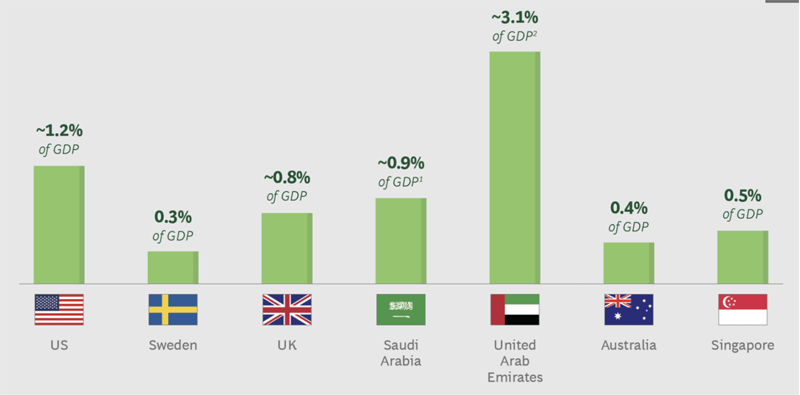

Economies that are more cash intensive tend to grow slowly and miss out on significant financial benefits. Conversely, economies that switch to digital are more successful. The digital switch can boost annual GDP by as much as 3% as predicted below in the analysis done by Boston Consulting Group (BCG)

Potential economic benefits of a move to Cashless Economy

World bank global data; BCG analysis

- 1.3% of non-oil GDP

- Based on Dubai

But, surprisingly, the global ratio of cash to GDP rose to 9.6% in 2018, compared with 8.1% in 2011. The situation is fast changing post Covid 19 crisis and economies are fast moving to cashless through various means.

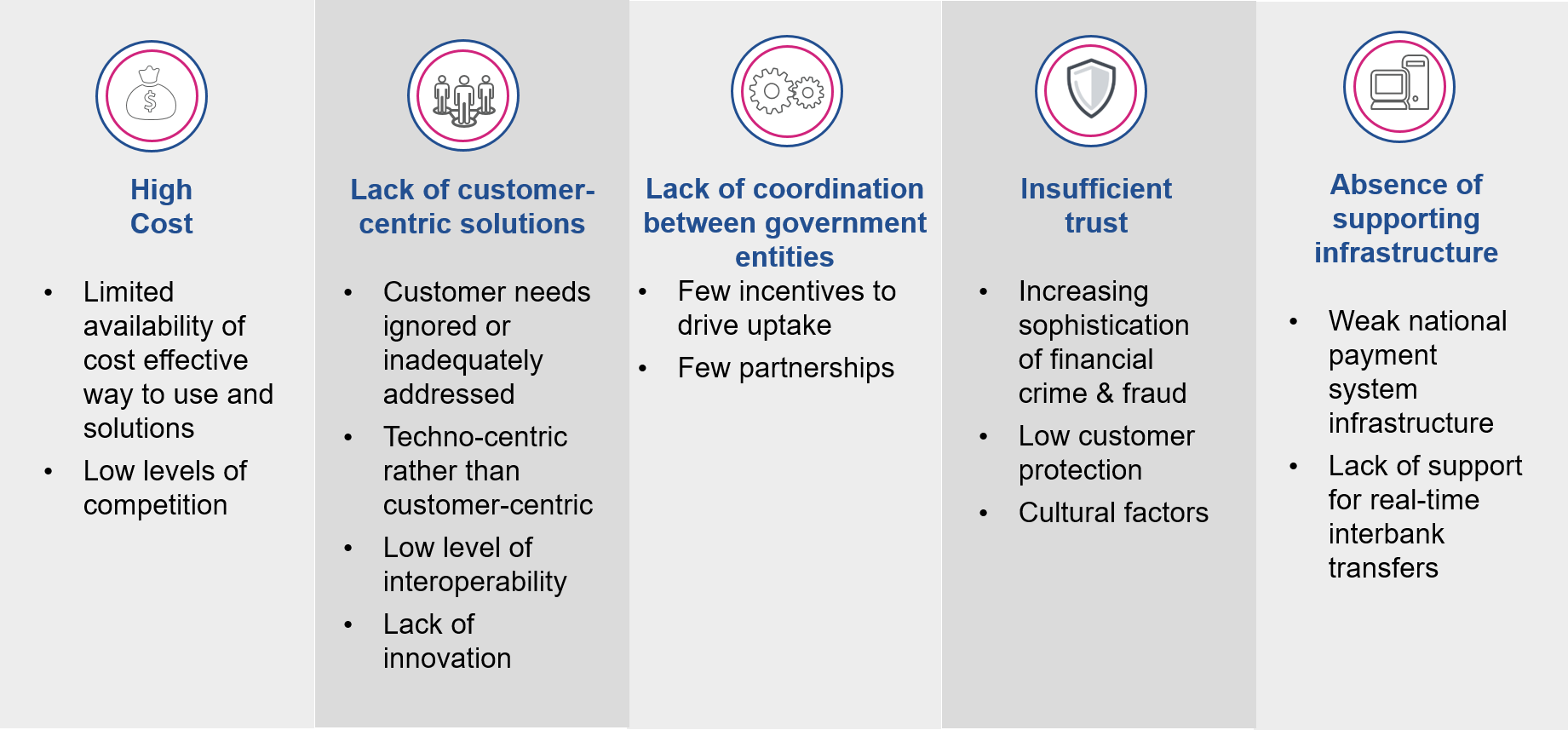

Digital is an attractive alternative where the cost of cash is high (transport, ATM servicing, security, labor), where technology uptake is accelerating, or where the government struggles to collect sales tax. Numerous countries meet one or more of these criteria, according to an analysis in Harvard Business Review.

World bank global data; BCG analysis

Having said that, Middle-East region seems to be showing many positive signs of digital progression as you read the article further.

Encouraging and Notable changes in the Middle-East

While the Middle East has traditionally been slow to move away from cash when compared with the rest of the world, a new wave of technology alongside strong government initiatives are starting to change habits across the region.

In recent years, more convenient payment options like tap-to-pay, mobile wallets, and online payment platforms have been eroding the popularity of cash.

In the Middle East, both Saudi Arabia and Egypt have taken large steps to bring their citizens access to many of the latest cashless technologies through their Mada debit card and Meeza debit card schemes.

Mobile payments start-up Ziina launched in its first market, the UAE and unveiled plans to expand into Saudi Arabia in 2021, as it seeks to take advantage of initiatives to encourage cashless payments in the Middle East.

Becoming a cashless society is one of the key aims included in the UAE’s Vision 2021 strategy, which also includes goals around refocusing of the economy, and enhancements to healthcare and education facilities.

Ziina’s next target market of Saudi Arabia also has goals around reducing cash transaction numbers to 30 percent of all payments as part of its Vision 2030 initiative.

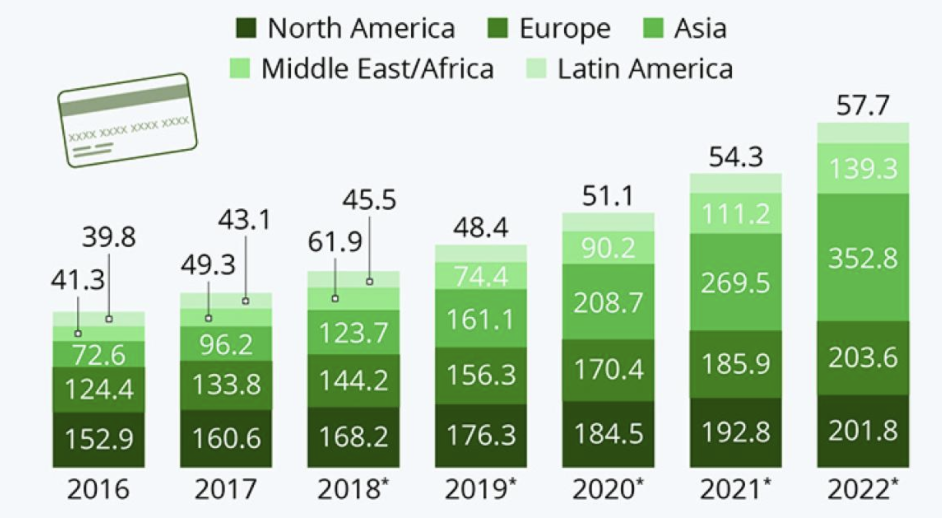

Cashless Revolution

Number of non-cash transactions world-wide from 2016 to 2022 (in billions)

* Estimates from World Payments Report 2019

The EIU report entitled ‘A Whole New World: How technology is driving the evolution of intelligent banking in the Middle East and Africa’ indicates that MEA retail banks are highly conscious of the threats financial exclusion and delaying digitalization pose to their business models.

The survey reveals that the Middle East, in particular, is poised to encourage digital financial inclusion, with young populations and smartphone use predicted to hit 74% by 2025.

Role of Fintech players

The initial synergies between Banks and Fintechs started way back in 2018, which progressed the payment trend with more new innovative ways of payments. We can infer from the data published by Visa that the card payments in the UAE were noted at 70% rise with a substantial indication on the importance of e-commerce which also witnessed an increase of 48% in 2018.

Saudi Arabia is aggressively promoting digitization across financial services in line with Kingdom’s 2030 Financial Sector Development Program by welcoming 30 fintechs regulatory sandbox through the SAMA arm. These fintechs will also focus on currency exchange, micro-lending, financial information aggregation, crowd funding, international processing and digital savings apart from digital payments. Through the regulation, this sandbox will act as a safe space in which financial services firms can test new digital solutions under a set of conditions and limitations designed to protect consumers and relax normal regulatory obligations. The testing on new digital solutions will be an outcome by building partnership with the fintechs. As a sample of this note, Financial Software & Systems and Arab Financial Services entered into an agreement to bring omni-channel payment acceptance solutions to banks in December 2019. Both the firms had successfully launched services in Oman and Bahrain, with a future plan of expansion into other markets. This underlines the strong necessity of Fintech to maintain the momentum of digital readiness across the region.

COVID – 19 crisis acts as a catalyst

According to 2019 GSMA report, 30% of the Middle East region’s population belongs to youth who have a mobile penetration rate of 64% as they are tech-savvy in encouraging digital payments. With these factors, COVID- 19 crisis acts as a catalyst for adopting and promoting cashless payment methods for contactless experience.

The global mobile wallet market is expected to reach $3.1 billion by the end of 2022, as per Zion market research report. Gradually, the dependence on mobile wallets and secured payment gateway will be high and this will streamline the launch of new digital services from banks. To capitalize the digitization, Saudi Arabia’s Riyad bank collaborated with CCAvenue to expand its payment platform in Saudi Arabia when there was an upsurge in the country’s e-commerce market.

Vision 2030 & so on

The upsurge is highly commendable but the Middle East region could take at least two decades to achieve cashless society which only reaches 46% by 2030 in its digitization. Though the advancements in blockchain and AI are progressing in good pace, the regional regulatory guidelines are far behind when compare to other global regions. This may be the reason on the delay on achieving the cashless economy, but it definitely completes its notion in 2050.

This was originally published on Business Live Middle East website and is being reproduced here.

Reference links

- https://apnews.com/89fc8f4c49544927a49f46b1a1d64c95

- https://www.payfort.com/blog/2019/07/31/cashless-payments-in-middle-east/

- https://www.electronicpaymentsinternational.com/news/saudi-arabias-alinma-bank-introduces-digital-cards/

- https://www.finextra.com/pressarticle/80908/fss-and-afs-partner-to-promote-digital-payments-in-the-middle-east

- https://www.fintechfutures.com/2020/04/saudi-arabias-fintech-sandbox-welcomes-nine-more-start-ups/

- https://www.wamda.com/2020/05/rise-contactless-payments

- https://www.prnewswire.com/news-releases/e-commerce-payments-market-2020-2025-covid-19-pandemic-rapidly-accelerating-growth-301064372.html

- https://valustrat.com/role-mobile-wallets-growth-gcc-banking

- https://economictimes.indiatimes.com/small-biz/startups/newsbuzz/ccavenue-collaborates-with-riyad-bank-to-make-inroads-into-saudi-arabias-digital-payment-space/articleshow/71213181.cms

- https://www.temenos.com/news/2020/05/05/mea-retail-banks-are-the-strongest-believers-in-a-cashless-society-says-study-by-the-economist-intelligence-unit-released-by-temenos/

- https://www.bcg.com/publications/2019/cashless-payments-help-economies-grow.aspx

- https://www.pcmag.com/news/the-cashless-revolution-is-happeningin-asia